Breathtaking Info About Income Tax Website Form 26as What Goes On A Balance Sheet Accounting

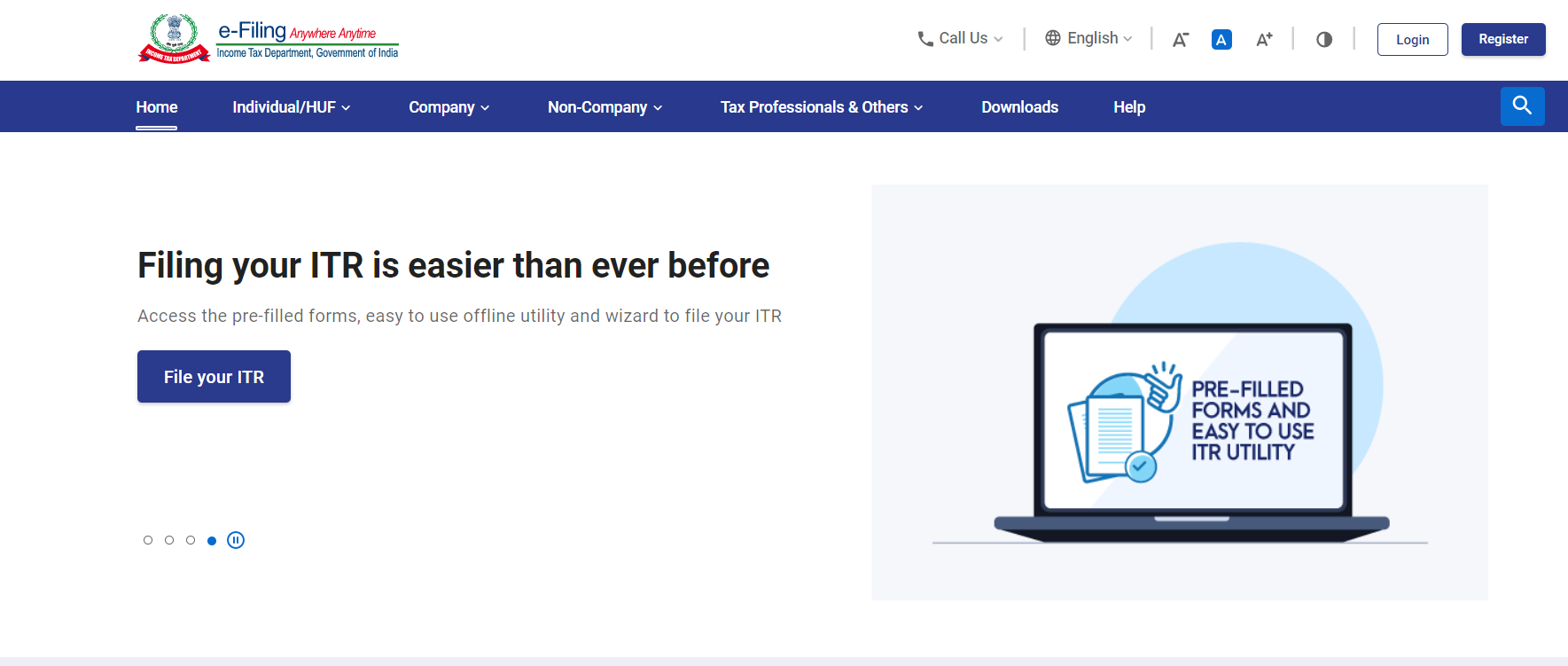

Click on the 'login' button.

Income tax website form 26as. Now, click on the 'continue' button. Start by visiting the income tax portal. Issued by the income tax.

Enter your user id/pan/aadhaar number. Step for downloading form 26as: Is filing income tax return mandatory?

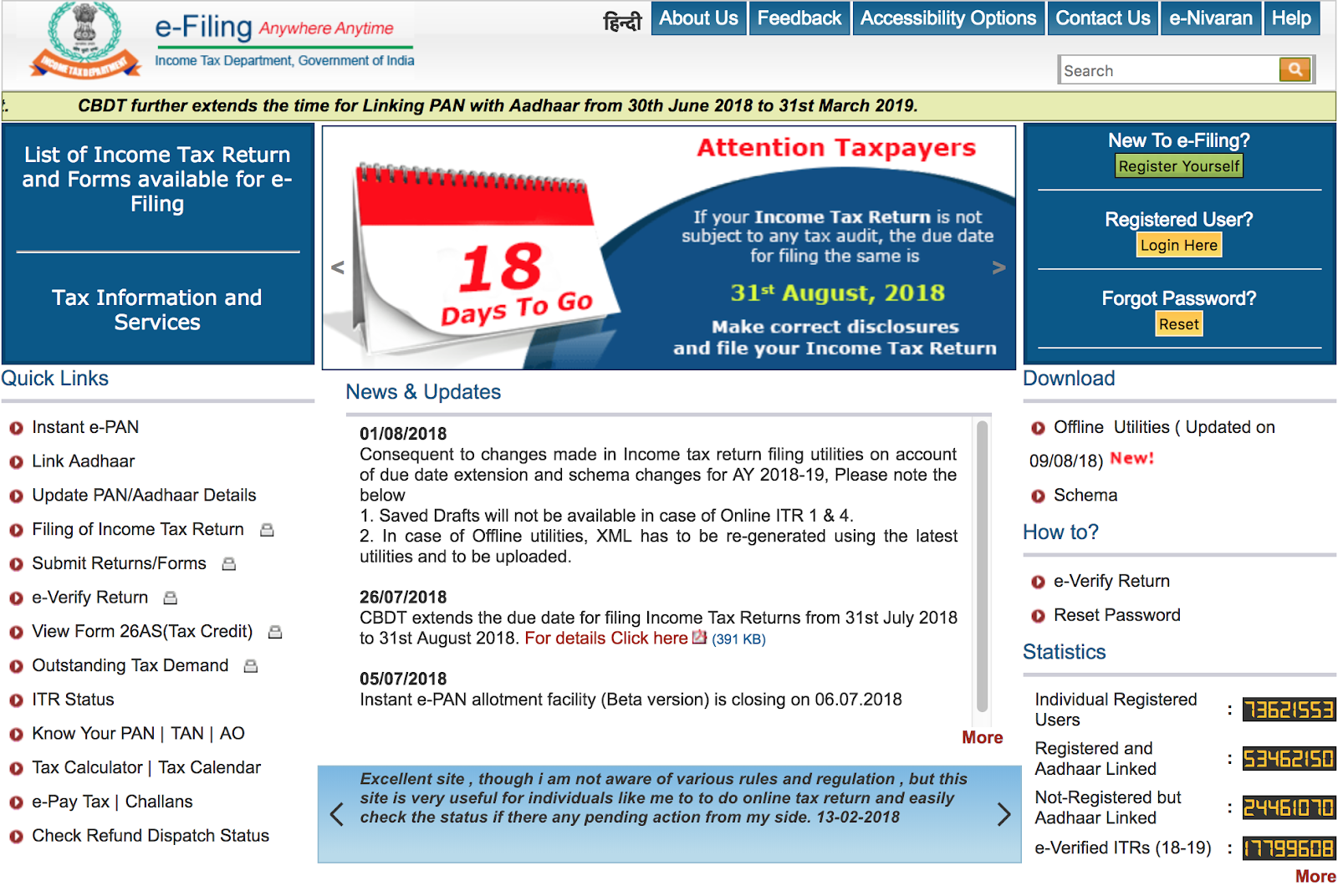

To download one's form 26as, the income taxpayer needs to log in at the new income tax website — www.incometax.gov.in. The income tax department’s website provides an option to view form 26as by logging in using one’s pan (permanent account number). Click on the income tax forms tab.

Enter your user id and the individual can also access the account via net banking. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your. Then click at the 'login' button at.

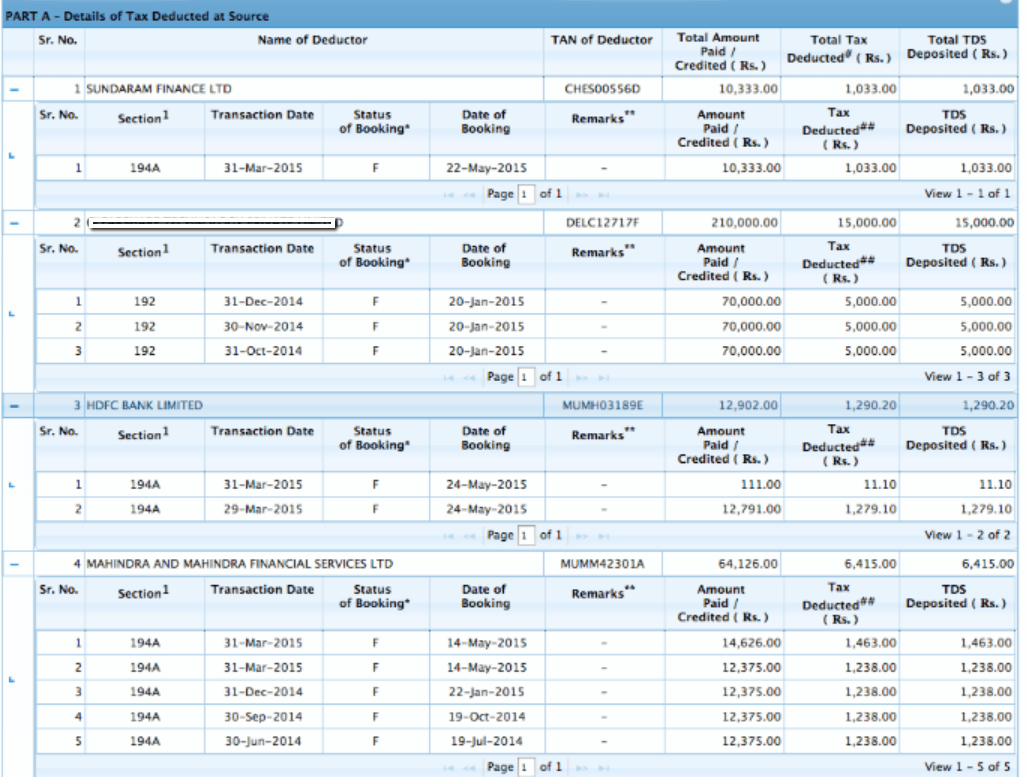

Income tax return filing 2024: The website provides access to the pan holders to view the details of tax credits in form 26as. Form 26as displays the amount of tax deducted at source (tds) from various sources of income, such as salary, interest, or dividends.

If you are not registered with traces, please refer to our e. Srishti, an nri, discovered inr 20,000 tds. Form 26as is a consolidated yearly tax statement that includes information on taxes deducted at source, taxes collected at source, assessee advance tax paid, and.

Locate and select the form 16 option from the frequently used forms section. Income tax form 26as is a consolidated statement showing details related to tds and tcs from different sources. Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and.

Here are some steps to easily download form 26as on the new income tax portal. Tax deducted on income: