Out Of This World Info About Debt Equity Ratio Of Maruti Suzuki Cash Flows From Financing

The following section summarizes insights on maruti suzuki india limited's debt / total equity:

Debt equity ratio of maruti suzuki. Enter the first few characters of company and click 'go' maruti suzuki india ltd. The balance sheet page of maruti suzuki india ltd. Company financial ratios analysis financial ratios analysis of maruti suzuki.

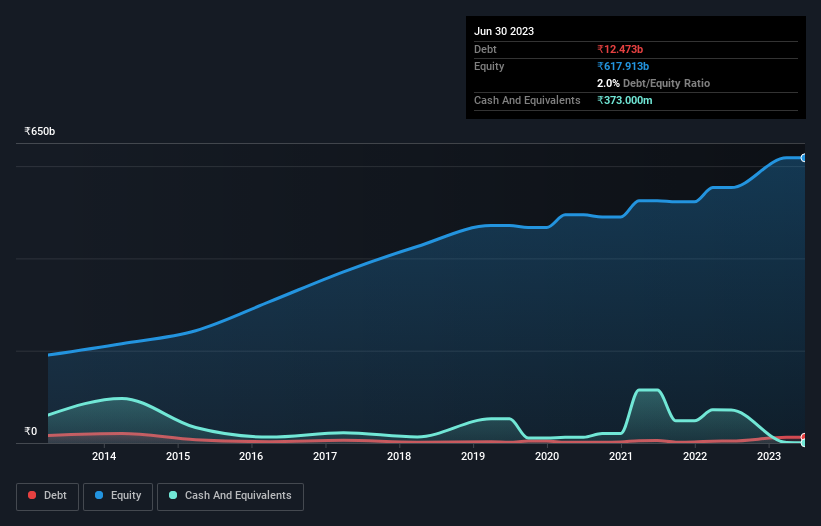

The company sold a total of 514,927 vehicles during the quarter, higher by 5.3% compared to the same period. Smc currently holds 56.28% of its equity stake. Maruti suzuki india's total debt / total capital for fiscal years ending march.

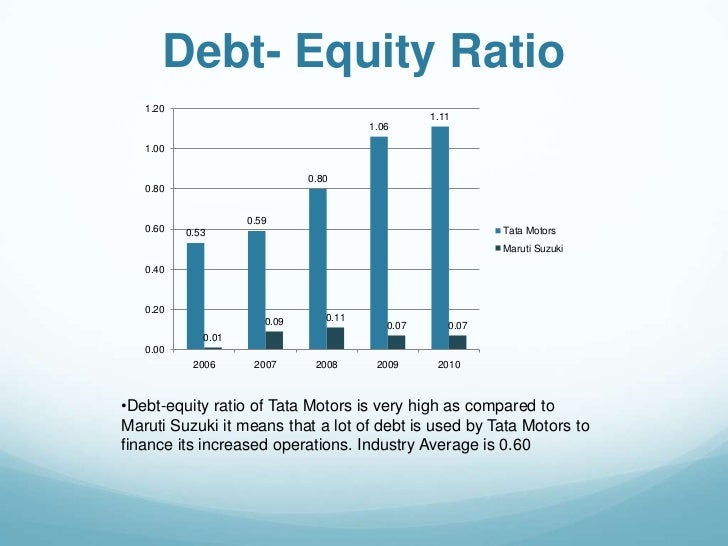

Debt to equity ratio 0.0197 of maruti suzuki india ltd. And the median was 0.01. Debt to equity ratio of maruti rose.

Mar 2015 mar 2017 mar 2019 mar 2021 mar 2023 0.0% 4.0% 8.0% 12.0%. Maruti suzuki maruti suzuki india ltd. Current and historical debt to equity ratio values for suzuki motor (szkmy) over the last 10 years.

Maruti suzuki ind key financial stats and ratios. Maruti suzuki india's latest twelve months total debt / total capital is 0.1%. Total debt/equity (x) 0.02:

Get maruti suzuki india latest consolidated cash flow, financial statements and maruti suzuki india detailed profit and loss accounts. Price of sbi on previous budgets. Total debt to total equity 2.02:

[consolidated] what is the latest total debt/equity ratio of maruti suzuki india ? The principal activities of the company are manufacturing, purchase and sale of motor vehicles, components and spare parts. Find out all the key statistics for maruti suzuki india limited (maruti.ns), including valuation measures, fiscal year financial statistics, trading record, share statistics and more.

Total debt to total assets 1.47: Asset turnover ratio (%) 1.50: Presents the key ratios, its comparison with the sector peers and 5 years of balance sheet.

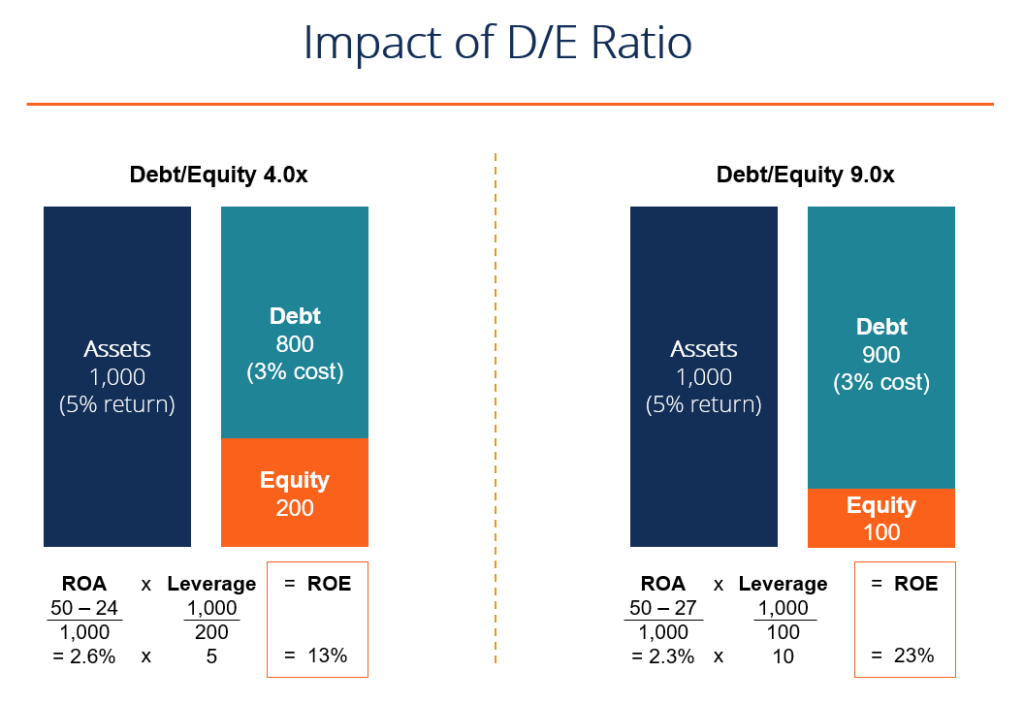

Maruti suzuki ind key financial stats and ratios. The companies that have a debt equity ratio greater than 0.5 should be avoided current ratio free sign up / sign in to view 10 years data current ratio min. The company sold a total of 488,830 vehicles during the quarter, lower by 0.7% compared to the same period.

The company has an enterprise value to ebitda ratio of 21.67. Mar 2015 mar 2017 mar 2019 mar 2021 mar 2023 0.0% 4.0% 8.0% 12.0%. The debt/equity ratio can be defined as a measure of a company's financial.