Impressive Tips About Interpreting A Balance Sheet Retained Earnings Formula On

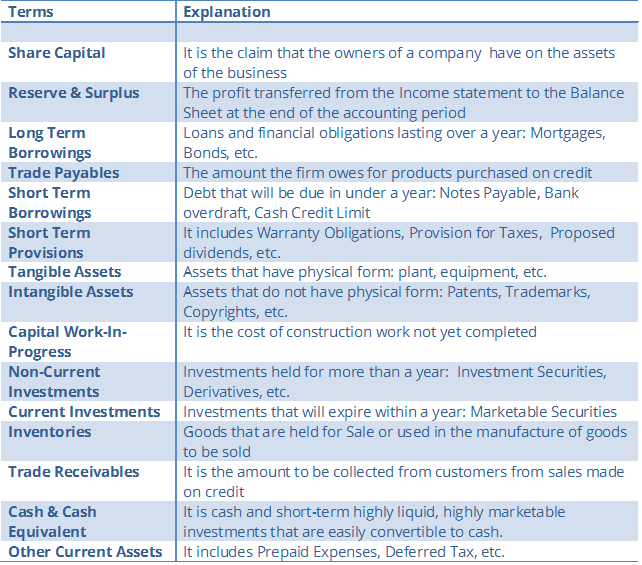

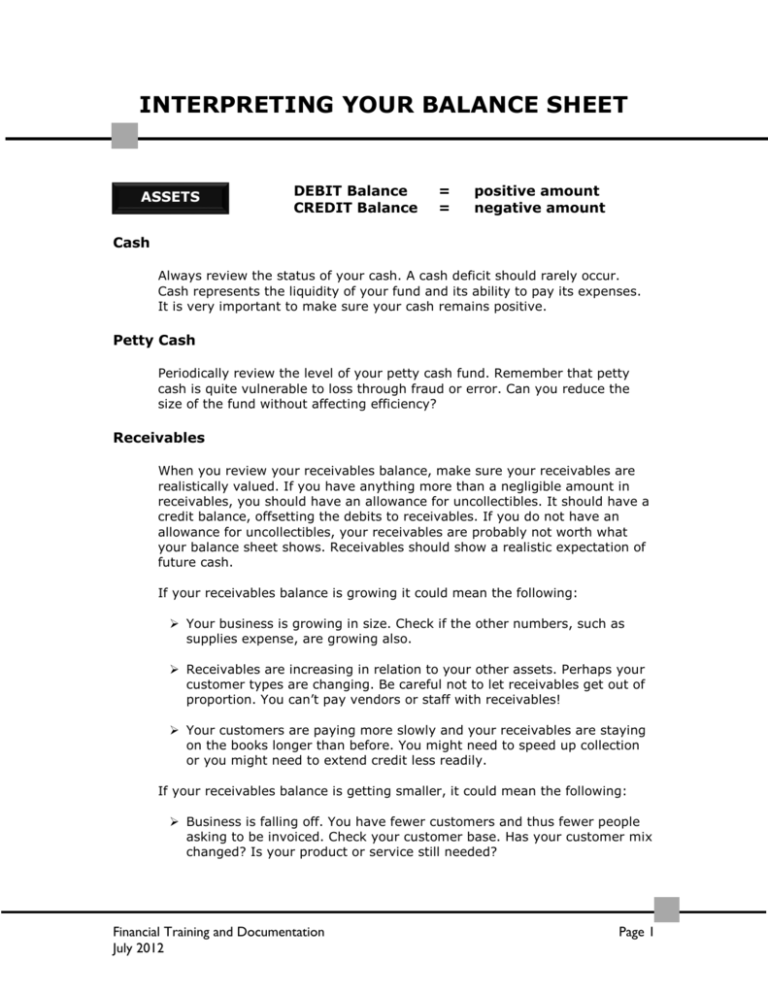

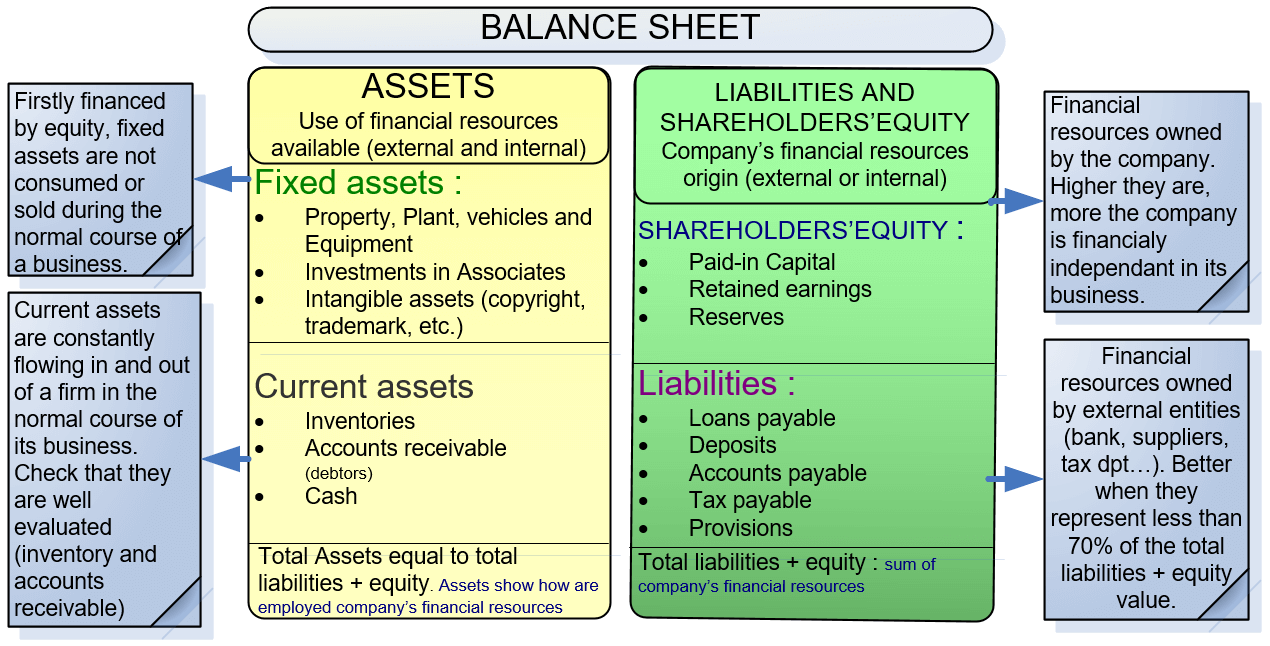

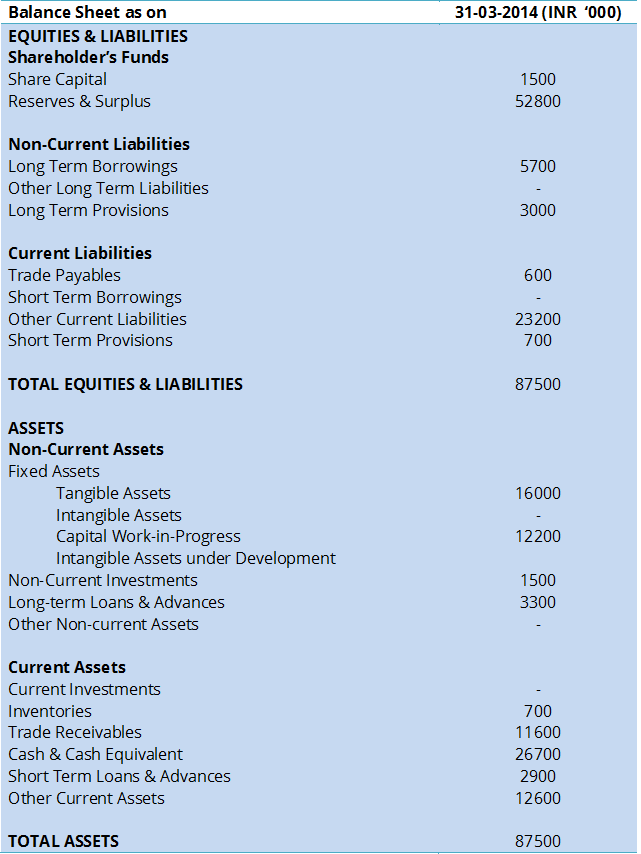

Assets represent the use of funds.

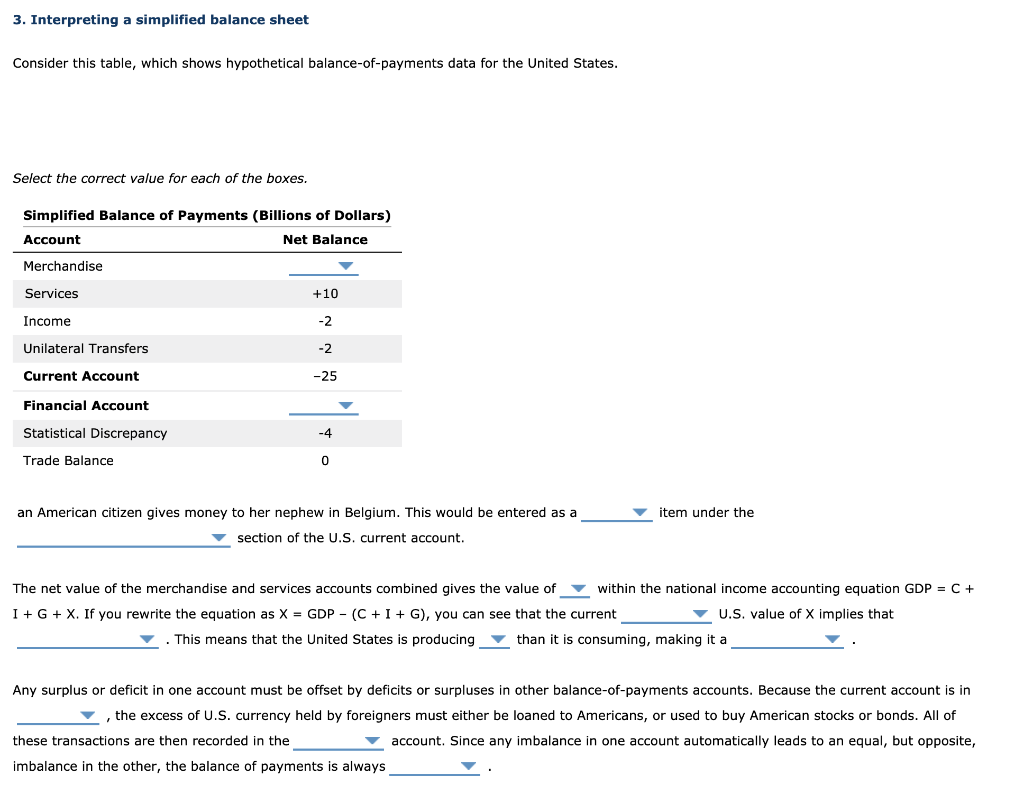

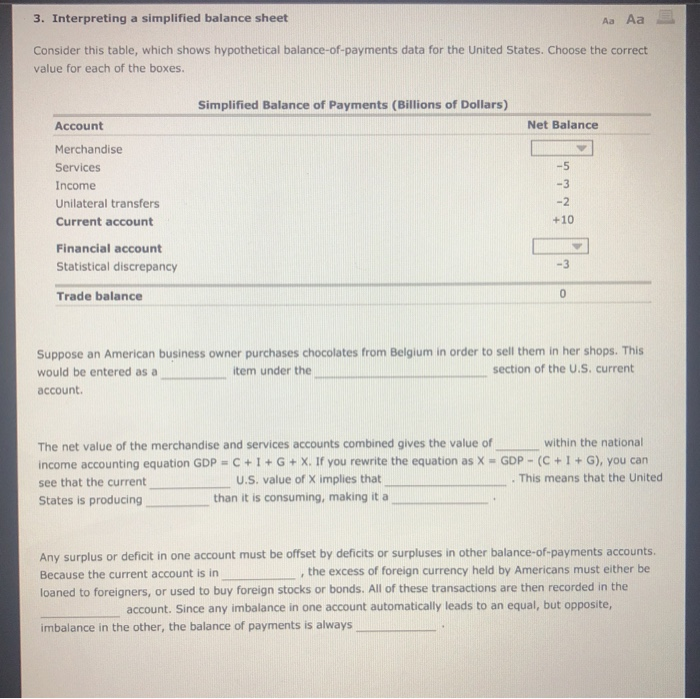

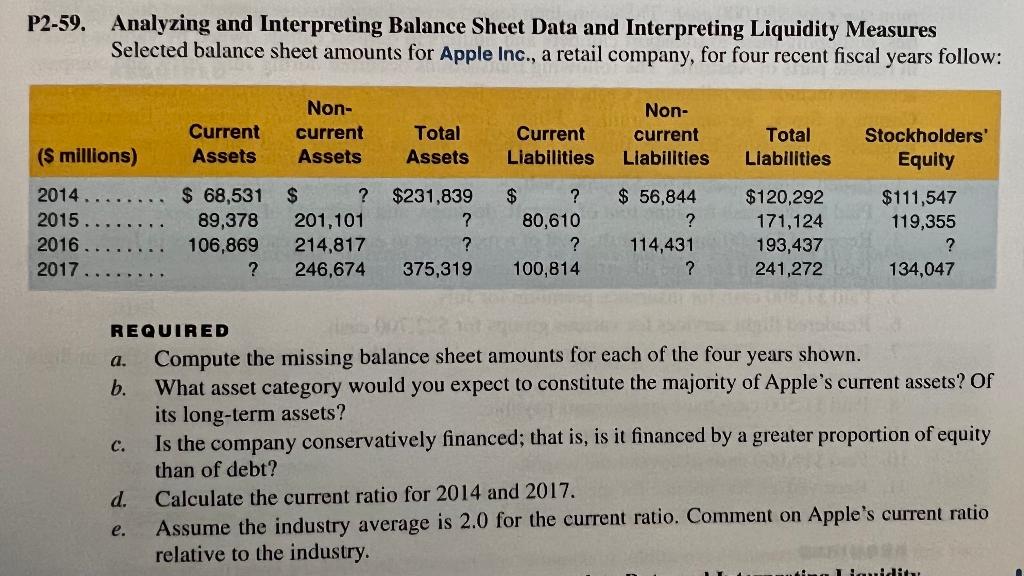

Interpreting a balance sheet. The balance sheet shows the cumulative effect of the income statement over time. It is the first thing investors and banks want to see if you’re looking to raise additional capital, and typically what they rely on heavily to give you money. A statement released by a company to report its financial health at a given point in time.it is important for accountants and business owners to know how to read and interpret the balance sheet and act on it to avoid negative business outcomes.

Interpreting the balance sheet a balance sheet provides the financial snapshot of your business. The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time. The term ‘balance sheet’ is widely used, although most people have never seen one and have little idea of what it shows.

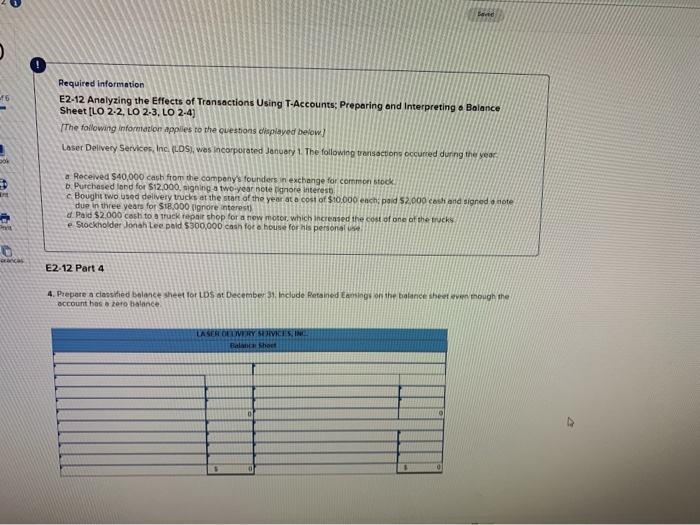

The balance sheet has three sections, each labeled for the account type it represents. Understanding cash flow • 1 minute; It is divided into various sections.

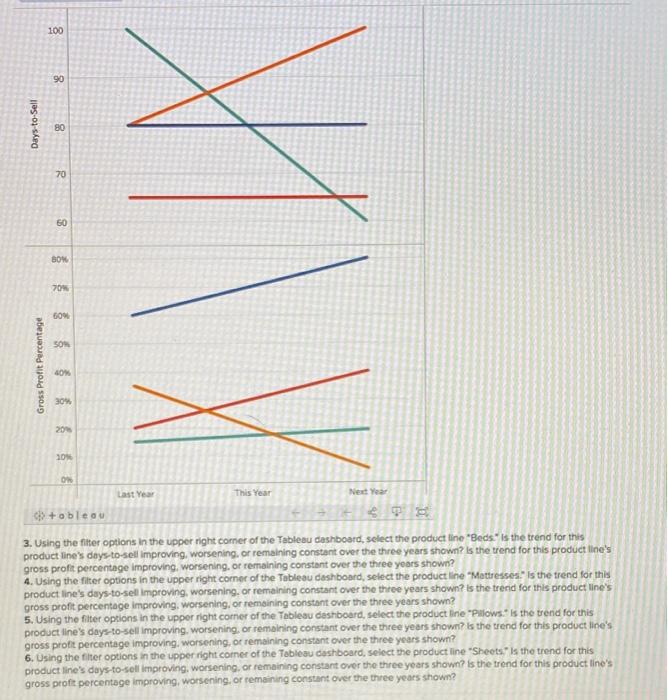

This is your balance sheet: One smart way to approach balance sheets is by doing a comparative analysis. Introducing statement of cash flows • 1 minute;

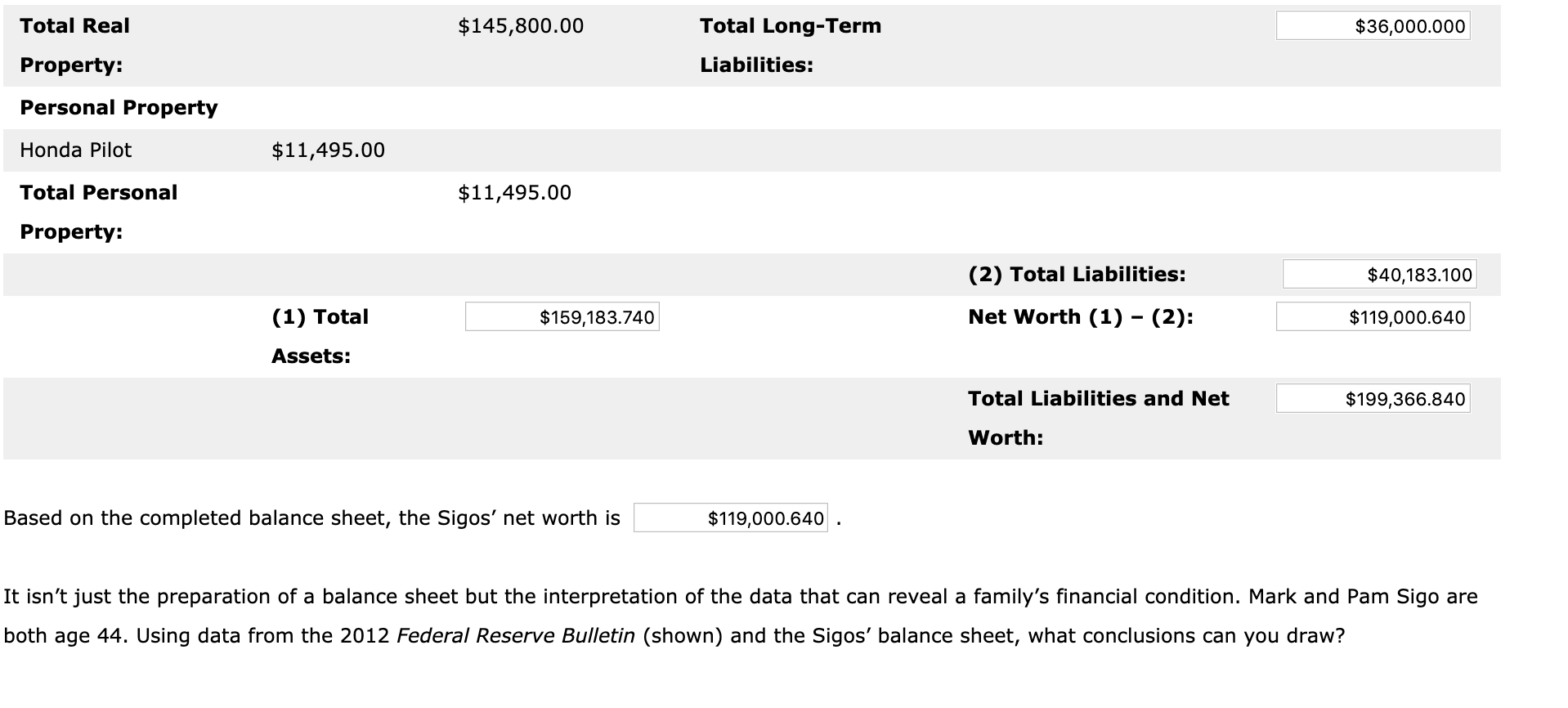

One of the most prominent ones is the assets section, which includes current assets like cash and equivalents, followed. When the company earns money and keeps it, it gets added to the balance sheet. This chapter provides a gentle introduction to balance sheets by showing how individuals can prepare their own personal balance sheets, and how similar these are to company balance sheets.

A balance sheet lists the value of all of a company's assets, liabilities, and shareholders' (or owners') equity. Calculator take a look at this balance sheet for the great american department store. Hence, the balance sheet is often used interchangeably with the term “statement of financial position”.

A balance sheet is a financial statement that lists a company’s assets, liabilities and owner's equity to provide an overview of the business’ financials at a specific point in time. Become a pro at reading, analyzing and interpreting balance sheets! The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time.

How to read a balance sheet. Let’s look into each section of the balance sheet in more detail. Cash flow • 4 minutes

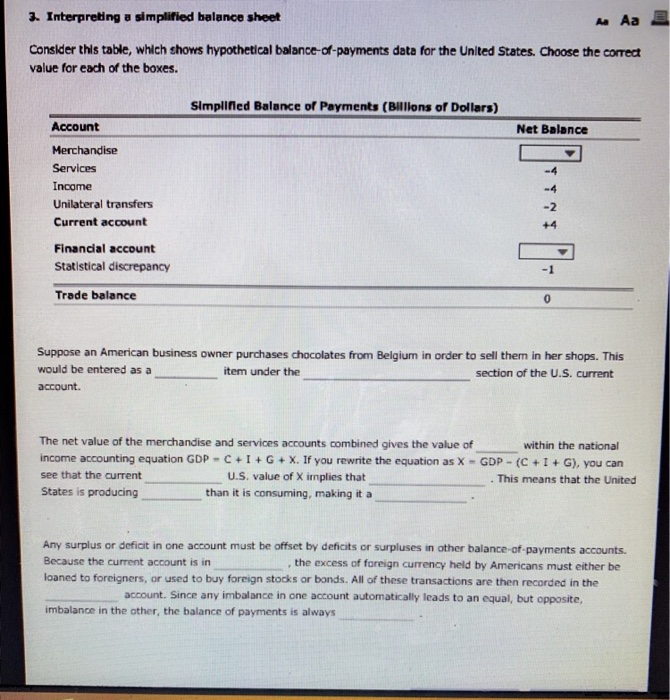

This guide will walk you through (1) the definition of a balance sheet, (2) the main reasons you should use it and (3) tips for understanding and reading balance sheets. Interpreting the balance sheet google classroom you might need: Assets = liability + owner's equity (aloe).

One of the financial statements you are likely to come across is a balance sheet. Your bank balance is the sum of all the deposits and withdrawals you have made. Knowing how to read a balance sheet is fundamental to financial literacy.

![[Solved] Interpreting balance sheet changes Exhibi SolutionInn](https://s3.amazonaws.com/si.question.images/image/images4/65-B-A-B-S-C-F(433).png)

![[Solved] Interpreting balance sheet changes Exhibi SolutionInn](https://s3.amazonaws.com/si.question.images/image/images4/65-B-A-B-S-C-F(432).png)