Peerless Tips About Accounting Efficiency Ratios Projected Balance Sheet For Bank Loan In Excel Format Financial Reporting Assertions

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

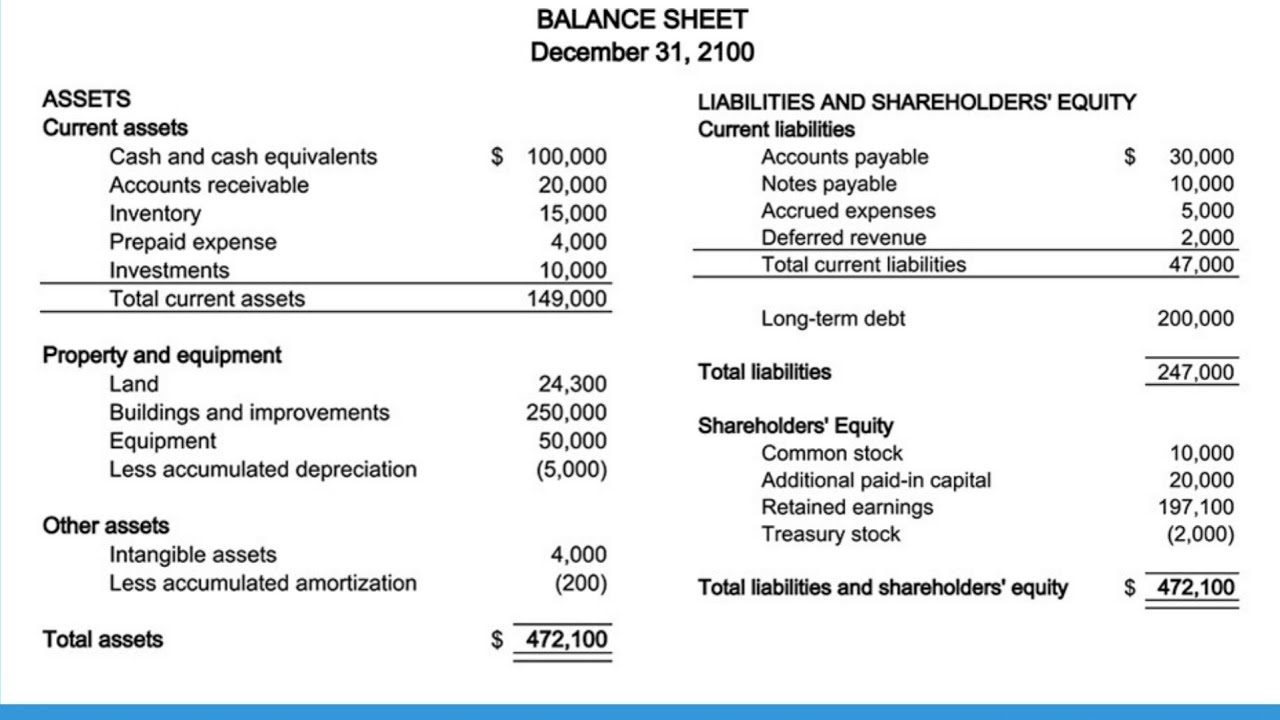

A liability is a present obligation of the enterprise.

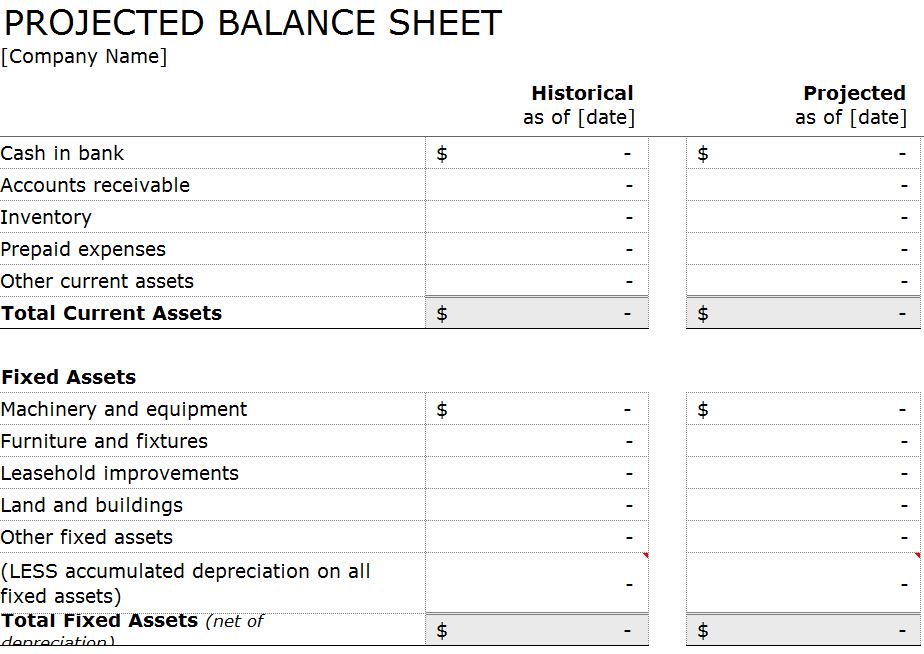

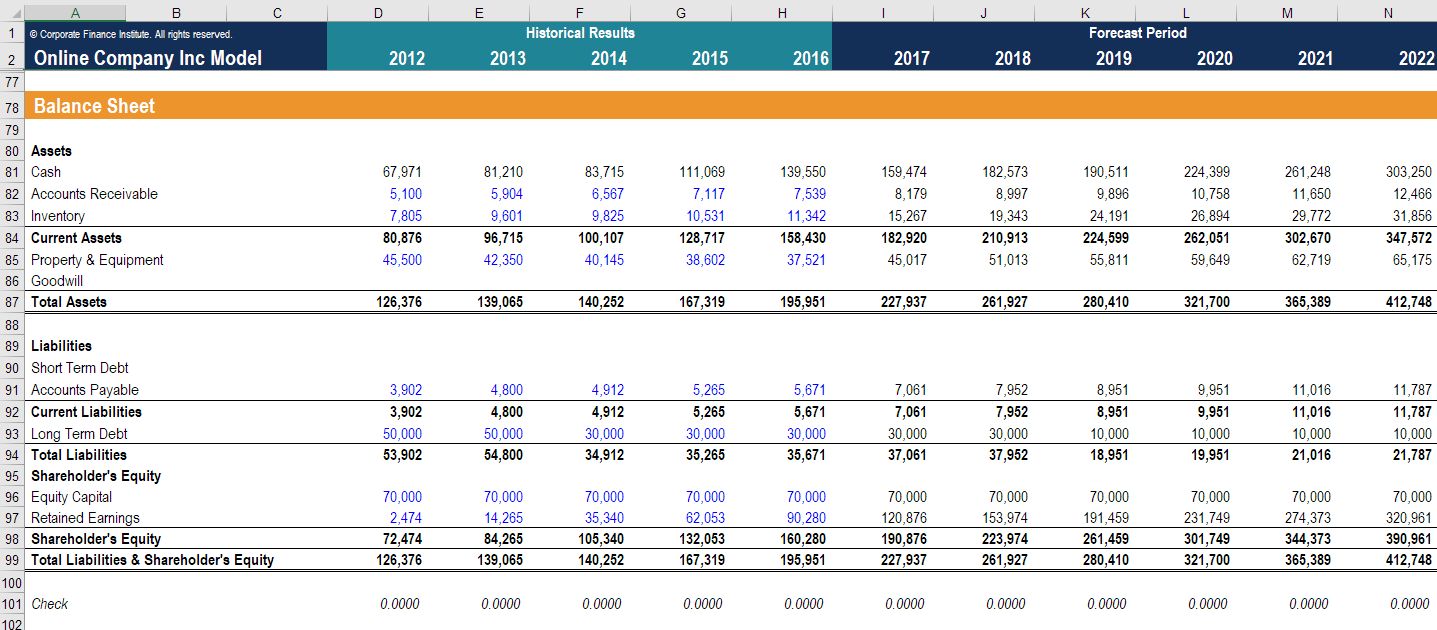

Accounting efficiency ratios projected balance sheet for bank loan in excel format. In this method, we will make an excel projected balance sheet format for 3 years. In theory, an optimal efficiency ratio is 50%, which would mean $1 of expenses results in $2 of revenue. First, input the financial data into the excel sheet, for example, financial statements like a balance sheet, income statement, or cash flow statement.

We have taken a concise excel dataset to explain the steps clearly. To calculate the monthly interest on a loan, you can use the formula: Ratio analysis is a type of financial statement analysis used to obtain a rapid indication of a company’s financial performance in key areas.

Using the pmt function to calculate monthly. Calculate balance sheet ratios with the balance sheet and income statement in the example above, we can calculate the balance sheet ratios as below: This template includes the following ratios:

Projected balance sheet in excel #xls. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and. You can use ratio analysis to evaluate various aspects of a company’s.

Ratios used by banks and other lending institutions in credit analysis. Calculating the efficiency ratio involves comparing the bank’s. Projected balance sheet and profit and loss account for a period of 3 to 5 years collateral security (depending on amount of loan) project report/ dpr all.

Interest = remaining balance * monthly interest rate. Create excel projected balance sheet format for 3 years manually. Financial projection template building up forecast from payroll schedules, operating expenses schedules and sales forecast to the three financial statements over 1.8 million.

Other files by the user. However, banks regularly end up with higher ratios. The efficiency ratio is a profitability metric that can determine the operating efficiency of a bank.

It arises from past events, the settlement of which is expected to result in an outflow from the enterprise of resources embodying.