Painstaking Lessons Of Info About Negative Net Income On Balance Sheet Format In Excel With Formulas For Partnership Firm

Net income is the amount of accounting profit a company has left over after paying off all its expenses.

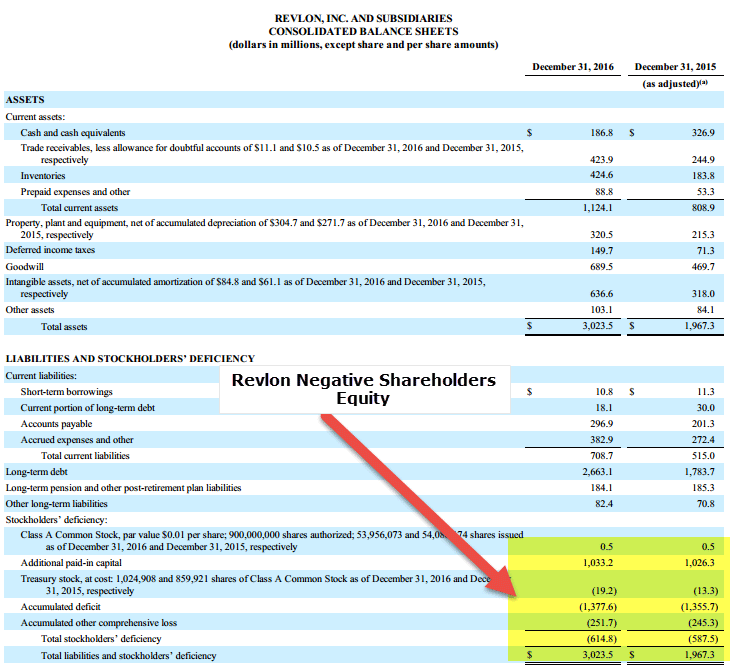

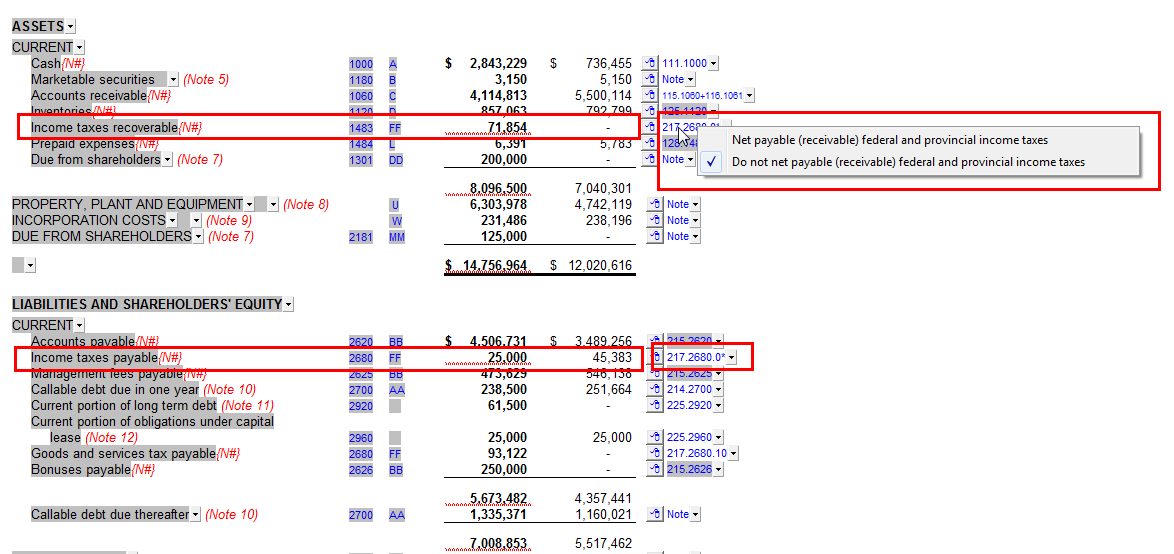

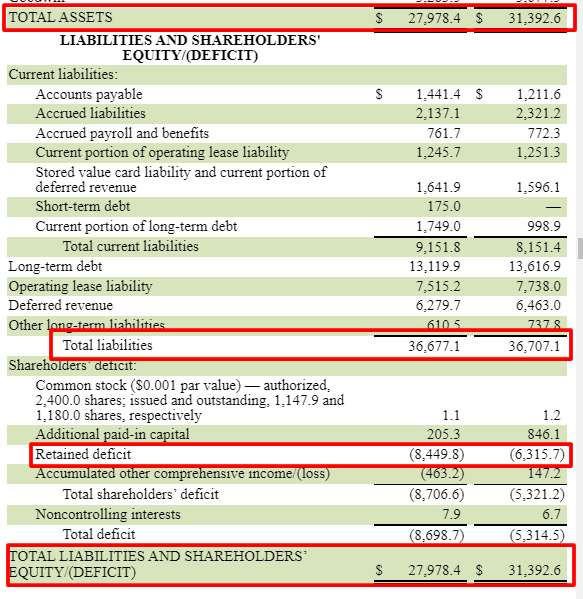

Negative net income on balance sheet. Written by cfi team what is net income? If the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income. The negative numbers showing on the accounts indicate that there is a credit balance that made the company paid more than the expected amount.

If so, what does it indicate? There are a few account balances that should always show as negative amounts, such as accumulated depreciation or distributions. Naturally, the same items that affect net income affect re.

This would be the case if a company. In this case, the net. Yahsat, the uae's leading provider of satellite solutions listed on the abu dhabi securities ex.

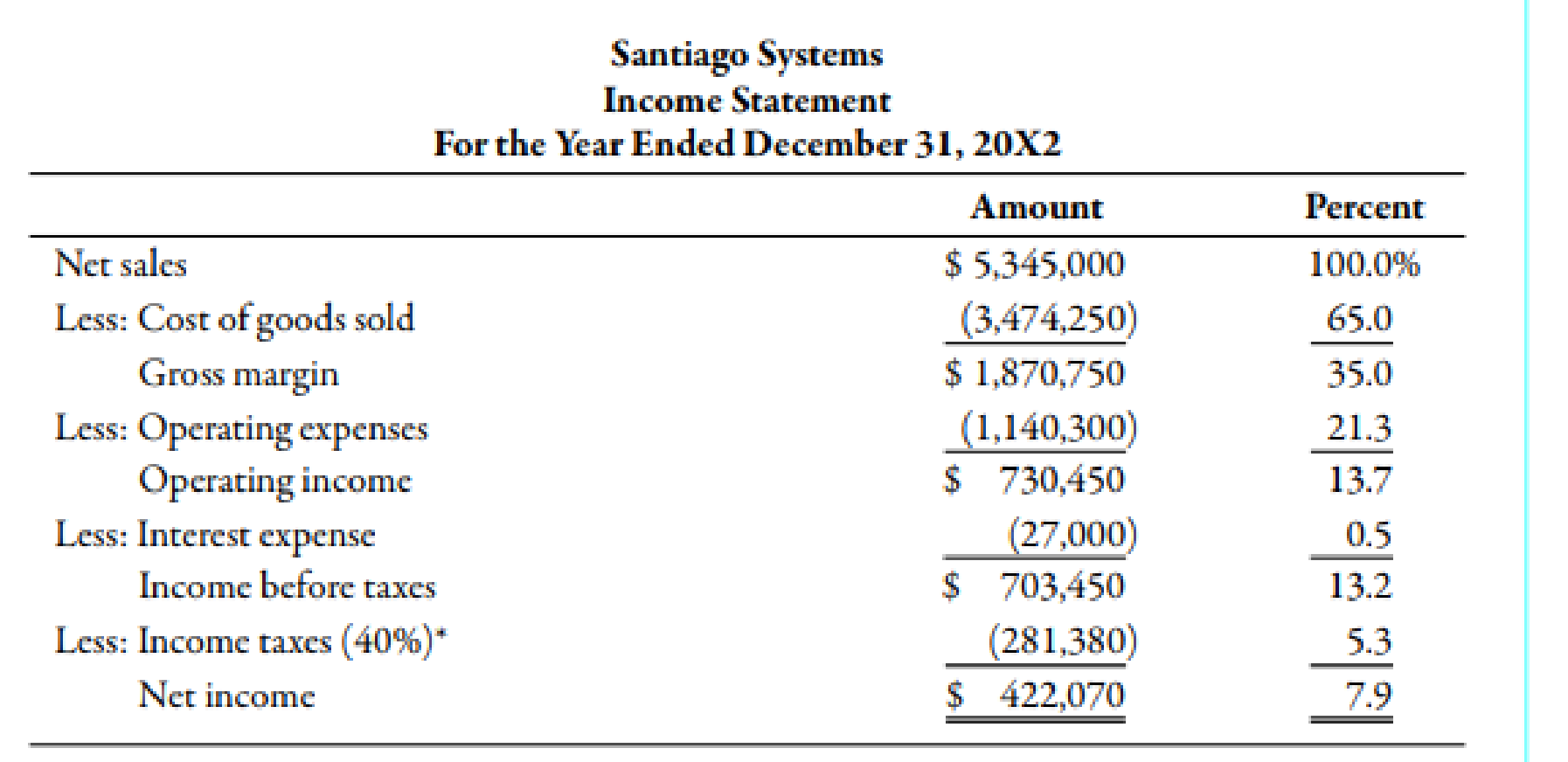

In the equity section of the balance sheet, the net income line does not reflect the net income number from the profit & loss bottom line. The details of net income calculations are. To calculate net income on a balance sheet, take your total revenue and subtract all expenses, including cost of.

The current assets (saving and checking) are. Gulf.stock.markets on may 8, 2023: After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000 accumulated depreciation, for a net book value.

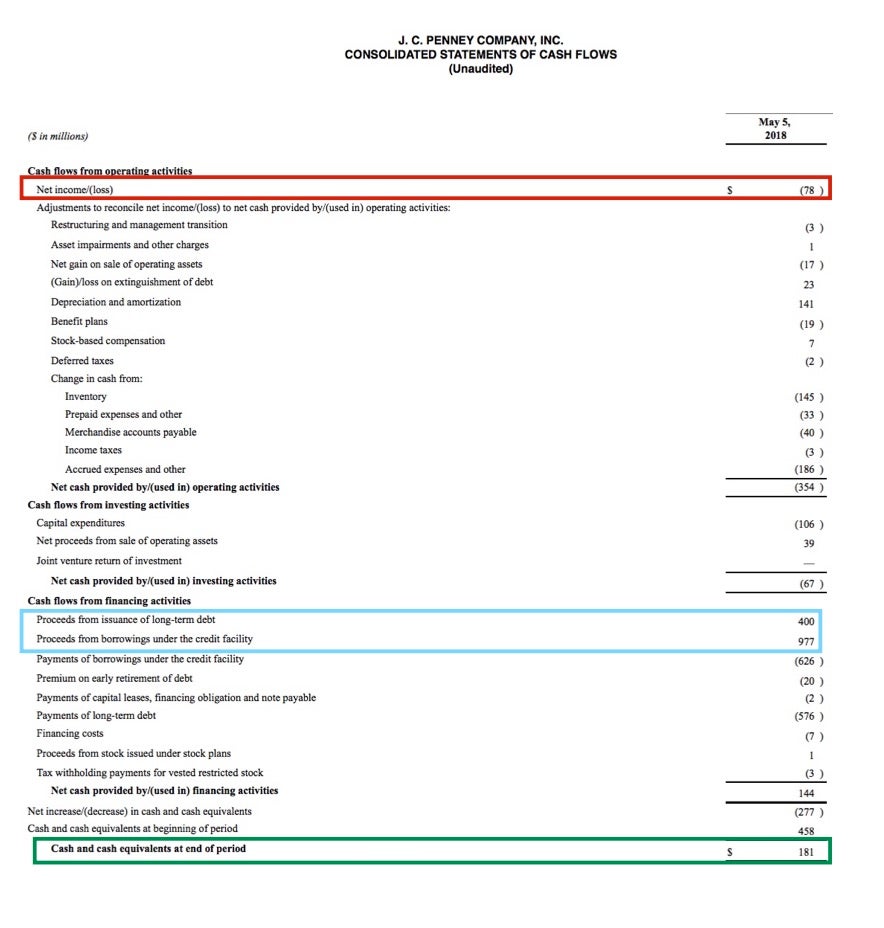

Revenues and expenses are part of the income statement, and at the bottom line, you will find the net income or net loss. If the net income becomes negative, meaning there is a possibility that expenses are higher than sales or there are expense transactions (or perhaps journal. How to calculate net income on a balance sheet.

A negative result is a net loss for a company. When you subtract the expenses and costs from. Running a successful business means keeping track of a lot of financial data, and one crucial metric that every entrepreneur.

Here are some common reasons for negative. This mainly reflects the phasing. It measures your company’s profitability.

If only one liability account has a negative sign, it is likely that the liability account has a debit balance instead of the normal credit balance. It is found by taking sales. Negative cash on the balance sheet.

Can net income be negative? You can't really have negative numbers on the balance sheet because the balance sheet just records the assets, liabilities, and equity a company has at a particular point in time. Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and interest.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)