Painstaking Lessons Of Info About Irs Form 1116 Explanation Statement How To Read Balance Sheet In Hindi

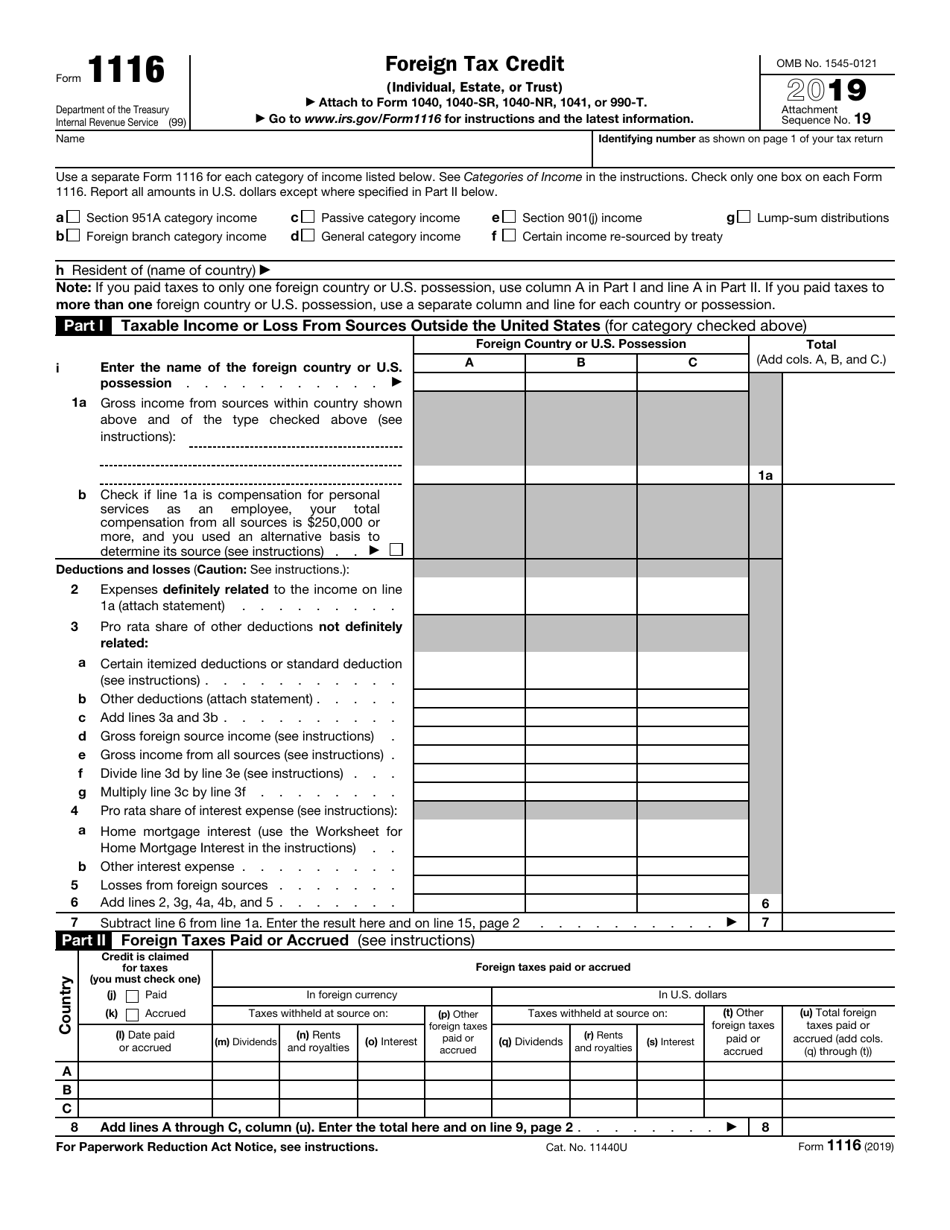

Citizens who paid certain foreign taxes to either a foreign country or u.s.

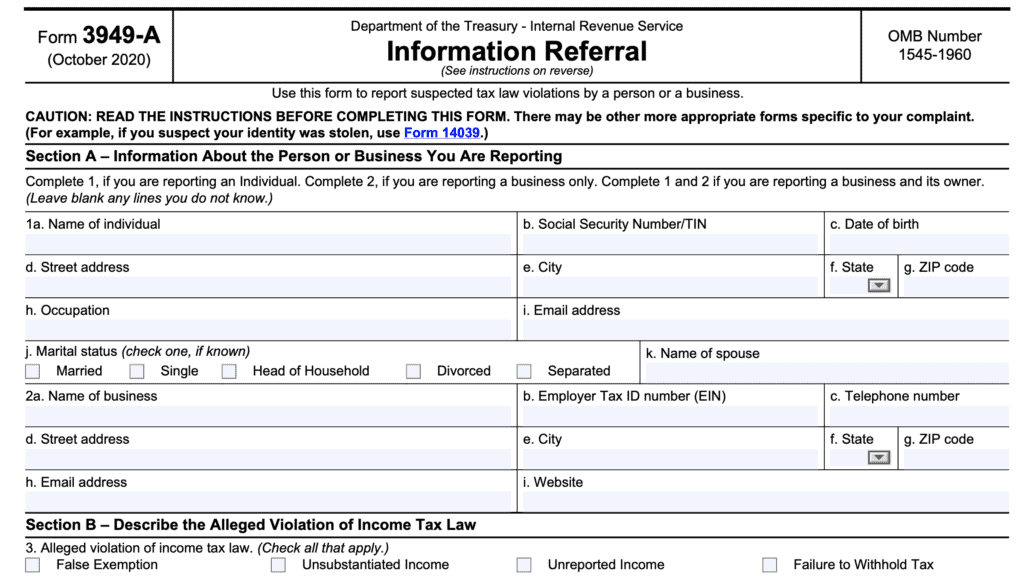

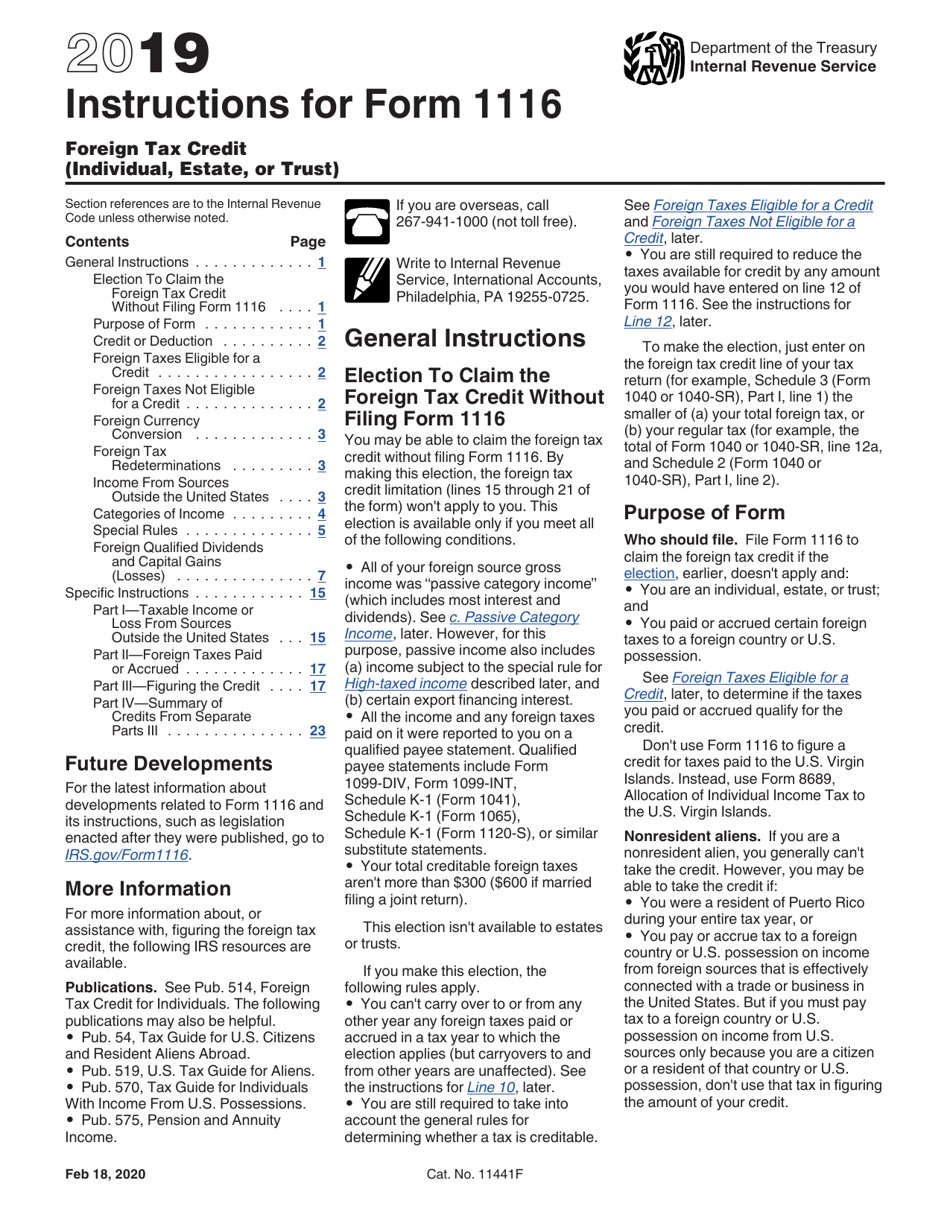

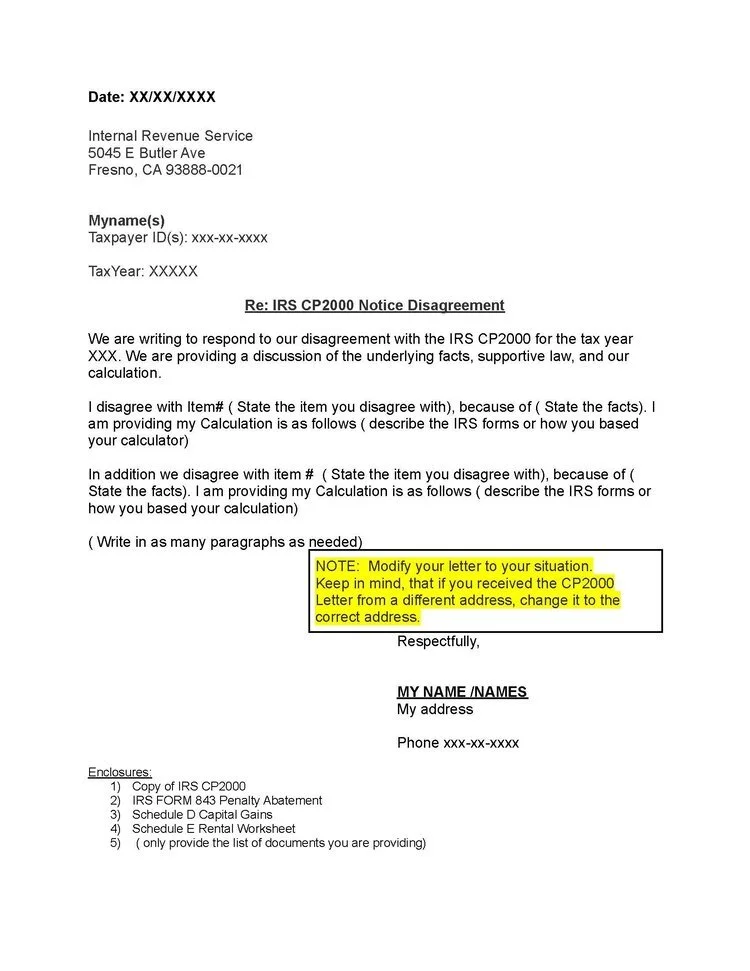

Irs form 1116 explanation statement. Detailed explanation must be completed. When filing form 1116 to claim the foreign tax credit, you must attach a statement explaining how you calculated the credit. These are deductions not related to the foreign source income.

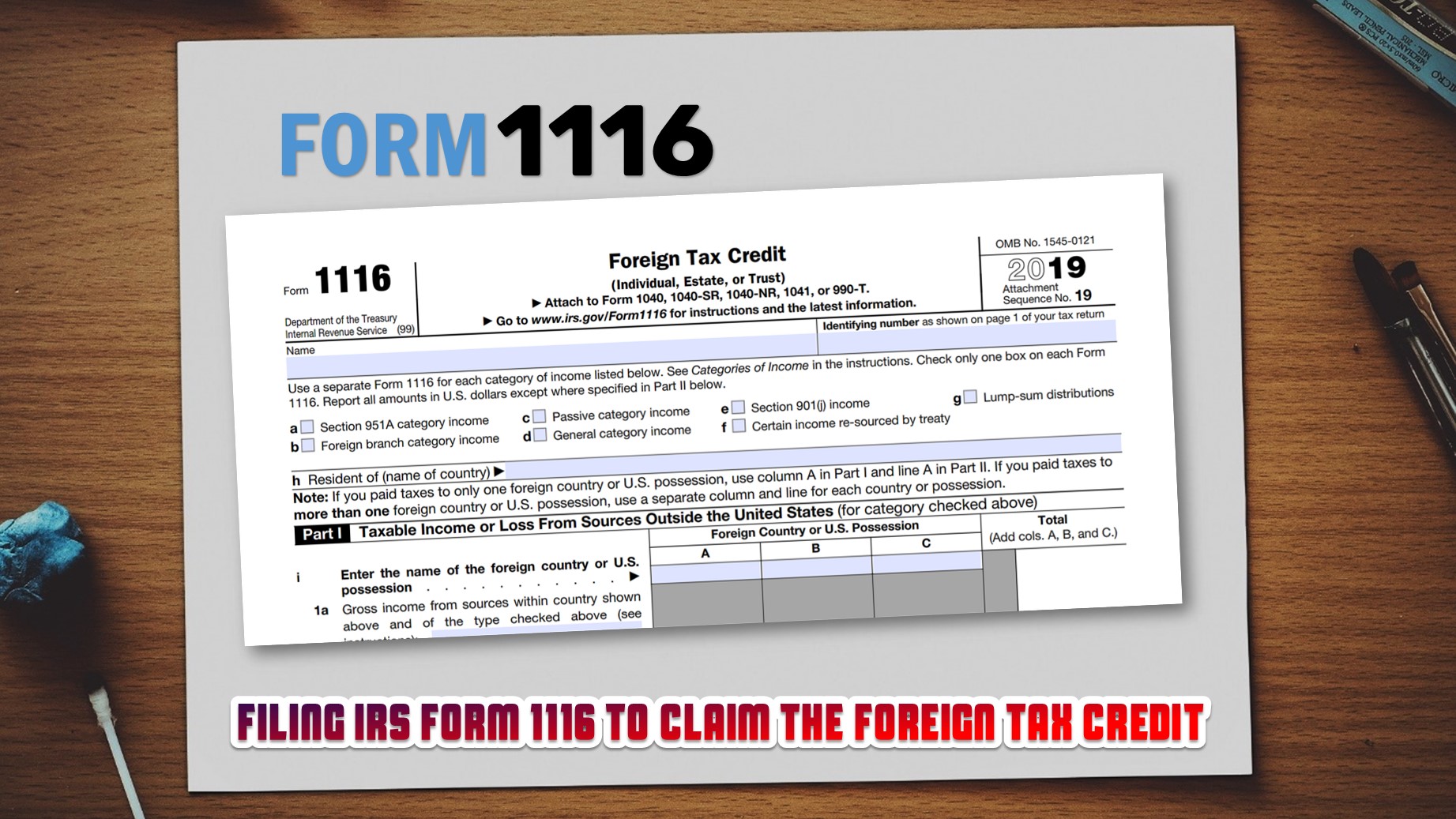

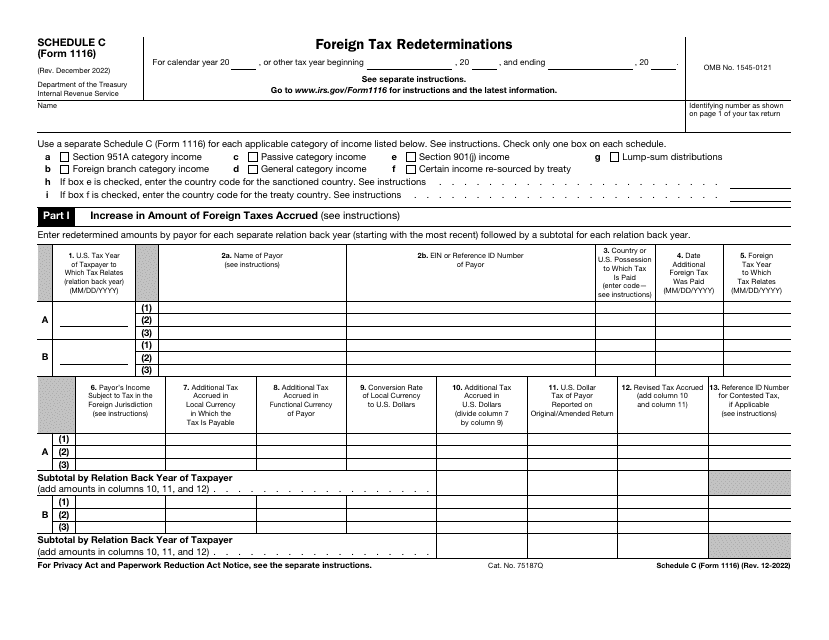

The turbotax community is the source for answers to all your questions on a range of taxes and other financial topics. Foreign taxes not eligible for a credit. The full amount of the foreign income taxes paid or accrued will not necessarily be the amount of the ftc for that year and that is because the allowable credit is limited and it is the lesser of, one, the amount paid or accrued or,.

Form 1116, associated with the foreign tax credit, is an essential irs form designed to alleviate the financial impact of double taxation for us taxpayers with foreign income. Possession may be eligible to claim a foreign tax credit against their u.s. Updated on december 14, 2023 reviewed by a greenback expat tax accountant when filing form 1116 to claim the foreign tax credit, you will need to attach a statement explaining how you calculated the credit.

Tax liability by the amount of tax already paid to a foreign government. I'm a us/eu citizen filing from germany for 2022. I'm using form 1116 to claim the foreign tax credit, but i'm stuck on how and what to submit for the explanation statement.

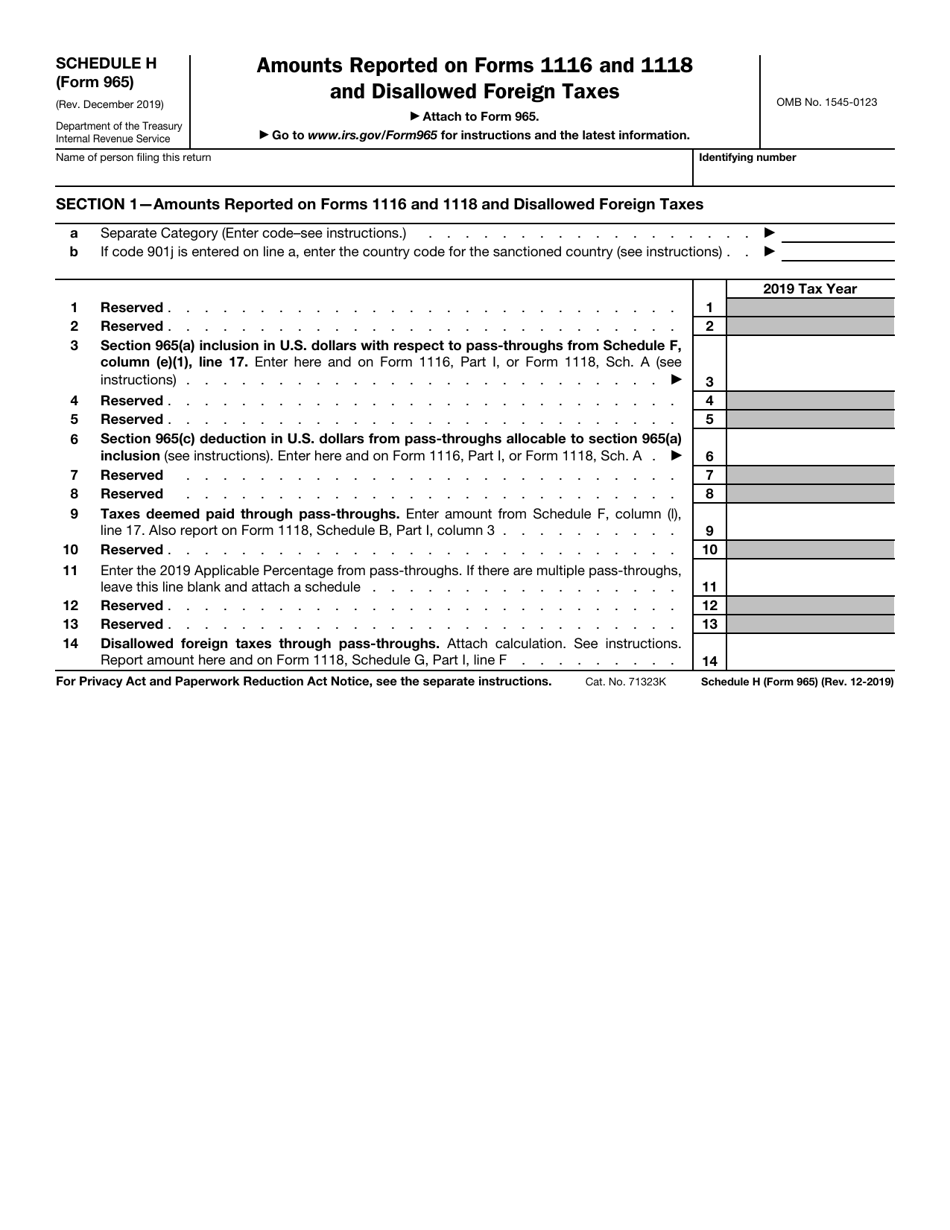

The form 1116 is designed to calculate foreign tax credits for individual taxpayers. Election to claim the foreign tax credit without filing form 1116. Foreign taxes eligible for a credit.

His taxable income is $24,320 figured as follows: The form 1116 explanation statement turbotax isn’t an exception. Tax is asking for explanation statements for line 3 a, 3 b and 3 c.

Computation of taxable income before making any entries on form 1116, robert must figure his taxable income on form 1040. Enter your explanation here to complete the required statement. They are especially crucial when it comes to stipulations and signatures associated with them.

What is form 1116 and who needs to file it? Form 1116 is an irs tax form used by u.s. Here’s what you need to know to complete your form 1116 explanation statement.

Income from sources outside the united states. Expat should learn to love, because it’s one of two ways americans working overseas can lower their u.s. A form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met;

What exactly is the software asking ? Before any taxpayer attempts to complete the form 1116, he or she should understand some basic rules regarding claiming foreign tax credits. 19 name identifying number as shown on page 1 of.

.jpeg)