Neat Tips About Merchandising Business Income Statements Show Cash Flow Statement From Operations

Income statement, statement of retained earnings, balance sheet, and statement.

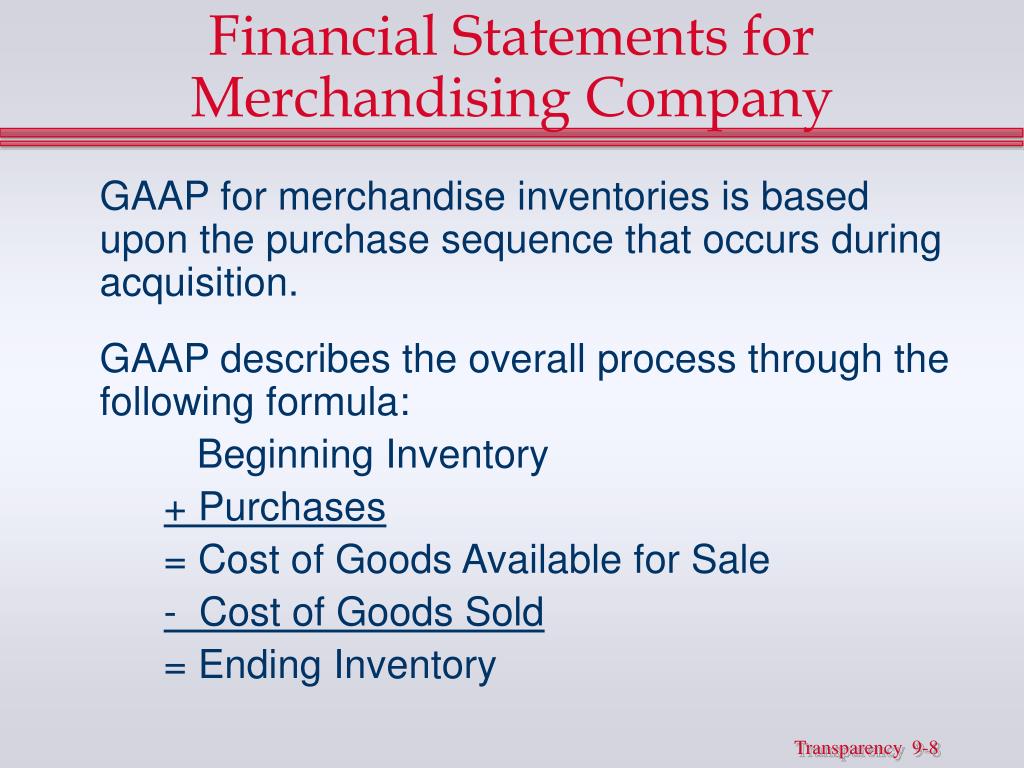

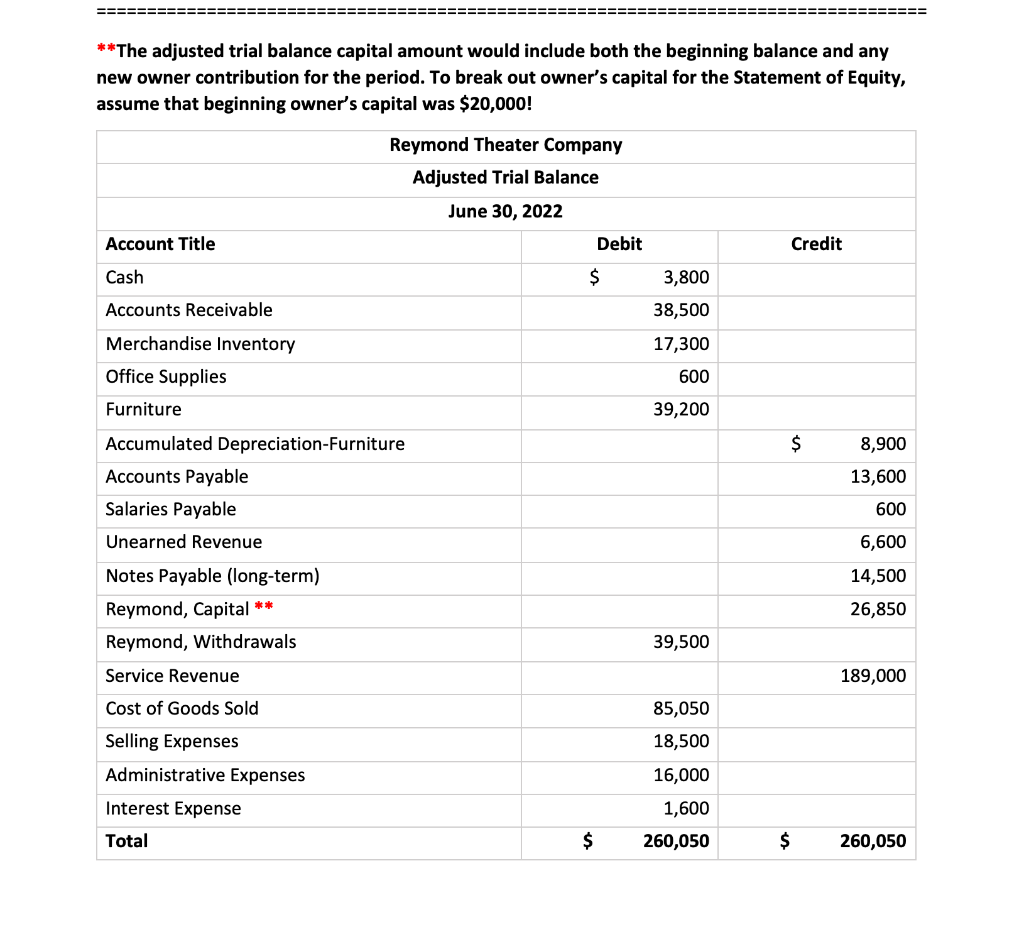

Merchandising business income statements show. Adjustments to merchandise inventory (perpetual) 5.6: The statement of comprehensive income is a. The income statement is prepared before other financial statements.

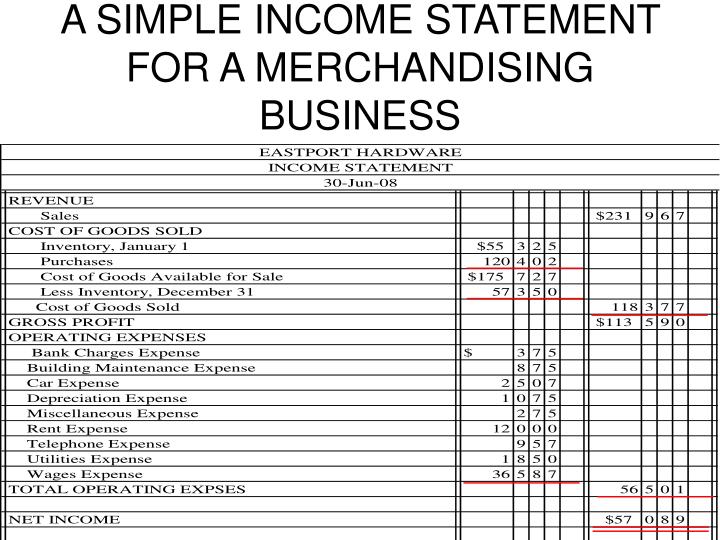

Merchandising companies prepare financial statements at the end of a period that include the income statement, balance sheet, statement of cash flows, and statement of. Here is a basic income statement for a merchandising business. Statements reflect the differences between these types of businesses.

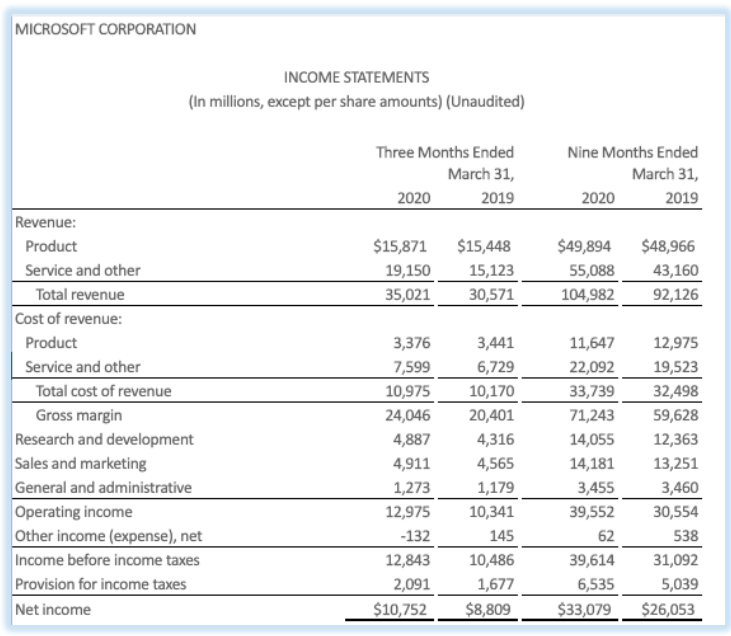

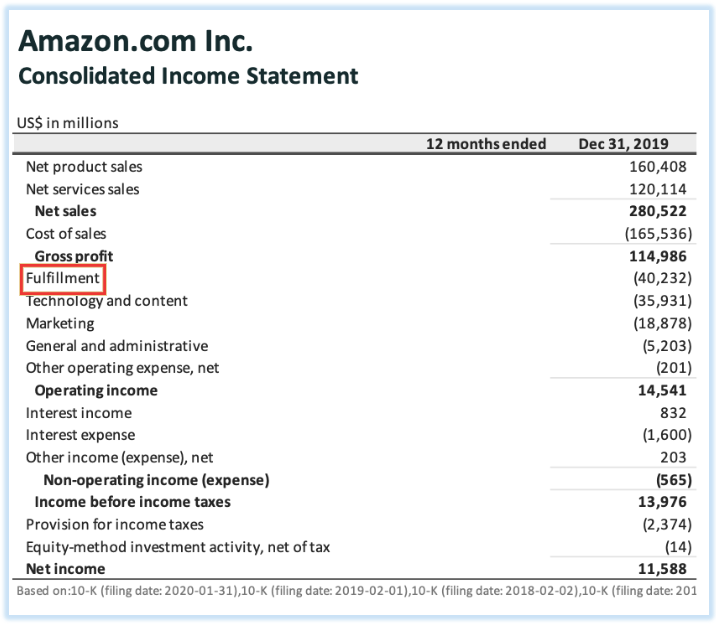

The companies' financial statements, including the income. A merchandising company uses the same 4 financial statements we learned before: Cost of goods for manufacturers manufacturers break the cost of goods into.

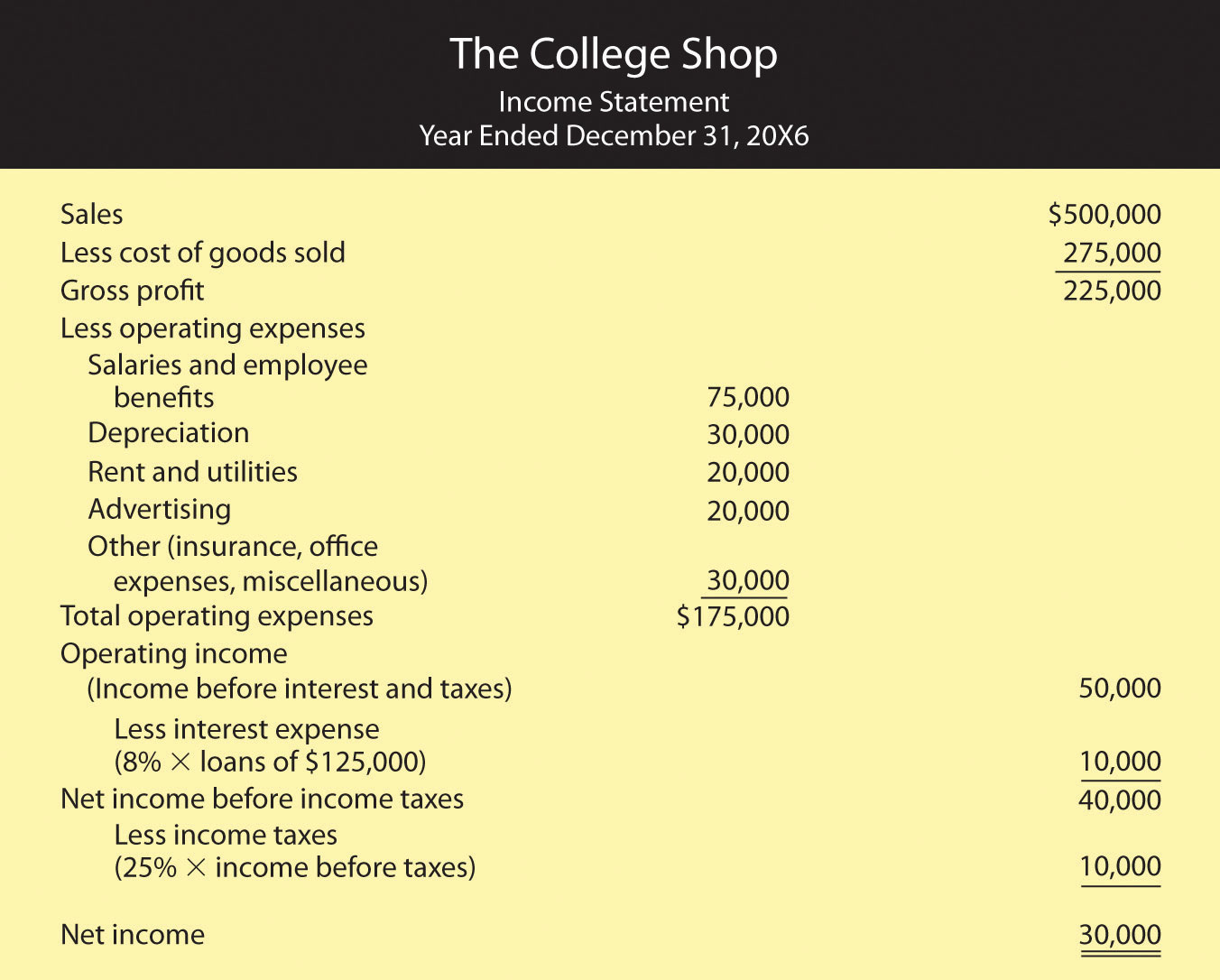

Gross profit is also known. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to. The statement of comprehensive income (merchandising business) what is a statement of comprehensive income?

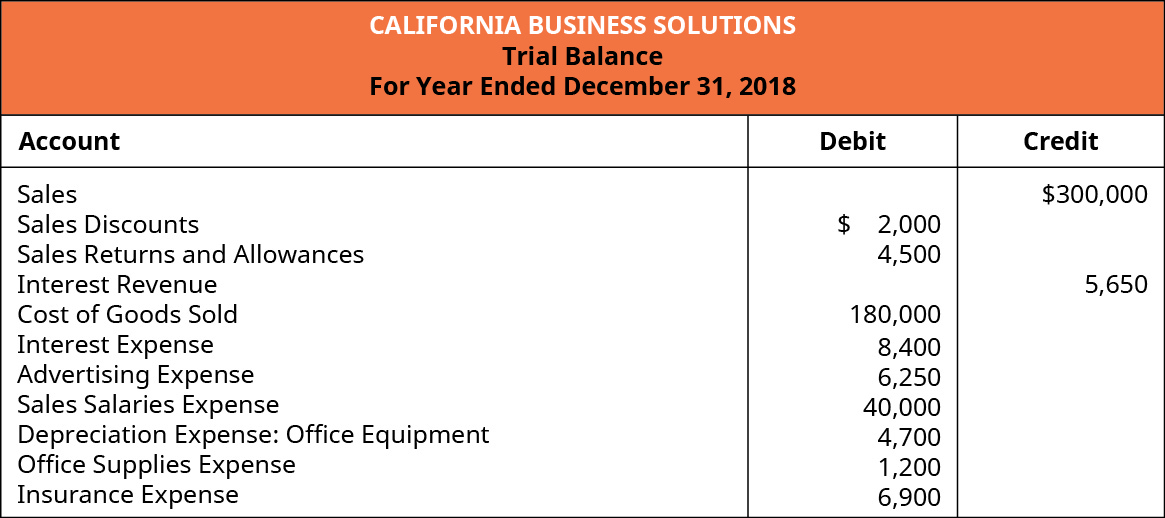

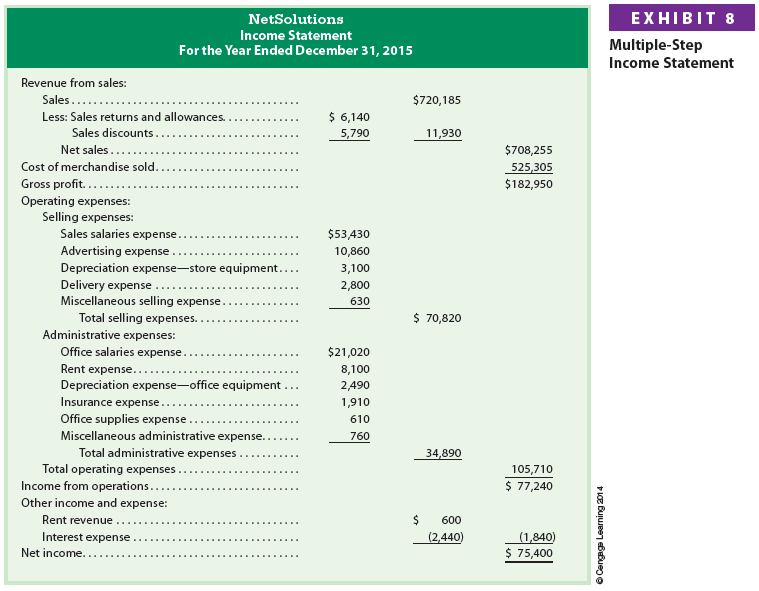

The income statement of a merchandiser begins with gross profit, which is the difference between sales revenues and cost of goods sold. A merchandising income statement highlights cost of goods sold by showing the difference between sales revenue and cost of goods sold called gross profit. Closing entries for a merchandiser

Income statement, statement of retained earnings, balance sheet, and statement of cash. For a merchandising business, it is. Merchandising companies prepare financial statements at the end of a period that include the income statement, balance sheet, statement of cash flows, and statement of.

A merchandising company uses the same 4 financial statements we learned before: By sean butner updated january 20, 2022 the income statement is the first financial statement that any small businesses should prepare. Purchasing merchandise, paying for merchandise, storing inventory, selling merchandise, and.

To understand merchandising costs, figure 2.2 shows a simplified. Notice that cost of merchandise sold, an expense account, is matched up with net sales at the top of the statement. A single‐step income statement for a merchandising company lists net sales under revenues and the cost of goods sold under expenses.

Merchandising firms account for their costs in a different way from other types of business organizations.