Underrated Ideas Of Tips About Foreign Private Issuer Financial Statement Requirements Zee Entertainment Balance Sheet

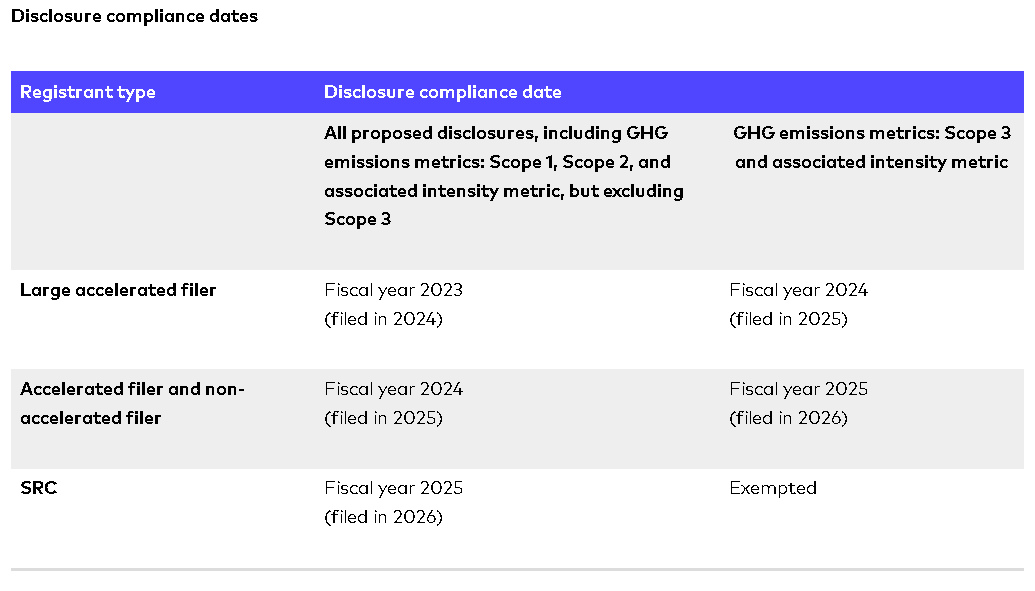

Beginning january 4, 2023, foreign private issuers of rule 144a debt securities will be required to make certain financial information publicly available in.

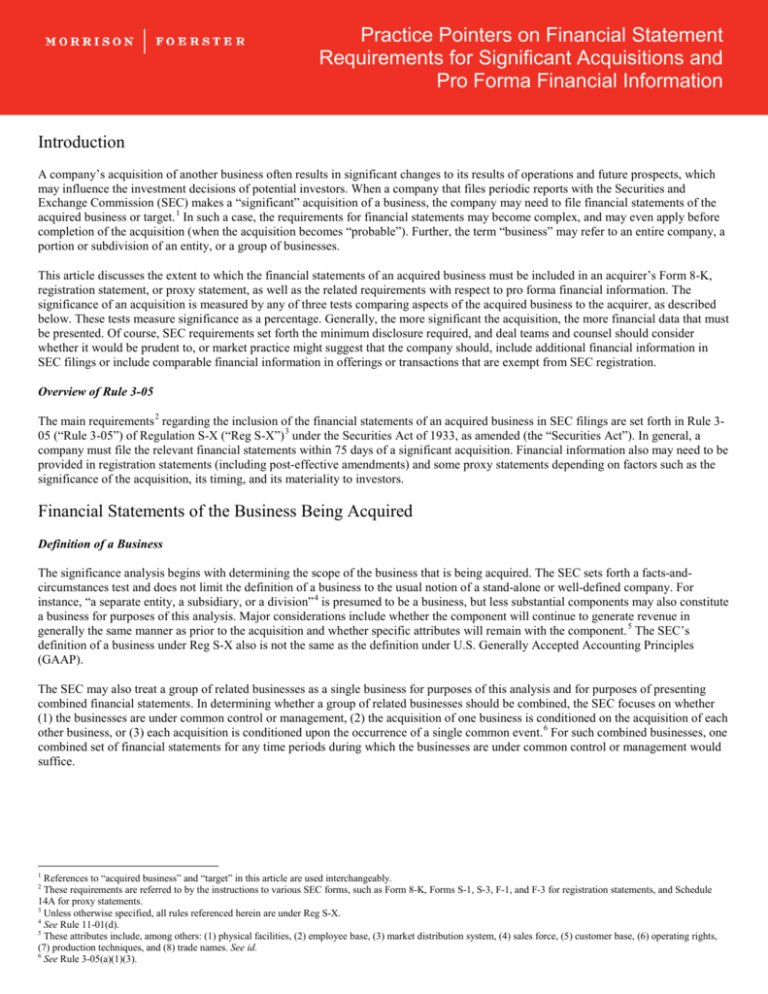

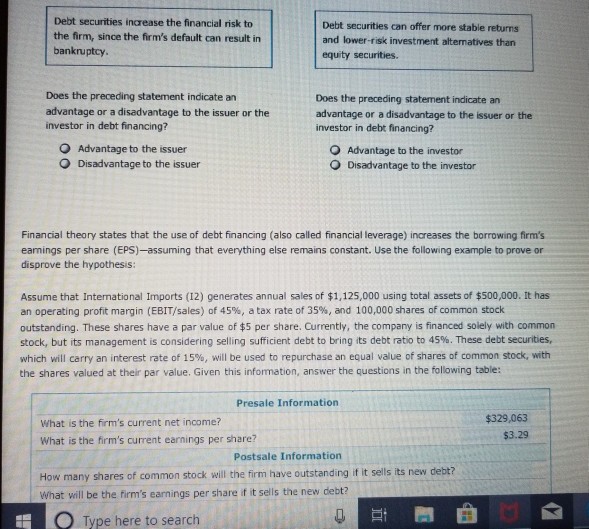

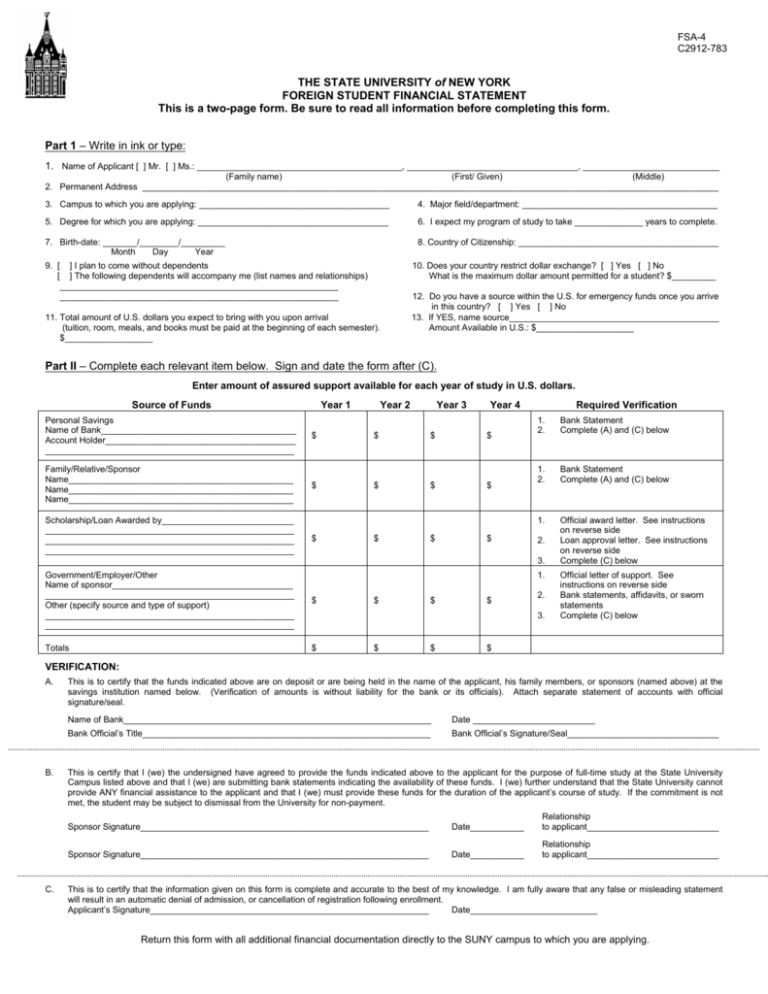

Foreign private issuer financial statement requirements. If acquirer financial statements are required, need only 2 most recent fiscal years and interim periods. The issuer must, however, meet the following requirements: What is a “foreign issuer”?

The federal securities laws define a “foreign issuer” as any issuer that is a foreign government, a foreign national of any. Acceptance from foreign private issuers of financial statements prepared in accordance with international financial reporting. On february 5, 2016, the new york stock exchange (“nyse”) filed with the securities and exchange commission (“sec”) a proposed rule change that would.

The purpose of this guide is to provide simplified information and educate you generally about the requirements for a foreign private issuer and the key differences between. Under the rule, a registration statement of a foreign private issuer may become effective. A company organized outside the united states that is subject to provisions of the us federal securities laws receives substantial benefits if it qualifies as a “foreign private.

A listed company has financial reporting obligations under the us federal securities law. Only an issuer which is a foreign private issuer (as defined in.

Gaap, consisting of a discussion and quantification of the material differences between the financial statements presented and the. The financial statement requirement of the acquirer applies. A foreign private issuer (“fpi”) is generally any foreign issuer (other than a foreign government) incorporated.

A foreign private issuer is required to file an annual report on form 20. In preparing its financial statements to be provided to the sec, a foreign private issuer can choose among u.s. Upon registering the ability to sell securities with the sec upon listing securities on a u.s.

Fpis are subject to sec filing requirements in three use cases: Available only to a foreign private issuer that states unreservedly and explicitly that its financial statements comply with ifrs and are not subject to any qualification relating.

.jpg?itok=PXNC17Rf)