Looking Good Tips About Finance Cost In Profit And Loss Account Assertions Financial Statements

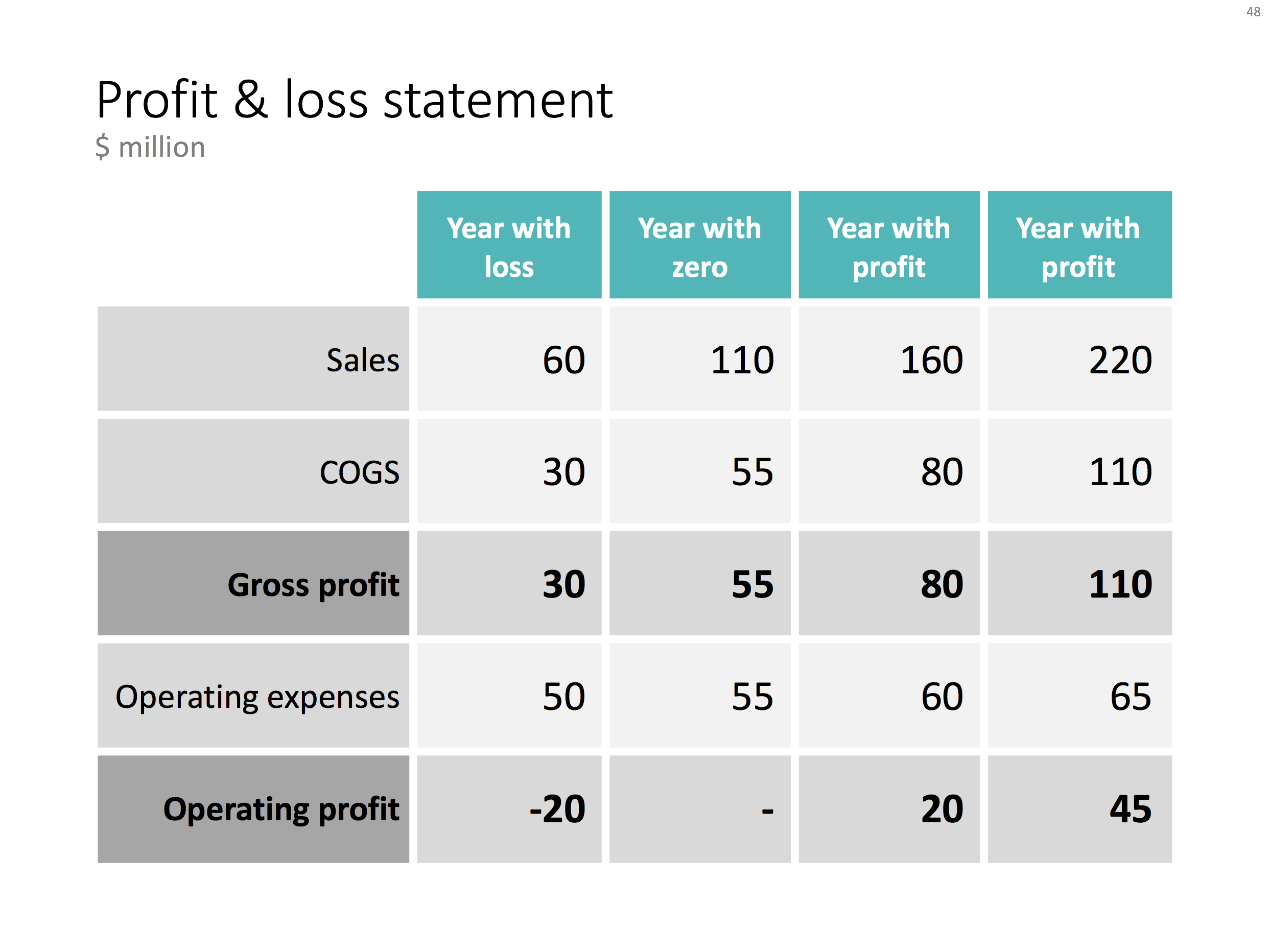

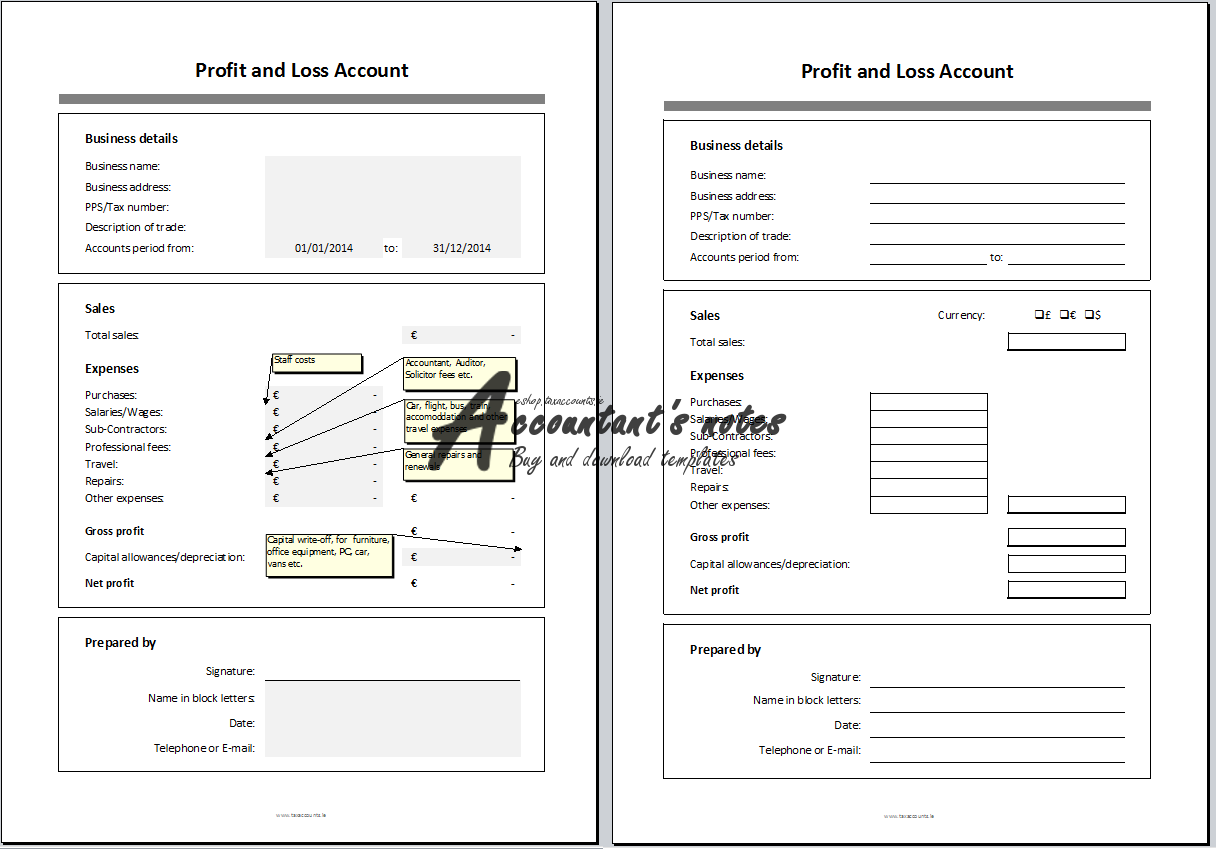

It is prepared to determine the net profit or net loss of a trader.

Finance cost in profit and loss account. Following the finance cost, the next line item is “depreciation and amortization” costs which stand at rs.64.5 crs. We explain how companies use cost information to calculate their profit and assess their profitability. Finance costs are also known as “financing costs” and “borrowing costs”.

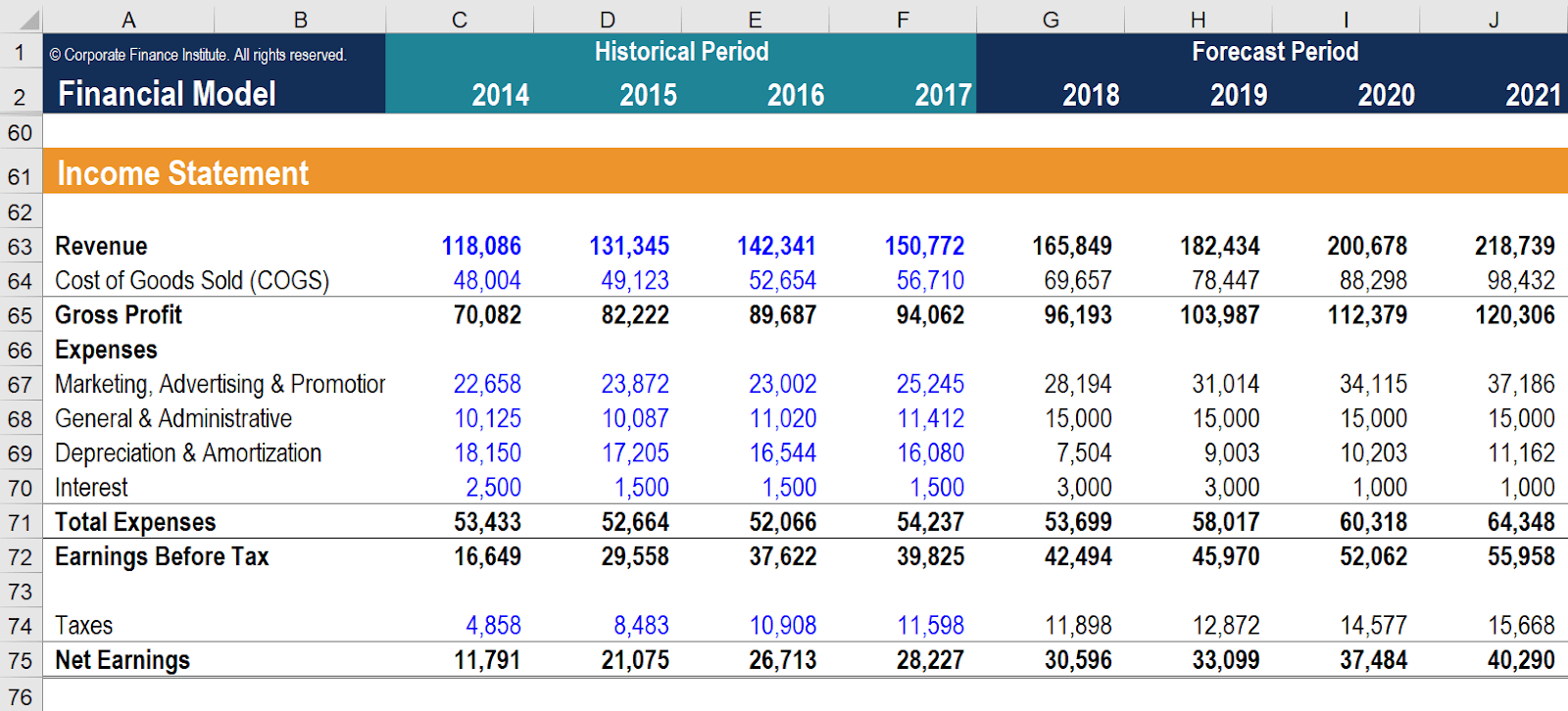

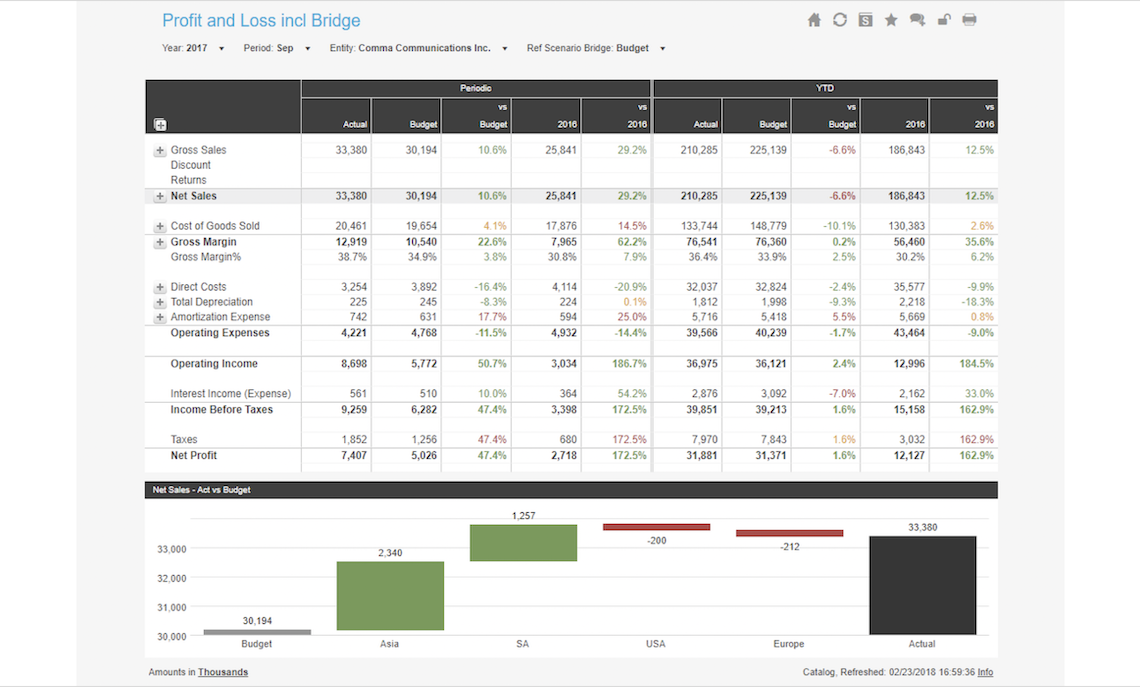

An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. As the industry’s first matched maturity ftp application, oracle financial services funds transfer pricing helps you determine the spread earned on assets and liabilities and interest rate exposure for every customer account.

Sg&a = $20 million. Interest expense = $5 million. The purpose of the profit and loss account is to:

The profit and loss account reflects the financial performance of the company by analysing the overall profitability of the entity. Gain an accurate assessment of net interest margin and profitability across various dimensions. The income statement is one of three financial statements prepared by a company to report its financial performance.

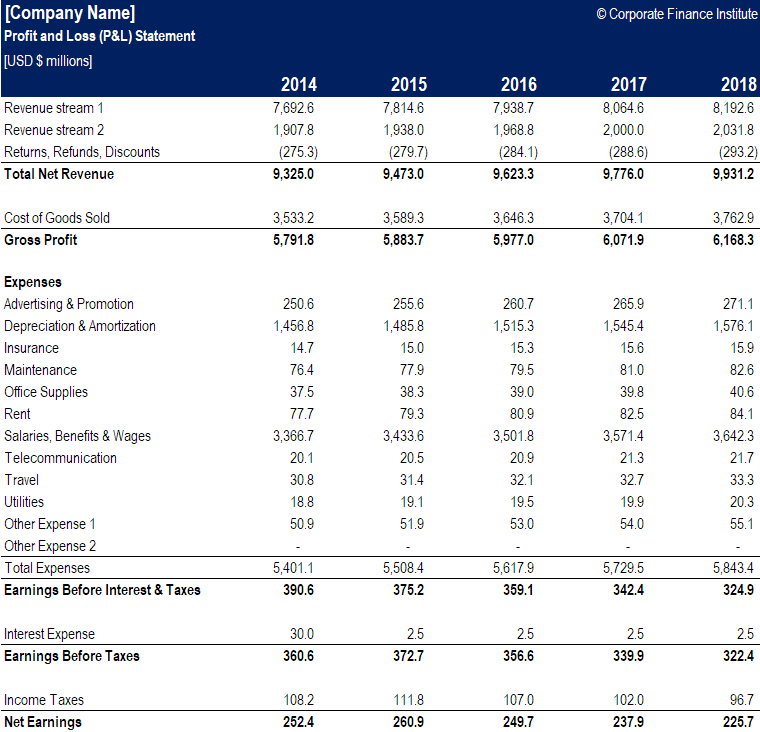

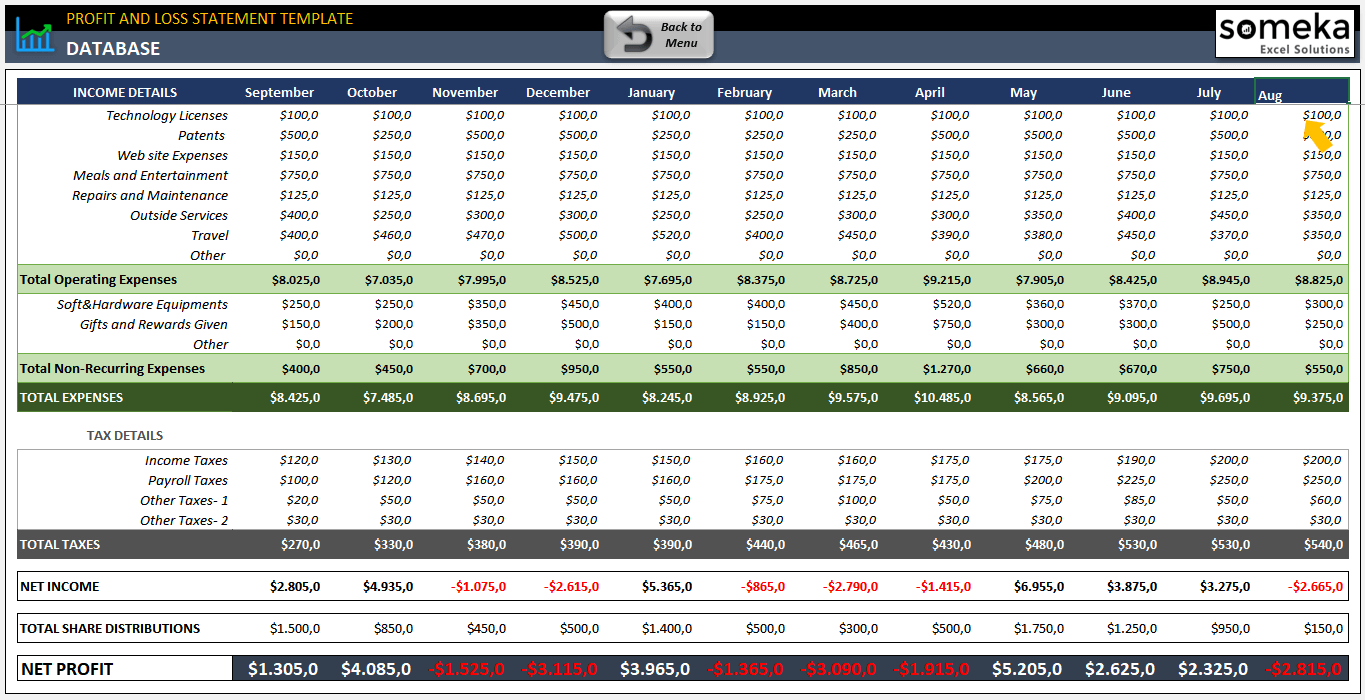

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Here are other takeaways for 2023:

Profit and loss accounting generates a profit and loss statement, also referred to as an income statement income statement the income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss. Items shown only in financial accounts: In contrast, a balance sheet is a ‘snap shot’ of the assets and liabilities of the.

Explanation a profit and loss account is prepared to determine the net income (performance result) of an enterprise for the. As you can see in the extract below, almost all the line items have a note associated with it. This includes interest paid on loans, insurance,.

The profit and loss statement, also called an income statement, details a company’s financial performance for a specific period of time. A p&l statement provides information about whether a company can. A profit and loss account starts with the trading account and then takes into account all the other.

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. Show whether a business has made a profit or loss over a financial year.; The outcome is either your final profit or loss.

All the indirect expenses and incomes, including the gross profit/loss, are reported in the profit & loss statement to arrive at the net profit or loss. Depending on how companies account for changes in inventories, we. Companies do not only need to know the costs of different products, but they also need to know whether they gain a profit or realize a loss.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income-547x1024.jpg)