Sensational Tips About Corporate Income Statement Monthly Cash Flow Format In Excel

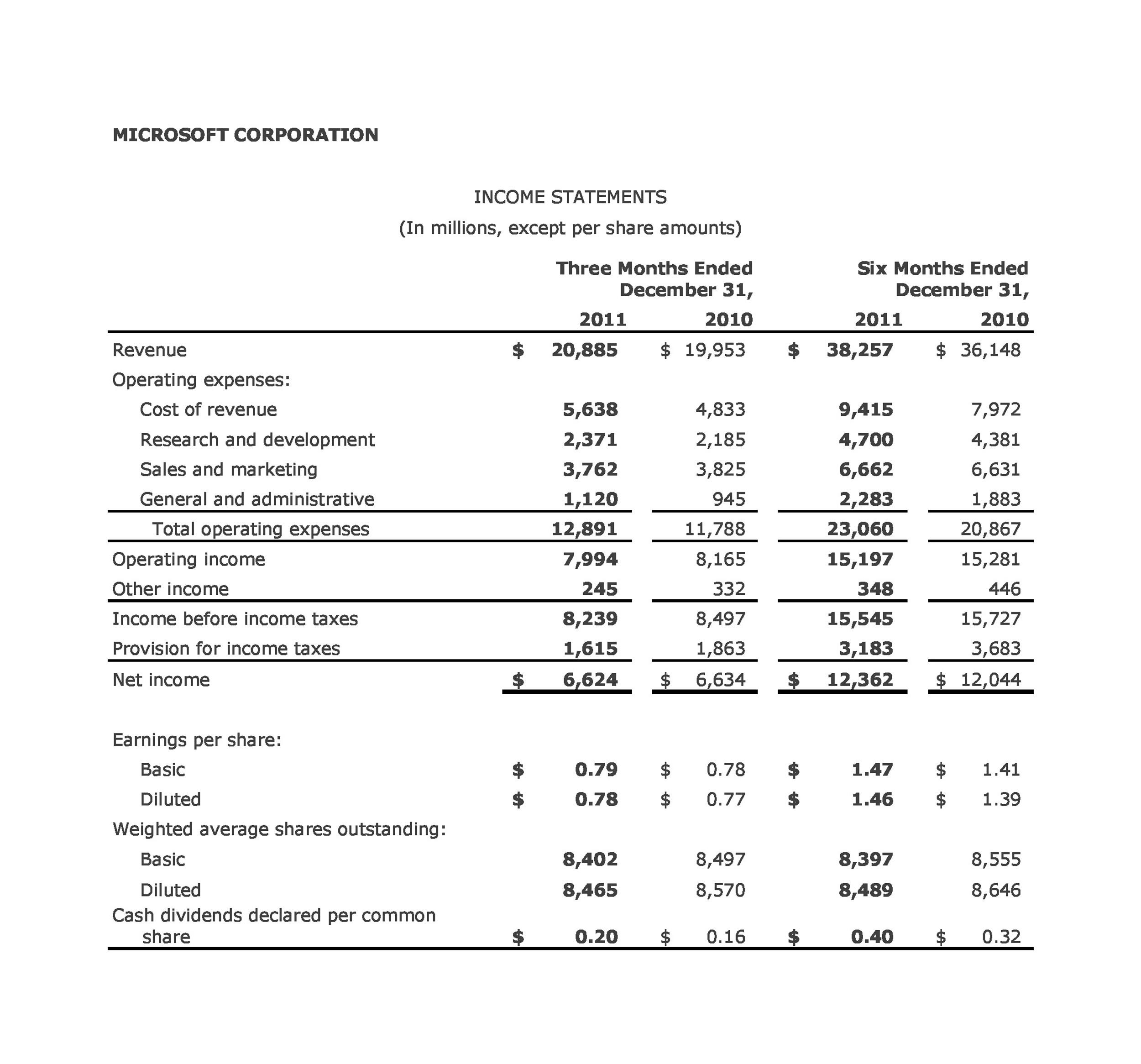

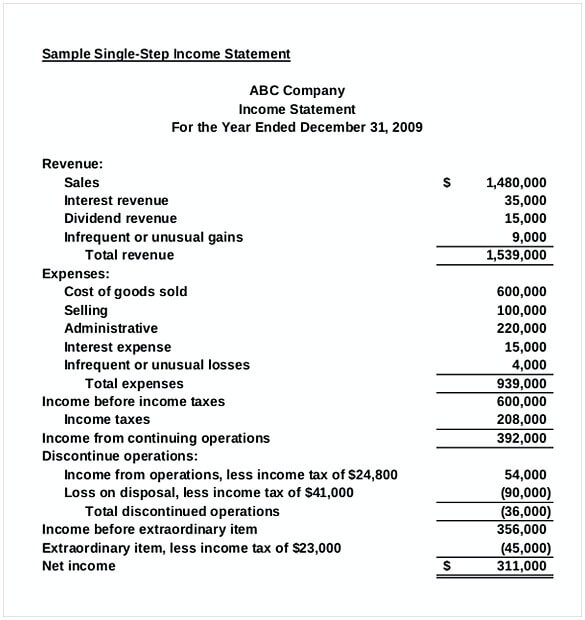

Net income (ni) is a company's total earnings (or profit );

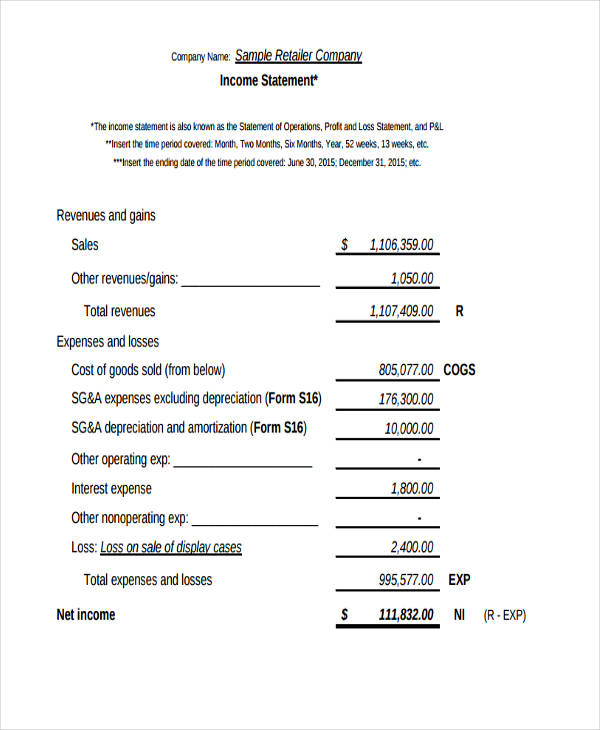

Corporate income statement. The other two key statements are the balance sheet and the cash flow statement. By andy marker | april 6, 2022 we’ve compiled a collection of the most helpful small business income statements, worksheets, and templates for small business owners. Lawrence wong, delivered the budget statement.

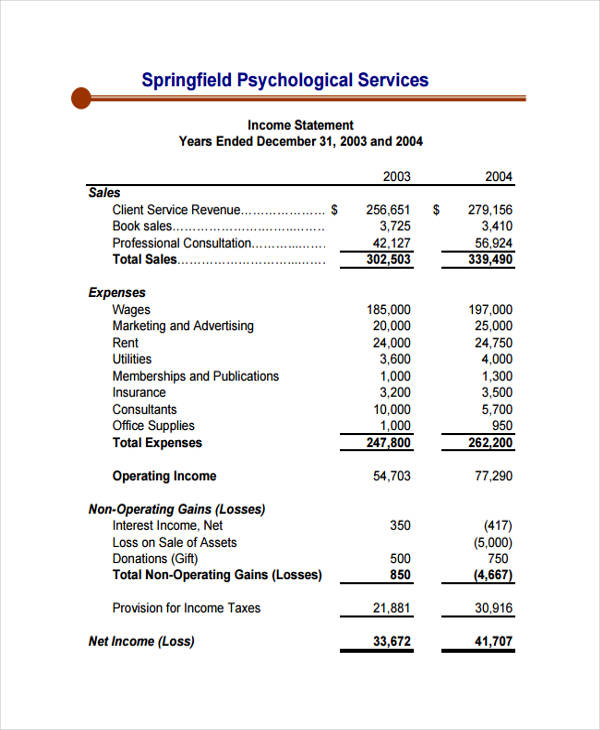

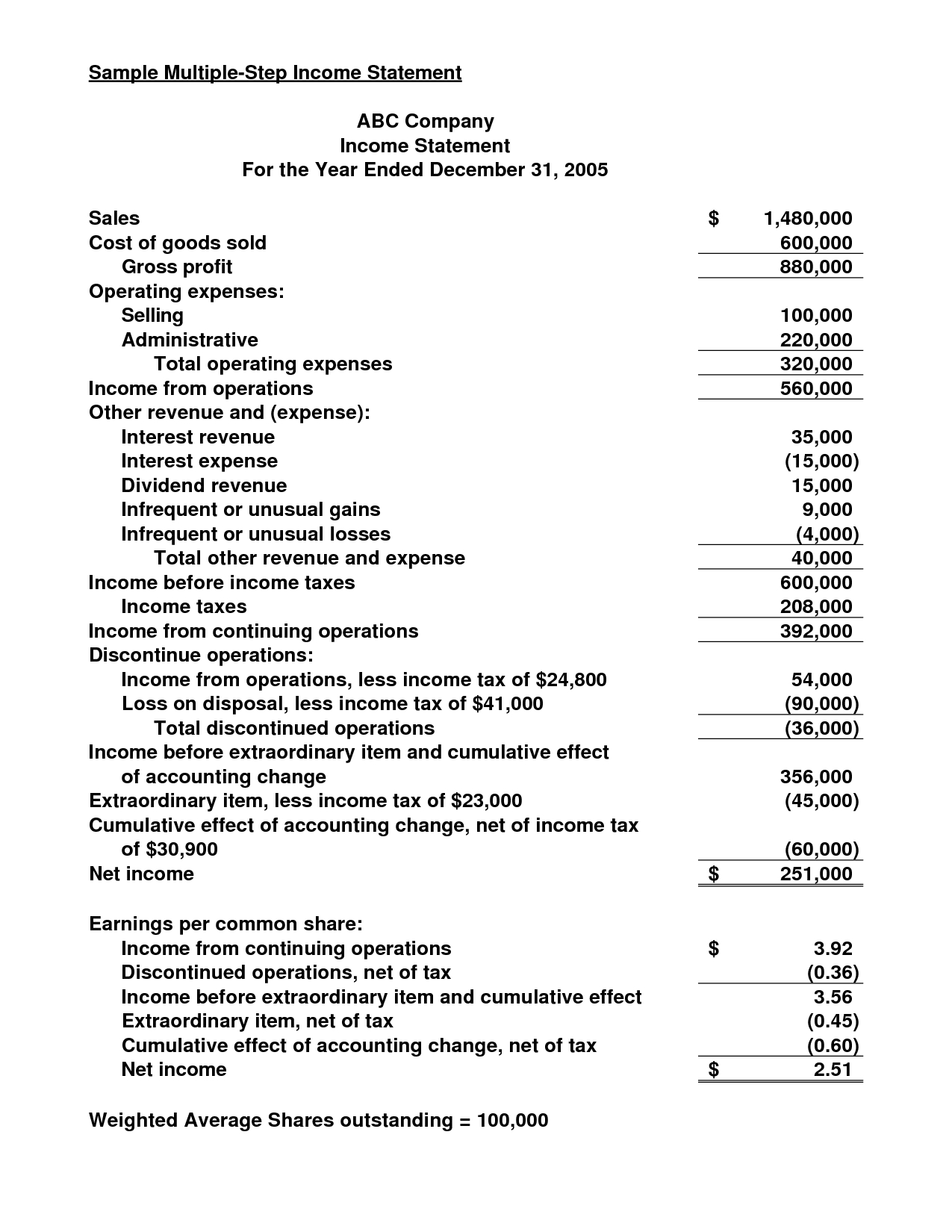

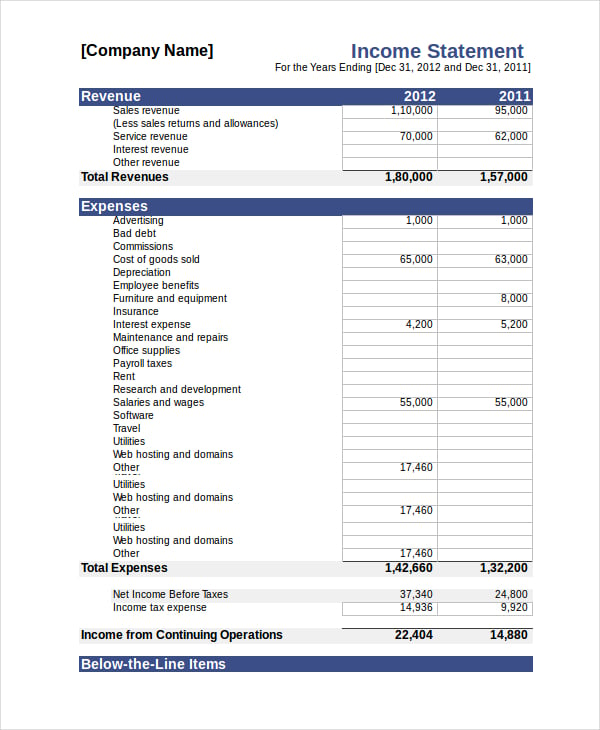

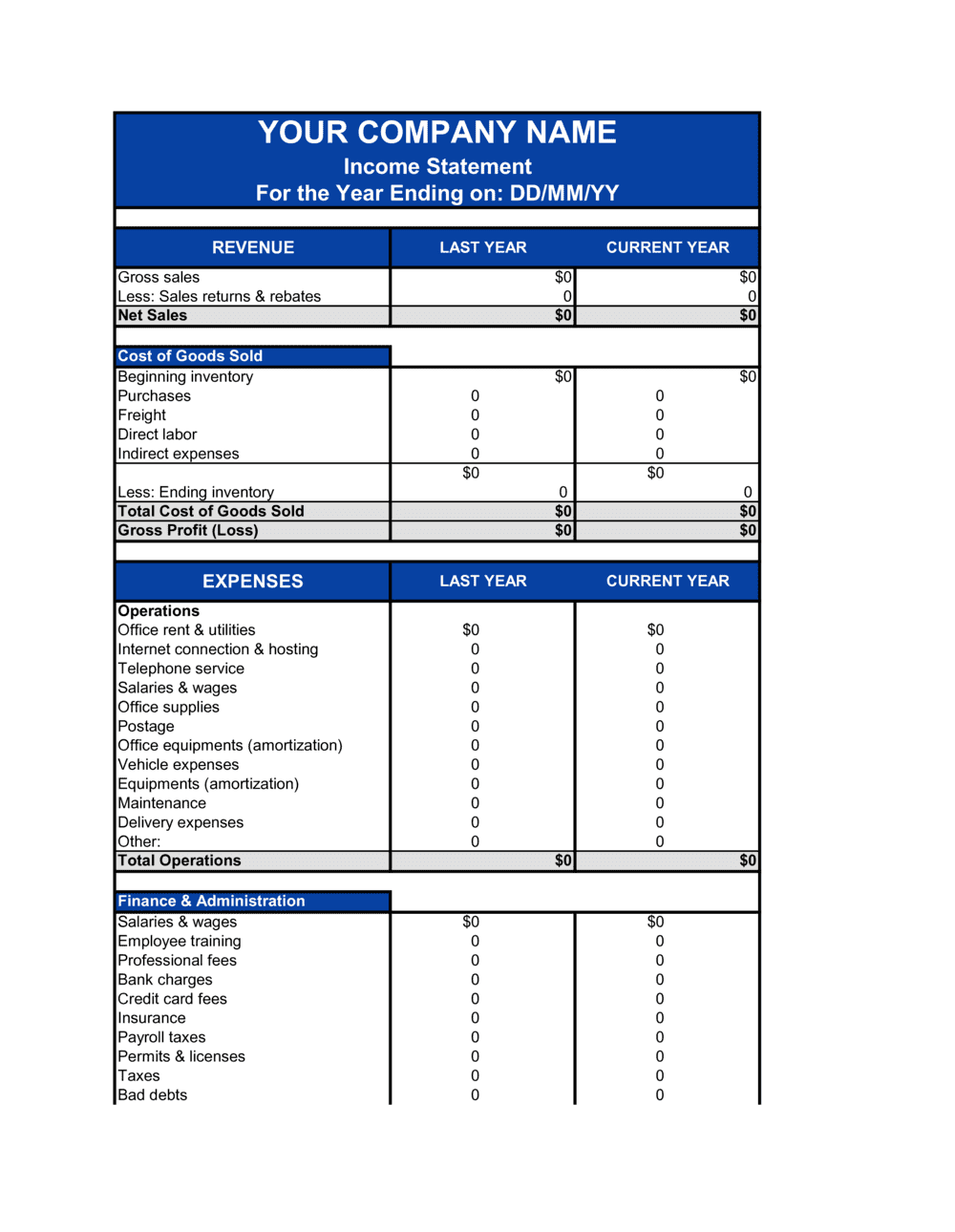

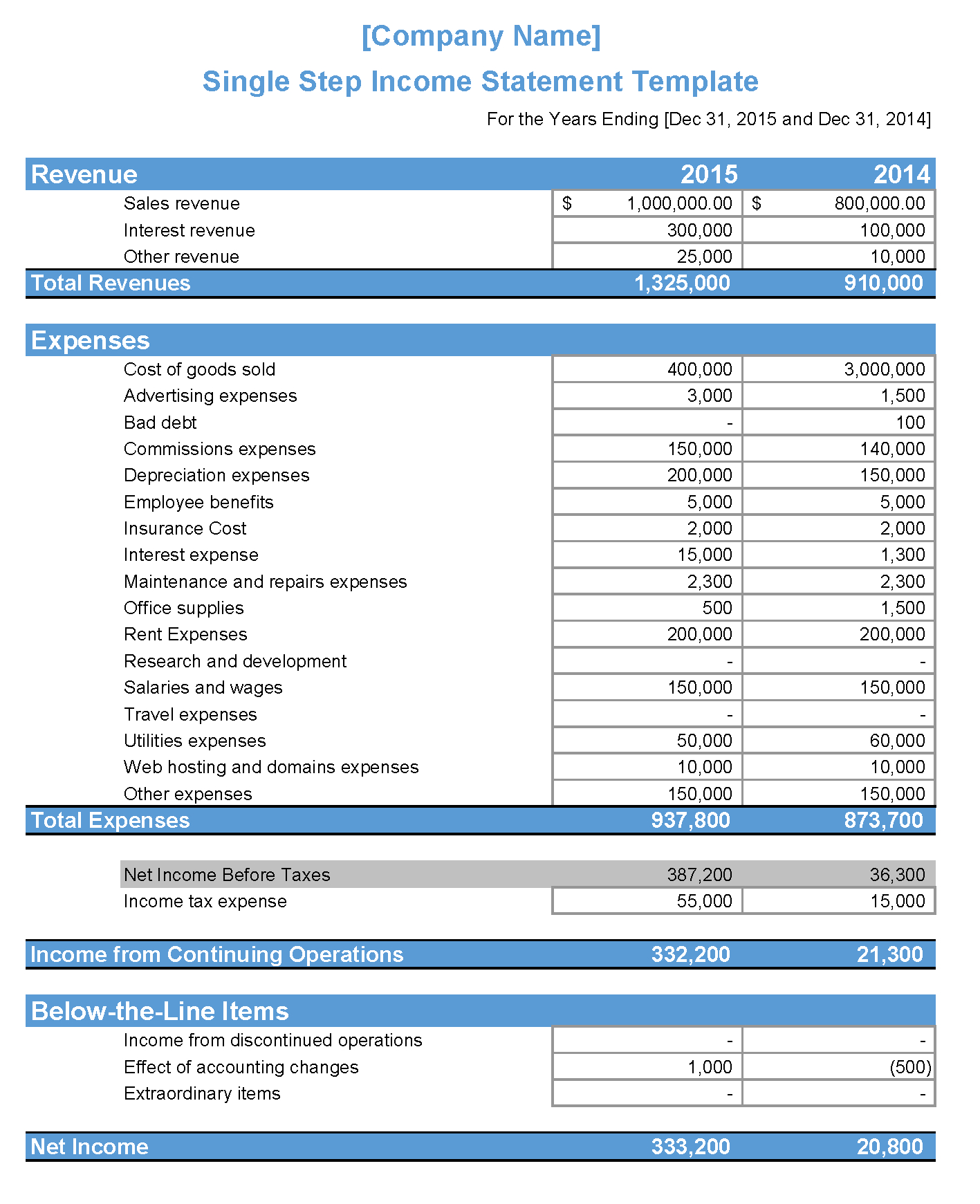

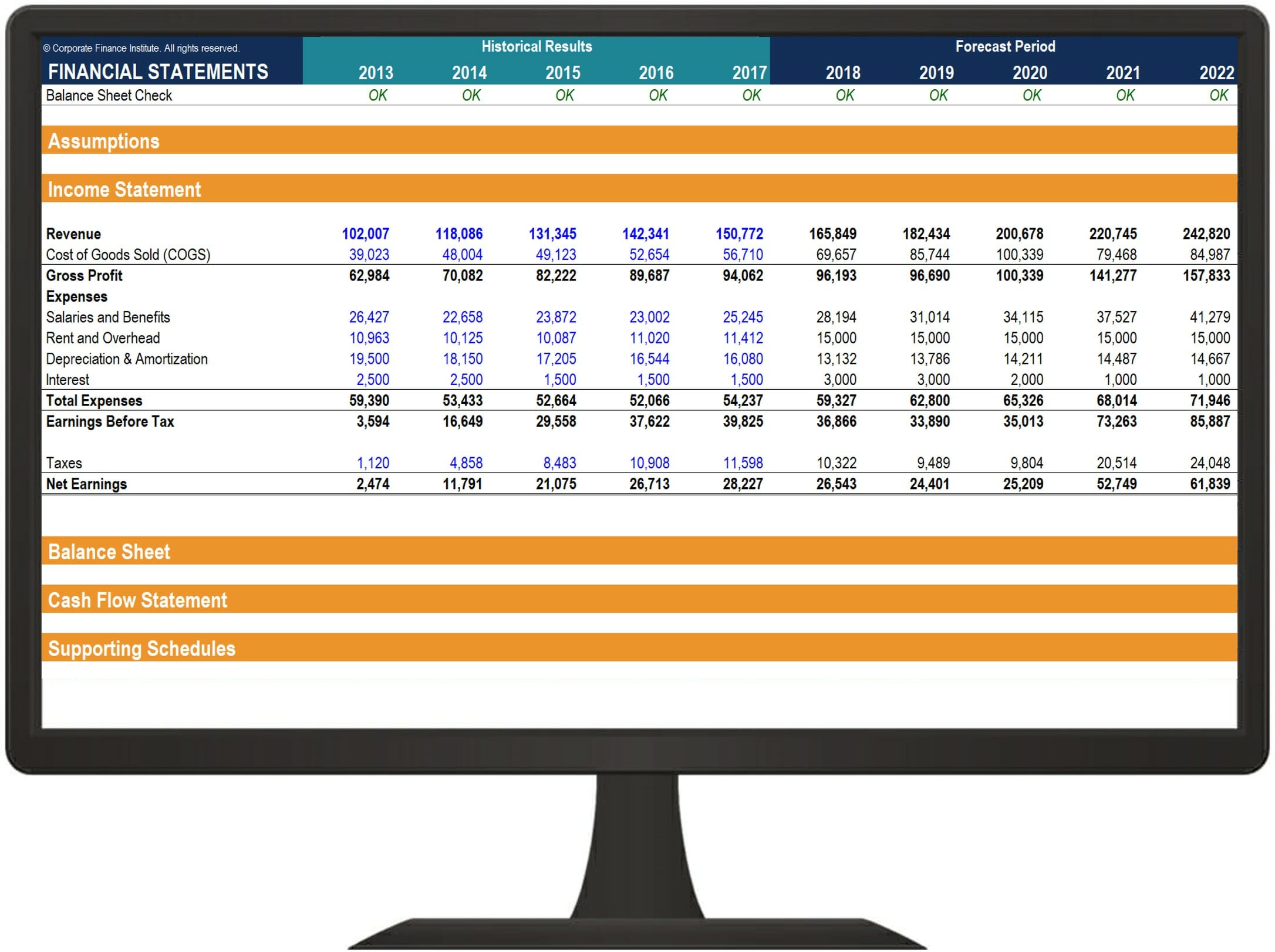

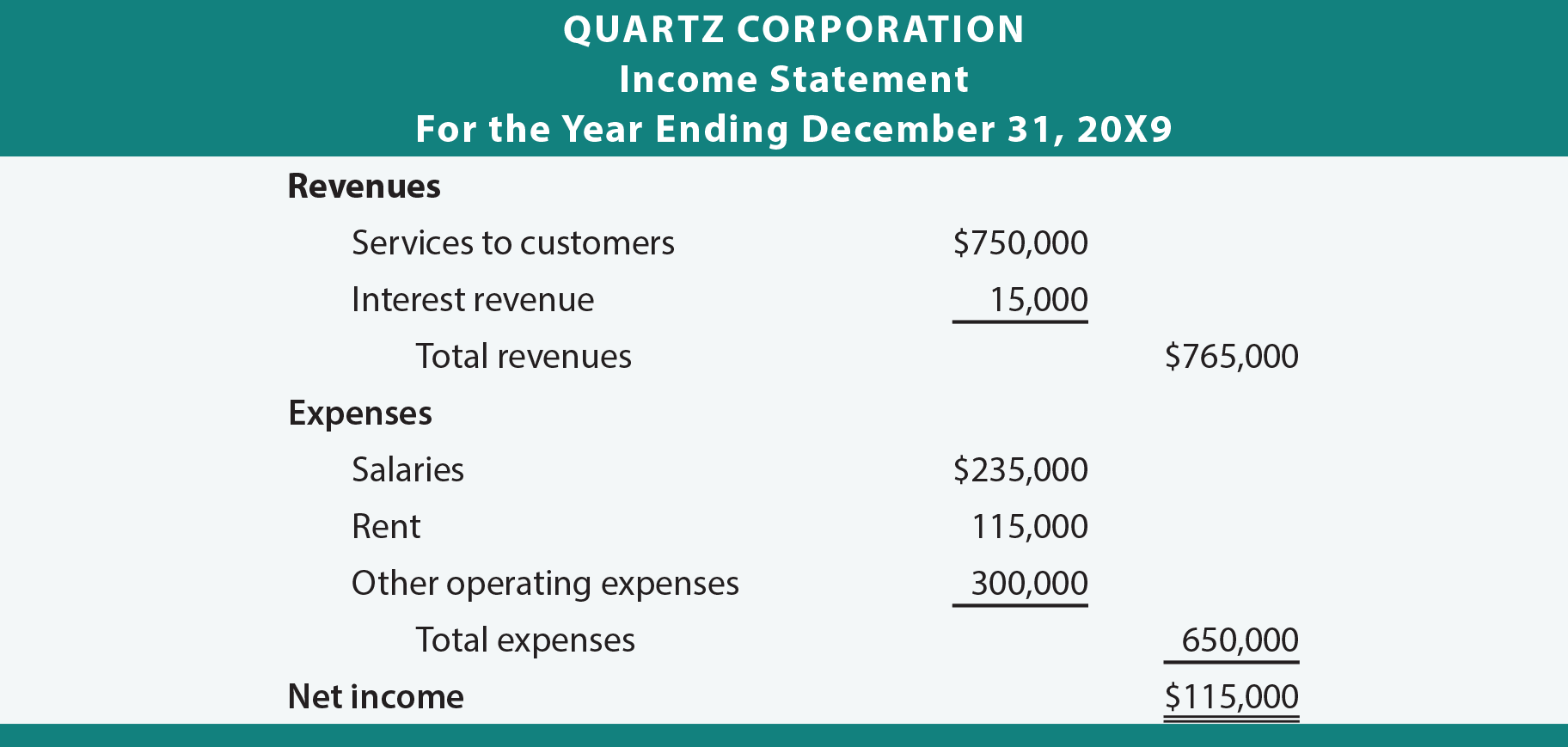

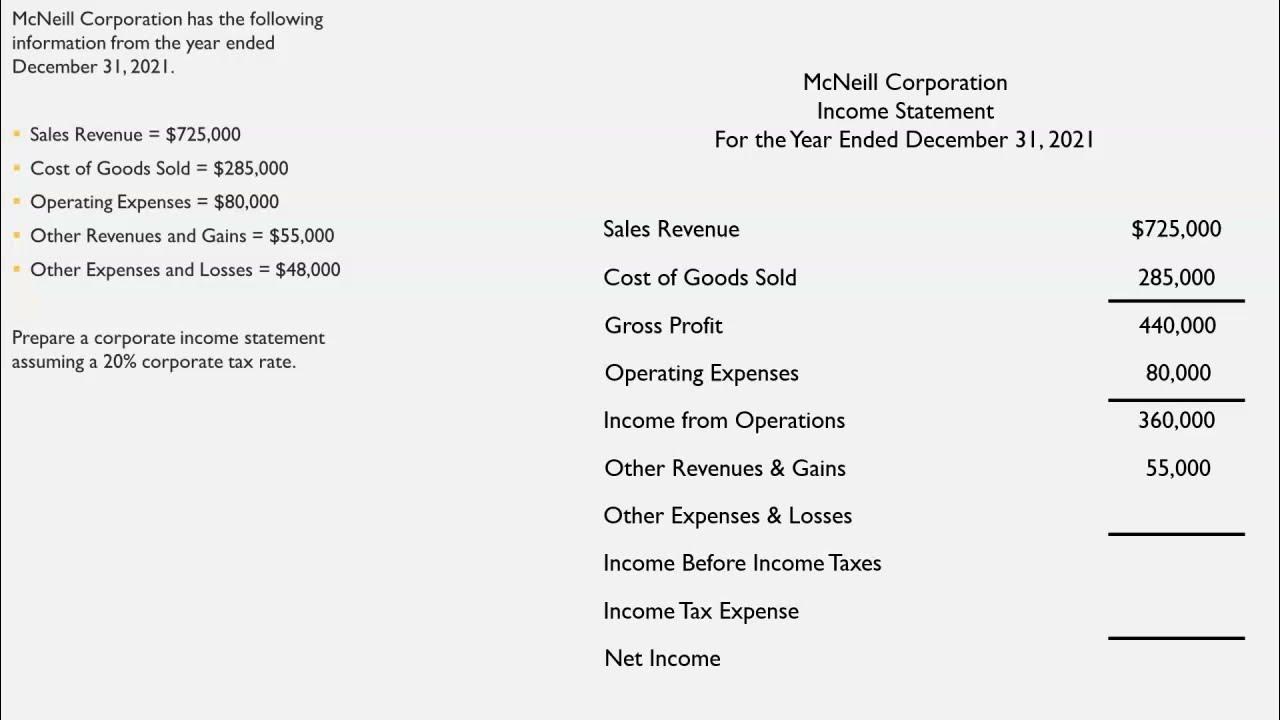

The income statement, also known as the profit and loss statement, is an important tool as it calculates the profitability or loss of a business. Calculate the cost of goods sold. The first portion of a corporate income statement, called gross profit, seeks to calculate the profitability of a company’s.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period. Santa clara, calif., feb.

Pick a time period for the income statement. Calculate the revenue earned from the sale of goods and services. Income and tax withhodings and l corporate income taxes as well as decreased deposits of earnings from the federal reserve due to increased interest rates.

The net income is the. Corporate finance for dummies. The income statement shows the performance of the business throughout.

The statement of comprehensive income is a financial statement that summarizes both standard net income and other comprehensive income (oci). An insurance product that consumers use to help fund their retirements is selling at record levels, powering demand for corporate debt and commercial. Net income is calculated by taking revenues and subtracting the costs of doing business.

Deputy prime minister and minister for finance, mr. Income statement often, the first place an investor or analyst will look is the income statement. Nvda) today reported revenue for the fourth quarter ended january 28,.

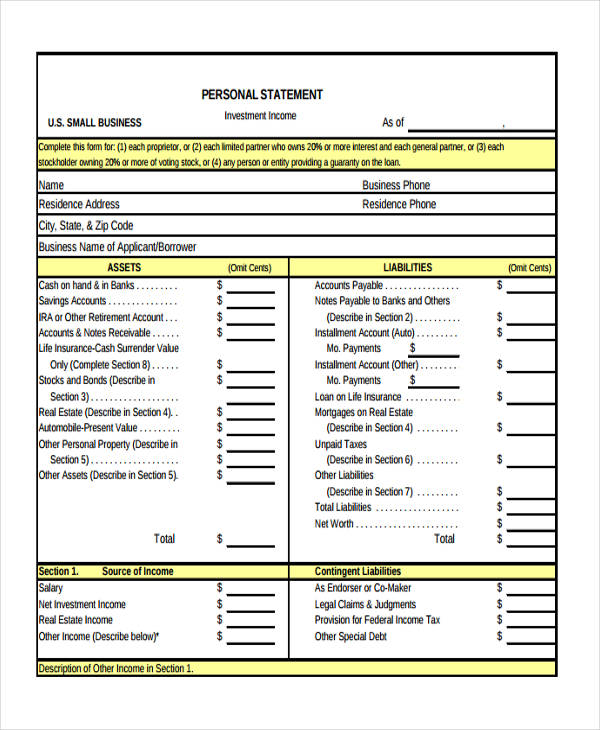

To be eligible, the applicant: Must be a resident of new brunswick at the time of application. Tax changes and enterprise disbursements.

Guidance, forms and manuals for corporation tax. Filed a new brunswick tax return. In general, the tax code passed by congress allows a business deduction for expenses of maintaining an asset, such as a corporate jet, if that asset is utilized for a.

For either 2022 or 2023: Two items of information appear: