Simple Tips About Credit In Balance Sheet Non Operating Income And Expenses

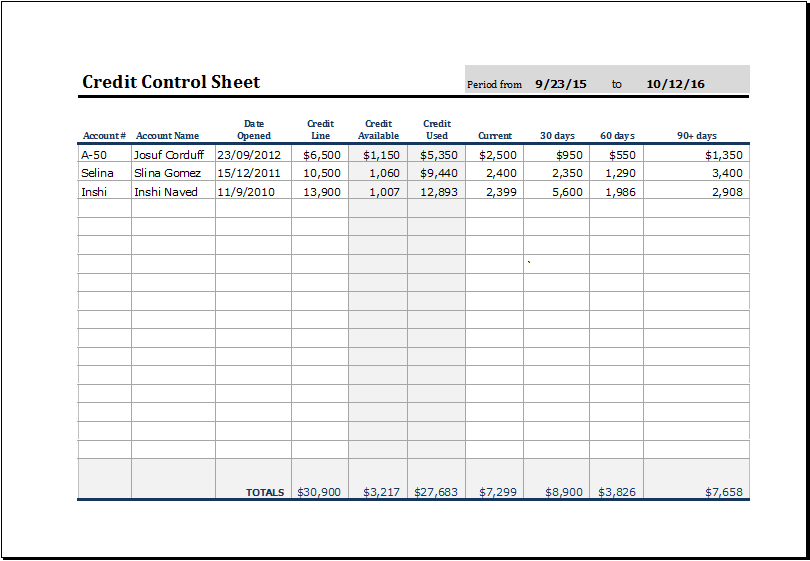

Until the customer pays the company the amount owed in cash, the value of the unmet payment sits on the balance sheet as accounts receivable (a/r).

Credit in balance sheet. A credit balance is an amount attributed to the margin account following the successful completion of the short sale transaction. If you make your balance transfer in the first 60 days, you’ll. Liability and revenue accounts are increased with a credit entry, with some exceptions.

On a $7,500 balance transfer, a 3% fee will cost you $225. The balance sheet is derived using the accounting equation.

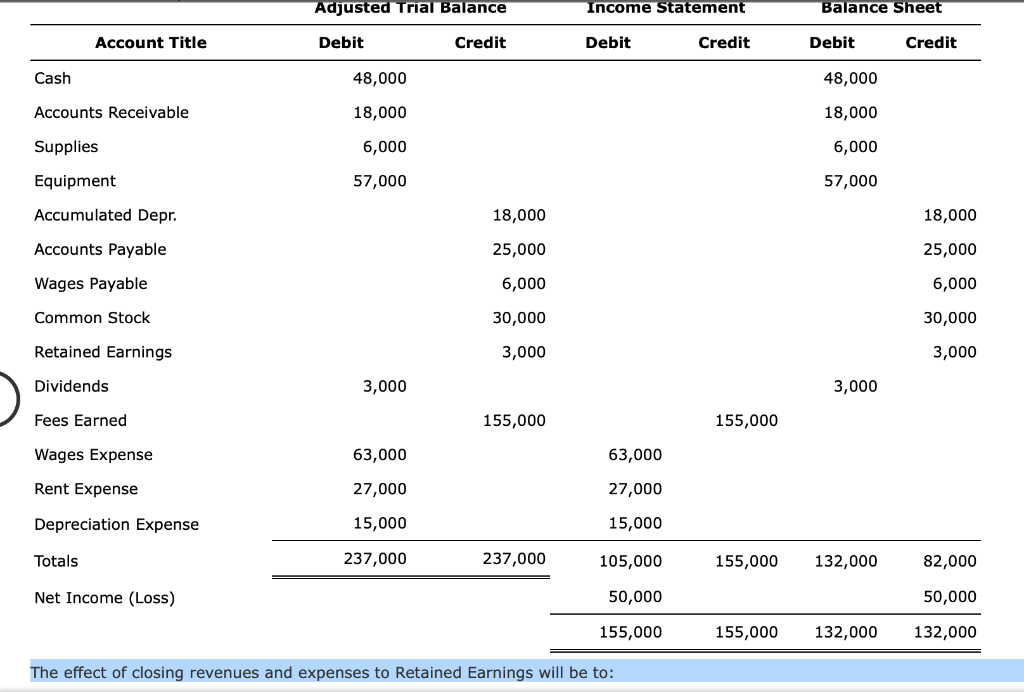

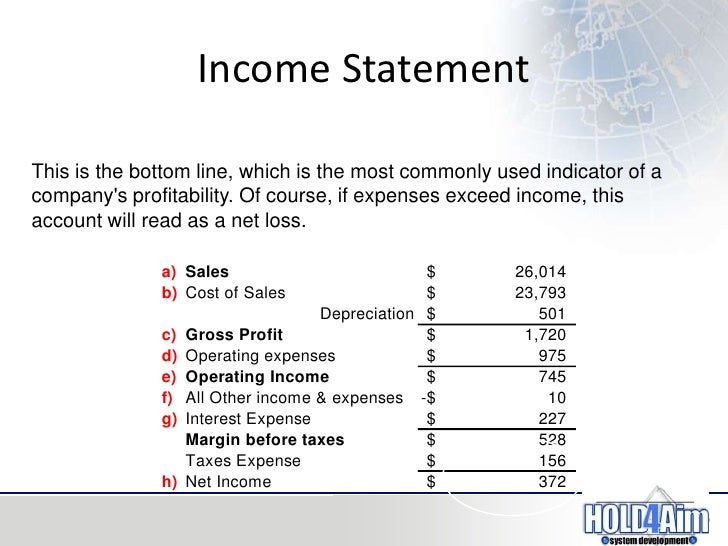

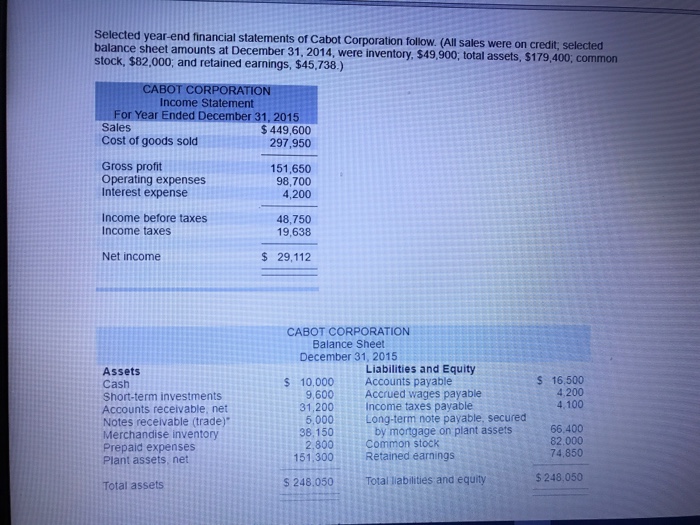

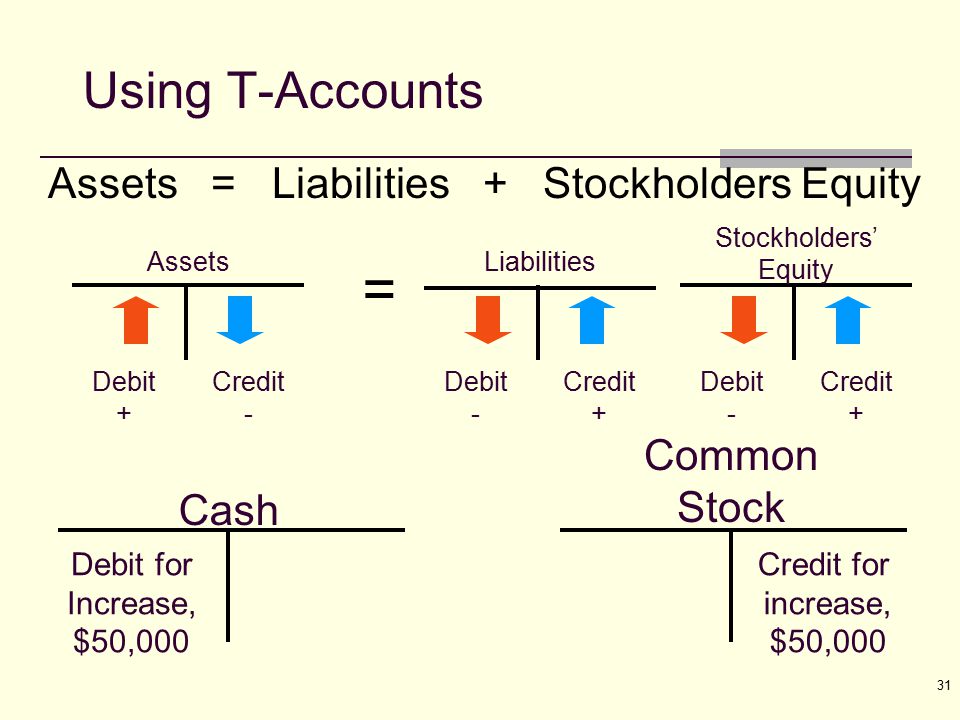

In order to correctly calculate credits and debits, a few rules must first be understood. A balance sheet is a financial statement that shows a business's current financial state and calculates the book value, or investors' equity, in the company. The statement balance is the total amount you.

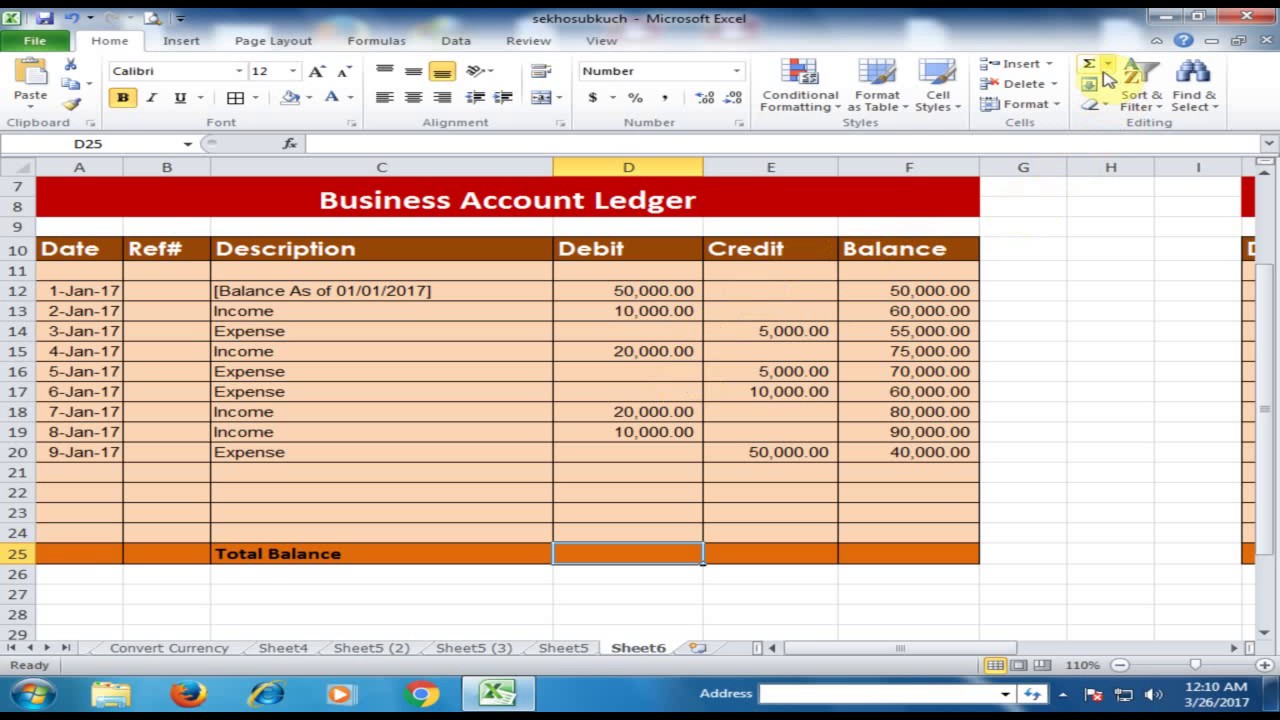

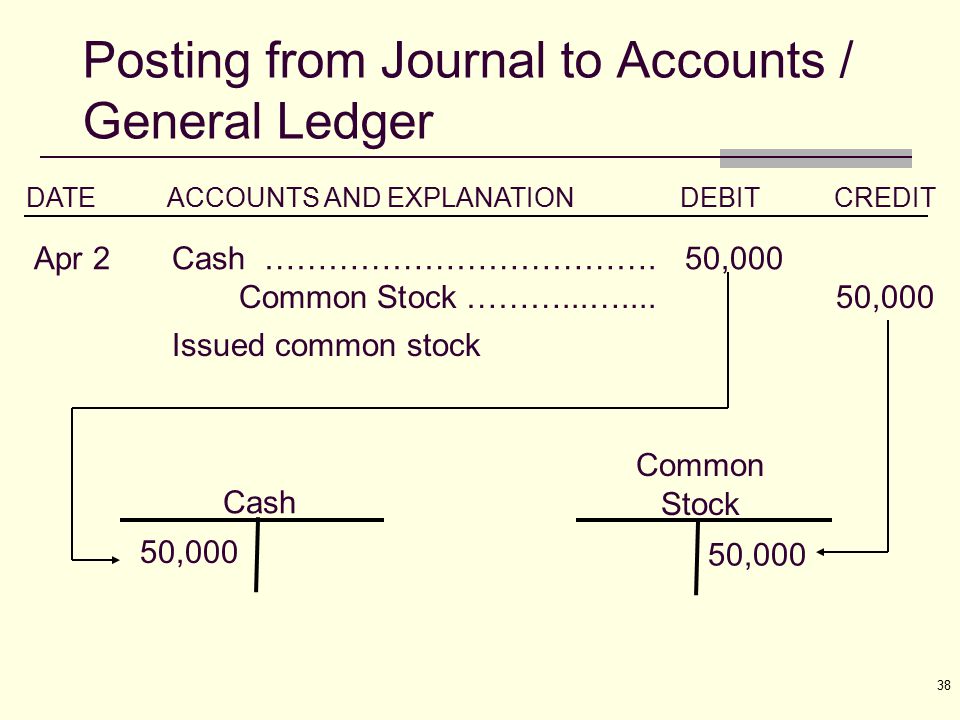

That is, the general ledger accounts for assets typically have their balances on the left side. Assets = liabilities + equity. Every accounting transaction must be either a credit or debit.

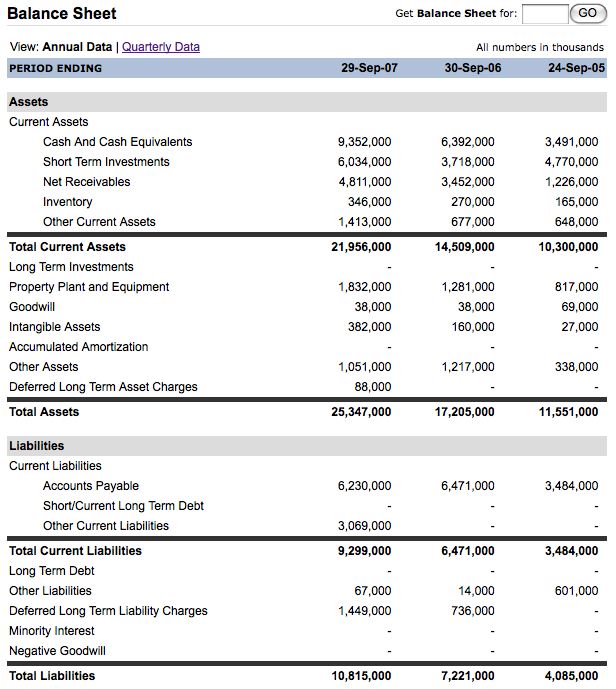

You pay for your company’s assets by either borrowing money (i.e. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Assets go on one side, liabilities plus equity go on the other.

Crédit agricole is one of the biggest french lenders to atos in a group of banks that includes bnp paribas, natixis, credit mutuel cic and société générale. Balance transfer fees will typically be at least 3% of the transferred amount. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

Companies accept payment from customers on credit under the impression that the payment will soon be completed, which is the reason that accounts receivable is categorized in the current. You can check your credit card balance over the phone, online, or mobile app. Assets = liabilities + owner’s equity.

D/e = total liabilities / total shareholders' equity = $152,969 / 83,253 = 1.84. The credit rating agency stated: Conceptually, the assets of a company (i.e.

Fact sheets published by the irs in 2023. Increasing your liabilities) or getting money from the owners (equity). A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment.

Keep a close eye on your credit card balances to avoid overspending. It summarizes a company's assets, liabilities, and owners' equity. The accounting equation and the double entry system provide an explanation.