Glory Tips About Cash Flow Out Ryanair Financial Statements 2018

In a sentence, an outflow is a movement of cash out of a bank account that may or may not occur at the same time as the associated cost.

Cash flow out. It is often prepared using the indirect method of accounting to calculate net cash flows. Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to. For example, a movement of $100 as consideration for the.

The global x u.s. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period. * constant currency (c.c.) adjusts prior year for movements in currencies.

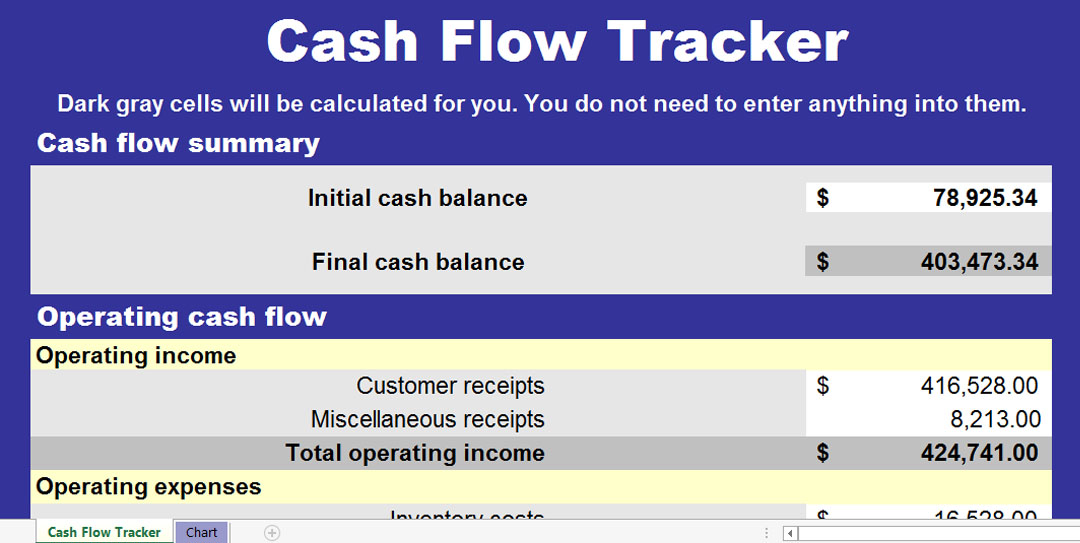

Cash inflow is the money going into a business which could be from sales, investments, or financing. Save 40% on year 1 540 € 319. What is a cash flow statement?

Smaller cash movements are usually called “disbursements.”. Cash outflow is the amount of cash that a business disburses. Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has.

Costly resources such as rent, inventory, and raw material expenses used for operational purposes all add up to eat. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. Cash flow kings 100 etf ( flow), which debuted last july, features an approach that’s similar to what’s found with the aforementioned cowz.

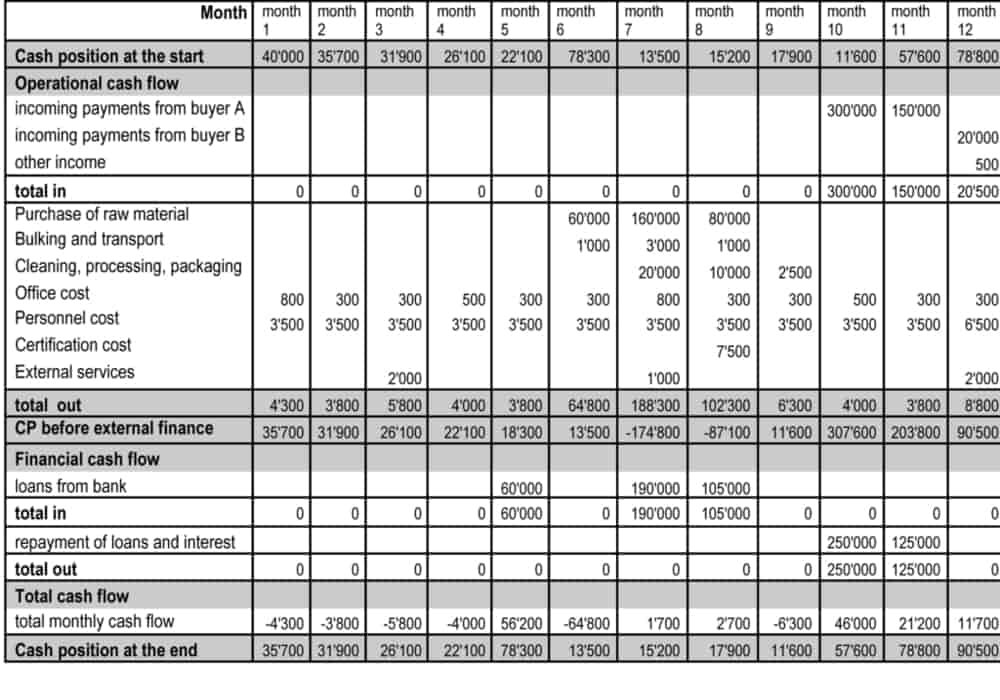

A cash flow statement lays out the sources of your cash and where you have used it. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Cash flow can be defined as the flow of money in and out of businesses during a period and needs to be monitored closely.

Beginning cash is, of course, how much cash your business has on hand today—and you can pull that number right off your. The reasons for these cash payments fall into one of the following classifications: The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. A cash flow analysis determines a company’s working capital — the amount of money available to run business operations and complete transactions. One of the biggest hurdles in keeping a positive cash flow is the costs of keeping operations going.

Cash flow is the way that. Examples are loans to other entities or expenditures made to acquire fixed. Cash flow is an inward and outward movement of cash and cash equivalents during a specific period.

What does cash outflow mean? The total net balance over a. There are many types of cf, with various important uses for running a business and performing financial analysis.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)