Awe-Inspiring Examples Of Info About Gross Profit And Loss Income Statement En Francais

The strategy update came as barclays posted a 6% fall in annual profit to 6.6 billion pounds, in line with analyst forecasts, as a higher charge for potential bad loans weighed.

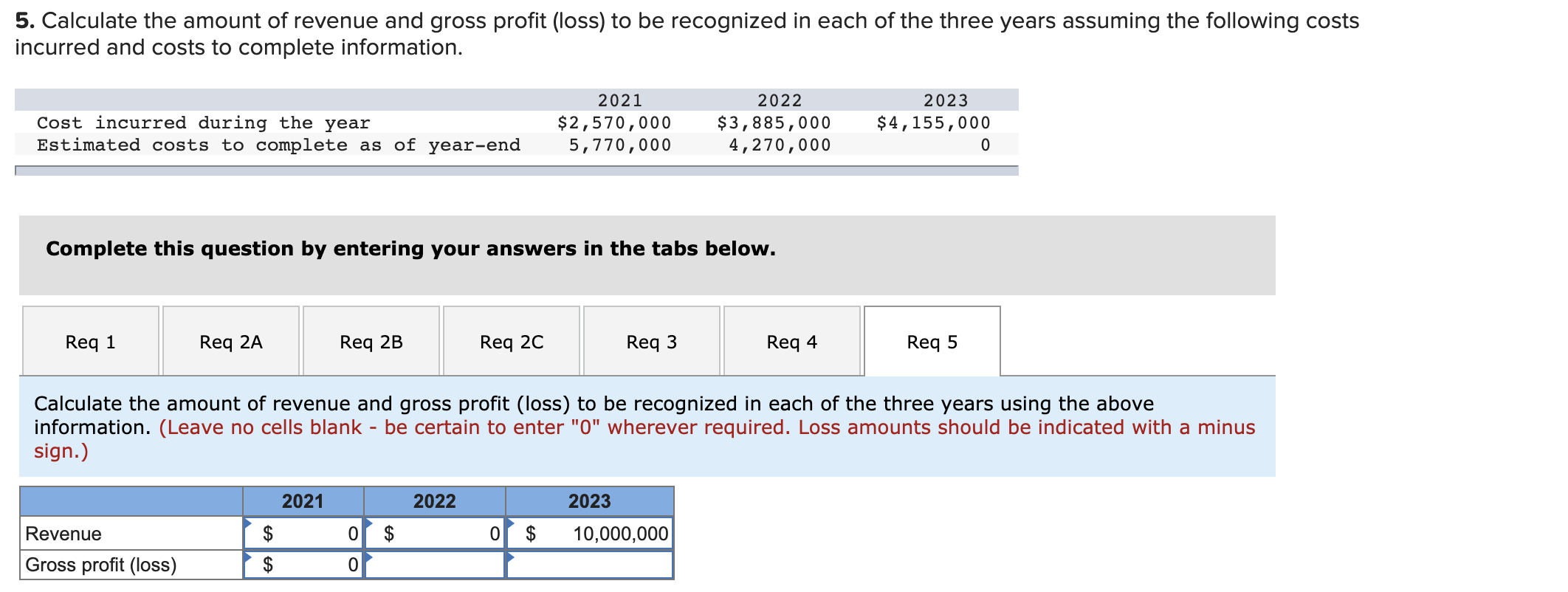

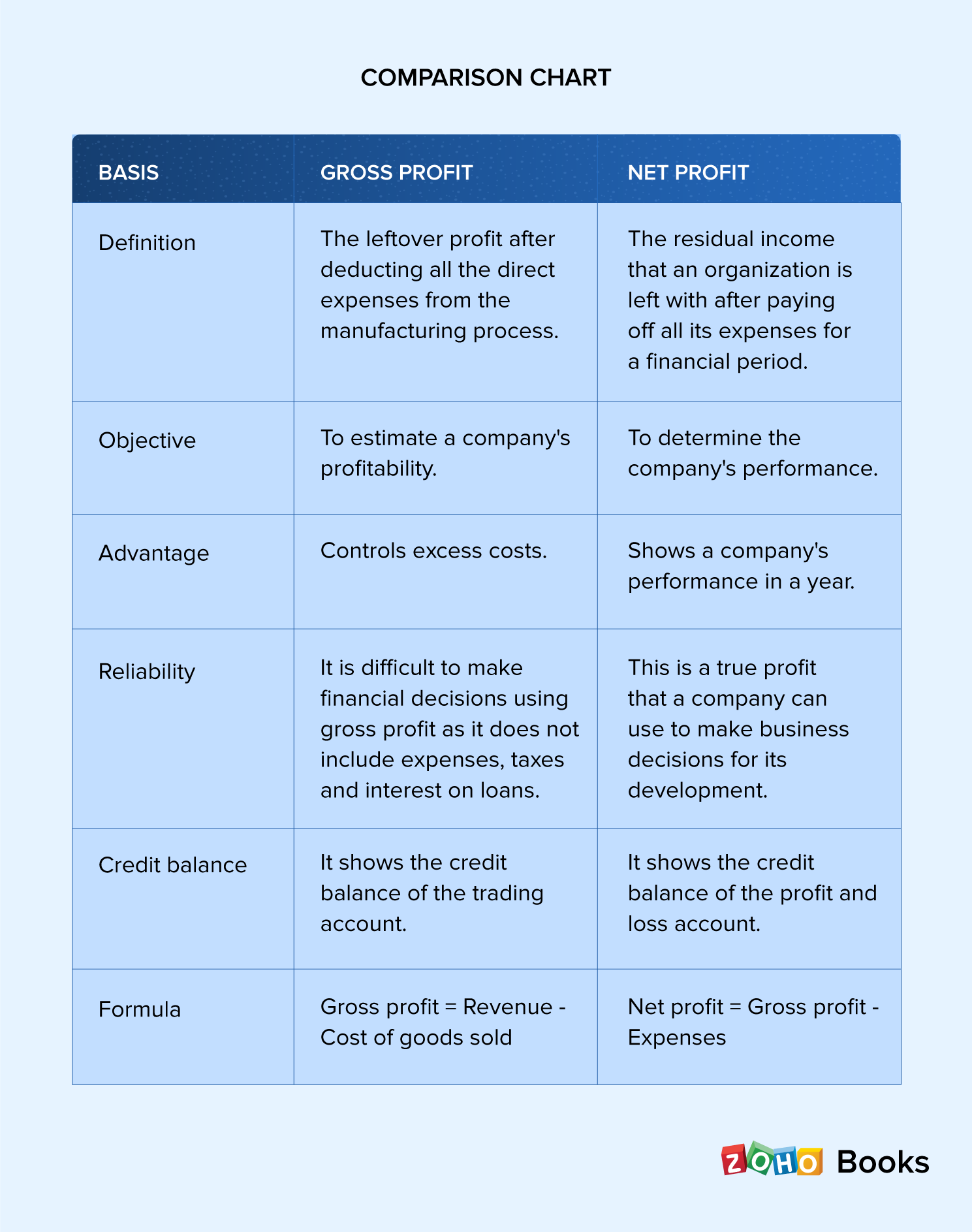

Gross profit and loss. This means that a business can calculate two different types of profit: Gp is located on the income statement (sometimes referred to as the statement of profit and loss) produced by a company and used to determine a company’s gross margin. Profit and loss formula is used in mathematics to determine the price of a commodity in the market and understand how profitable a business is.

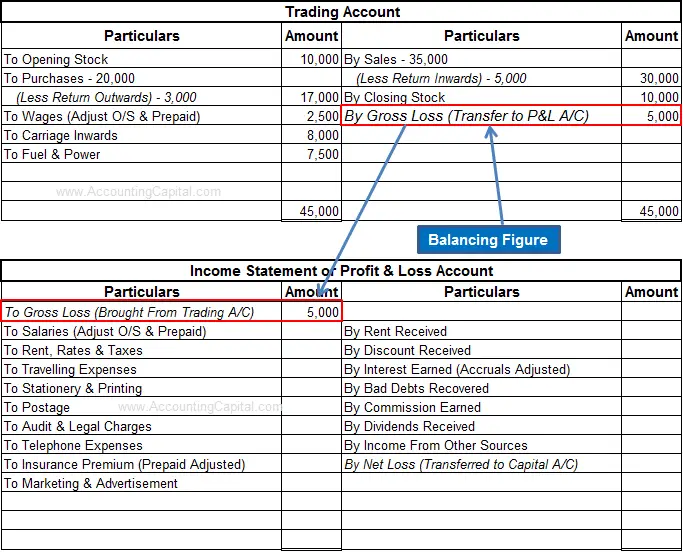

Gross profit / loss. Gross profit and gross loss. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

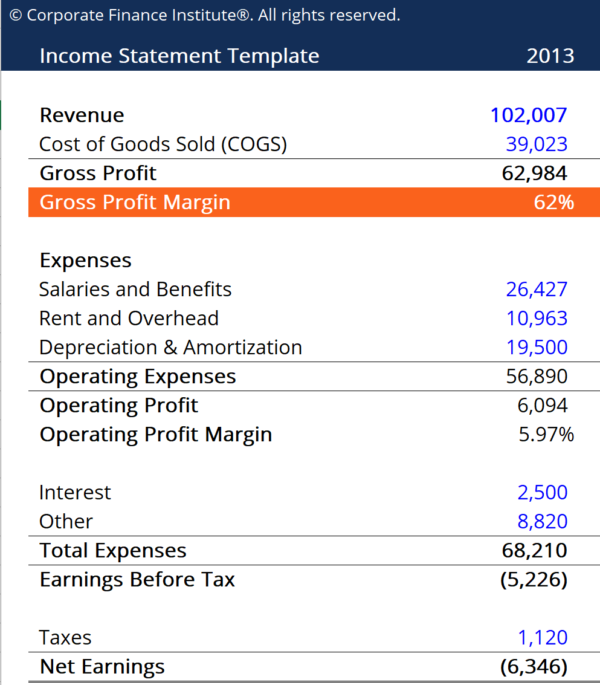

The gross profit (gp) of a business is the accounting result obtained after deducting the cost of goods sold and sales returns/allowances from total sales revenue. Gross profit was $944 million, or 30.3% of total net revenue; One can find a gross profit figure on the firm’s profit and loss statement firm's profit and loss statement the profit and loss statement is a financial report that summarizes the company's revenues and expenses over a period of time to determine profit or loss for that period.

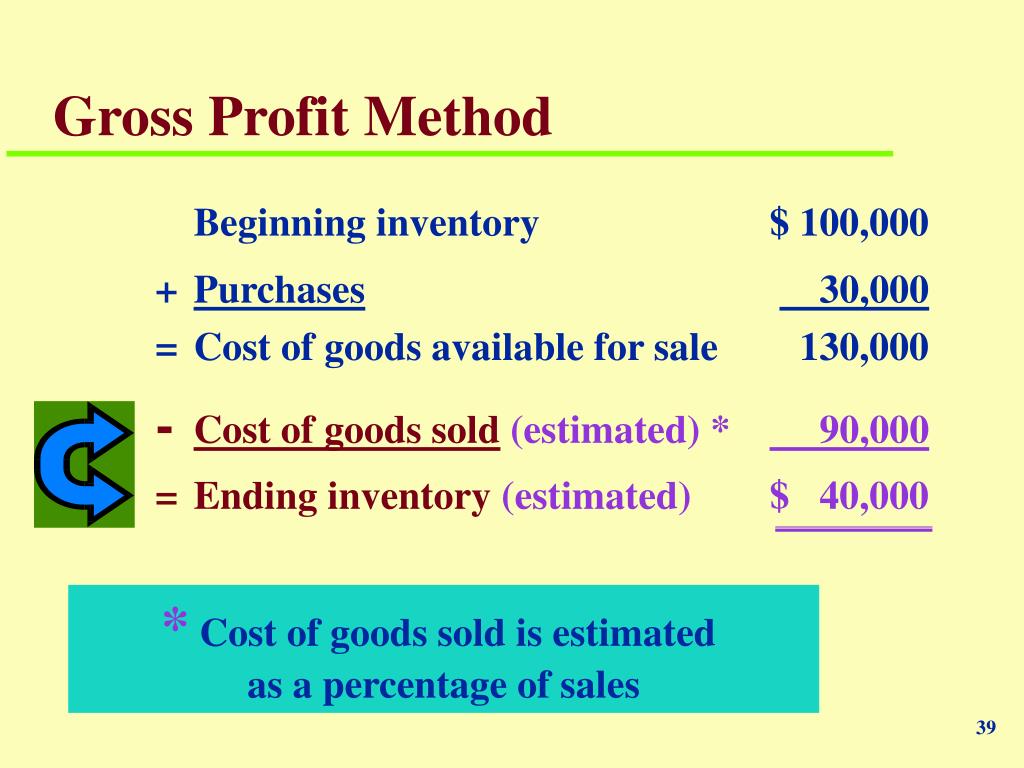

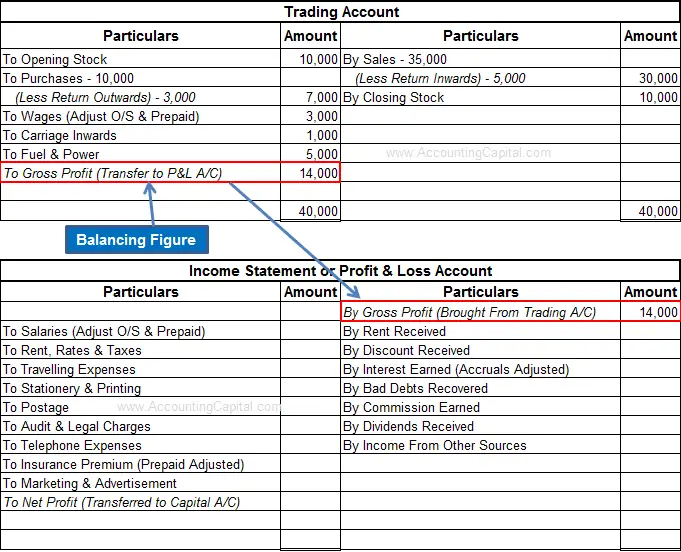

The formula to calculate gross profit subtracts a company’s cost. Every product has a cost price and a selling price. The trading account is prepared in order to find the gross profit/loss which is further carried to the profit and loss account.

Based on the values of these prices, we can calculate the profit gained or the loss incurred for a particular product. Gross profit gross profit is the difference between the money received from. Apart from the gross profit, m/s verma traders earns a commission of rs 5,000 and has incurred expenses or losses worth rs 42,500 (25,000.

The rising costs overshadowed a decent holiday quarter. The gross profit margin is a good way to measure your business’s production efficiency over time. The difference between direct expenses and direct revenues of business gives rise to gross profit and gross loss.

January 25, 2022 a profit and loss statement (p&l) is an effective tool for managing your business. Gross margin, operating margin, ebitda margin, net profit margin how to prepare the profit and loss statement (p&l) the profit and loss statement (p&l) can be prepared by an accountant under two different methods: Before you start, gather the necessary documents.

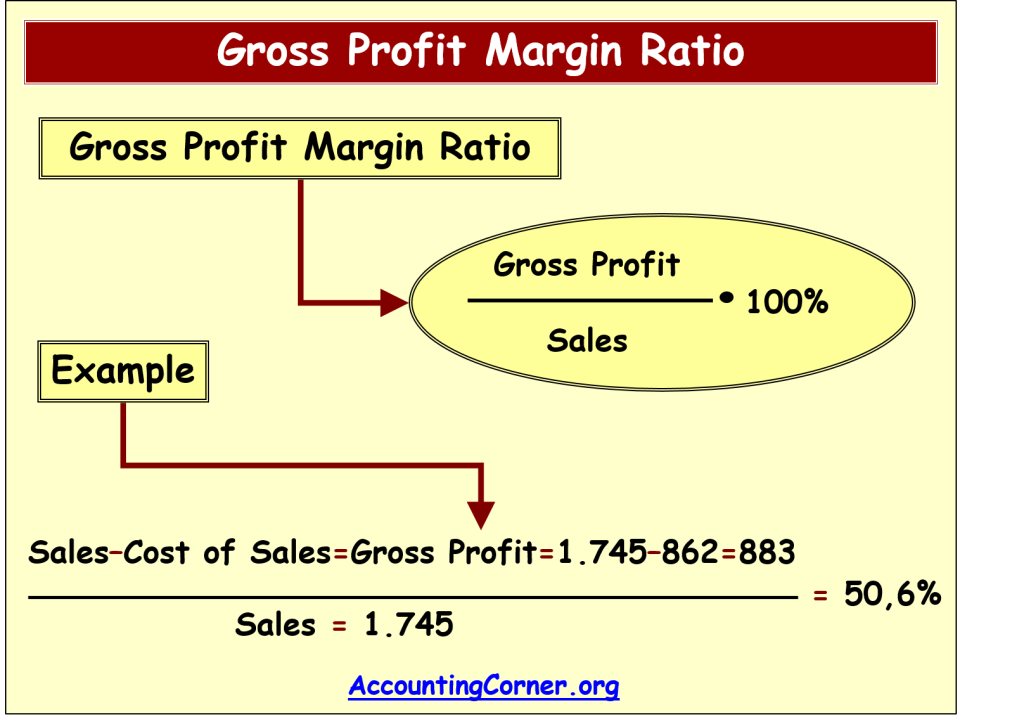

A gross profit margin of 75% is a really good indicator for the management and investors, as it shows them that for each dollar they make on. Earn profits → e.g. [1] whereas gross profit is a dollar amount, the gross profit margin is a percentage.

Gross profit is typically used to calculate a company’s gross profit margin, which shows your gross profit as a percentage of total sales. Gross profit margin is often shown as the gross profit as a percentage of net. Santa clara, calif., feb.

What is gross profit? First, find your gross profit by subtracting your cogs from your gross revenue. Therefore, gross profit ratio = 62.5%.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income.jpg)