Inspirating Info About Ifrs 16 Reporting Deutsche Bank Income Statement

Education, membership and licensing.

Ifrs 16 reporting. The new rules are applicable as from assessment year 2024, applying to financial years ending on or after 31 december. A free 'basic' registration will give you access to issued standards in html or pdf. This implies that the lessee cannot use forward rates or forecasting techniques in measuring variable lease payments (ifrs 16.bc166).

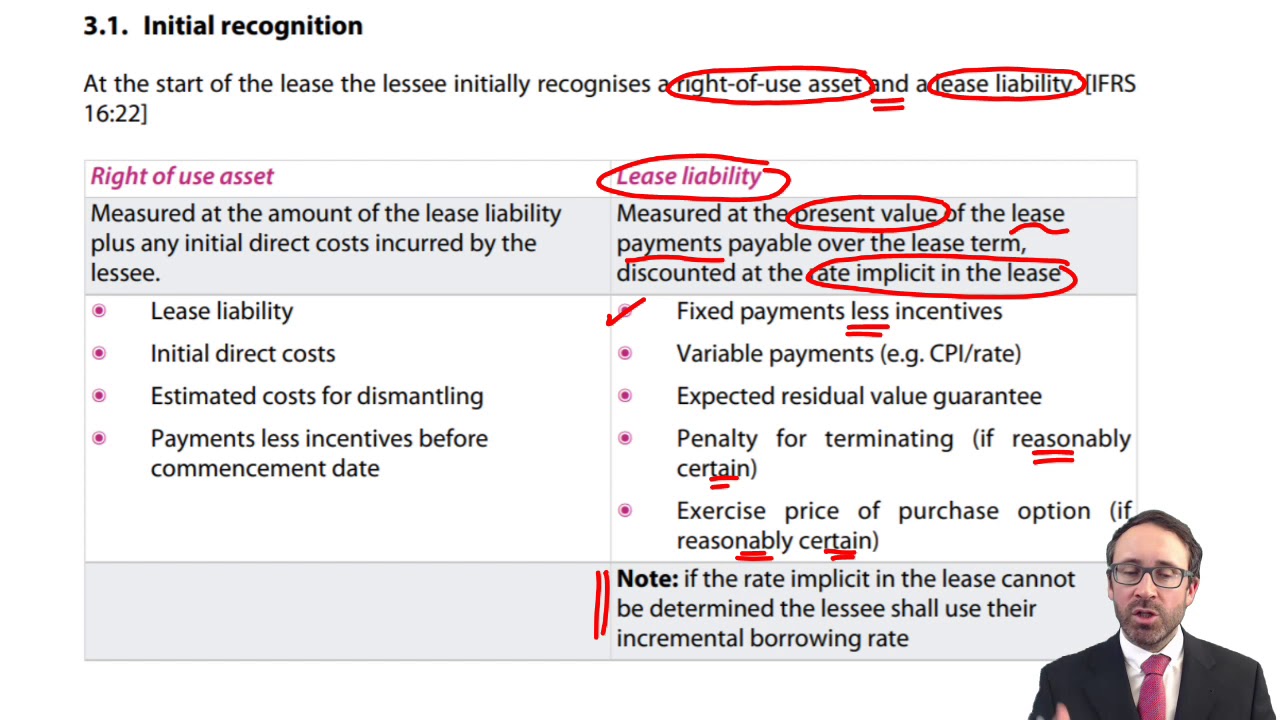

Lessor accounting however remains largely unchanged from ias. In january 2016 the board issued ifrs 16 leases. To determine whether a contract grants control of the asset to the lessee, the agreement must provide the following to the lessee:

This basis for conclusions summarises the iasb’s considerations in developing ifrs 16. Exemptions—discussion with board member sue lloyd. It enables companies to use property, plant, and equipment without needing to incur large initial cash outflows.

The ifrs sustainability alliance is diverse global network of members who explore and develop best practices related to sustainability standards and integrated reporting; The new standard replaces the previous lease accounting standard, ias 17, and represents a significant. The iasb worked jointly with the fasb on this project.

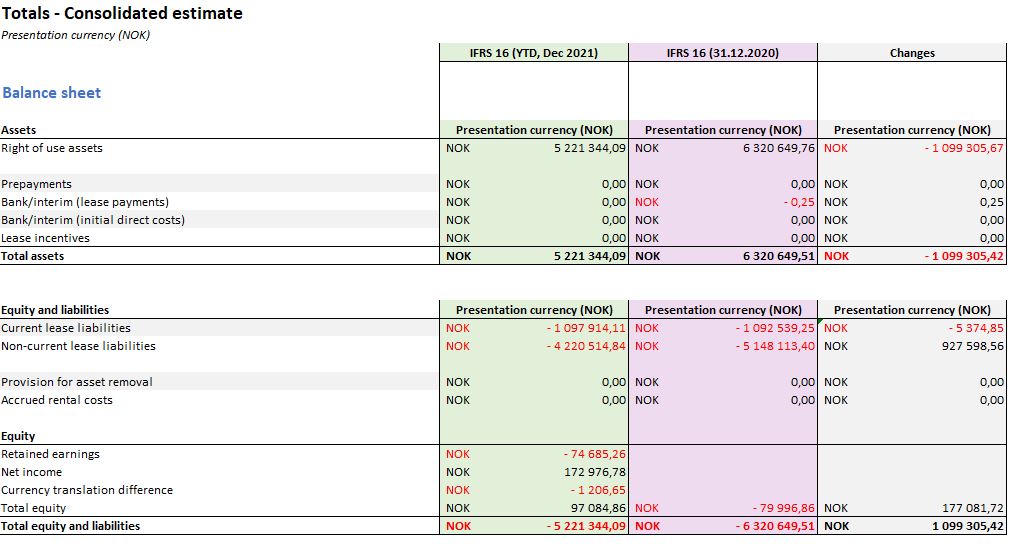

Ifrs 16 specifies how to recognize, measure, present and disclose leases. Overview ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases. Each one focuses on a particular aspect and includes explanations of the requirements and examples showing them in practice, to help you apply the new standard.

Ifrs 16 completes the iasb’s project to improve financial reporting for leases. The european financial reporting advisory group (efrag) has launched the second part of its survey on ifrs 16 to seek input from users on whether the standard has improved the reporting on lease activities. Ifrs 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases.

Ifrs 16 leases project summary and feedback statement. The ifrs foundation offers a broad range of products and services to support the widespread adoption and implementation of issb standards and integrated reporting. The standard provides a single lessee accounting model, requiring the recognition of assets and liabilities for all leases, unless the lease term is 12 months or less or the underlying asset has a low value.

Ifrs 16 is effective for annual reporting periods beginning on or after 1 january 2019, with earlier application permitted (as long as ifrs 15 is also applied). International financial reporting standard (ifrs ®) 16, leases was issued in january 2016 and has been effective for periods beginning on or after 1 january 2019. Ifrs 16 is effective for annual reporting periods beginning on or after 1 january 2019, with earlier application permitted (as long as ifrs 15 is also applied).

The standard explains how this information should be presented on the face of the statements and what disclosures are required. Entities may need to change aspects of their financial statement presentation and significantly expand the volume of their disclosures when they adopt the new leases standard issued by the iasb. Efrag survey on ifrs 16 — user perspective.

Overview of ifrs 16. Leasing is an important financial solution used by many organisations. Ifrs 16 was issued in january 2016 and is effective for most companies that report under ifrs since 1 january 2019.