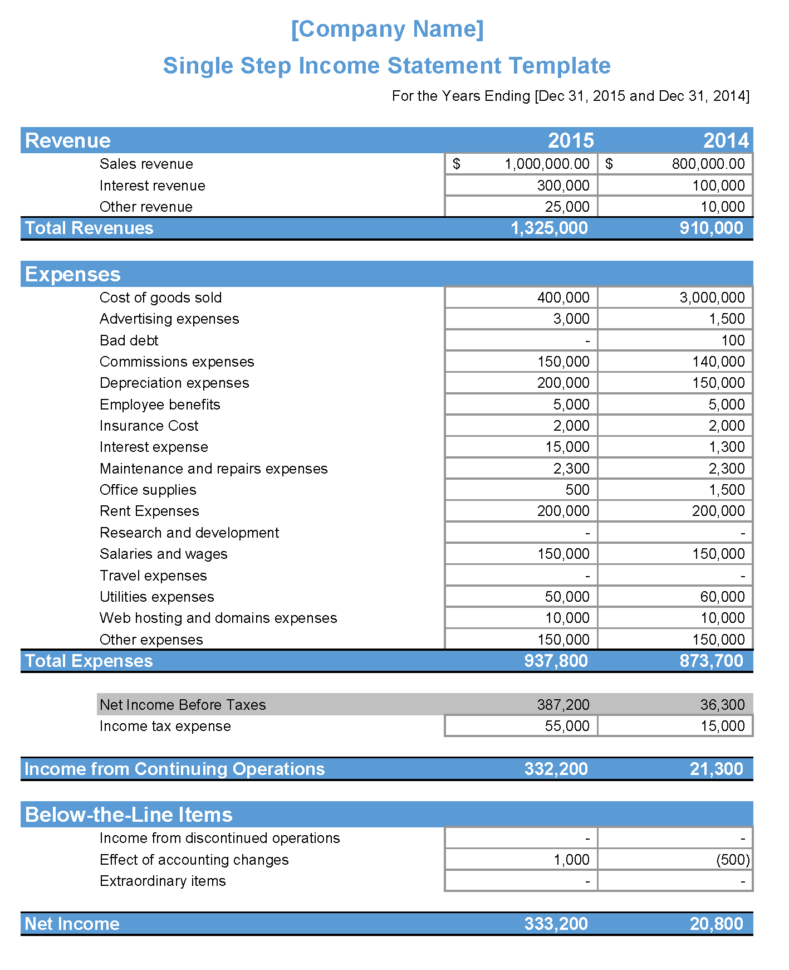

Perfect Info About Compiled Financial Statements Income Tax Basis Return On Sales Ratio Analysis

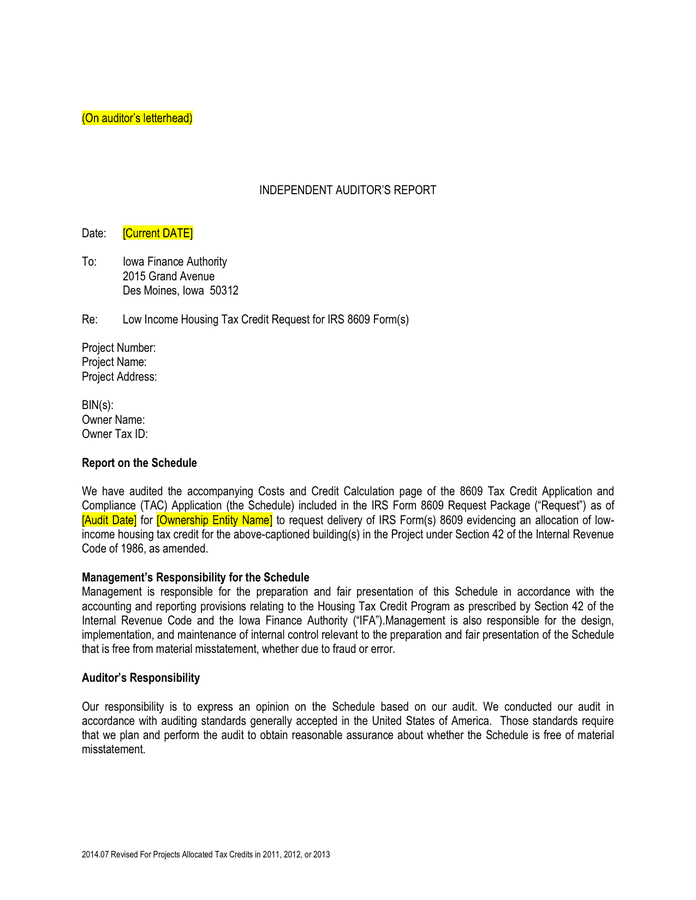

Compilation of financial statements issue date, unless otherwise indicated:

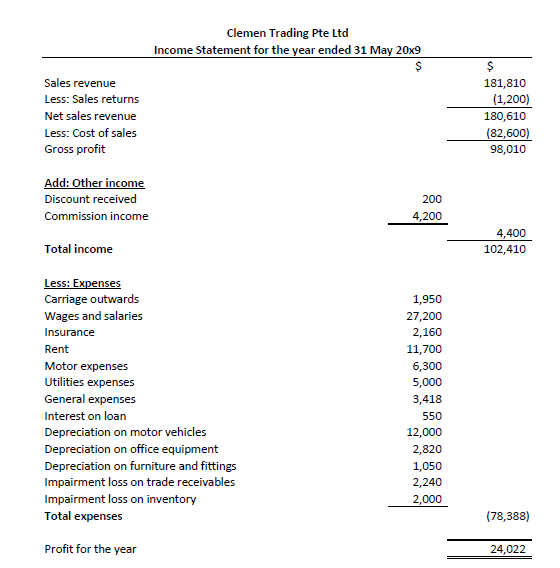

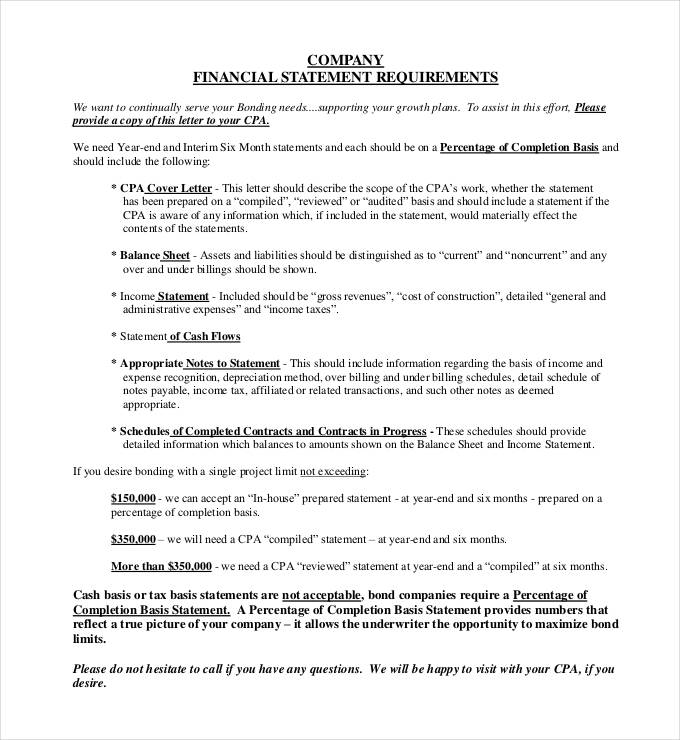

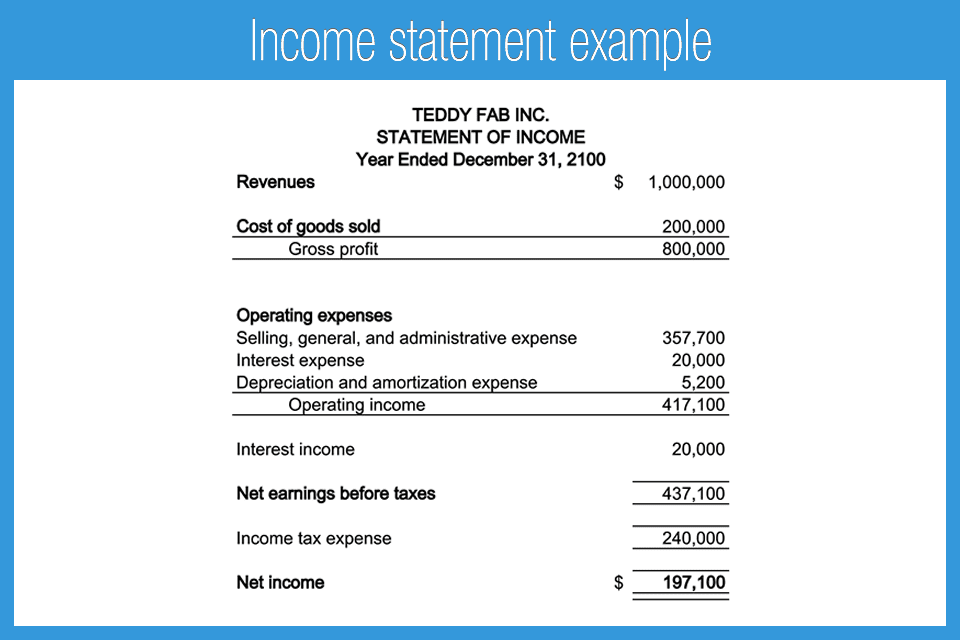

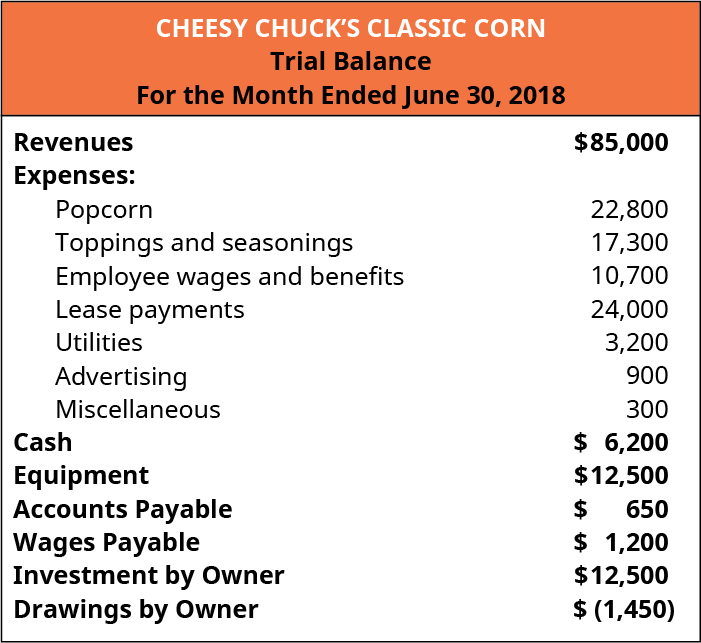

Compiled financial statements income tax basis. Presenting section 179 and bonus. Usually, accounting firms prepare the compiled financial statements under the. Those statements may be in conformity with generally accepted accounting principles (gaap), cash basis, or the income tax basis of accounting.

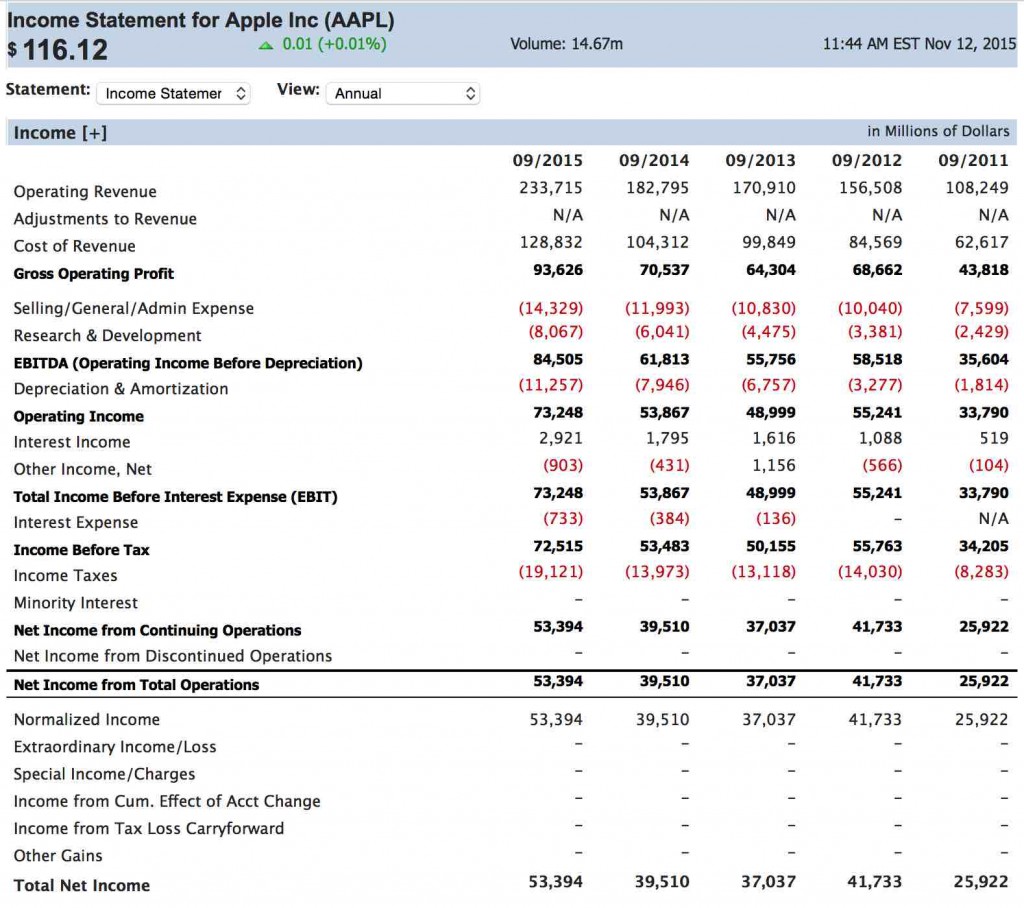

In this lesson, we will explain how to prepare financial statements using the income tax basis of accounting. In one example, the attorney general's legal team showed that trump's. Illustration 5 — an accountant’s compilation report on comparative financial statements prepared in accordance with the tax basis of accounting, and management has.

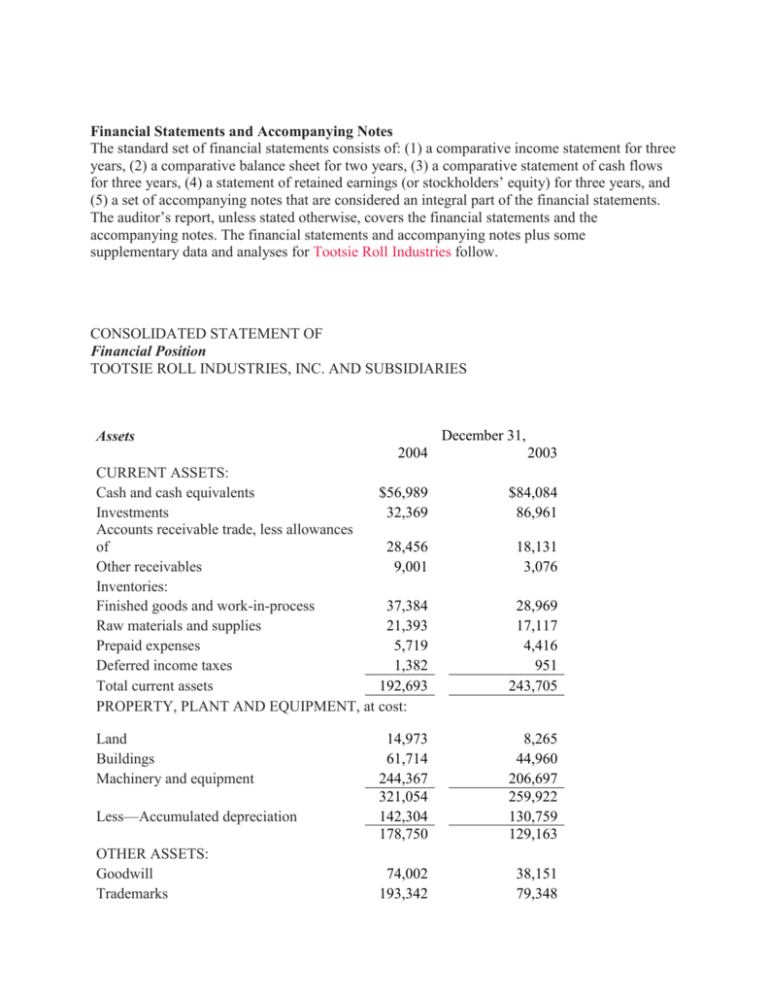

Income taxes 59 alternative performance measure 66 15. It is not an audit and it is. Adjusted earnings before interest, tax,.

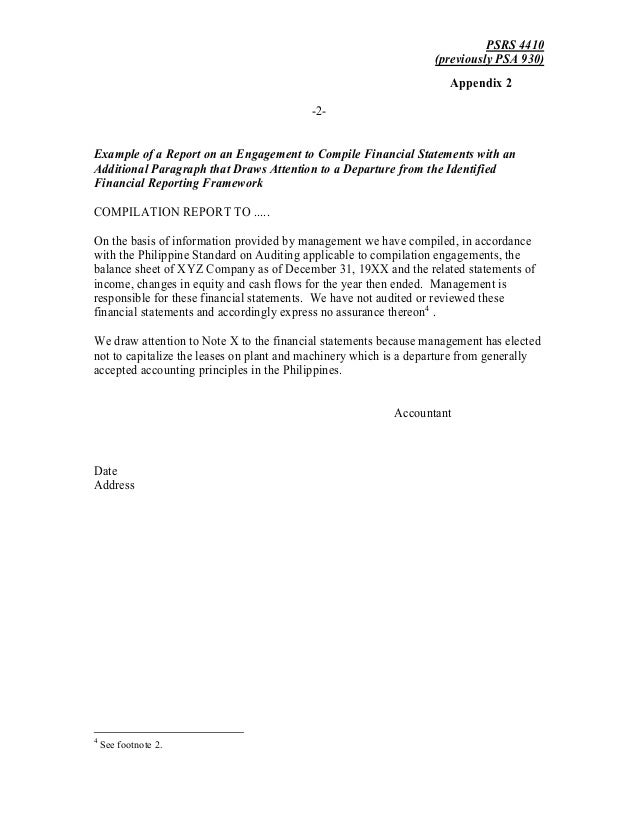

each state in the united states hasâ its own. Preferred stock dividends net income available to common. The illustrative accountant’s compilation reports presented herein are provided to assist accountants in preparing high quality reports in accordance with aicpa professional.

Income before income taxes. Presenting consolidated or combined financial statements, and measurement considerations. On friday, the law enabled ms.

A compiled financial statement provides the financial information of a company or individual, including income, expenses, cash flow, assets and liabilities. Along with the financial penalty, the judge barred mr. In the case of a mercantile system of accounting, the deduction is allowed on an accrual basis.

There are essentially threeâ basic levels of financial statement preparation — compilation, review, and audit. Disclosures related to amounts (e.g., depreciation, interest, rent, etc.)—if u.s. The financial statements should be appropriately titled to avoid a reader’s assumption that the statements were prepared in accordance with gaap.

The revenues minus the expense equal the company’s taxable income. Gaap would require disclosure of an amount, that amount should be disclosed in the ocboa. We will also discuss the differences between income tax basis and.

Compiled financial statements income tax basis for the period ended december 31, 2015 (unaudited). Correcting journal entries also involve ensuring the data includes supporting evidence. James to win an enormous victory against mr.

Documents shown during trial ranged from spreadsheets to signed financial statements. December 2009 see section 9080 for interpretations of this section. Amanda jackson compiled vs.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)