Glory Tips About Financial Accounting For Nonprofit Organizations Purpose Of Income Statement And Balance Sheet

Earn a bonus up to $300 when you use code axos300 to open a rewards checking account by june 30th, 2024.

Financial accounting for nonprofit organizations. Financial experts such as accountants bring a valuable skill set to the board table, along. Nonprofit organizations, no matter the size, can ensure financial. Nonprofit organizational accounting refers to the rules, standards, and conventions that govern how nonprofits treat and record financial transactions as well.

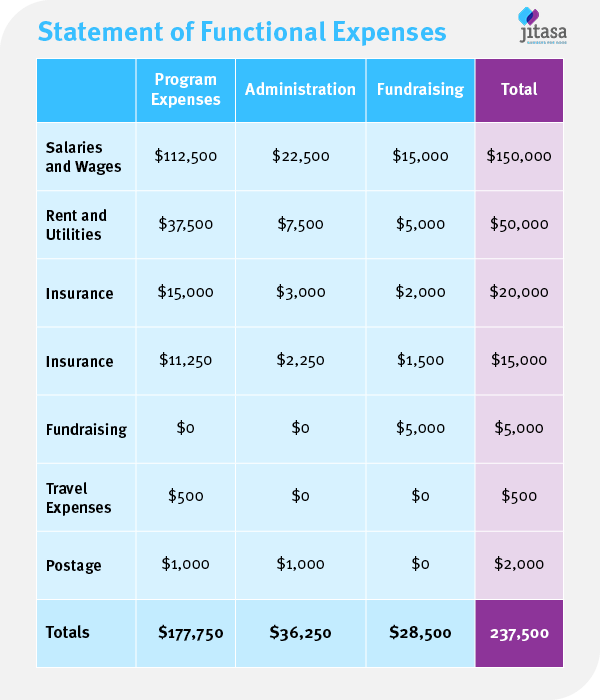

Learn how these best practices can help nonprofits comply with accounting rules, manage tax obligations, accurately track contributions, and create better. Nonprofit organizations should allocate expenses appropriately, ensuring they are attributed to the correct programs or functions. Best overall nonprofit accounting software:

Your board may require, or at least make it a practice to hear a reporting of the. 4.5/5 (88 reviews) Satellite account of nonprofit institutions and volunteering.

Nonprofit accounting for bookkeepers, financial officers, treasurers, organizations, and volunteers is your comprehensive guide through this intricate. 4.5/5 (88 reviews) How can nonprofit organizations ensure financial transparency and accountability?

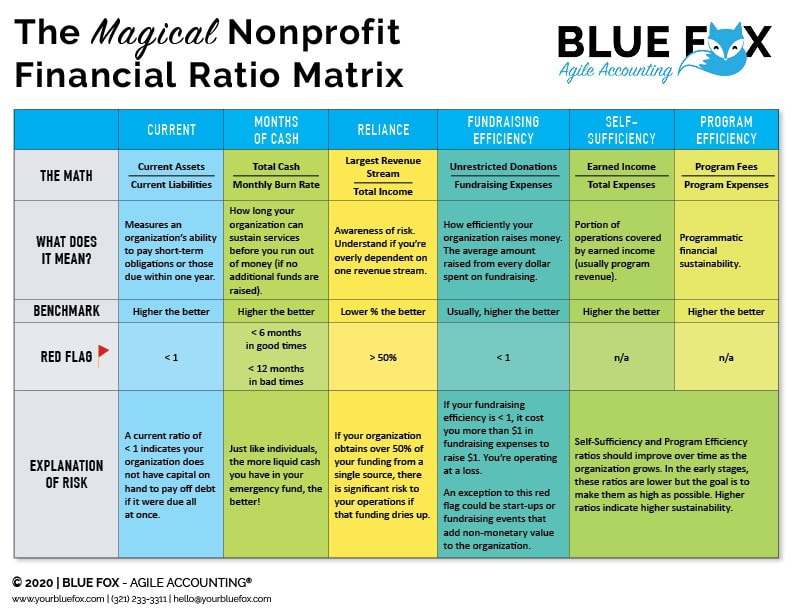

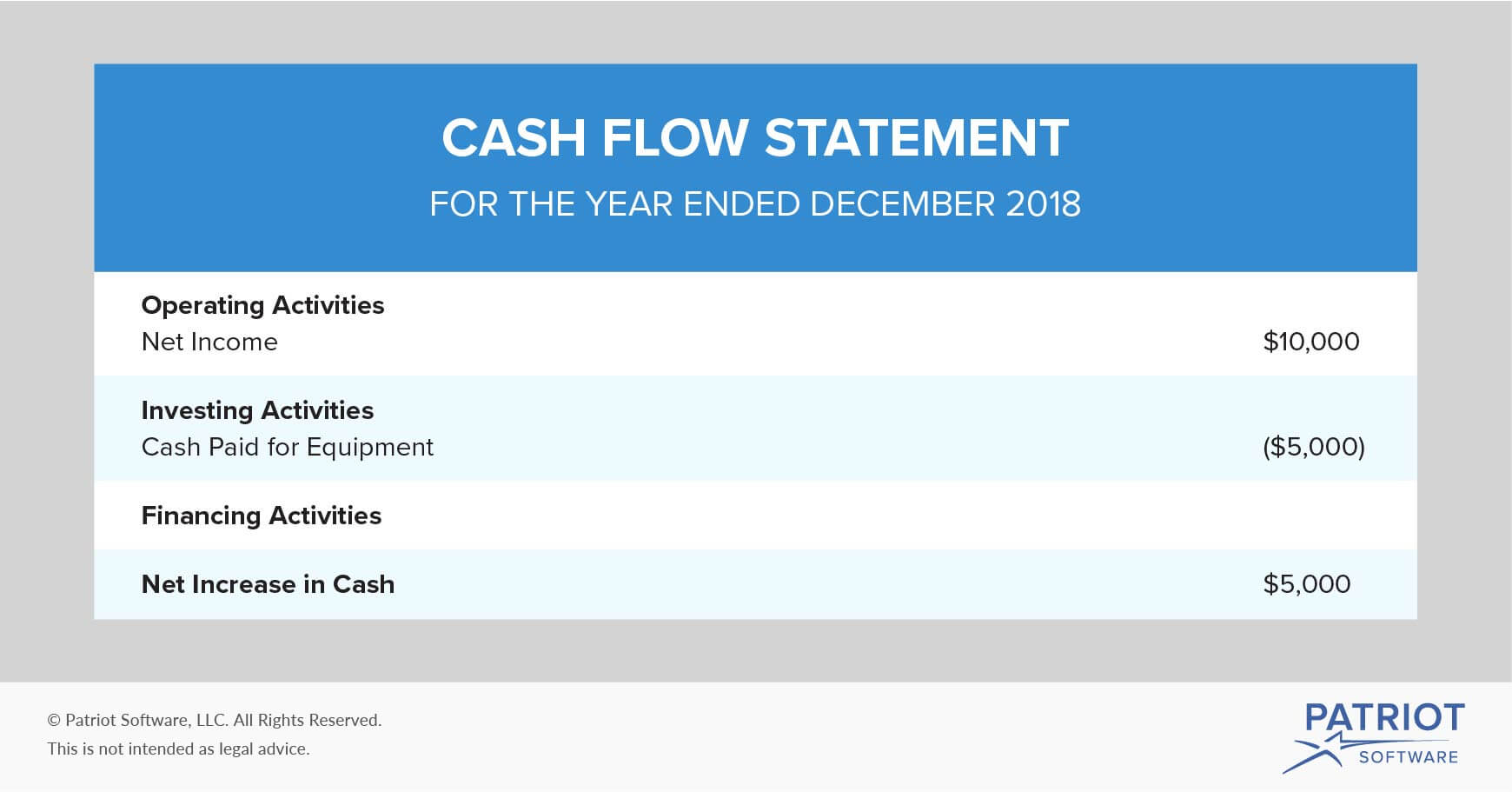

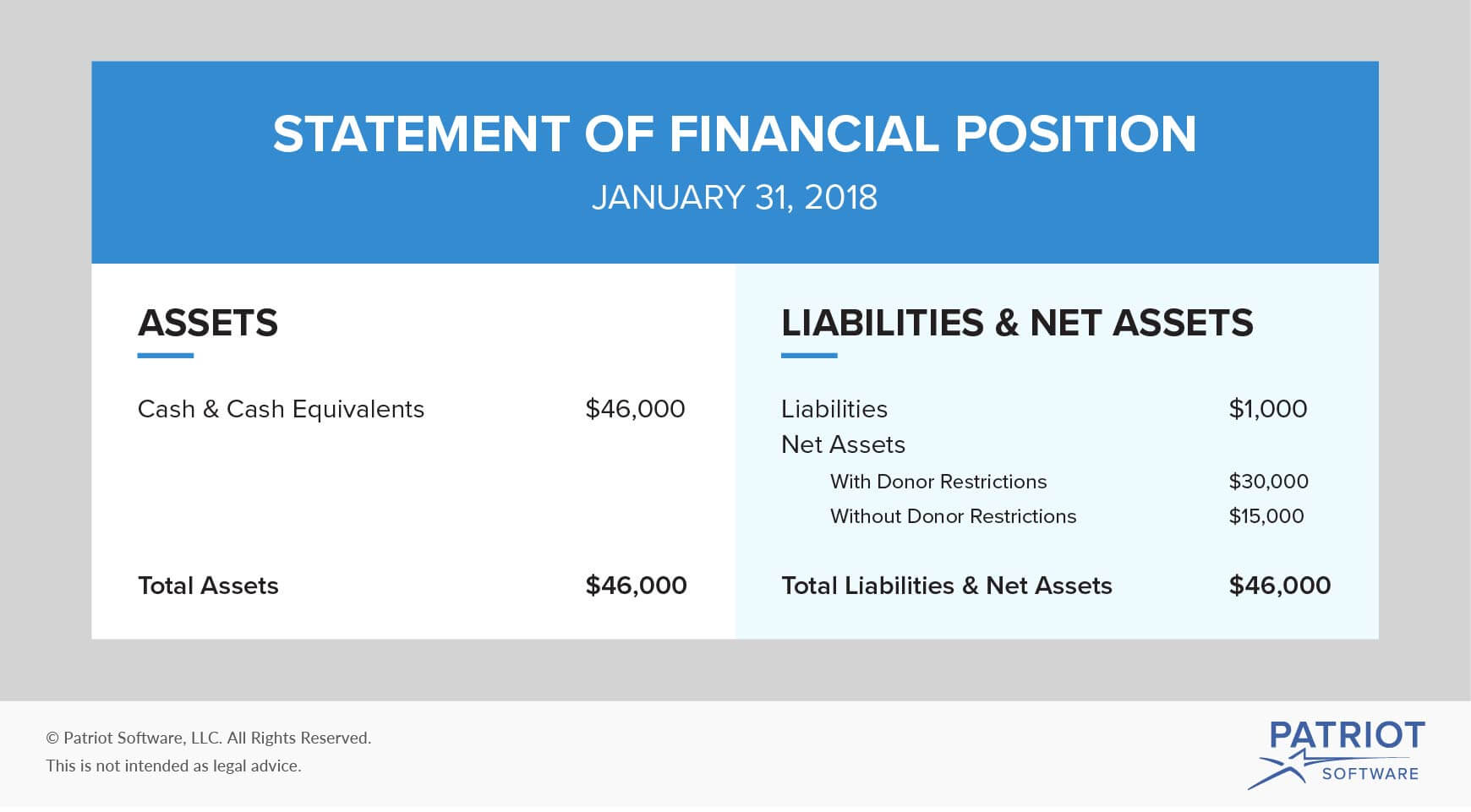

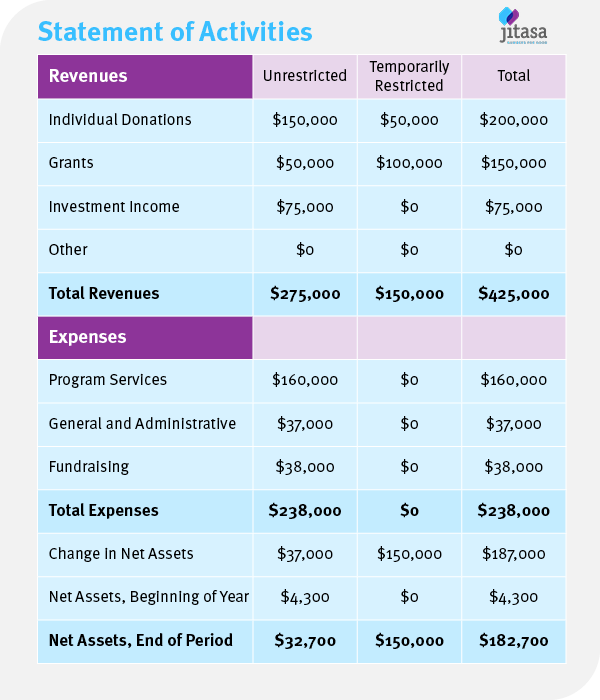

Assets = liabilities + net assets here’s an example from code. In nonprofit accounting, there are four required financial statements that organizations must produce, and we will touch on each of these in this guide. Before a nonprofit begins the.

Nonprofits use the statement of financial position to list their assets, liabilities, and net assets. Was the author of the first edition of this text and a significant contributor to many of the subsequent editions.he is a retired partner of price. What is nonprofit accounting?

Nonprofit accounting differs from small business accounting. Basic financial policies for nonprofits. Running a nonprofit organization comes with a set of unique.

Setting up a nonprofit finance department structure that works. Nonprofit accounting is the process of recording, tracking, and reporting the financial activities of a nonprofit organization. Accounting and reporting are central to nonprofit financial procedures.

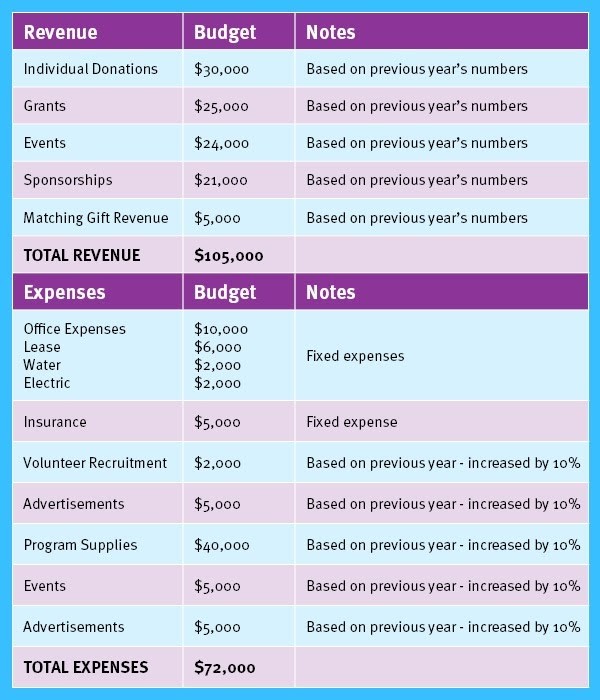

1993—sfas 116 and 117 fasb issues sfas 116, accounting for contributions received and contributions made, and sfas 117, financial statements. Best practices in nonprofit budgeting. Nonprofits should track revenues and expenses for multiple program service areas and product lines.

June 22, 2023 theresa rex. It’s a system of financial management, recordkeeping, and reporting for. These financial policy guidelines (nonprofit financial commons) offer a framework for drafting and adopting financial.