What Everybody Ought To Know About Cvp Income Statement Example Tax Form 26as

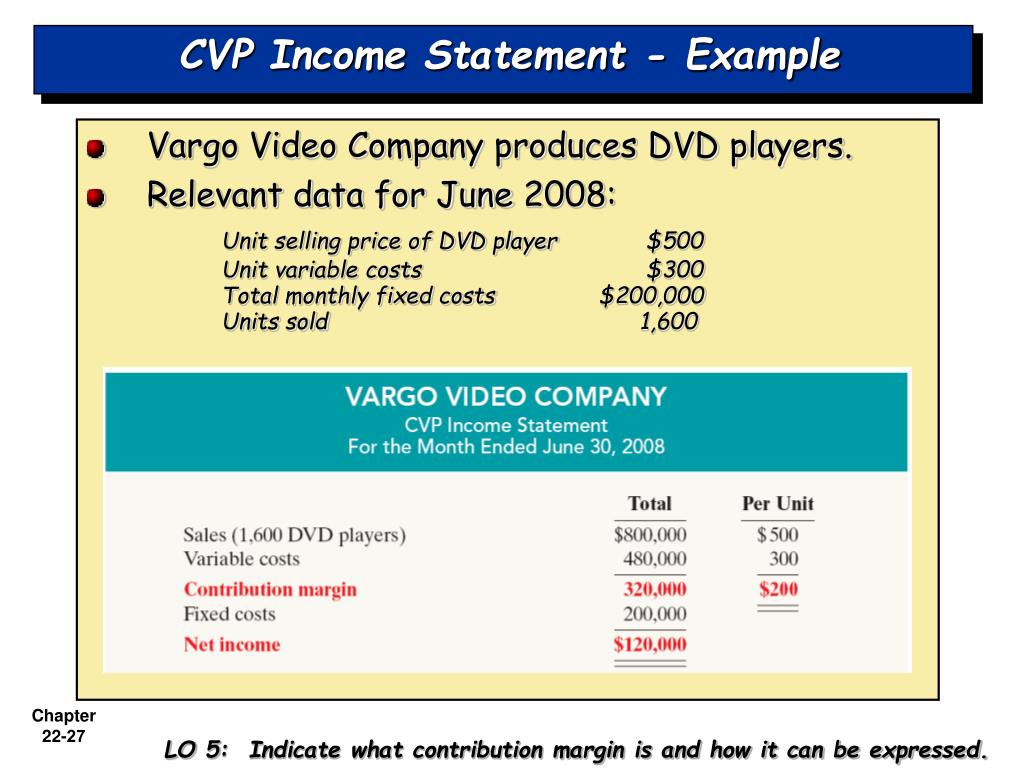

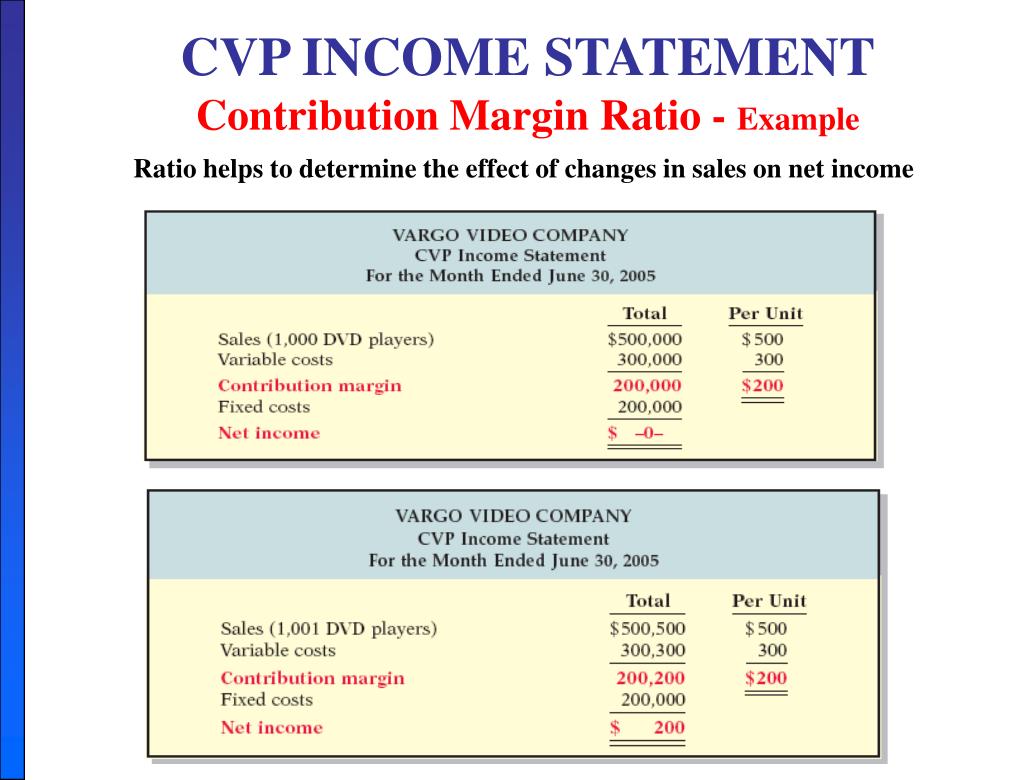

It shows how operating profit is affected by changes in variable costs, fixed costs, selling price per unit and the sales mix of two or more products.

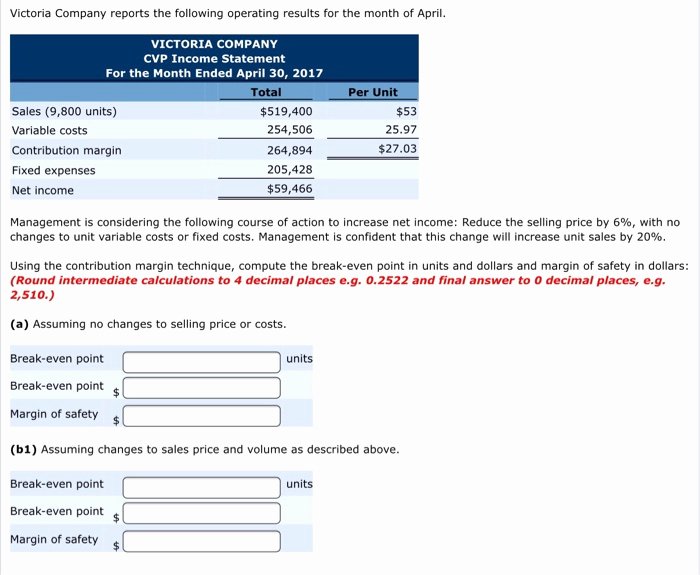

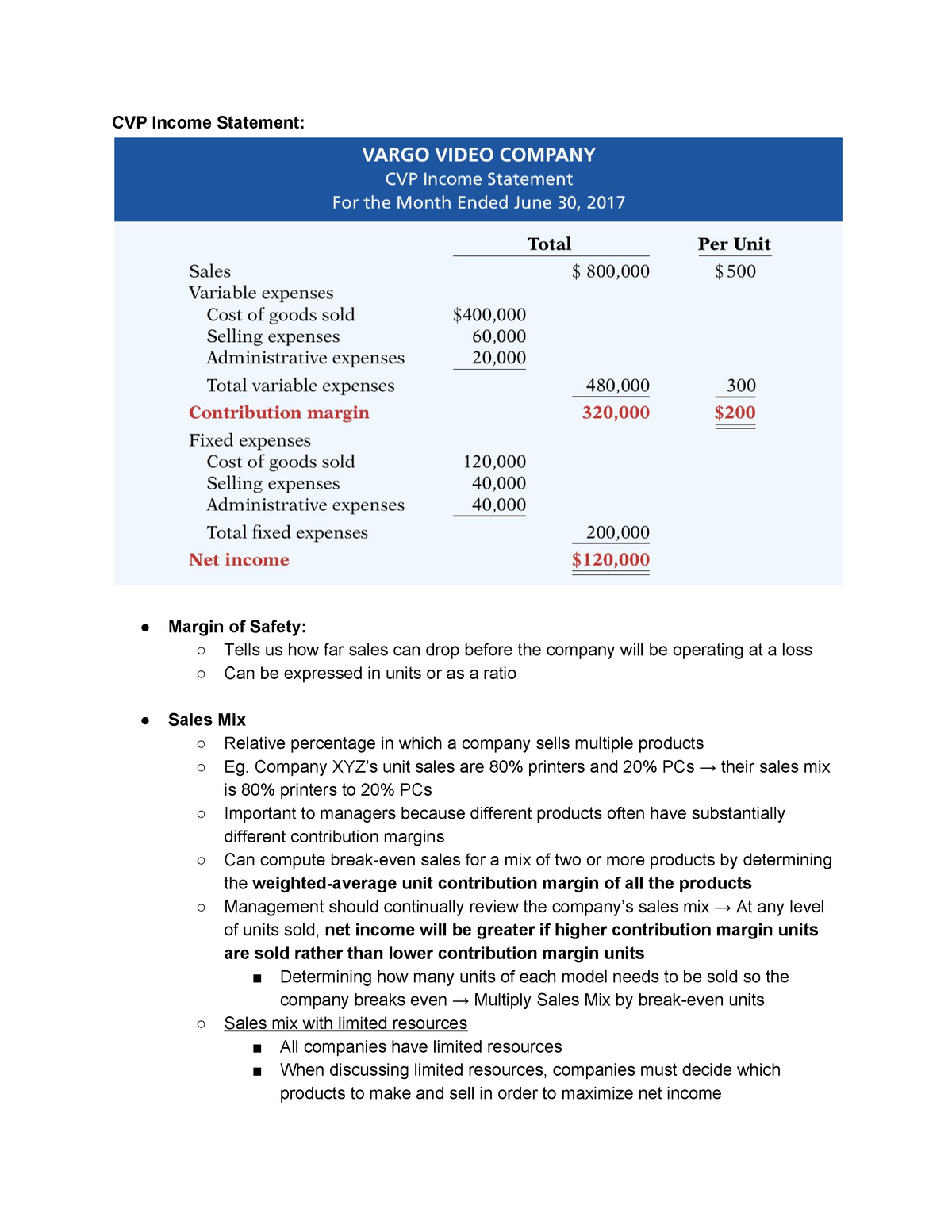

Cvp income statement example. Sales price per unit is constant. Organization's mix of products or services Lo3 apply cost volume profit analysis to show the effects on net operating income from changes in variable costs, fixed costs, selling price, and sales volume.

Variable costs per unit are constant. (round to nearest full percent.). Product a has a per unit sales price of $120, and product b has a per unit sales price of $100.

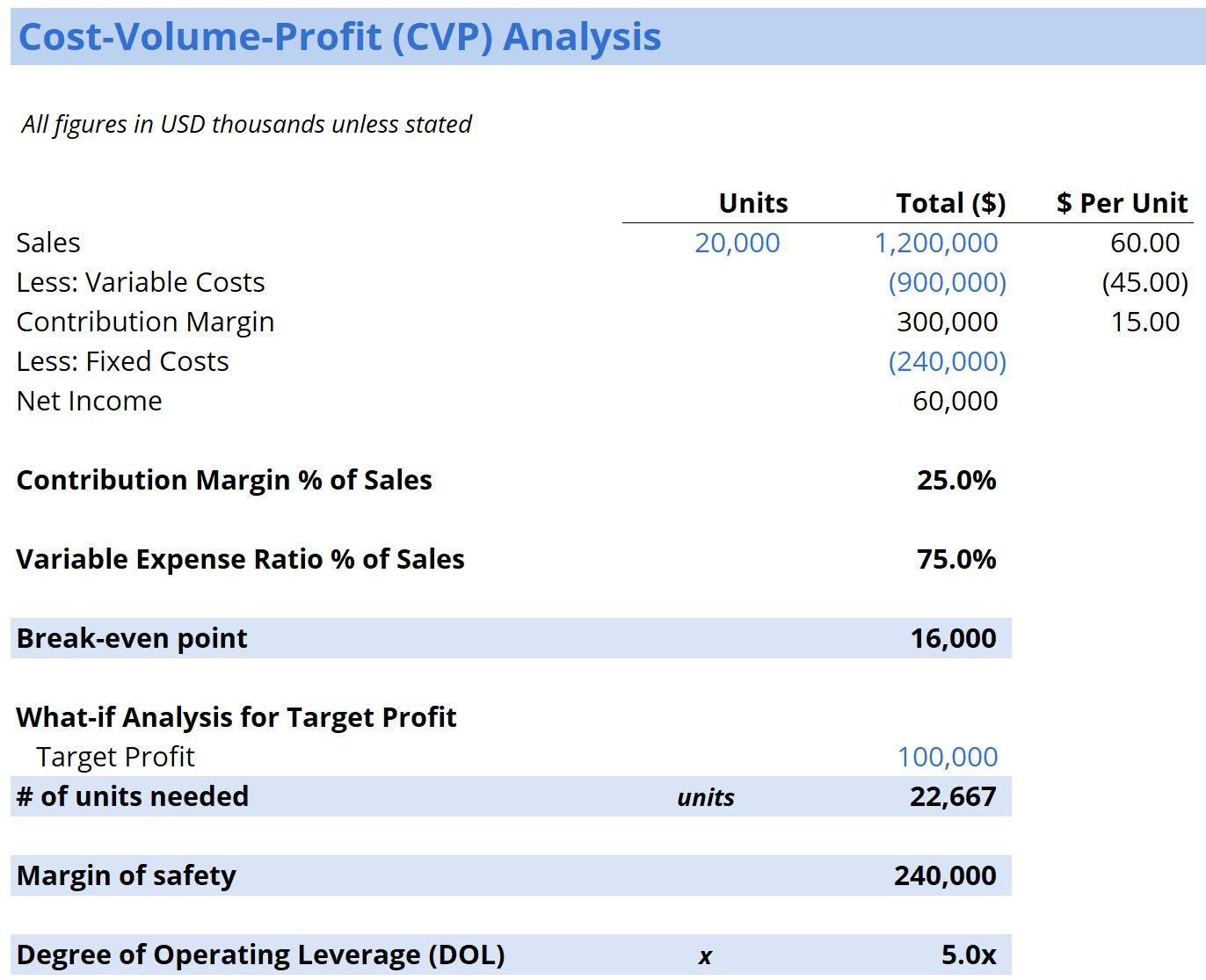

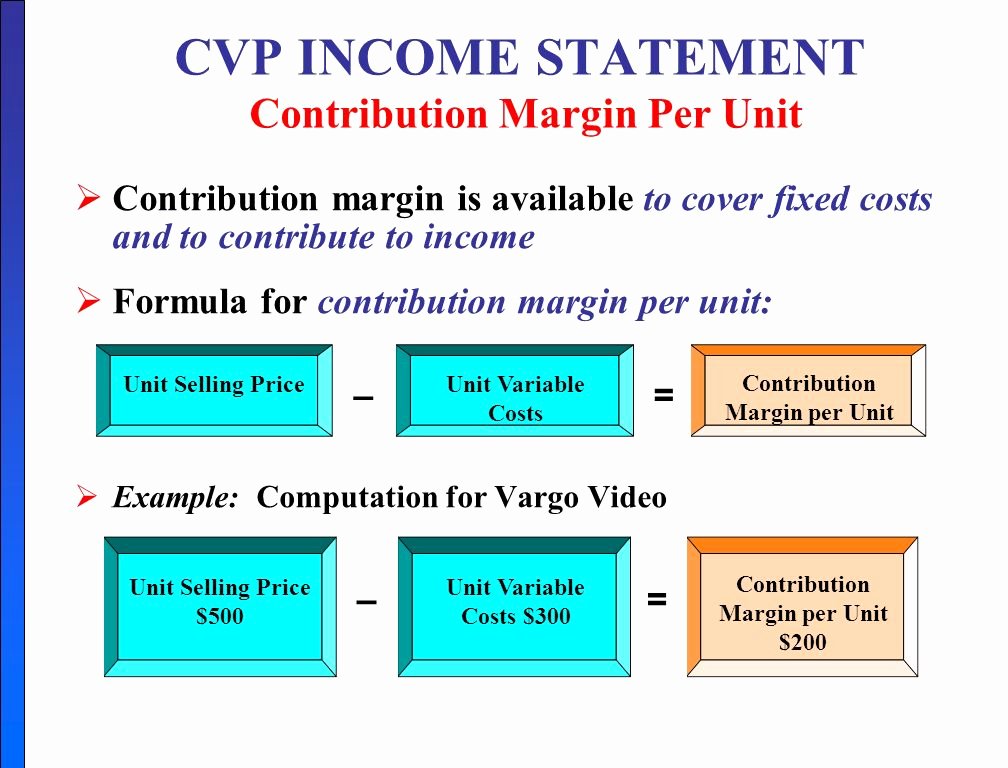

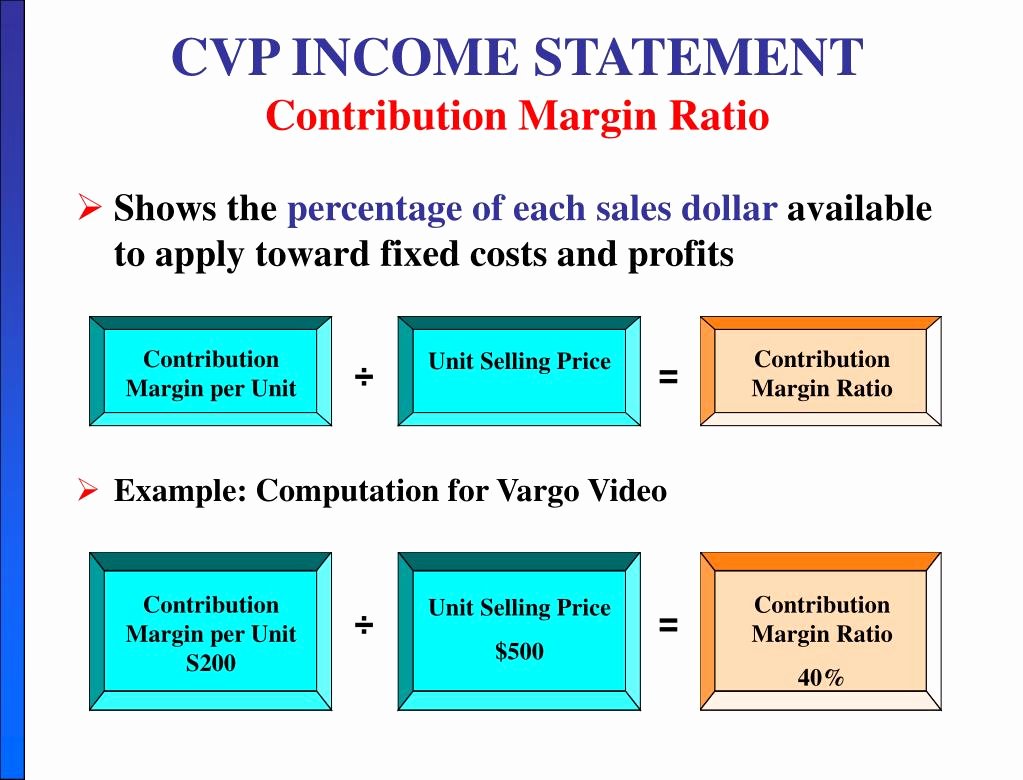

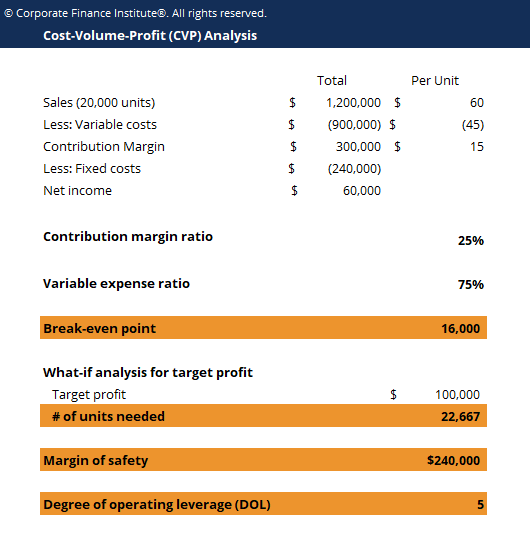

For example, a company with $100,000 of fixed costs and a contribution margin of 40% must earn revenue of $250,000 to break even. Example cost volume profit (cvp) analysis is a managerial accounting technique used to determine how changes in sales volume, variable costs, fixed costs, and/or selling price per unit affect a business’s operating income. #1 cm ratio and variable expense ratio

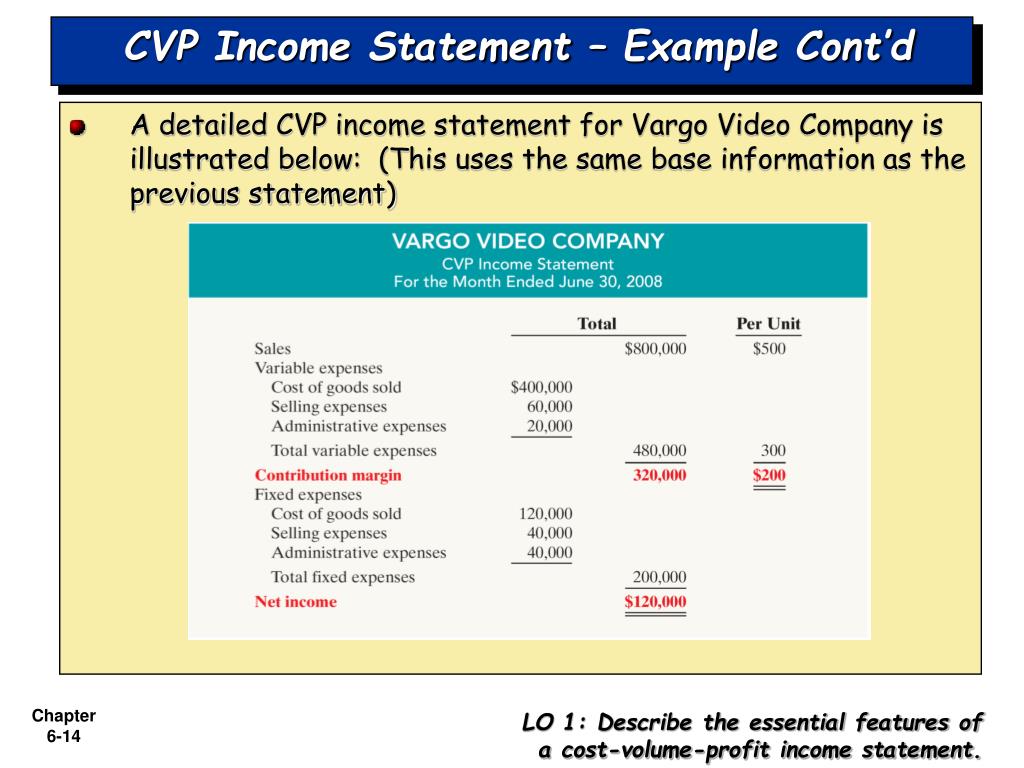

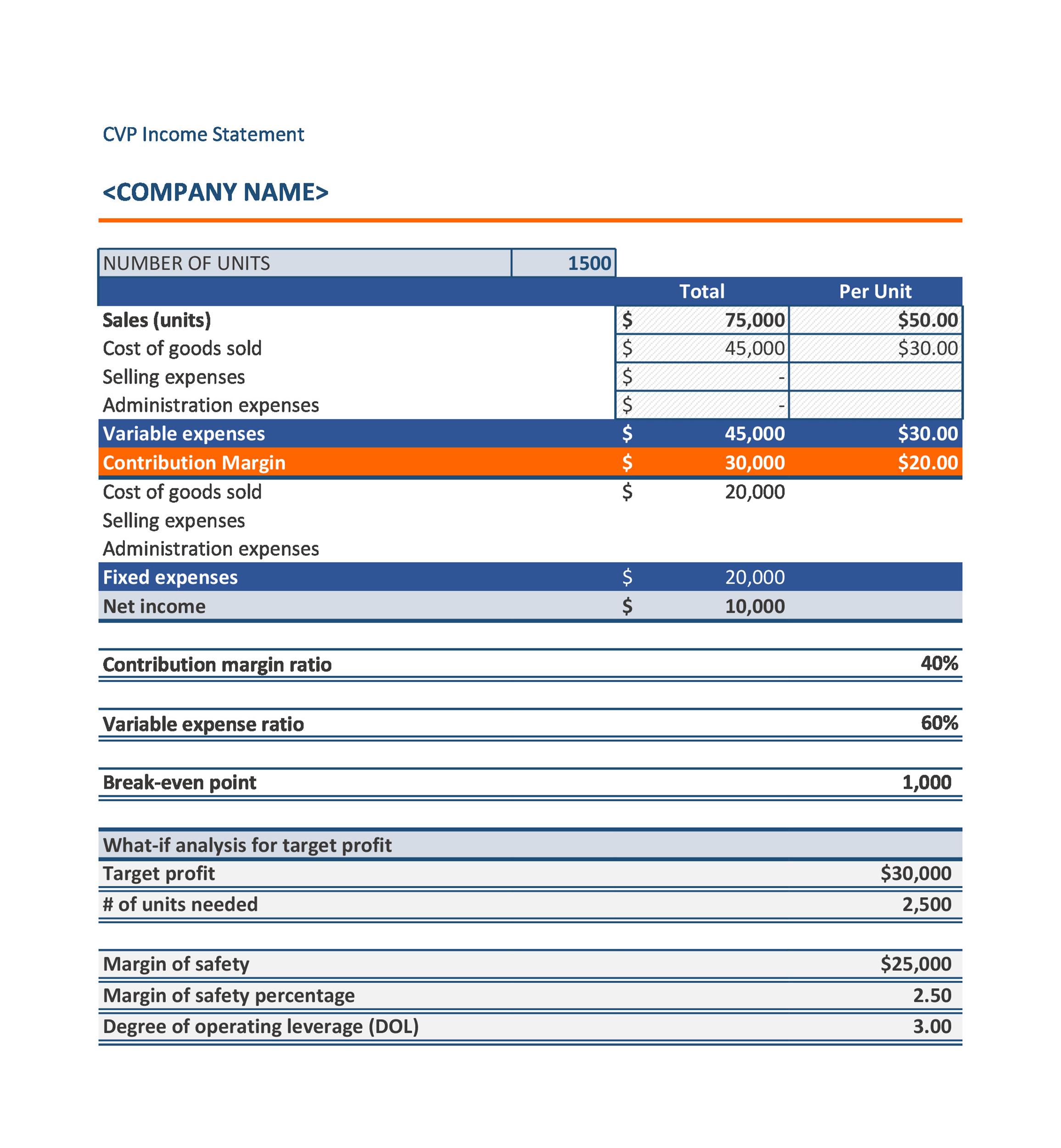

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. The contribution margin income statement can be used to forecast and analyze projected changes in selling prices, sales volume, unit variable costs, total fixed costs, and the mix of products sold. If we present the calculations in the income statement format, we get the contribution income statement, which is primarily used for internal purposes in companies.

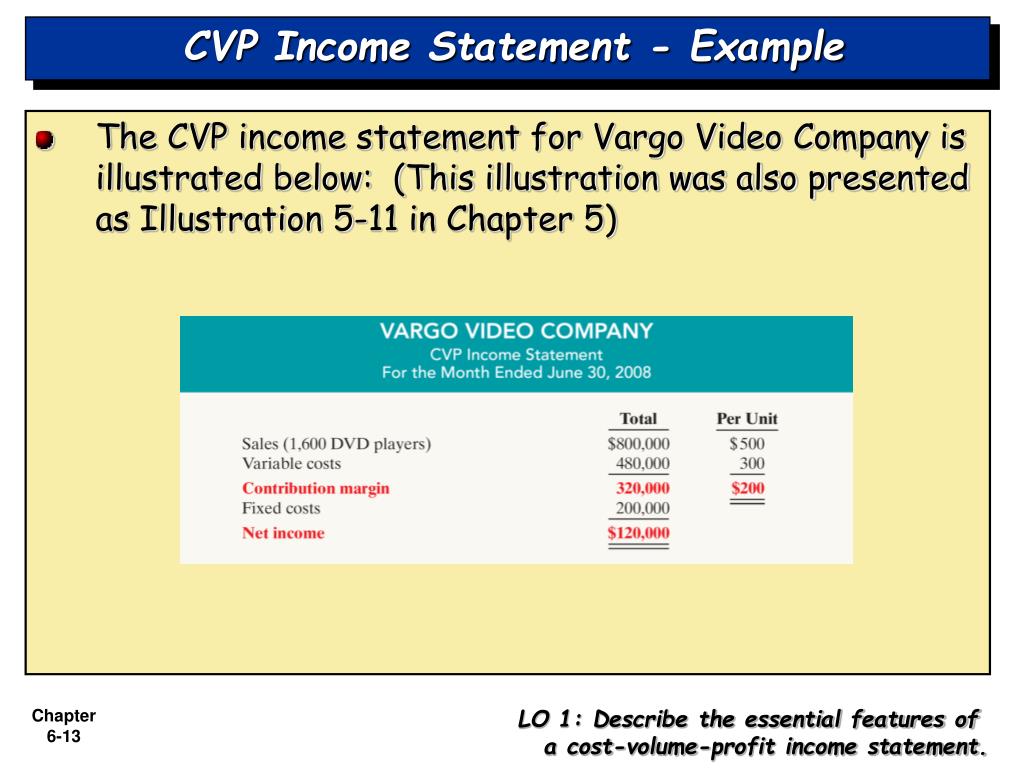

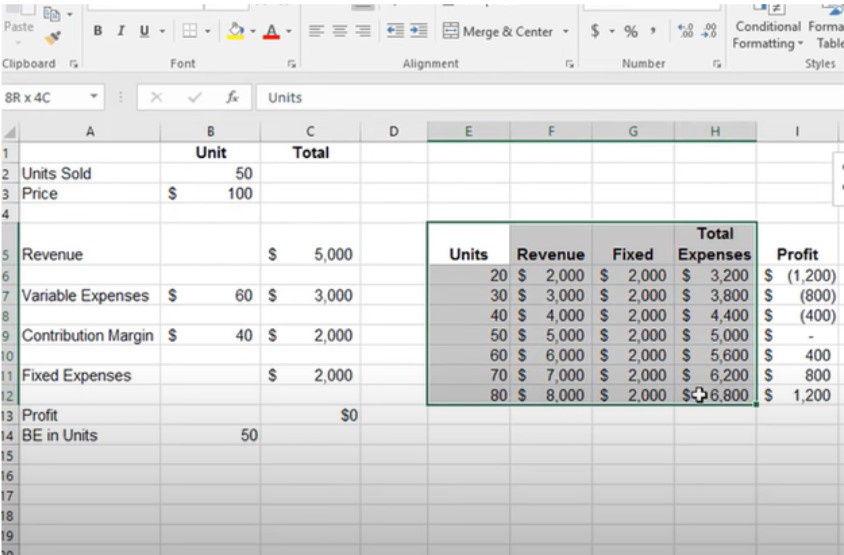

Lo2 explain how the contribution margin income statement is used for cost volume profit analysis. If the company expects to sell 20,000 lamps this year, prepare the cvp income statement. Explore the components in these analyses, the assumptions they take,.

Determine the sales dollars required to earn net income of $180,000. Contribution margin (cm) income statement example: A salesperson, earning a commission calculated as 5% of total sales, would prefer to sell product a.

What is cost volume profit analysis? Produces desk lamps that it sells for $50 each. Responses should include a description of how the cvp analysis information can be brought into a projected income statement that takes into account additional revenues and expenses of the business to create a “big picture” of what happens as a result of a change in cost, volume, and profit.

Consider the following example in order to calculate the five important components listed above. Cvp analysis is also used to analyze the effects on profit of various factors, namely: Profit may be added to the fixed costs to perform cvp analysis.

Total fixed costs are constant. How to prepare a cvp income statement. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.

Figure 6.5 income statement for amy’s accounting service shows the company’s income statement for the year. Lo1 identify the purposes of cost volume profit analysis. The following is the cost data for the desk lamps: