Brilliant Strategies Of Info About Expected Credit Loss Journal Entry Balance Sheet Uk

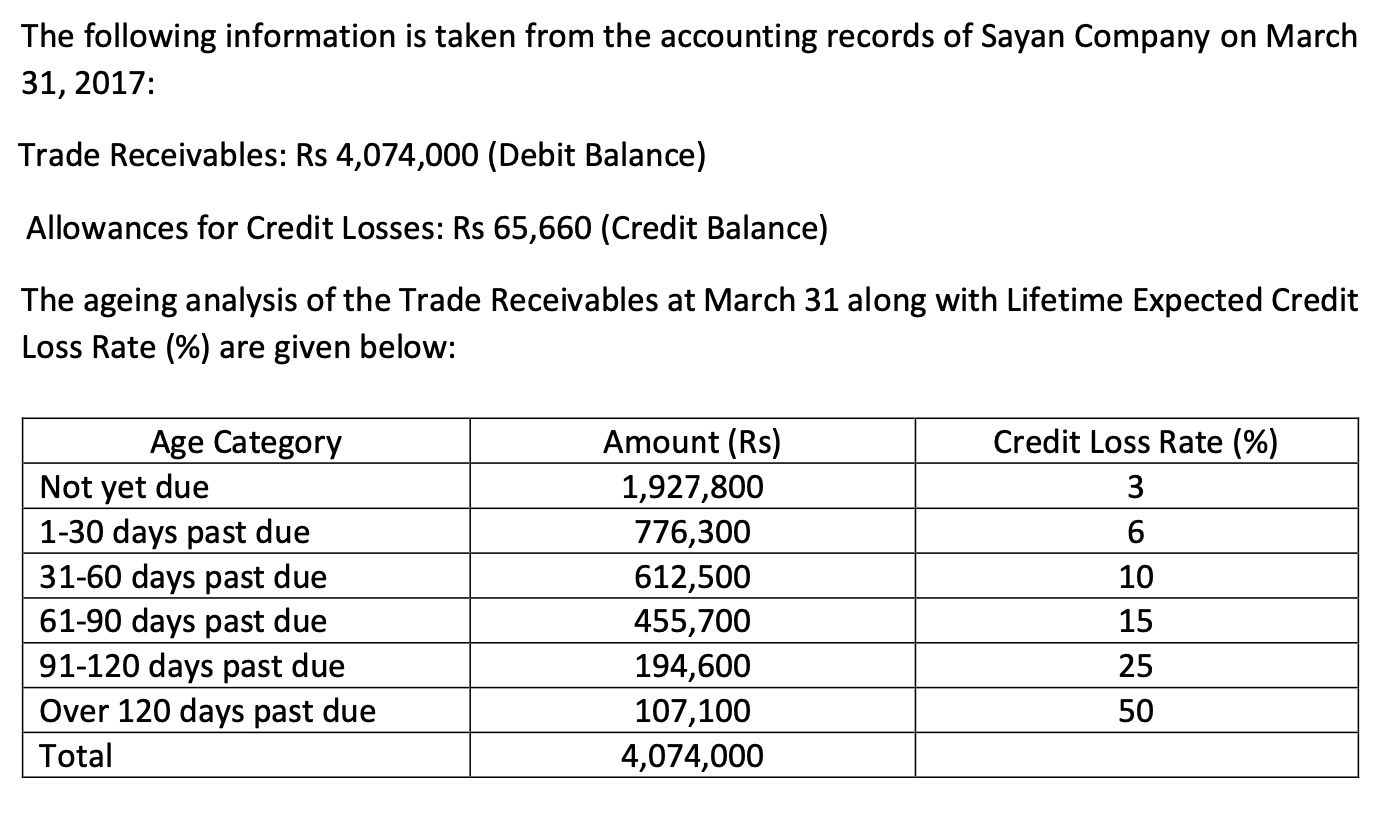

Measurement of expected credit losses (ecl) defining credit losses a credit loss refers to the difference between all due contractual cash flows to an entity in.

Expected credit loss journal entry. Expected credit losses are determined by comparing the asset’s amortized cost with the present value of the estimated future principal and interest cash flows. This is often referred to as the ‘cash shortfall’. Thomas brock what is allowance for credit losses?

Executive summary the transition to ifrs 9 generally resulted in an increase in impairment allowances. The current expected credit losses (cecl) impairment model applies to a broad scope of financial instruments, including financial assets measured at amortized. The impacts on financial statements and cet1 ratio are, in most cases,.

This section of the acl chapter covers: Reduce the complexity in u.s. Allowance for credit losses and current expected credit loss methodology.

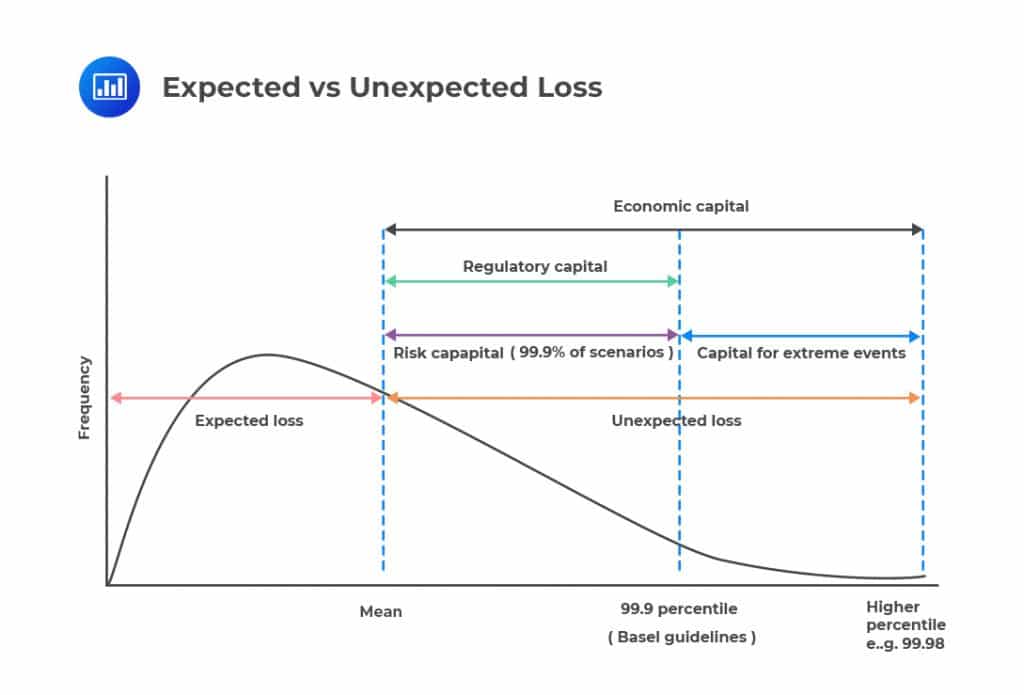

Gaap by decreasing the number of credit impairment models that entities use to account for debt. The new standard is called the current expected credit loss (cecl) model because it requires making an estimate of the total expected credit losses that will be. The concept of expected credit losses (ecls) means that companies are required to look at how current and future economic conditions impact the amount of.

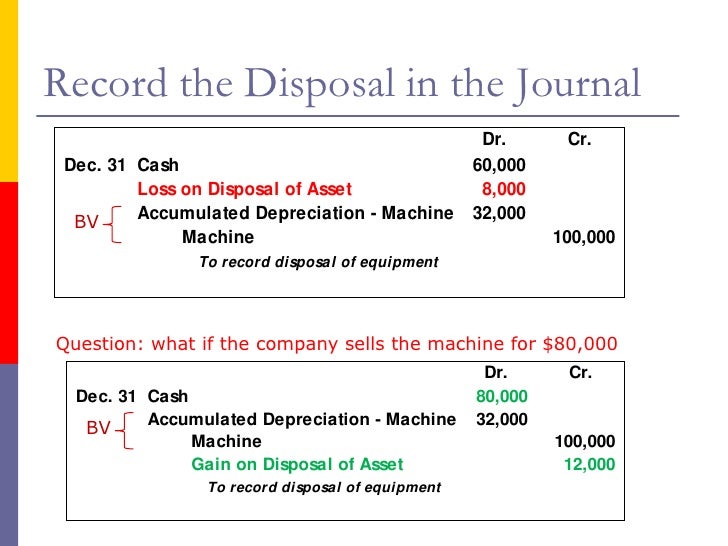

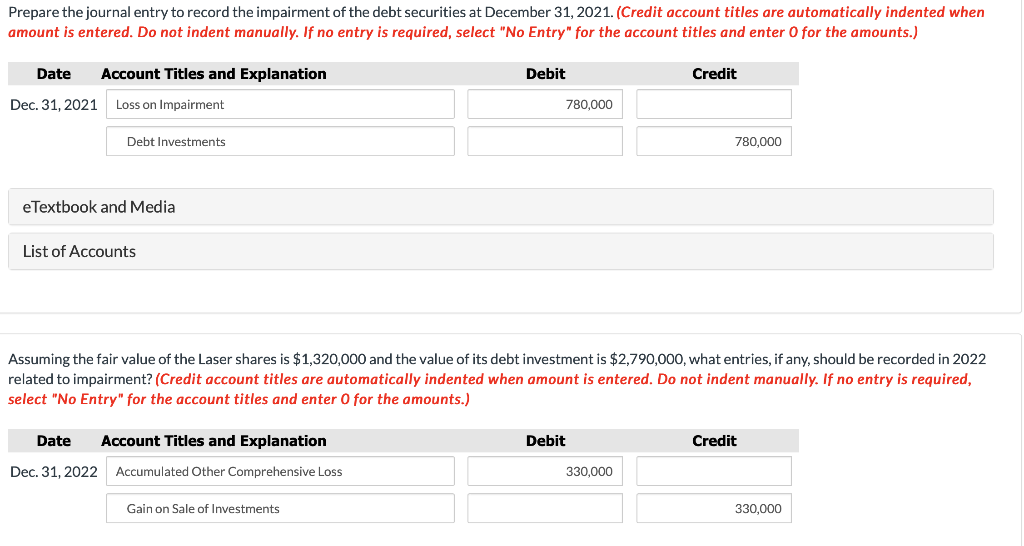

Credit losses are the difference between the present value (pv) of all contractual cashflows and the pv of expected future cash flows. The expected credit losses are recorded in profit or loss on initial recognition in an allowance account for the respective item in the statement of financial position and. Impairment models are based on expected credit losses, they take different approaches to measuring and recognizing those losses:

What is expected credit loss (ecl) under ifrs 9? The objectives of the cecl model are to: Suggestion/report error the iasb introduced its expected credit loss ( ecl) model for measuring impairment of.

The lengthiest amendments are to ifrs 7, ‘financial instruments: Ifrs 9 includes consequential amendments to other accounting standards. Concluding thoughts changing from the ias 39 ‘incurred loss’ model to the ifrs 9 ‘expected loss’ model will likely result in earlier impairment recognition, and the.

Does paragraph 5.5.20 of ifrs 9, which that requires that expected credit losses on certain revolving credit facilities be measured over a longer period than the maximum. Any amount of expected credit losses (or reversal) that is required to adjust the loss allowance at the reporting date to the amount required by ifrs 9 is recognised in profit.