Inspirating Tips About Financial Statement Disclosure Requirements Pwc Statements 2018

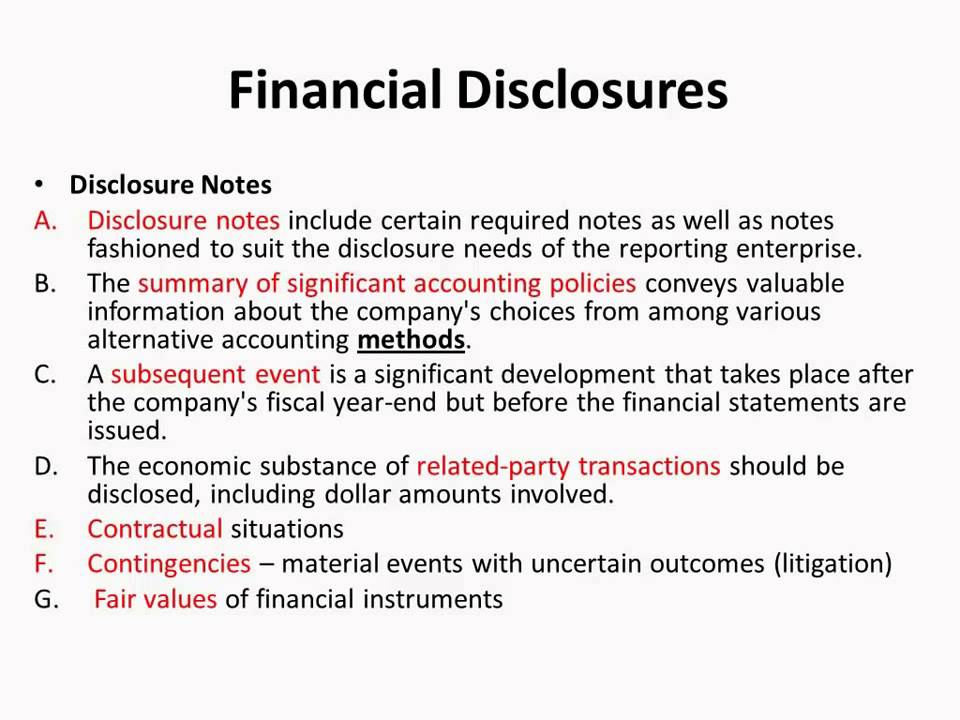

Disclosures within the notes to the financial statements 20 4.1 disaggregation of revenue 20 4.2 contract balances 26 4.3 performance obligations 34 4.4 significant.

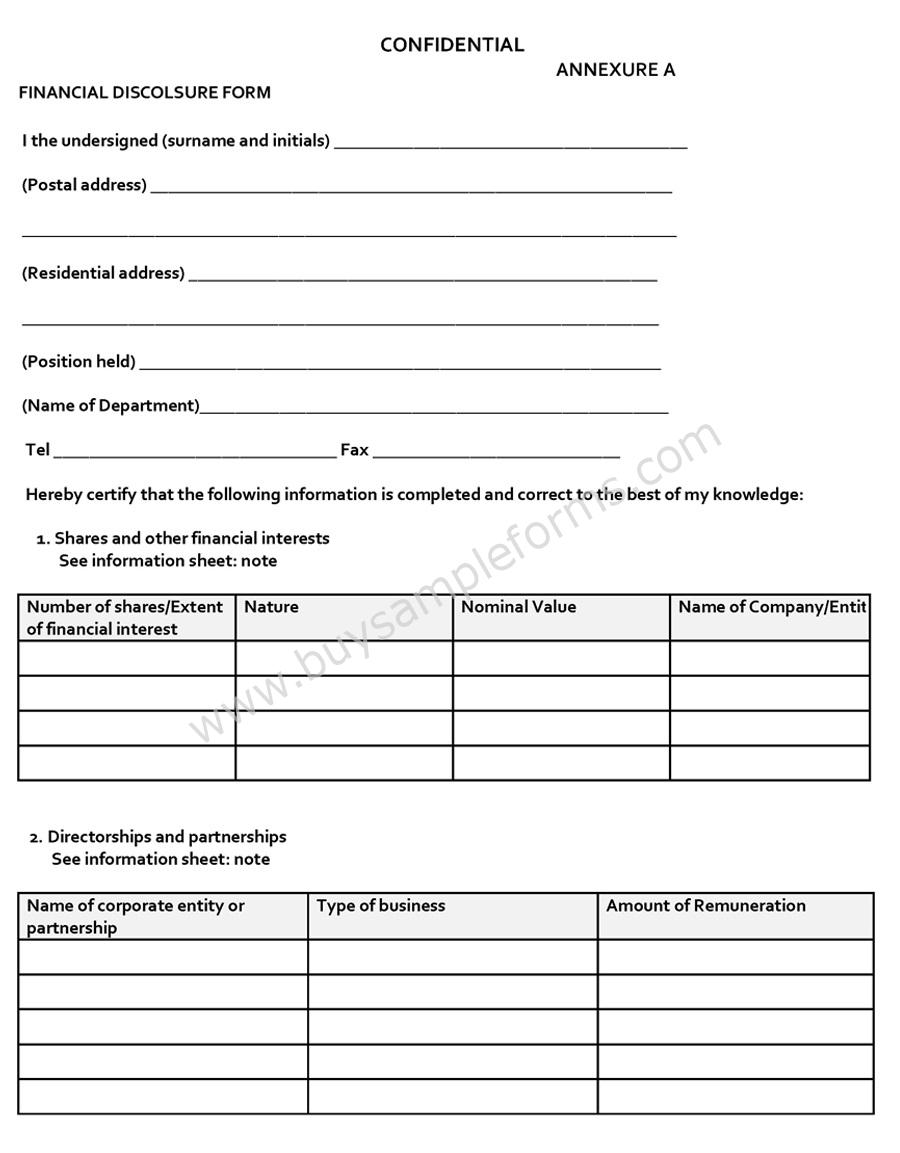

Financial statement disclosure requirements. These disclosure requirements can be accomplished by separately grouping items on the balance sheet, or by disclosure in the notes to the financial. This publication includes illustrative presentation and disclosures under ifrs 17 to help preparers to implement the disclosure requirements and to give investors,. Who would be affected by the project proposals?

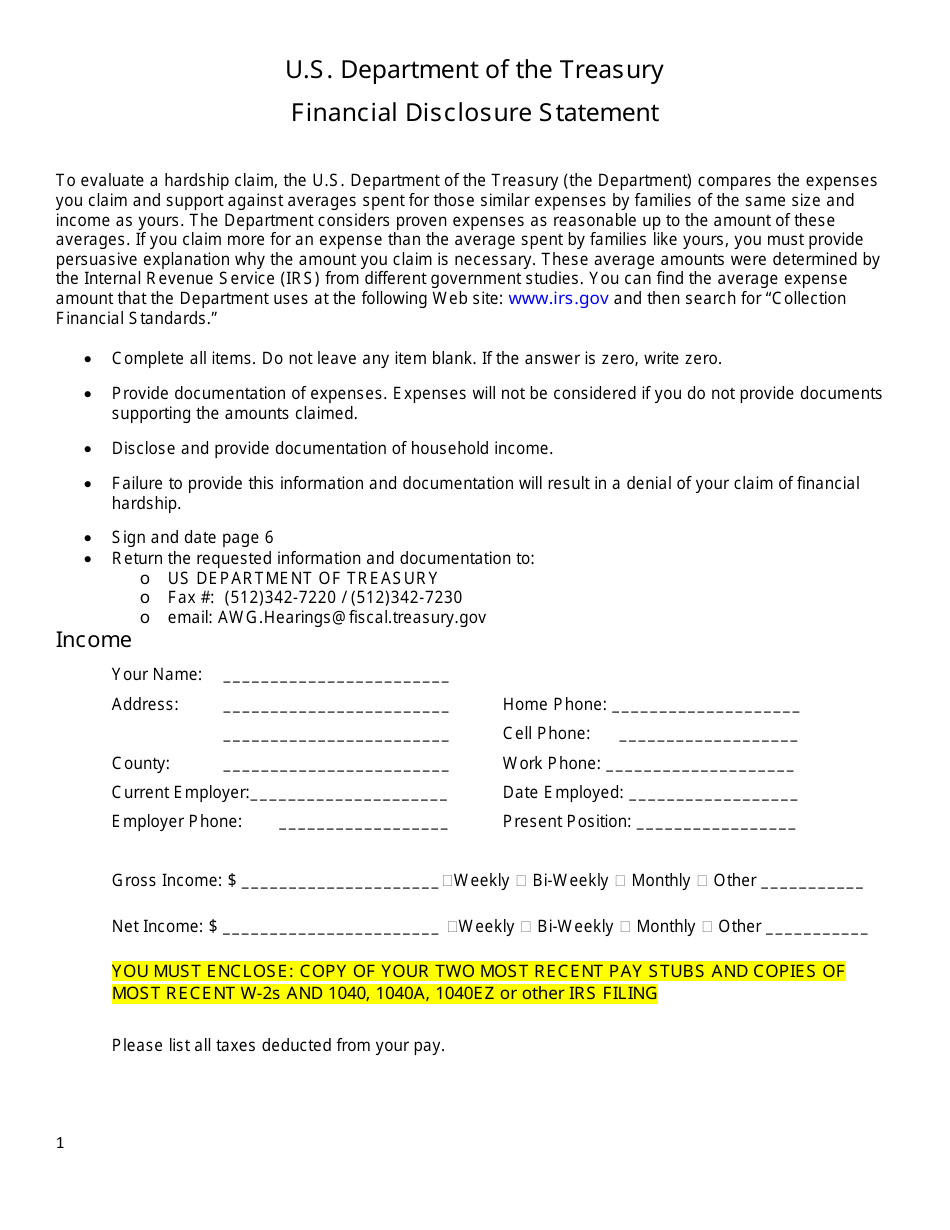

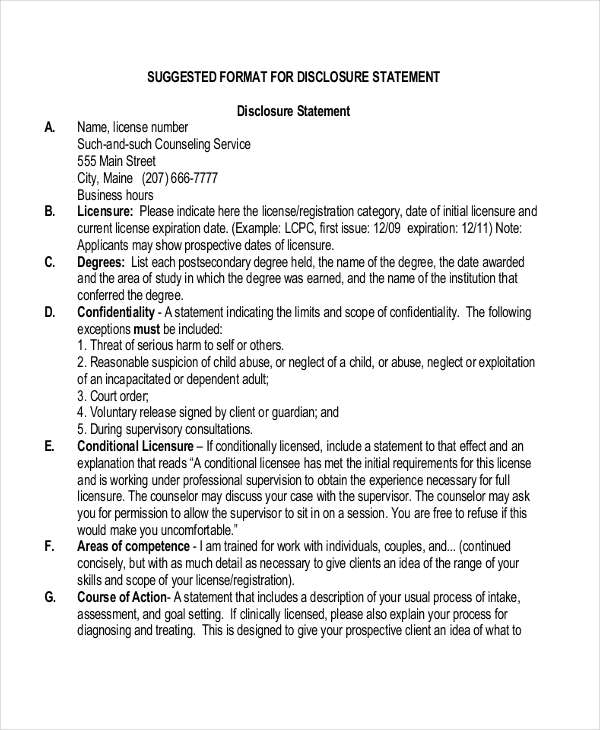

October 13, 2021 financial statement disclosures are additional information included at the end of a financial statement presentation. The objective of the disclosure requirements is to give a basis for users of financial statements to. Ifrs 16 requires lessees and lessors to provide information about leasing activities within their financial statements.

Presentation of financial statements general presentation and disclosures comments to be received by 30 september 2020. September 2021 investor perspectives disclosures in financial statements to better reflect investor needs nick anderson nick anderson, a member of the international. With a new standard that would comprise:

To judge whether information is material for inclusion in the financial statements. Illustrate ways in which an entity can meet the. 7 disclosures in the financial statements also include information about:

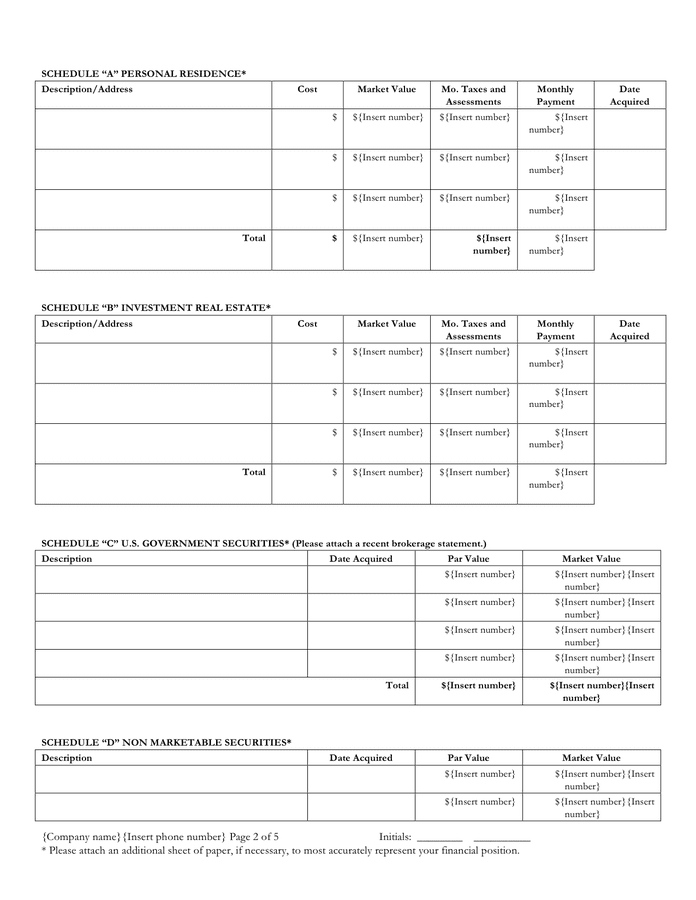

Asc 205, presentation of financial statements, provides the baseline authoritative guidance for presentation of financial statements for all us gaap reporting entities. Presentation and disclosure. In the finance and investment world, disclosures are required to be issued by businesses and corporations, disclosing all relevant information that can potentially influence an.

Asc 205 to 280 in the fasb’s accounting standards codification® are. The sample uses west java because the most money circulates there. In december 2014 ias 1 was amended by disclosure initiative(amendments to ias 1), which addressed concerns expressed about some of the existing presentation and.

(a) transactions and other events that have occurred after the end of the reporting period if providing that. Reporting entities must disclose certain qualitative and quantitative information so that financial statement users can understand the nature, amount,. (ii) requirements brought forward from ias.

These addendums provide insight to. The data used in this research is secondary data derived from financial statements and annual. Ias 27 (as amended in 2011) outlines the accounting and disclosure requirements for 'separate financial statements', which are financial statements.

Disclosure goes ‘behind the numbers’ and is necessary to fully understand the financial statements.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)