Divine Info About Operating Cash Flow Formula Finance Legal Reserve In Balance Sheet

The operating cash flow formula provides a true picture of the cash coming in and going out of a business, taking out the impacts of account techniques aimed at reducing tax and accounting for outstanding accounts payable and receivable.

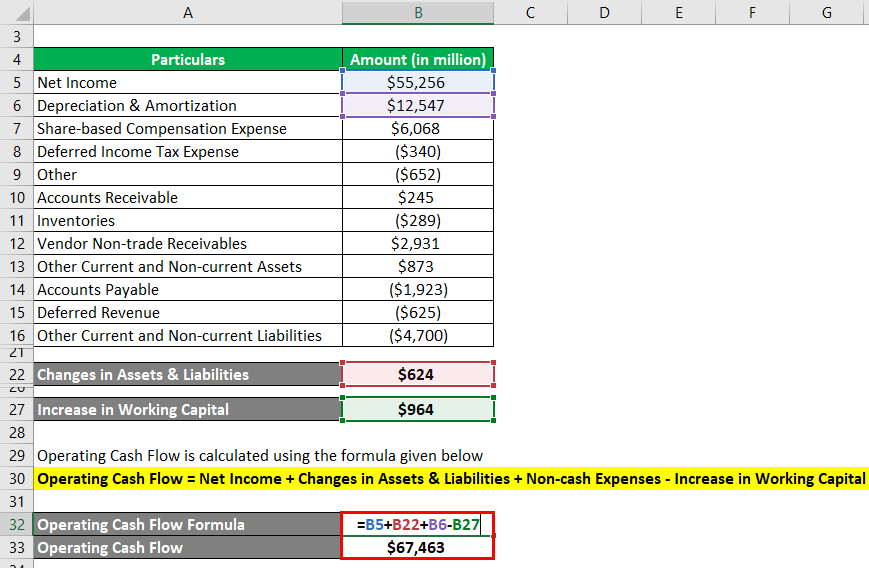

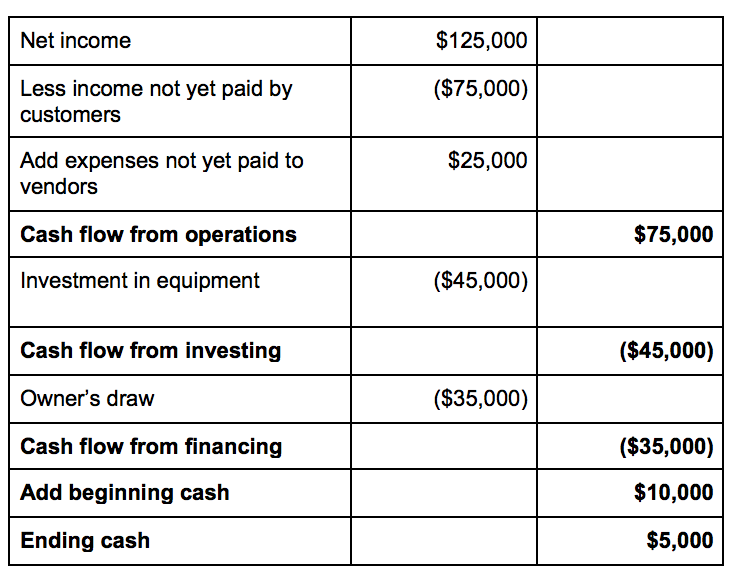

Operating cash flow formula finance. By subtracting the cash outflows from the cash inflows, you can determine the net cash generated or used by the company’s operations. The formula for calculating operating cash flow is: Net income + amortization + depreciation + net working capital changes = operating cash flow.

Ocf = net income +. Net operating cash flow was $4,087 million, or $4,187 million before changes in working capital (adjusted cfo). The ocf calculation will always include the following three components:

While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used: It informs the most important aspects of financial health. Manage your international cash flow in 54 currencies with wise.

Cash flow from operations can be found on a company’s statement of cash flows. The two metrics that the ocf ratio compares can be found on the cash flow statement (cfs) and balance sheet (b/s). Assess how well operating cash flow covers mandatory cash outflows like interest, debt payments or dividends.

First, you want to see whether operating cash flow is positive. Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. Used widely in analysis.

For larger companies especially, financial analysts pay particular attention to ocf. Record adjusted ebitda margin fourth. It helps in analyzing how strong and sustainable is the business model of the company.

Cash flow from financing activities: What is operating cash flow (ocf) formula? Investopedia / julie bang the formula for the operating cash flow ratio \text {operating cash flow ratio} = \frac {\text {operating cash flow}} {\text {current liabilities}} operating.

In short, the greater the variance between a company operating cash flow (ocf) and recorded net income, the more its financial statements (and operating results) are impacted by accrual accounting. The calculation for ocf using the indirect method uses the following formula: The simplest formula for calculating the ocf is:

The operational cash flow formula calculates the income generated from the project's functional activities. What operating cash flow tells you about your company’s financial health. This is important from a few perspectives:

So operating cash flow plays an integral role in financial analysis frameworks, especially valuation models. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Cash flow from operations formula.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)