Favorite Tips About Comparative Income Statement And Balance Sheet Direct Cash Flow Format

The income statement vs.

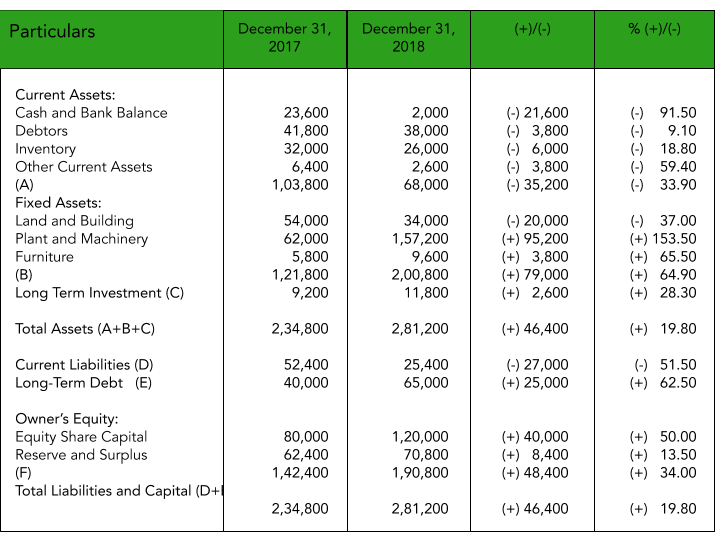

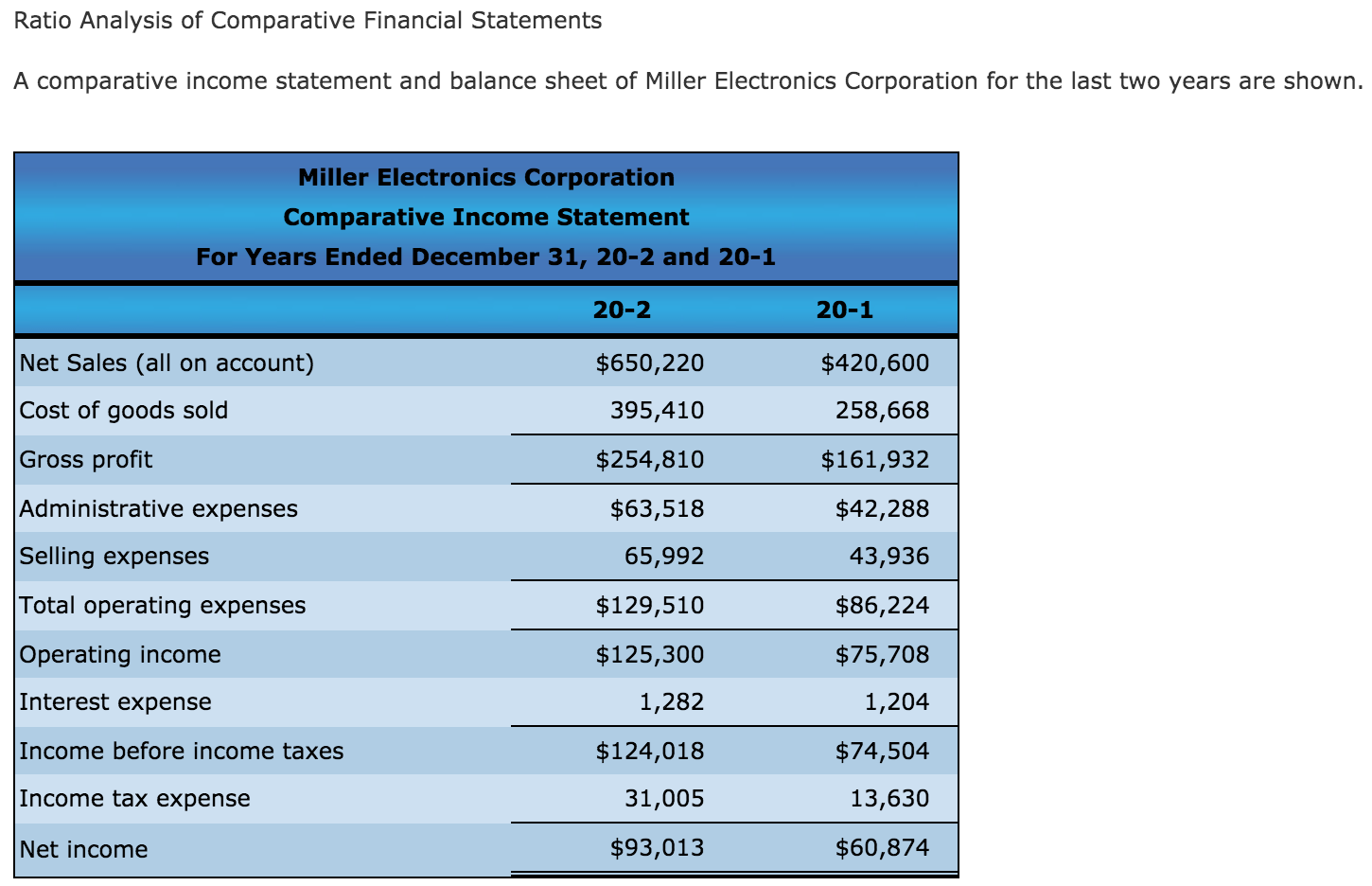

Comparative income statement and balance sheet. The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position. In the balance sheet, the common base item to which other line items are. Another variation is to present the balance sheet as of the end.

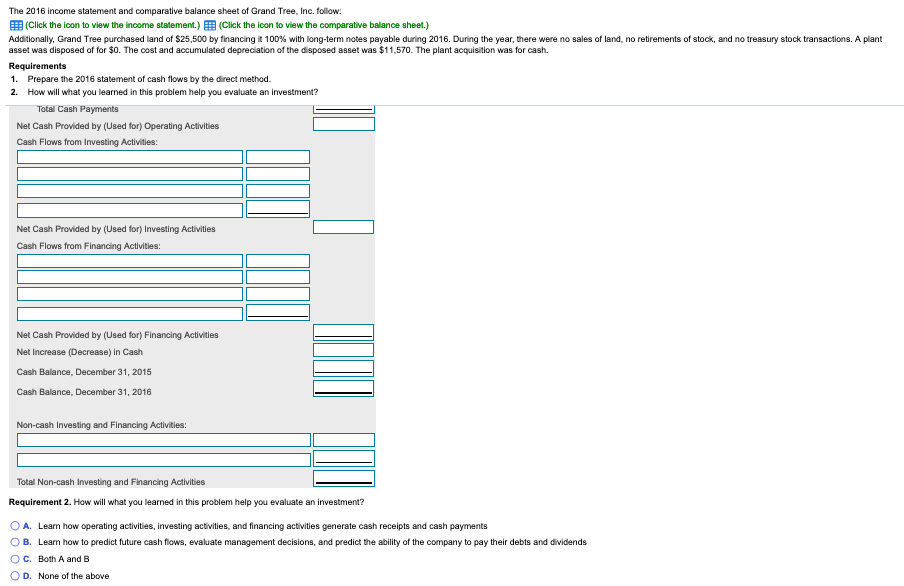

Or, you can compare your income statement to other companies. Comparative balance sheet helps to identify the increase or decrease in the cost of goods sold. In financial accounting, the balance sheet and income statement are the two most important types of financial statements (others being cash flow statement, and the statement of retained earnings).

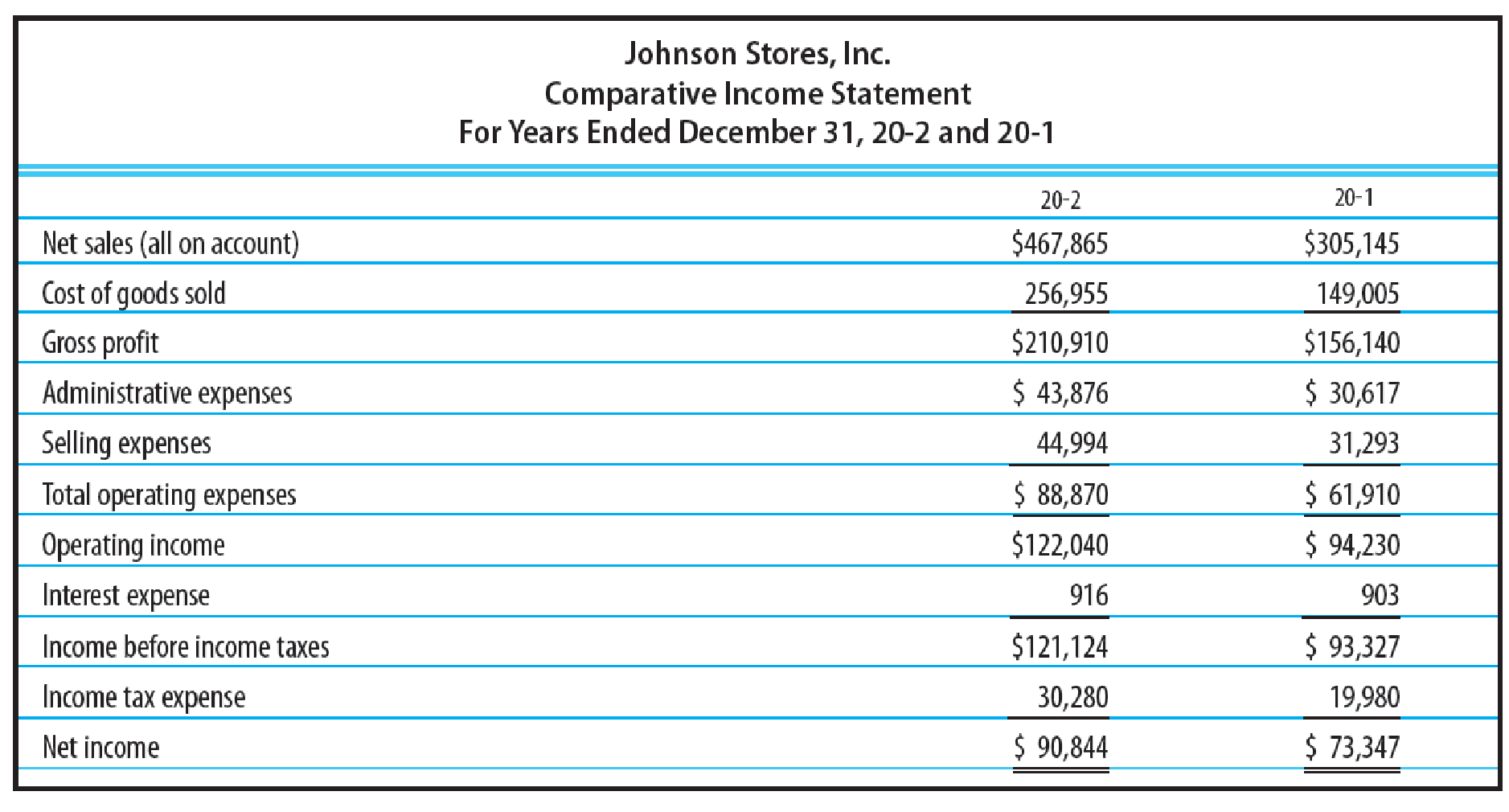

Get tata motors latest balance sheet, financial statements and tata motors detailed profit and loss accounts. Analysts, investors, and business managers use a company’s income statement , balance sheet, and cash flow statement for comparative purposes. This assists the business owner in understanding trends and measuring business performance over time.

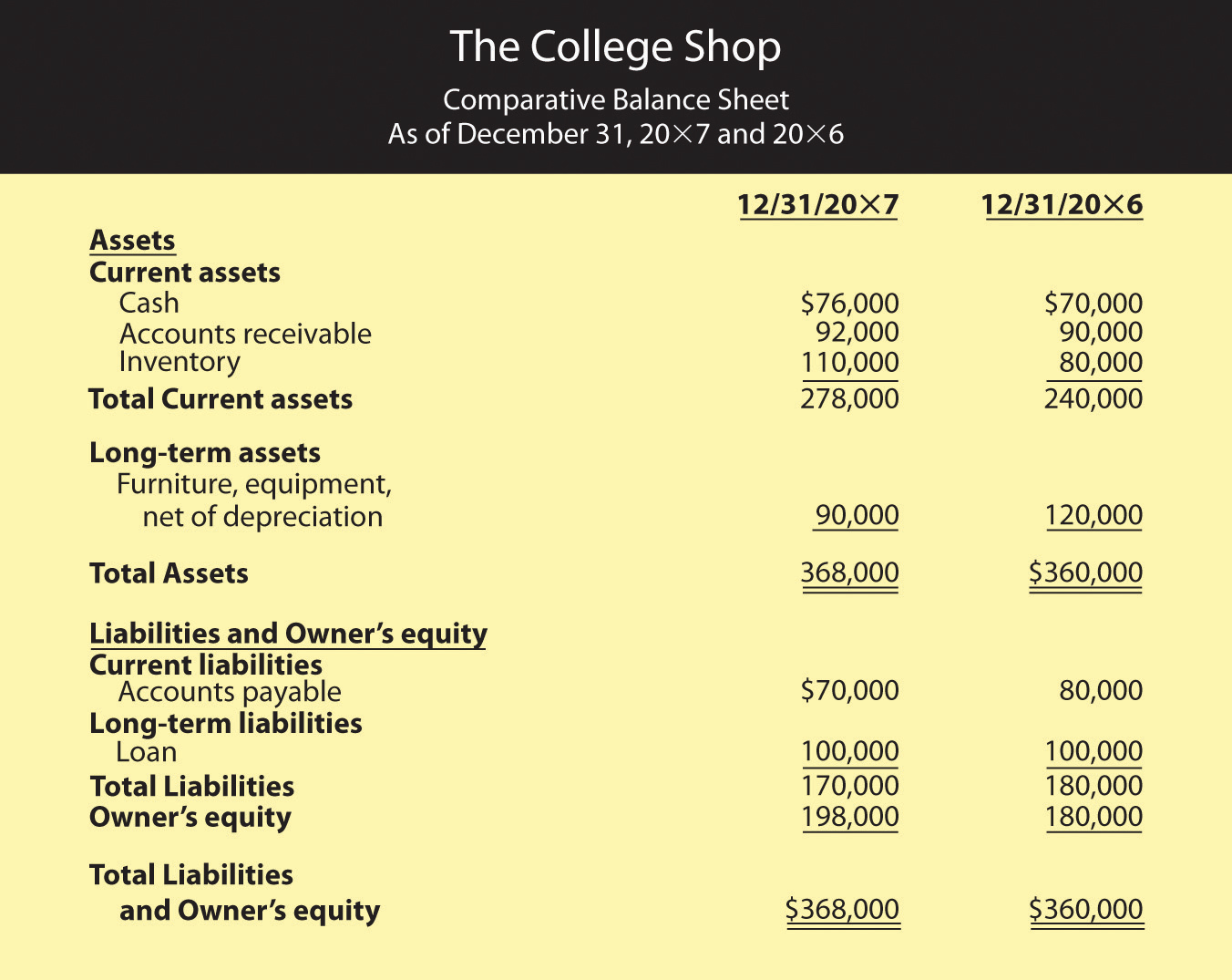

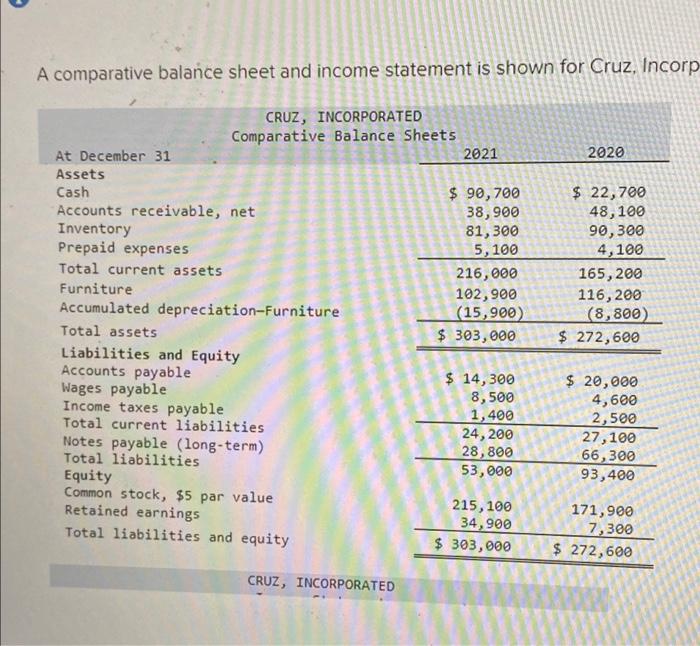

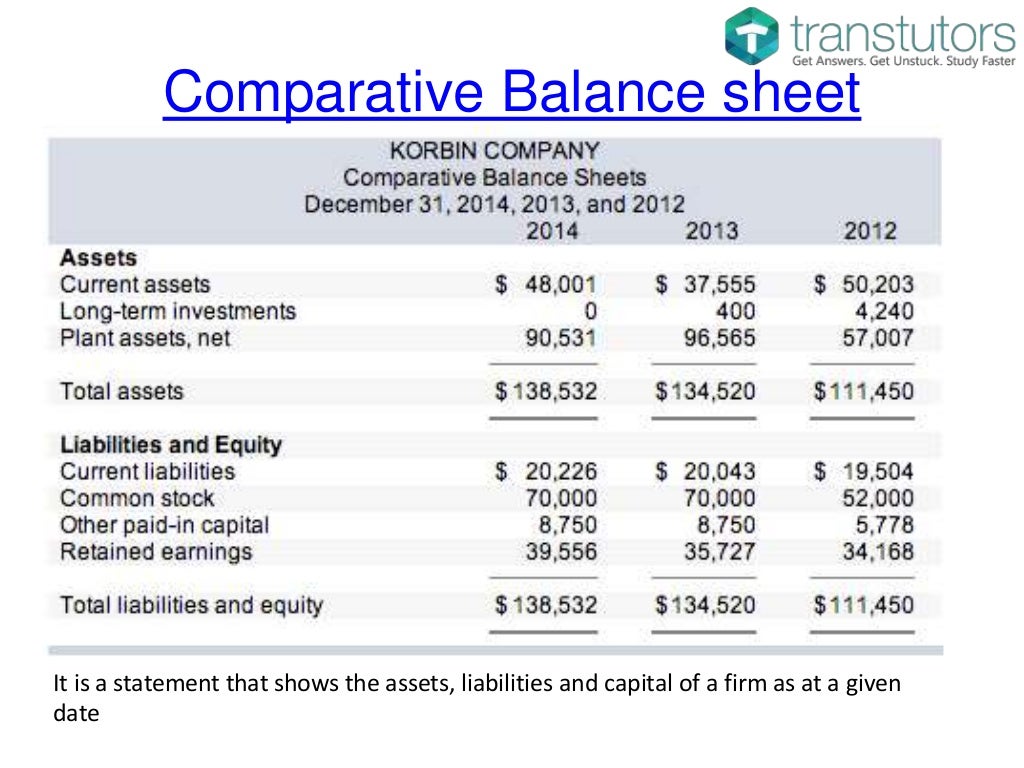

Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. Balance sheets show the value of a company at a specific point in time. The comparative balance sheet is a balance sheet that provides financial figures of assets, liabilities, and equities for “two or more periods of the same company,” or “two or more subsidiaries of the same company” or “two or more companies of the same industry” in the same format so that it can be easily understood and analyzed.

The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing. Therefore, a comparative balance sheet also showcases the details of the assets and liabilities of the firm over the various accounting periods. They want to see how much is spent chasing.

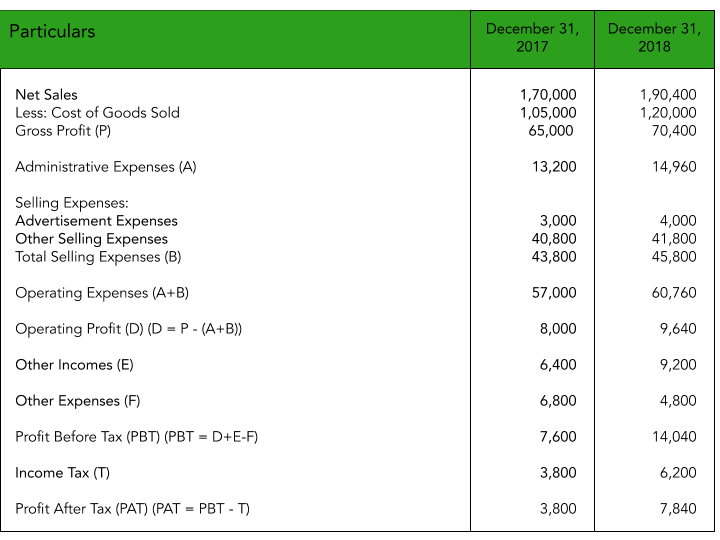

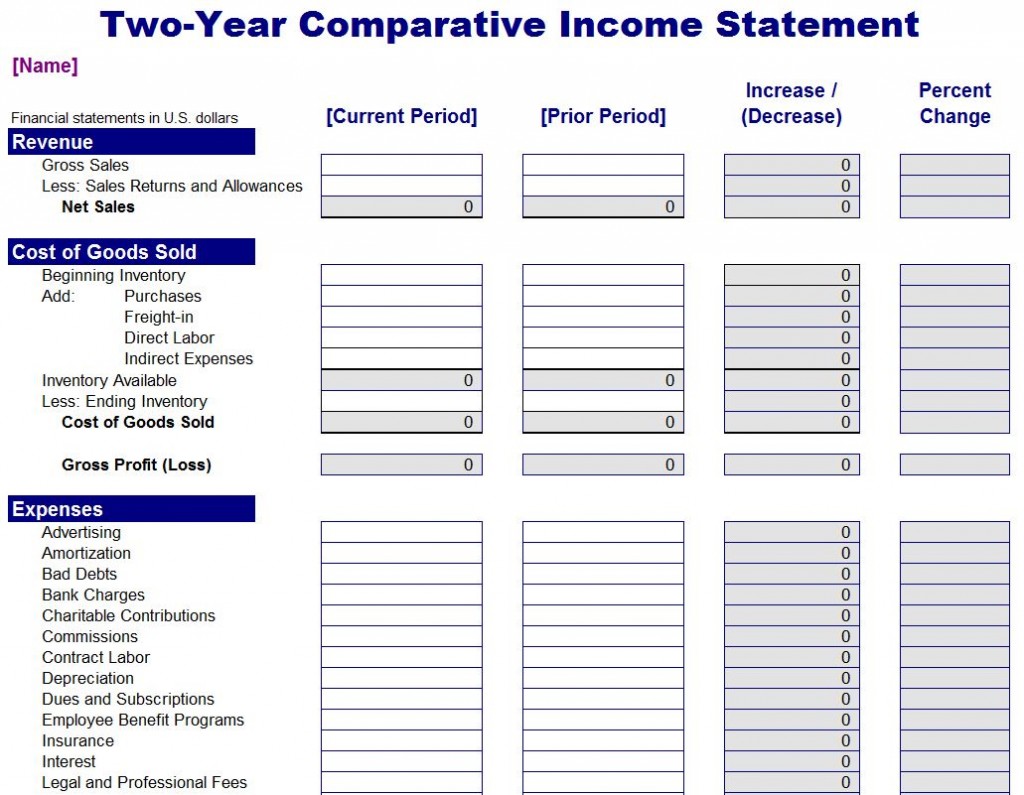

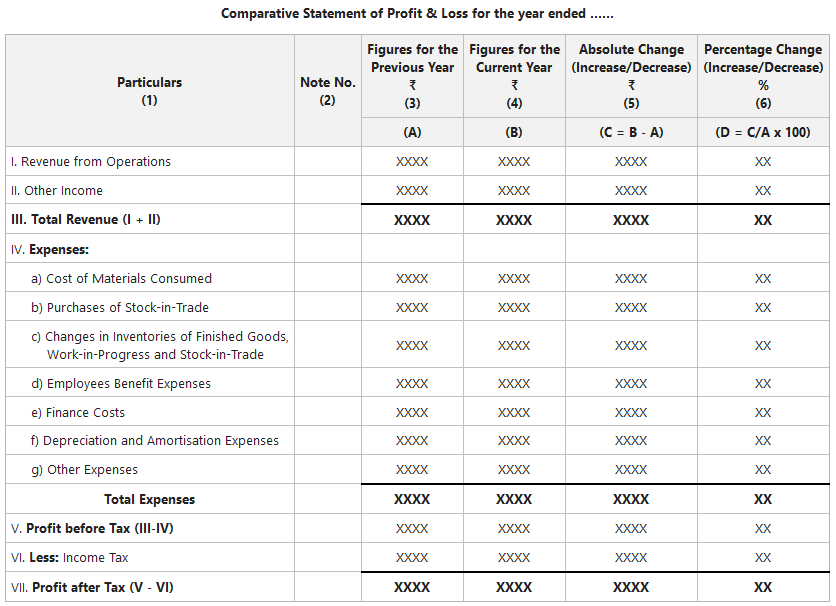

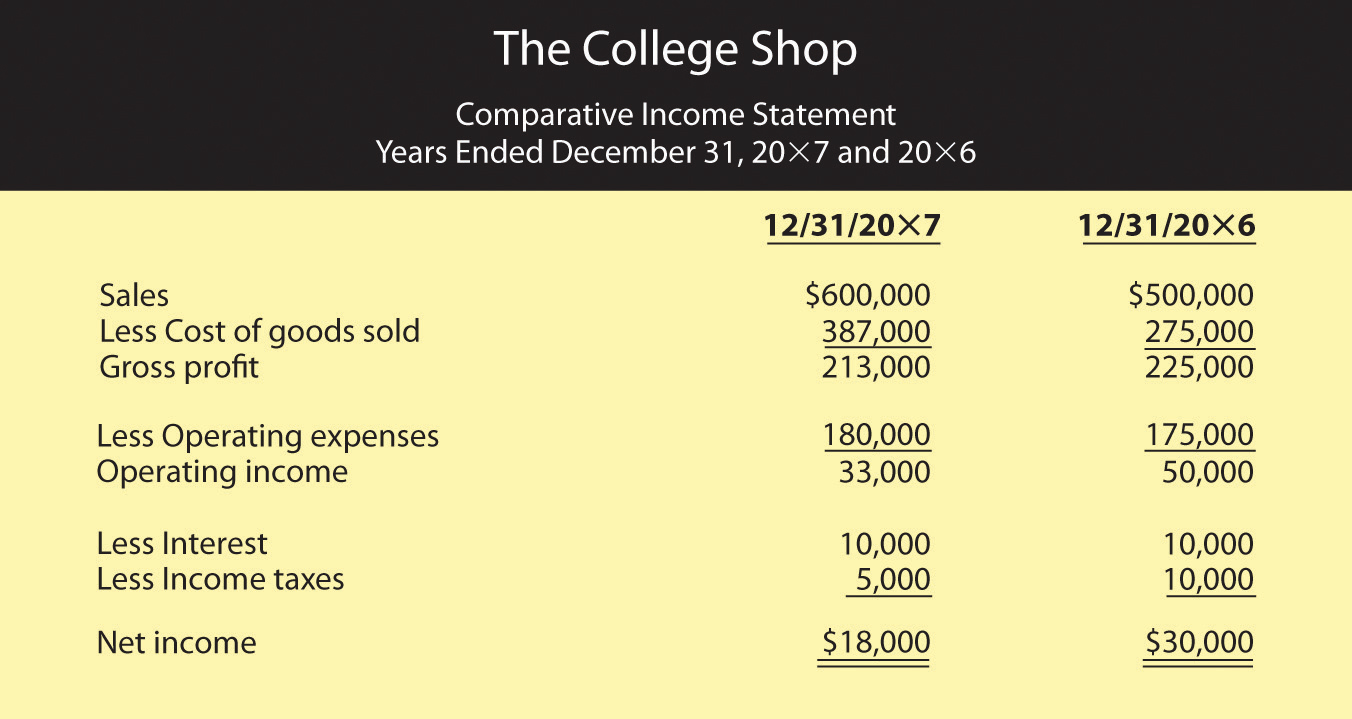

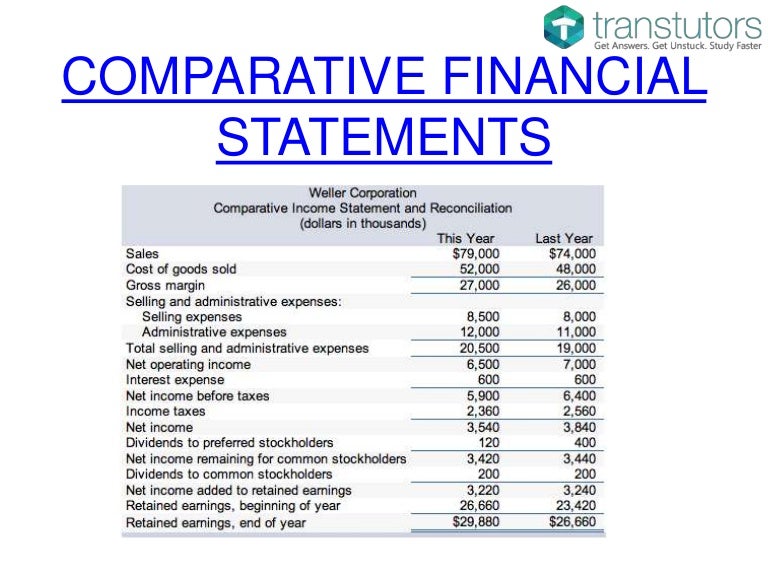

A comparative income statement is an income statement in which numerous periods are considered and compared to enable the reader to reach the last year’s income and decide about investing in the company. For example, a comparative balance sheet could present the balance sheet as of the end of each year for the past three years. Balance sheets income statements;

Balance sheet format format of income statement format of balance sheet colgate example to differentiate interpretation of colgate’s income statement interpretation of colgate’s balance sheet conclusion income statement vs. The comparative income statement format combines several income statements into a single statement. As of a certain date.

A balance sheet lists assets and liabilities of the organization as of a specific moment in time, i.e. More common size balance sheet. Balances sheets cover assets, liabilities, and investments.

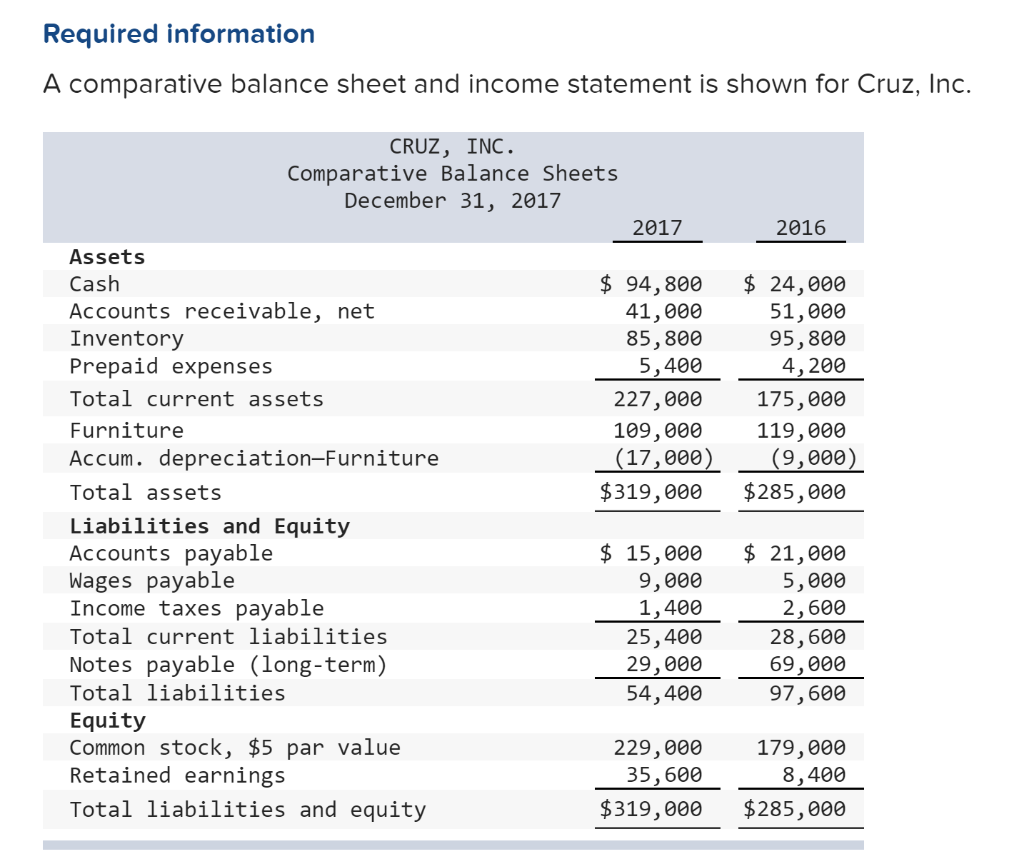

Income statement and balance sheet differences comparative table income statement vs. Comparative income statement or comparative statement is a financial statement that defines the current financial position of a business and compares it with prior period statements. A comparative balance sheet and income statement is shown for cruz, incorporated.

Comparative balance sheet helps to identify the increase or decrease in. Comparative balance sheet helps to identify the increase and decrease in sales. It helps the business owner to compare the results of business operations over different periods of time.