Unique Tips About Notes And Disclosures Cash Flow Statement Line Items

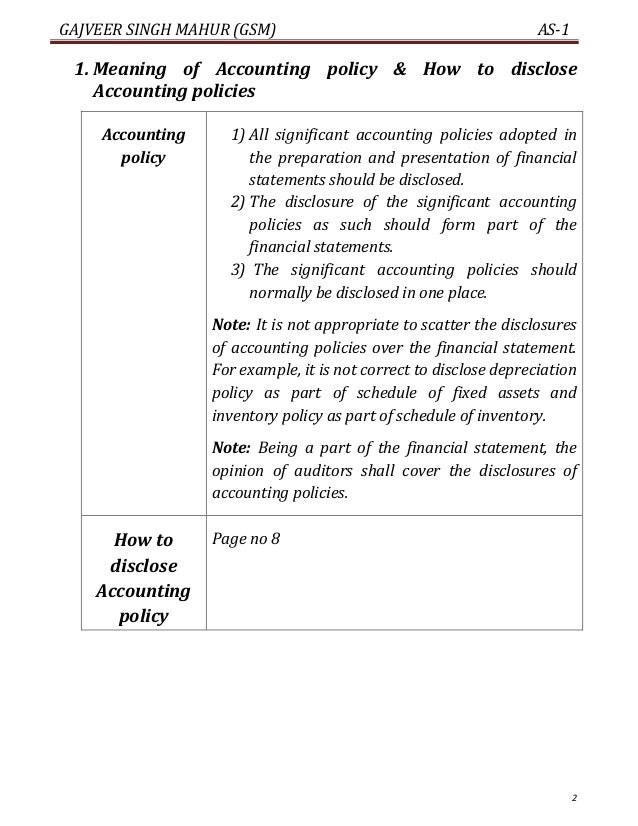

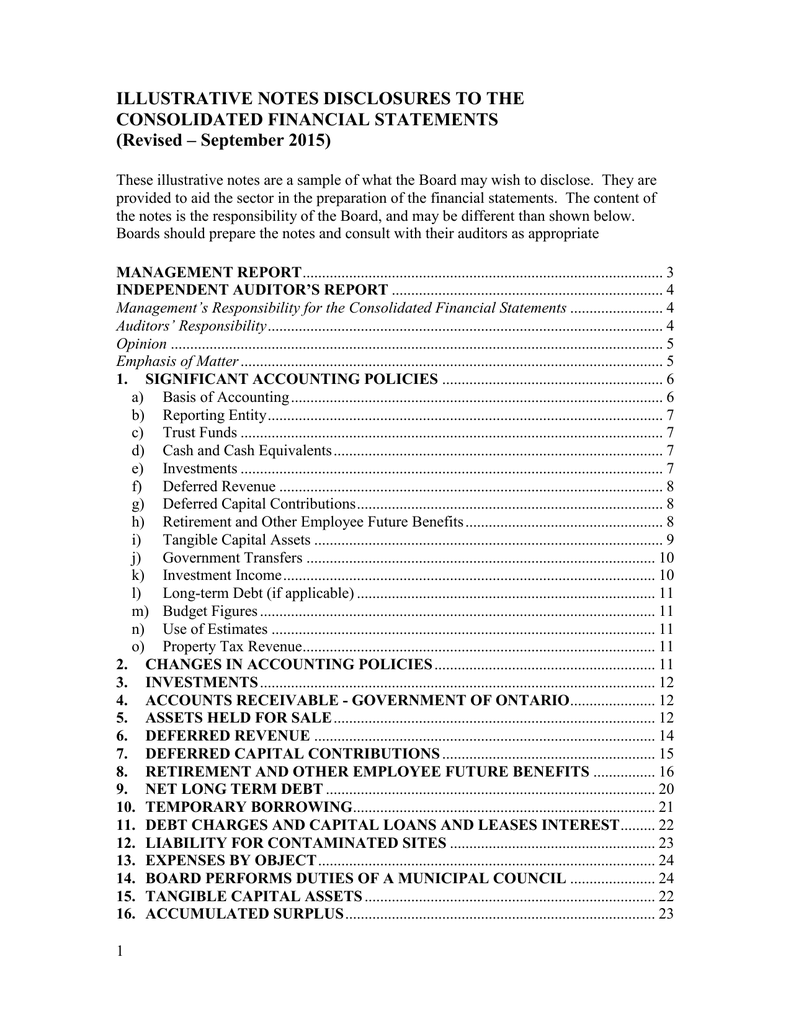

Disaggregation and analysis of balances and transactions included in the financial statements, for example of property, plant and equipment,.

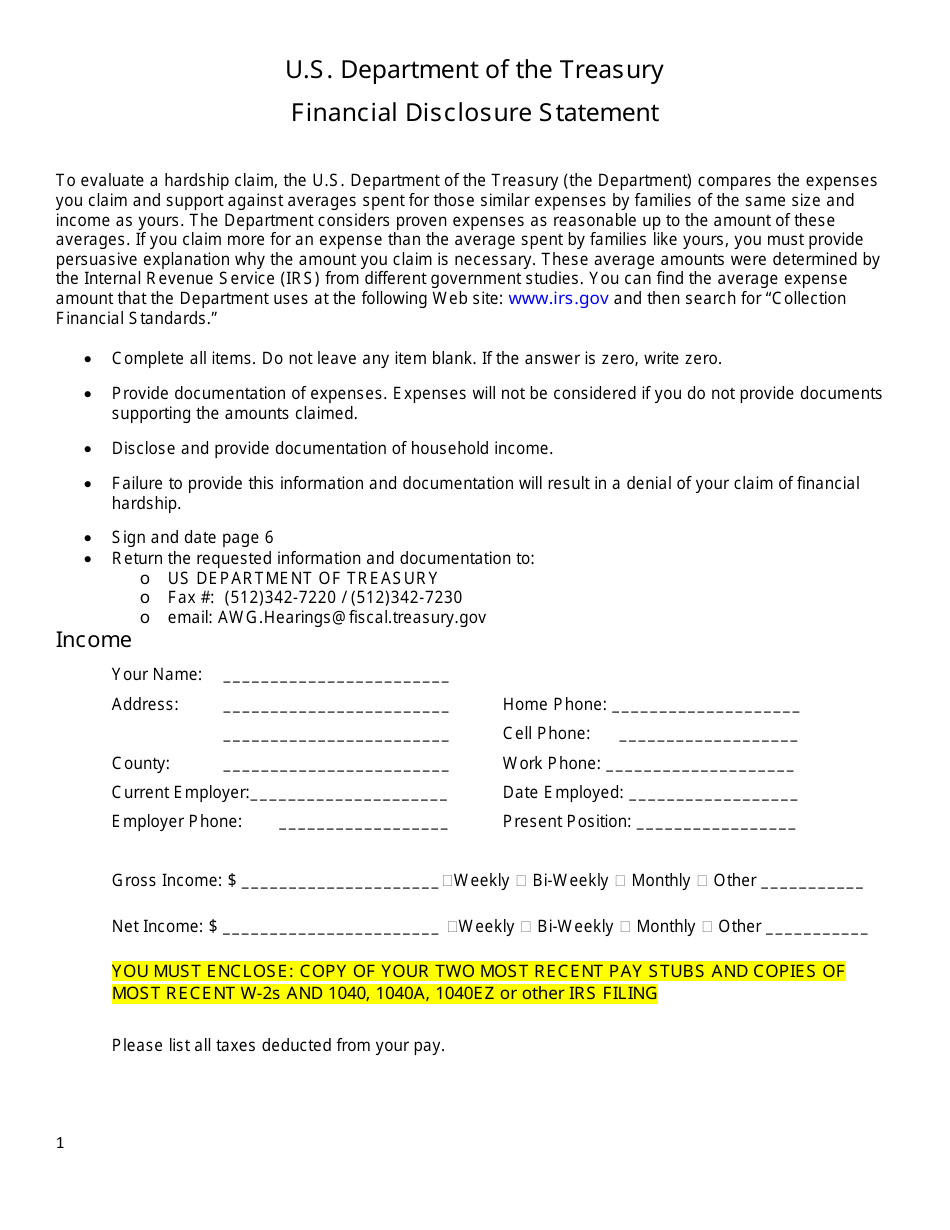

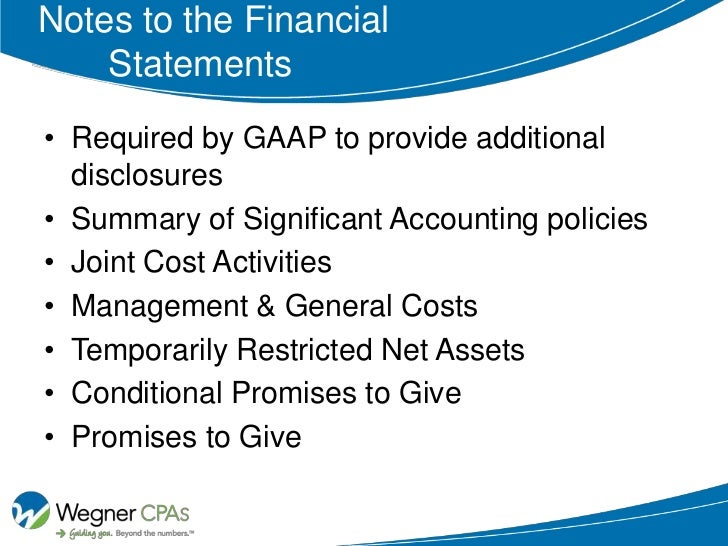

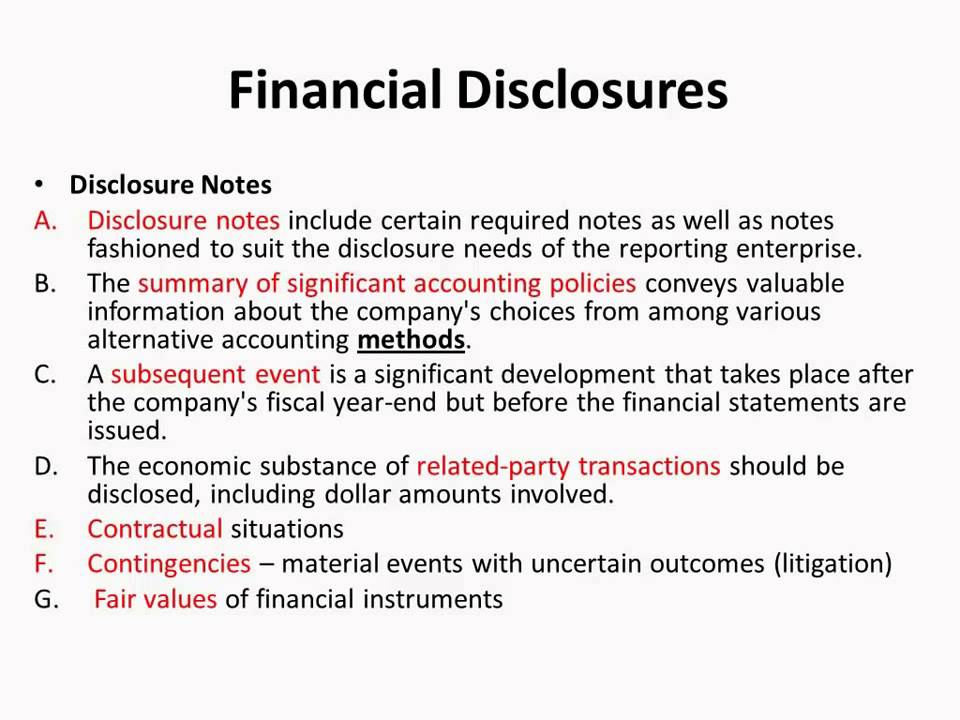

Notes and disclosures. Ifrs 15 provides explicit presentation and disclosure requirements that are more detailed than under legacy ifrs and increase the volume of required disclosures that entities. Financial statements are not complete without note disclosures. The notes to the financial statements are a required, integral part of a company's external financial statements.

Nick anderson nick anderson, a member of the international accounting standards board (board), discusses a pilot approach to developing disclosure requirements in ifrs. Use of judgements and estimates 22 performance for. Functional and presentation currency 18 4.

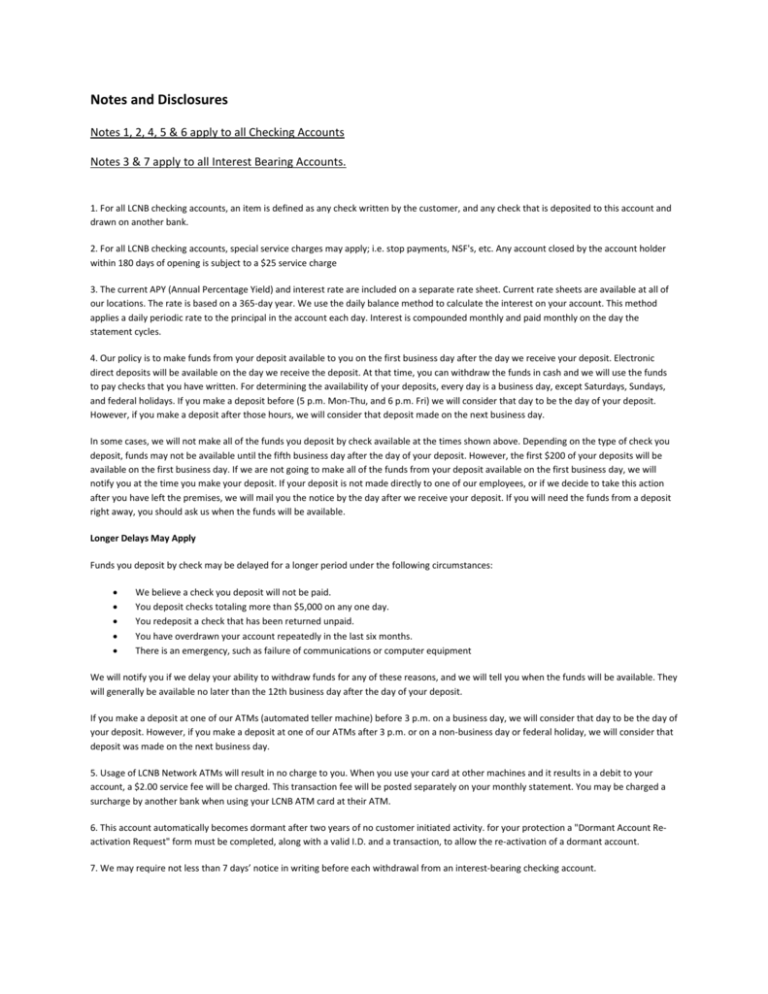

Project principles of disclosure paper topic the role of the primary financial statements and the notes contact(s) holger obst [email protected] +49 30 2064 1229 kristy robinson. Notes and disclosures notes to the financial statement present all such information which cannot be presented on the face of income statement, balance sheet,. These disclosures may be presented either on the face of the statement of cash flows or in the notes to the financial statements.

As we mentioned, there are additional disclosures that must be included at the end of a financial statement. The footnotes present required disclosures, accounting methodologies used, any modifications to methodologies from previous reporting periods, and upcoming. No potential conflict of interest was reported by the author(s).

Functional and presentation currency 22 4. In fact, there may be some large potential losses that cannot be expressed as a specific amount, but they are. Notes can be added as an attachment to a financial statement or as a footnote.

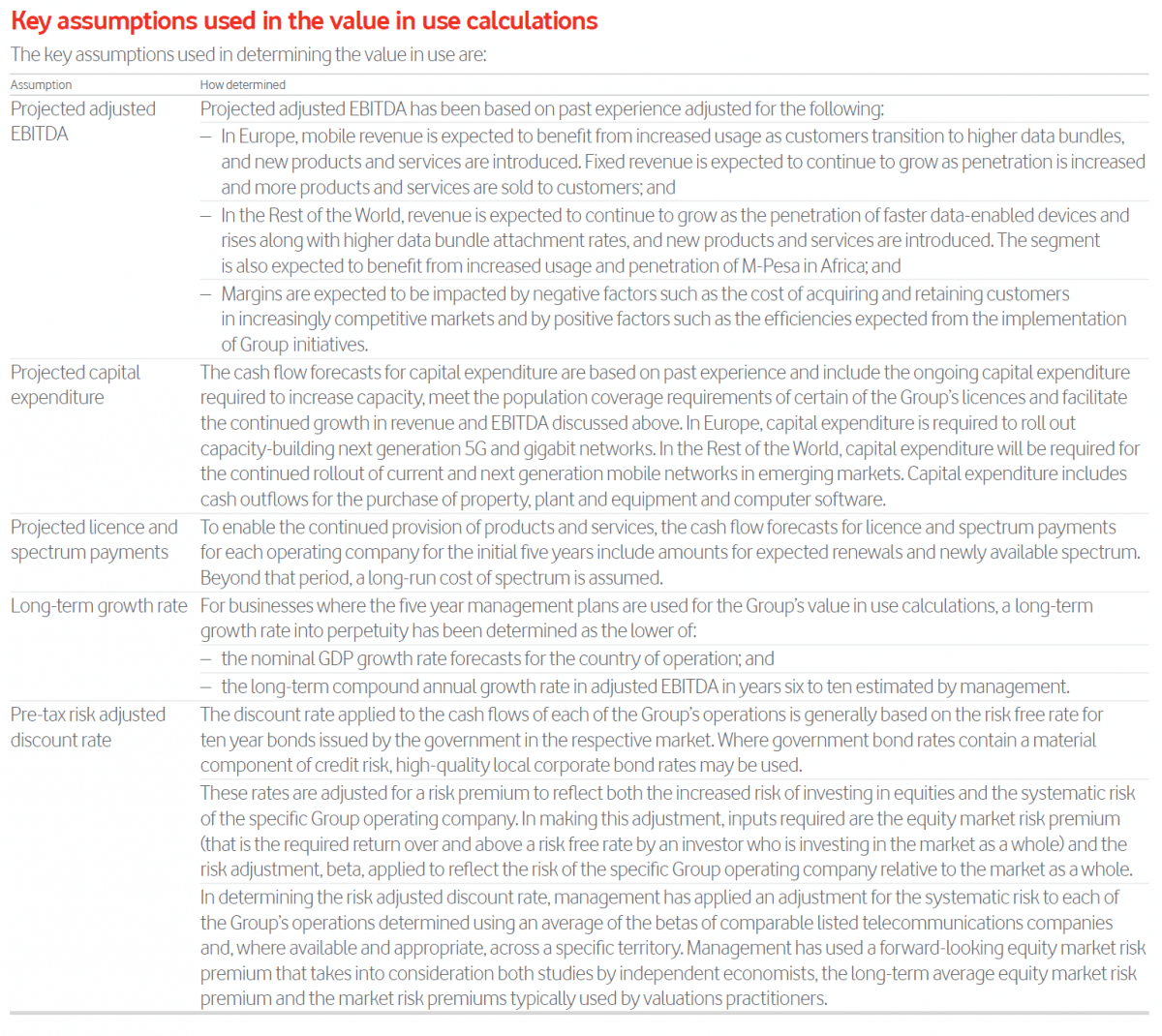

The notes are used to explain the assumptions used to prepare the numbers in the financial statements as well as the accounting policies adopted by the company. The notes (or footnote disclosures) are required by the full disclosure principle because the amounts and line descriptions on the face of the financial statements cannot provide sufficient information. What are disclosures in financial statements?.

Disclosures may be simple statements regarding the change or provide a lengthy explanation for the reason to change the company's accounting policies and procedures. 1 esen and gumuscu, “rising,” and öztürk, “an alternative reading.”. Use of judgements and estimates 18 5.

Notes basis of preparation 22 1. Learn what notes are, their importance, and how to use them. Financial notes regarding disclosures can appear on income statements, balance sheets and the.

General presentation and disclosures ifrs®standards exposure draft ed/2019/7 illustrative examples december 2019 includes a comparison of proposals with. Basis of accounting 18 3. They are required since not all relevant financial information can be.

Here are seven extremely important financial statement footnote disclosures you don’t want to miss: Ias 1 requires that comparative information to be disclosed in respect of the previous period for all amounts reported in the financial statements, both.