Awesome Info About Balance Sheet With Expenses Accounting Standard 3 Cash Flow Statement

An expense is a cost that has been used up, expired, or is directly related to the earning of revenues.

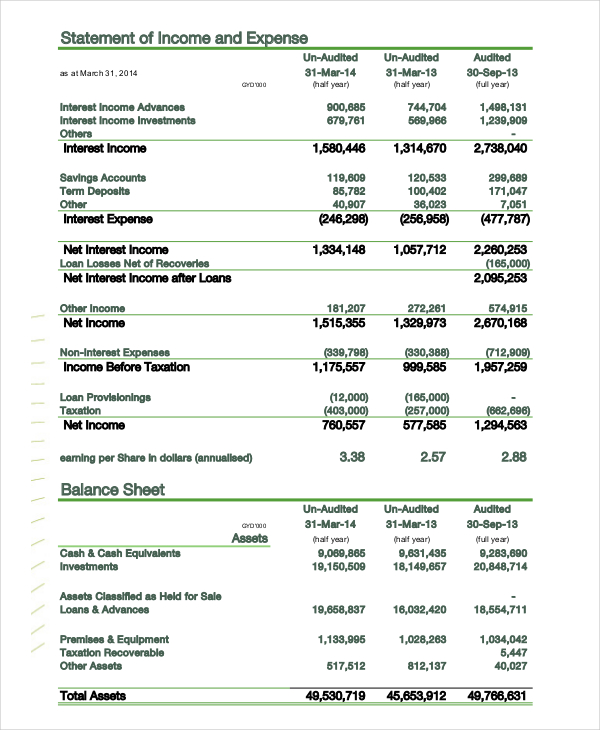

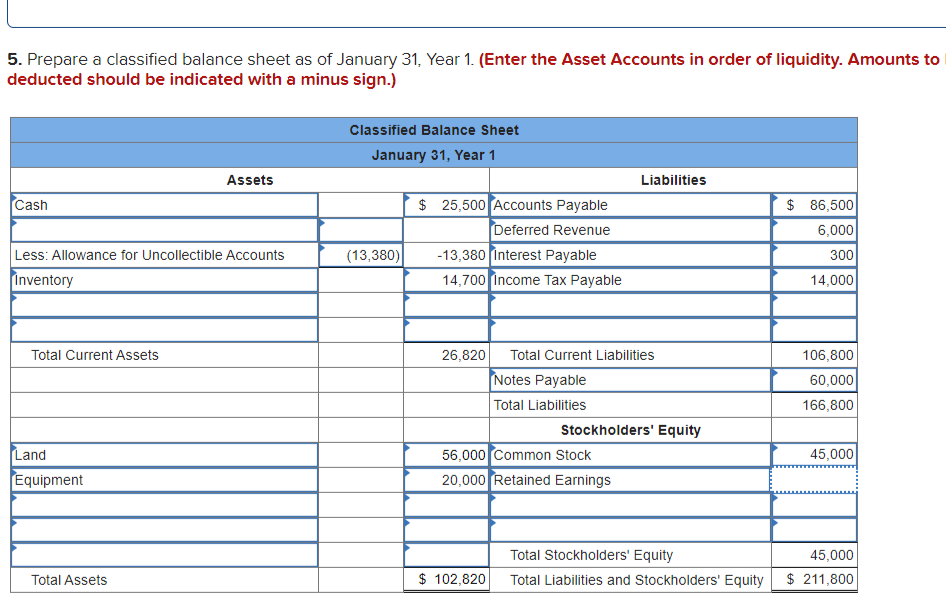

Balance sheet with expenses. However, the incurrence of an expense also impacts the balance sheet, which is where the ending balances of all classes of assets, liabilities, and equity are reported. How an expense affects the. Prepare an income statement by taking income and expense items (such as sales) from the trial balance and organizing them in a proper format.

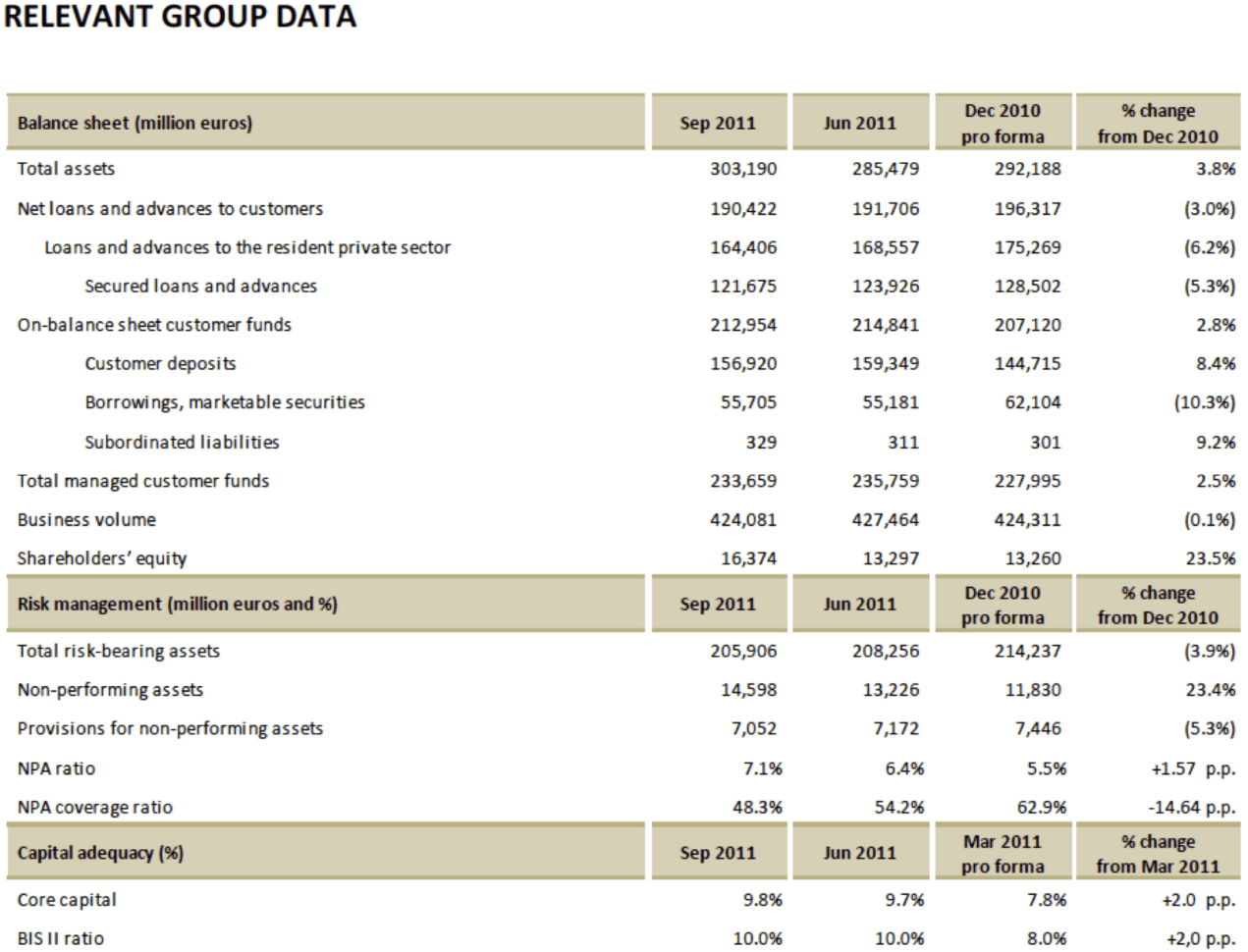

Line items reported: Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date. The trial balance in your balance sheet contains liabilities, assets, equity, expenses, revenue, losses and gains.

Balance sheet is part of any financial statement which provides a snapshot of entity’s financial condition on a given date. That’s where this guide comes in. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.

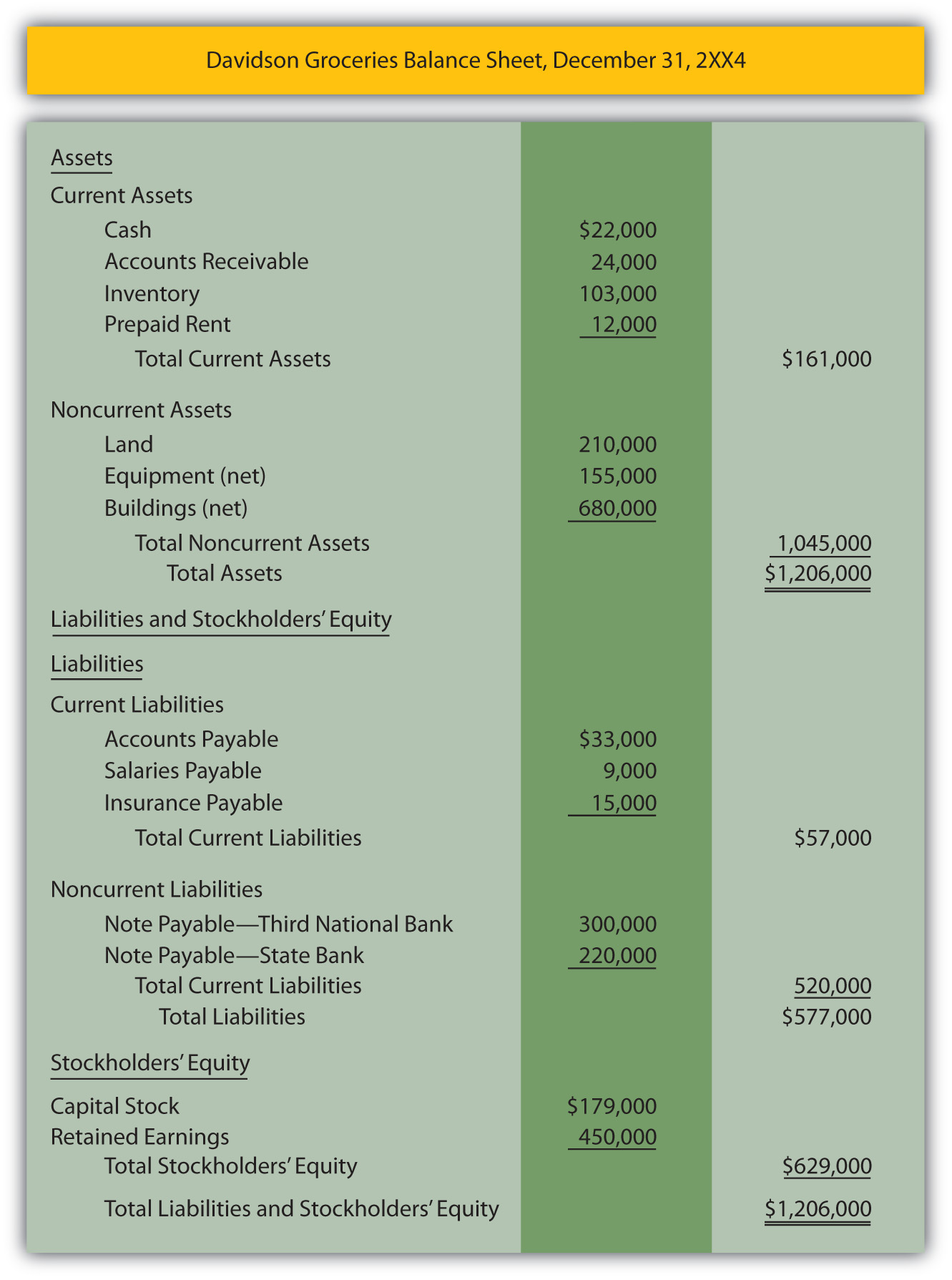

The balance sheet follows a basic accounting equation: So you definitely need to know your way around one. A balance sheet includes a summary of a business’s assets, liabilities, and capital.

Learn what a balance sheet should include and how to create your own. The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. The balance sheet is based on the fundamental equation:

Elena cardone is organizing this fundraiser. A balance sheet, at its core, shows the liquidity and the theoretical value of the business. The profit and loss statement or income statement shows a company’s income and expenses over a specific period, such as a month or year.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. 193 people just donated. Assets = liabilities + equity.

How does an expense affect the balance sheet? Assets = liabilities + equity. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

Most of a company's expenses fall into the following categories: A balance sheet lists a company’s assets, liabilities, and owner’s equity at a specific point in time. Often, the reporting date will be the final day of the accounting period.

Option one is straight to the profit and loss statement, effectively bypassing the balance sheet. It can be used to see how your business is doing and making a profit or loss. Balance sheet templates, such as this investment property balance sheet, allow you to factor in details such as property costs, expenses, rental and taxable income, selling costs, and capital gains.