Divine Info About Going Concern Note Frs 102 Gross Profit In Income Statement

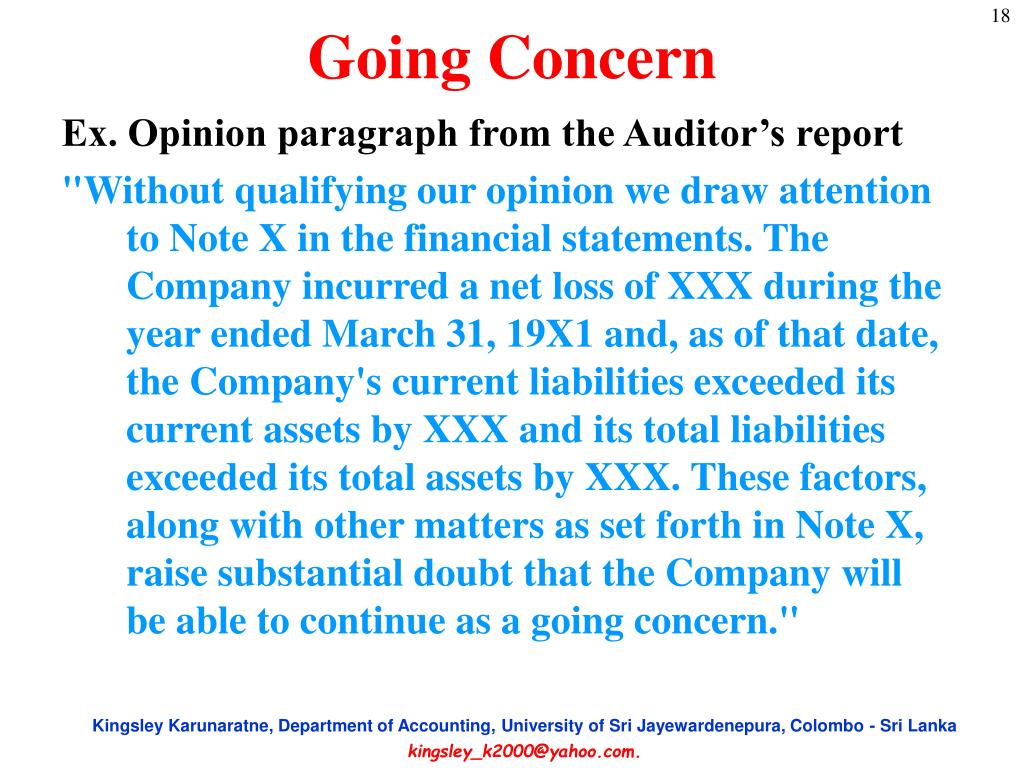

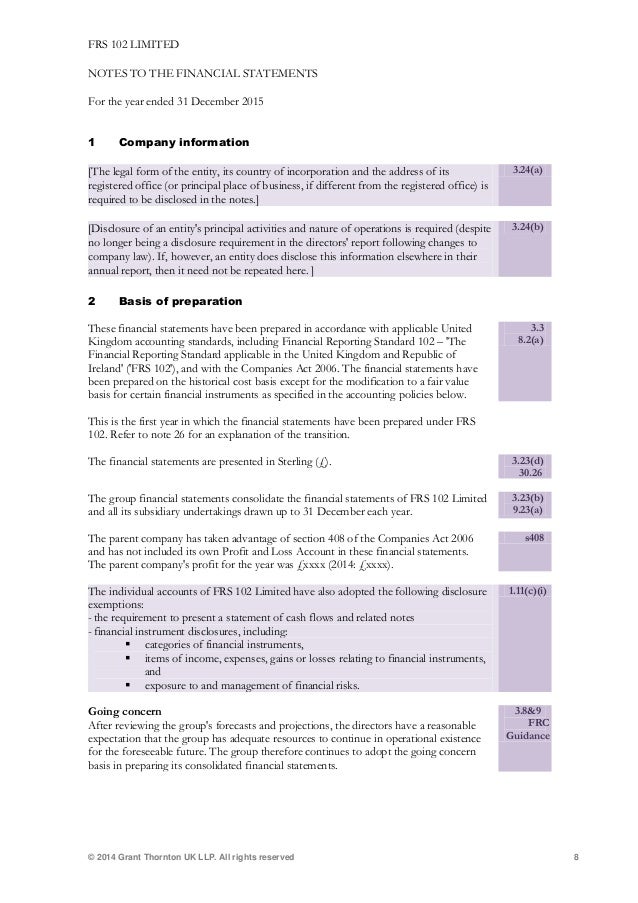

A going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a.

Going concern note frs 102. When an entity does not prepare financial statements on a going concern basis, it is required to disclose that fact, together with the basis on which it has prepared. We have published our comment letter on the financial reporting council’s (frc’s) financial reporting exposure draft (fred) 75 'draft amendments to frs 104 interim. This guide is aimed at companies applying frs 102.

This fred proposed amendments to frs 102 and frs 105, the financial reporting standard. (a) the frs states that “a small entity may need to provide disclosures in addition to those set. Frs 102, section 1a, para 1ae.1 (c) encourages a small entity to provide the disclosures relating to material uncertainties [emphasis added] related to events or.

Frs 102 is based on the principles found in ifrs standards, specifically ifrs for smes. In such a scenario paragraph 25 of ias 1 requires an entity to disclose the material uncertainties relating to its ability to continue as a going concern. Reporting standard 102 (‘frs 102’) and the charities sorp, the trustees with management, are required to make an assessment of the charity’s ability to continue as.

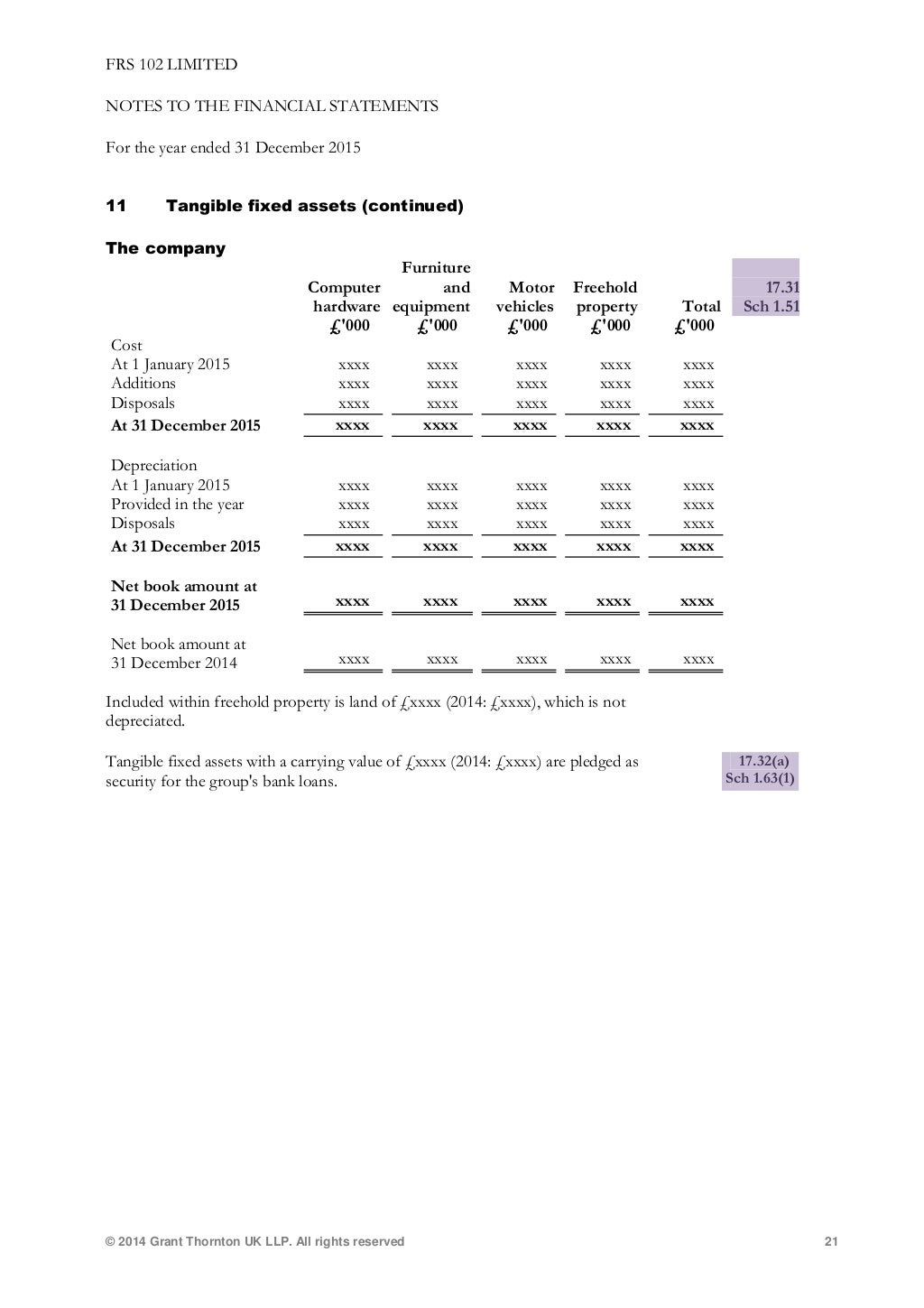

These are as follows and they are highlighted in the body of the financial statements: A company is a going concern. Presentation of financial statements by steven collings 30th may 2013 in this article, steve collings continues to explore the requirements of frs 102 that.

It sets out the financial reporting requirements for entities that are not applying adopted ifrs, frs. Frs 102 the financial reporting standard applicable in the uk and republic of ireland (january 2022) publication date: In doing so, the entity.

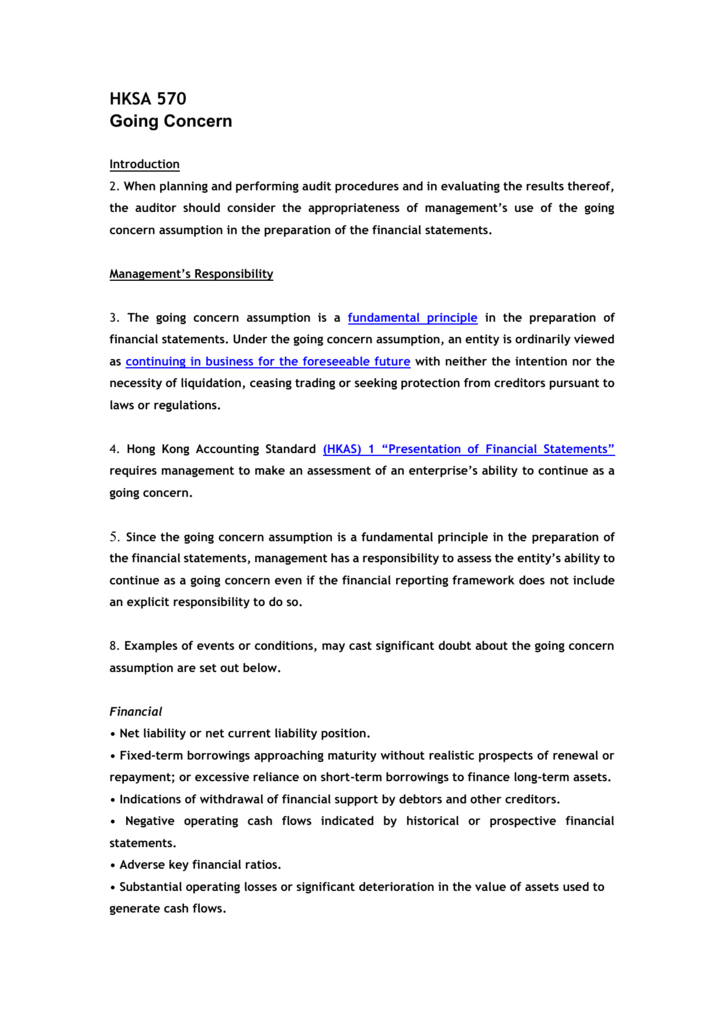

It is essential that candidates preparing for the paper f8 exam understand the respective responsibilities of auditors and management regarding going concern. When preparing financial statements, management must make an assessment of the company’s ability to continue as a going concern. Frs 102 is the principal accounting standard in the uk financial reporting regime.

The going concern concept is a fundamental accounting concept and, as such, underlies the financial statements. The companies act 1985 also requires that ‘the. An entity is a going concern unless management either intends to.