First Class Tips About Detailed Profit And Loss Operating Cash Flow Ratio Analysis

The profit and loss report is an important financial statement used by business owners and accountants.

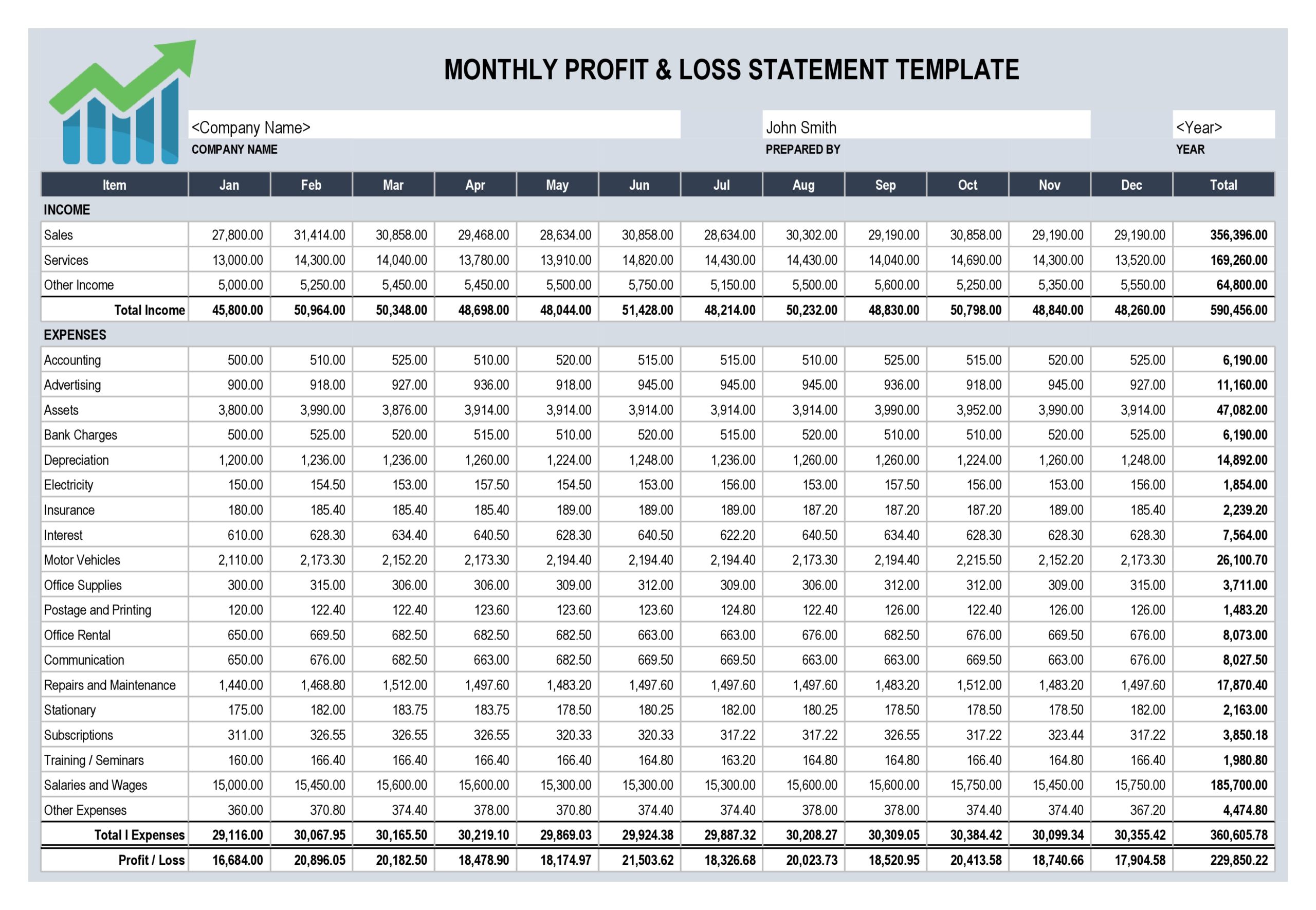

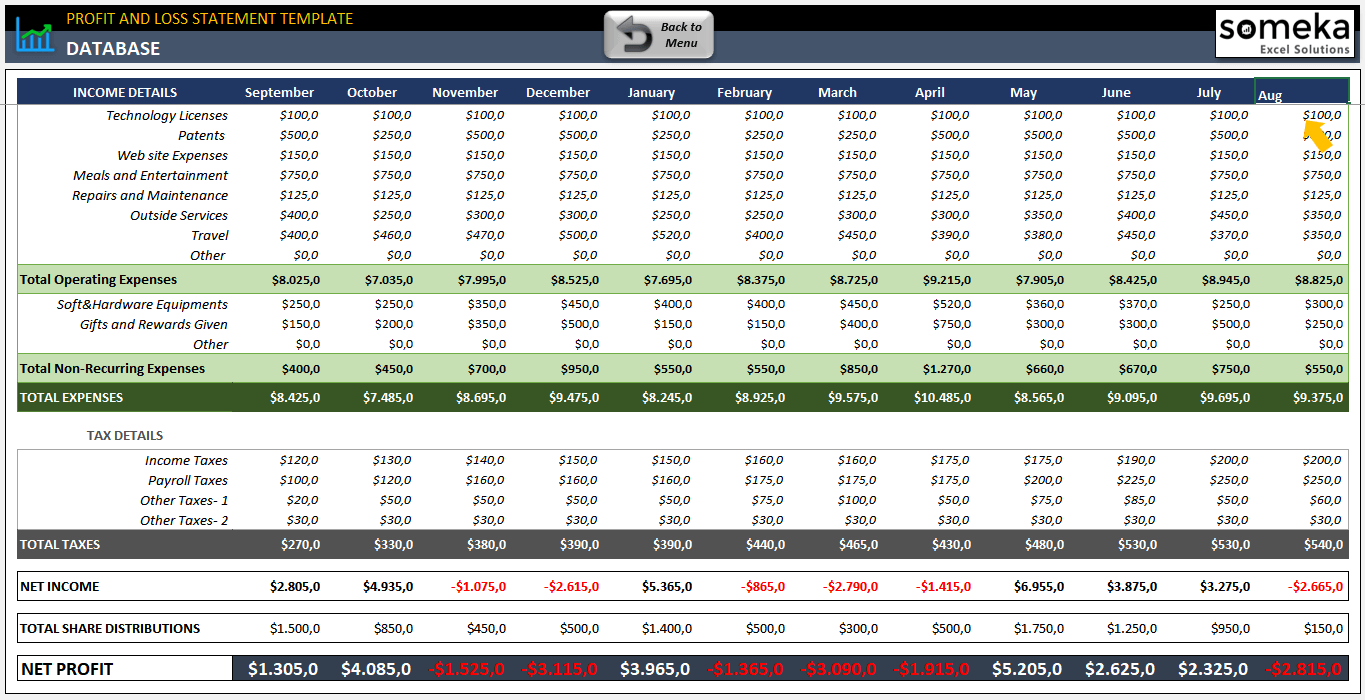

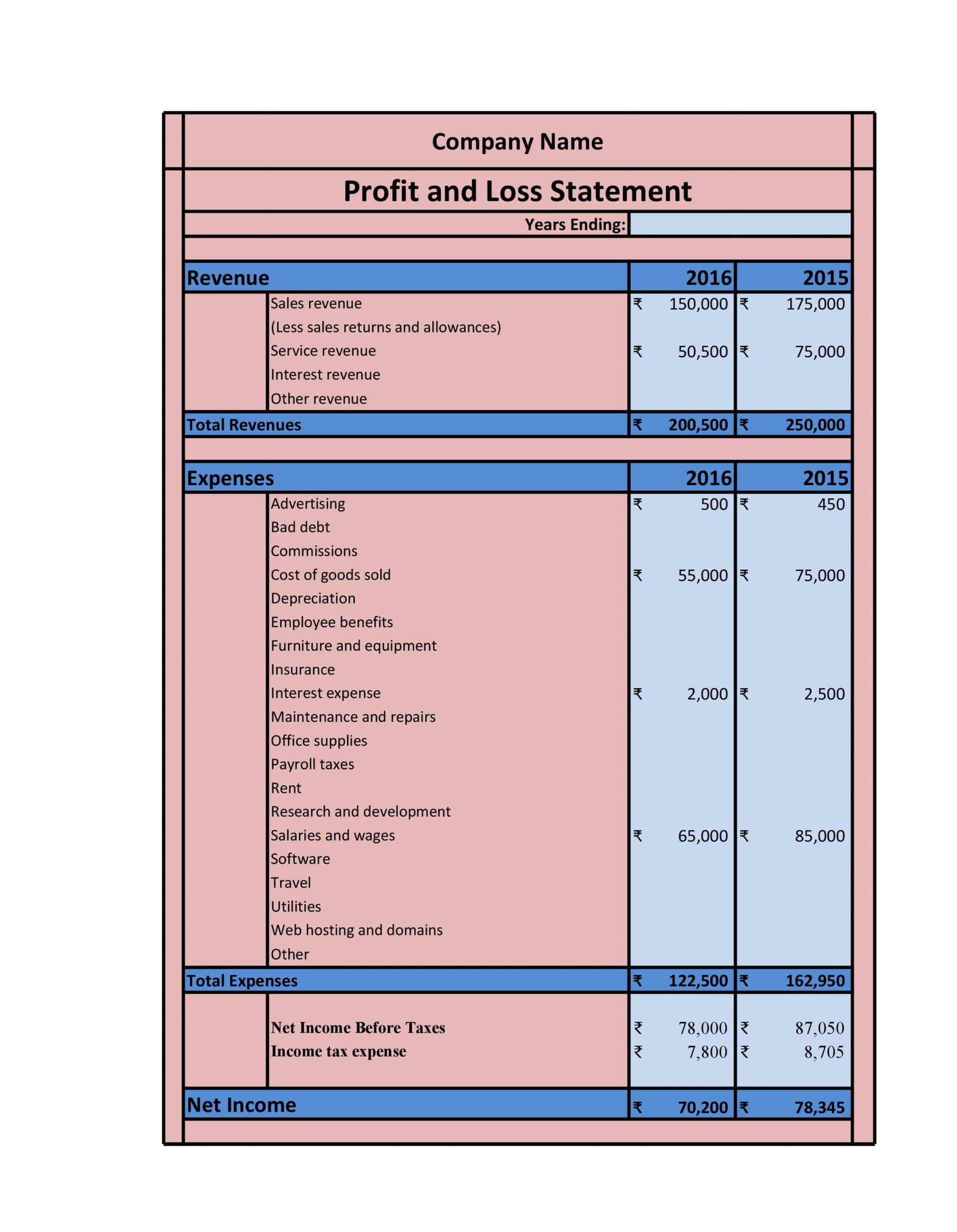

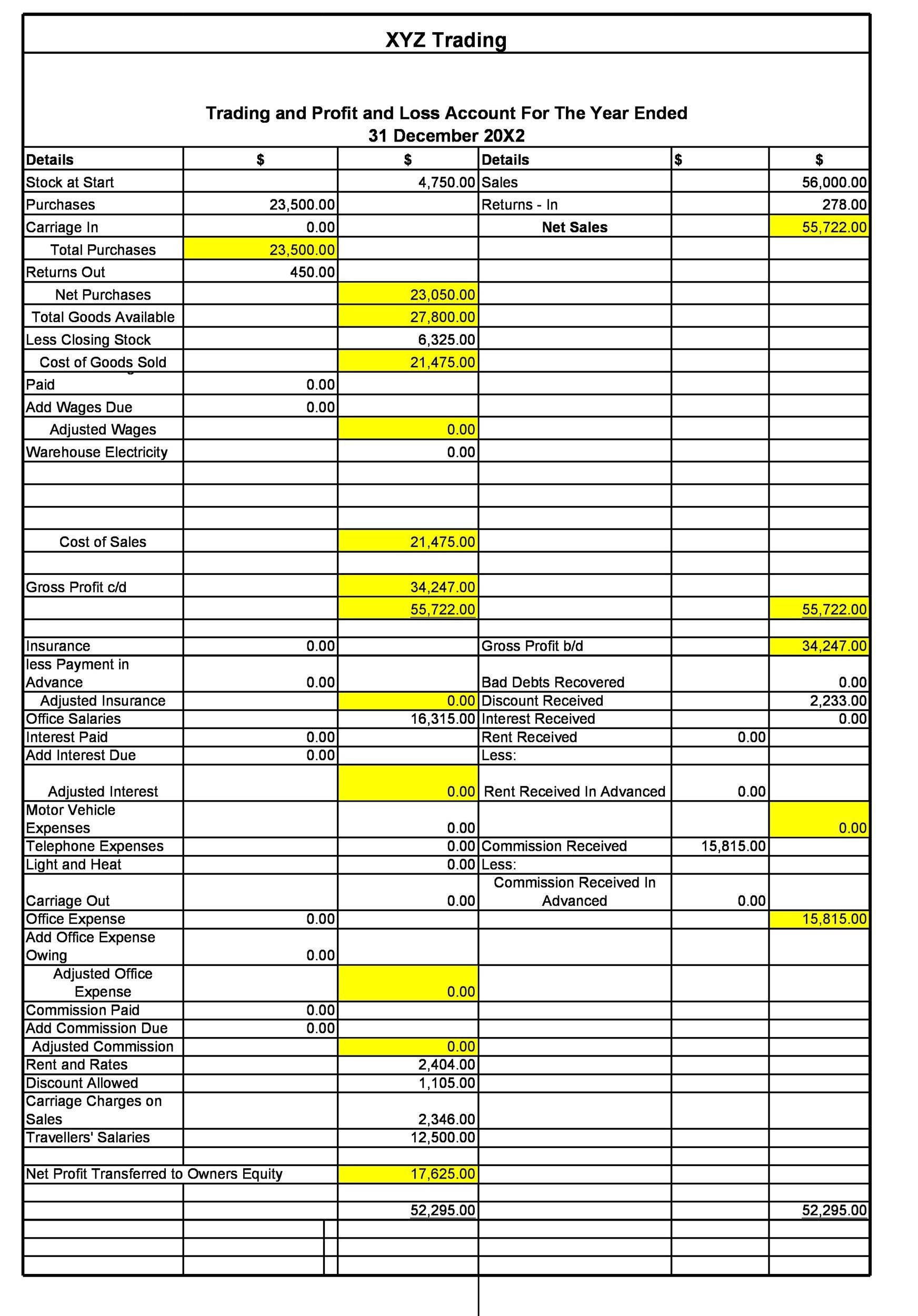

Detailed profit and loss. A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. The spending of the company on the rent was $6,000, on utility was $5,000, and on the salary of one staff working was $7,000. The cash method is a simple way to account for cash received or cash paid.

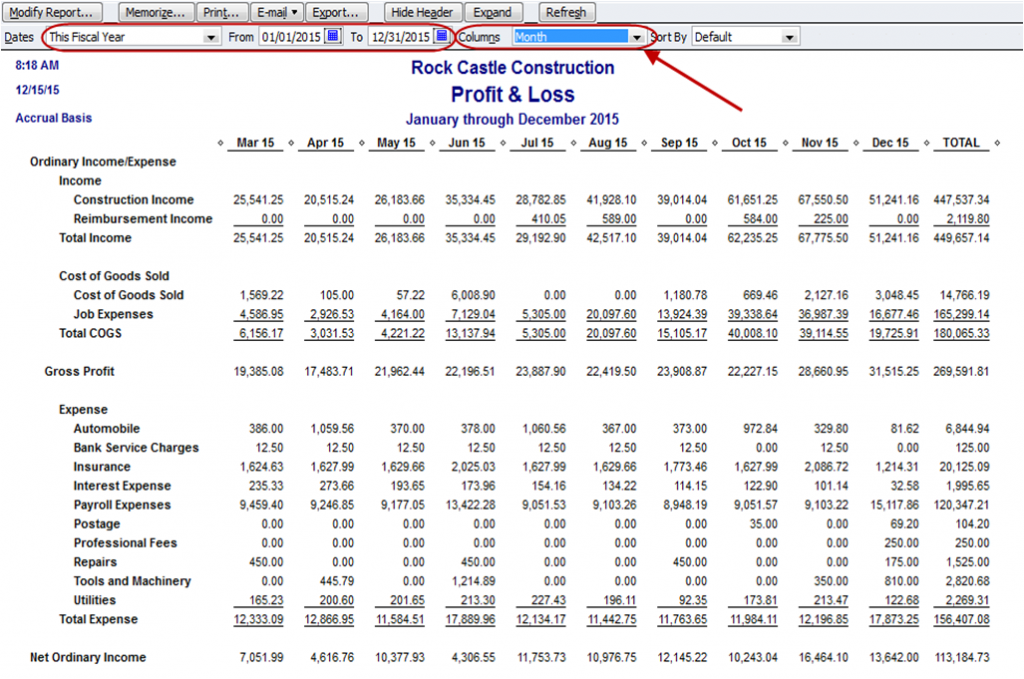

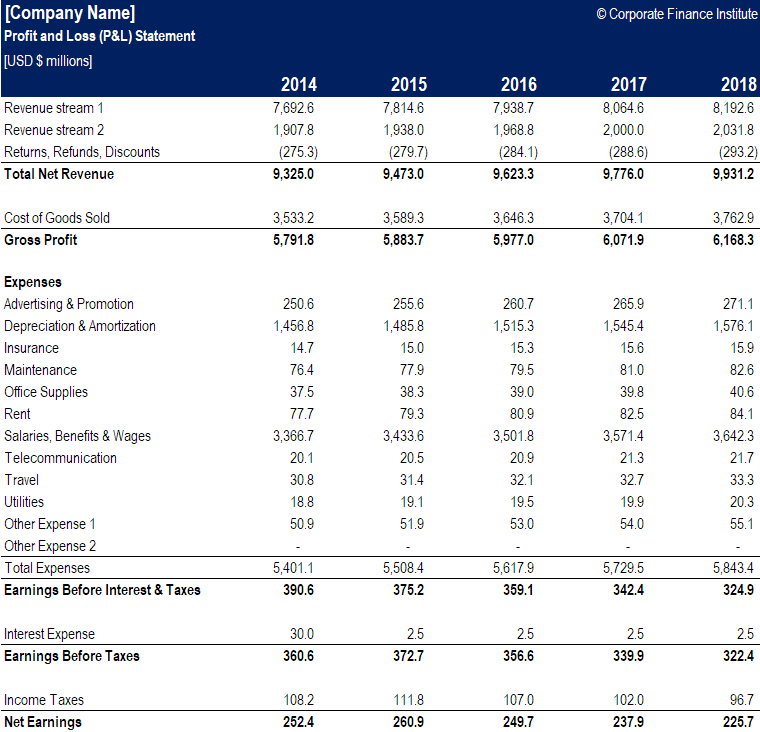

It shows your revenue, minus expenses and losses. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. What is profit and loss statement?

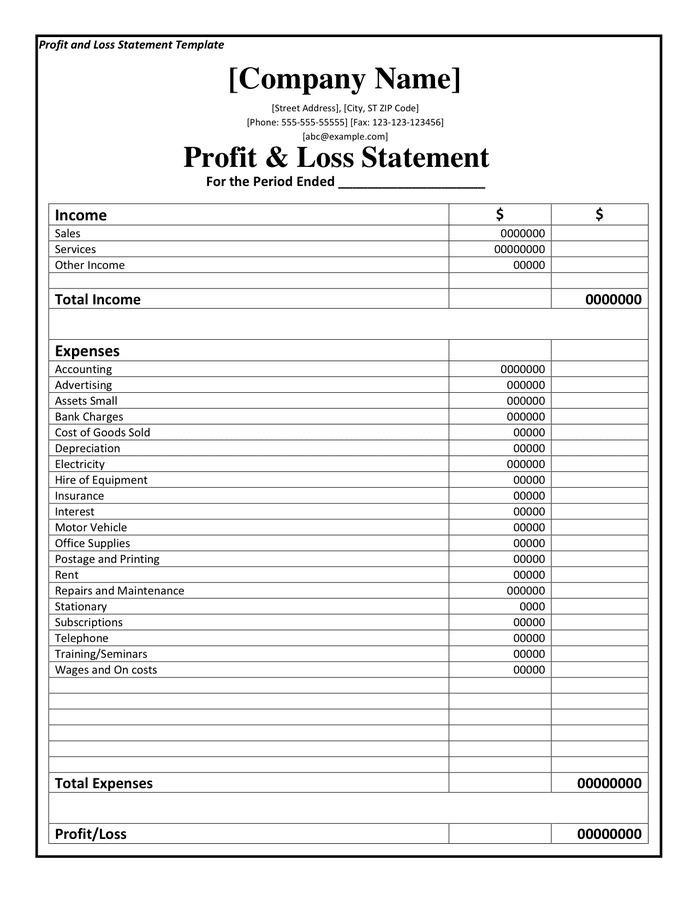

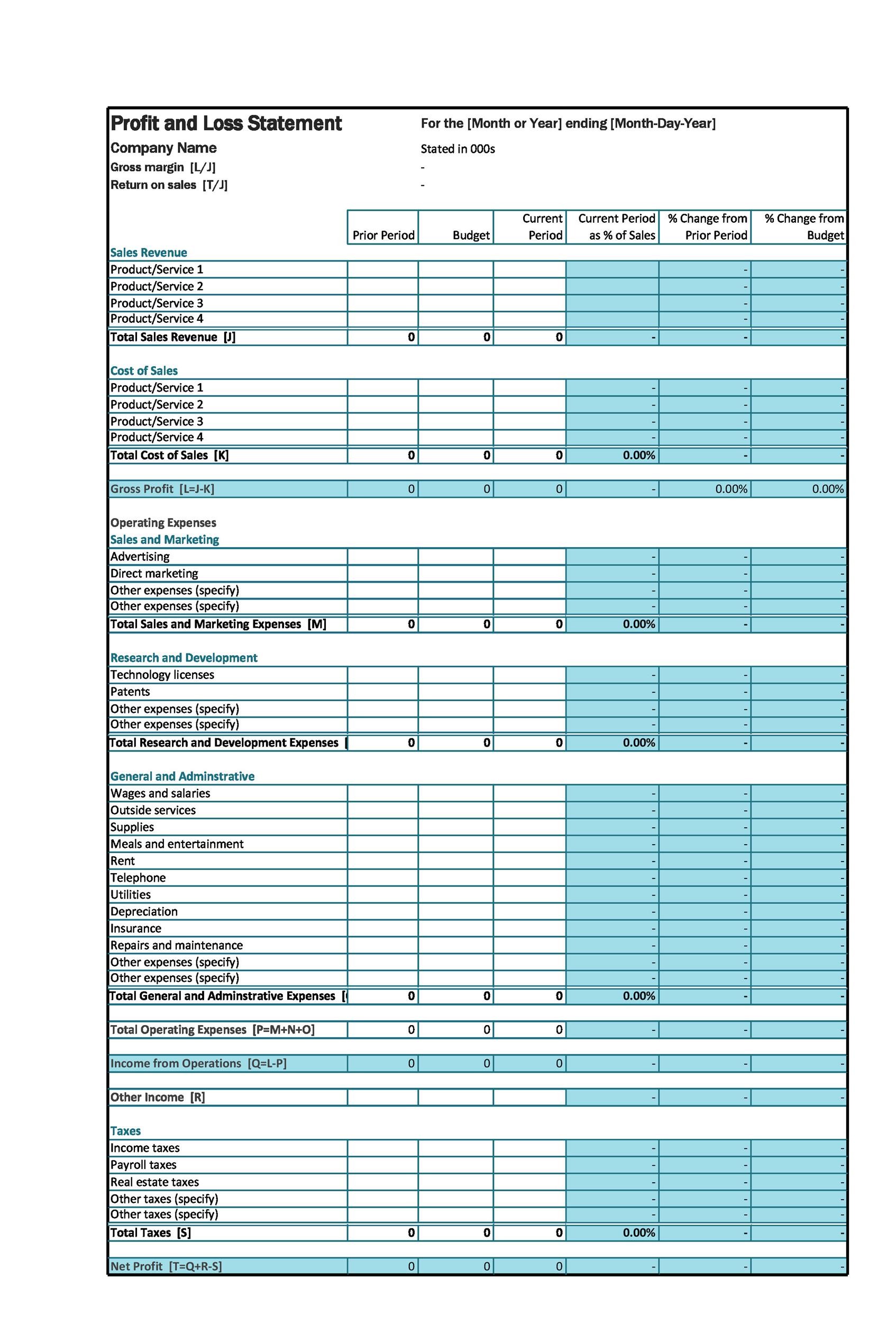

The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a p&l statement summarizes a company's revenues, costs, and. For example, a company has a choice to list its operating expenses as $210,000 or split out the individual line items that detail those expenses. The income statement can be presented in condensed form or in multiple steps showing different levels of detail, but it always includes revenue, gains, expenses, losses and net income/(loss).

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. And i'll be happy to guide you. Restaurant profit and loss template download restaurant profit and loss template — microsoft excel

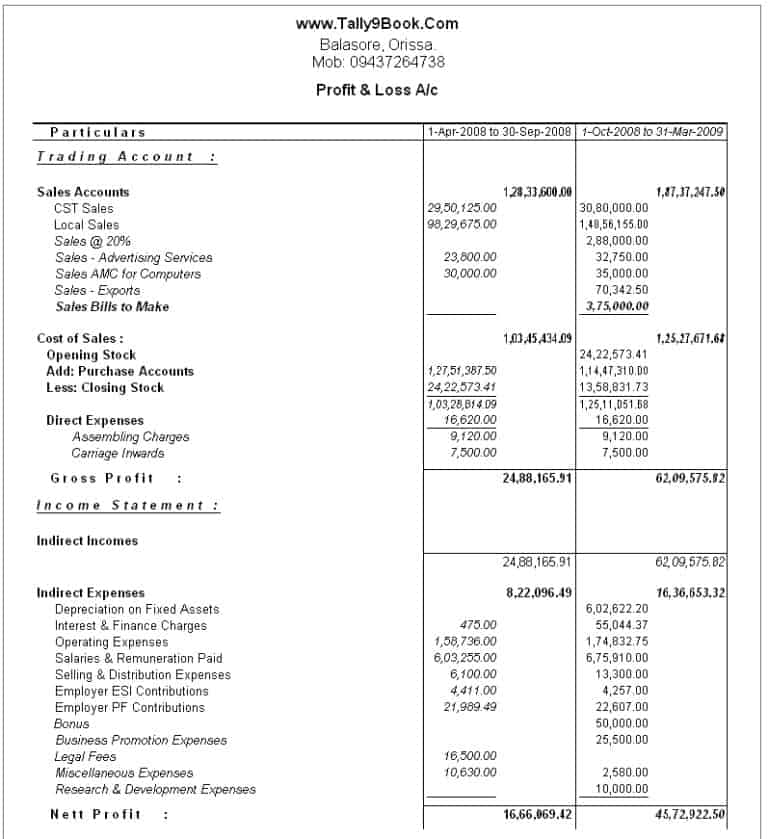

A detailed profit and loss statement provides a line item for every variable that affects profit rather than combining income and expense items. Companies may keep records of profits and losses using 1 of 2 methods. Revenue rose 24% to $2.1 billion during the period, beating the $2.08 billion average estimate of analysts surveyed by bloomberg.

The above profit and loss statement is. On the left of your quickbooks online (qbo), click reports. Net income or net profit is calculated by charging all operating expenses and by considering other incomes earned in the form of.

Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or services. It captures how money flows in and out of your business. It's a straightforward presentation of a.

Prepare the profit and loss statement for the year ended december 31, 2018, for the shop. A tax preparer may use a detailed business profit and loss statement for the entire year to create a tax return at the end of the fiscal year for a company. Net income/(loss) is often called “the bottom line” because it’s the last item on most income statements, although.

A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period. It details the ability of a business to manage its profits by cutting costs and driving revenue. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

Your p&l statement shows your revenue, minus expenses and losses. You usually complete a profit and loss statement every month, quarter or year. The basic formula for a profit and loss statement is:

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-33-790x709.jpg)