Fantastic Tips About Cash From Operating Activities Includes Balance Sheet Template Excel Exempt Private Company Financial Statements

This cash flow reconciliation template will help you differentiate between ebitda, cf, fcf, and fcff.

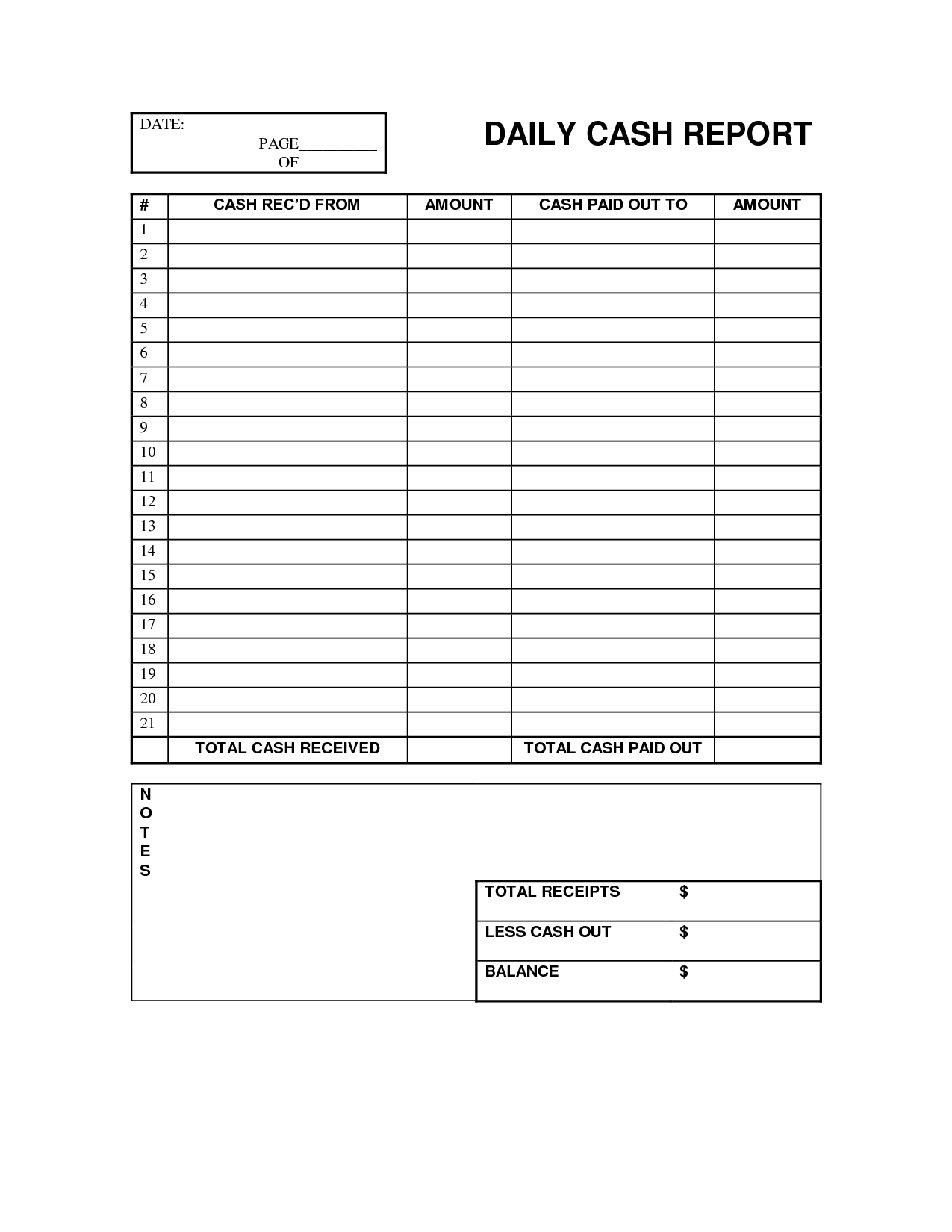

Cash from operating activities includes balance sheet template excel. Line items of direct method cash flow statement for operating activities. The direct and indirect method to determine operating cash flow; Enter your name and email in the form below and download the free template now!

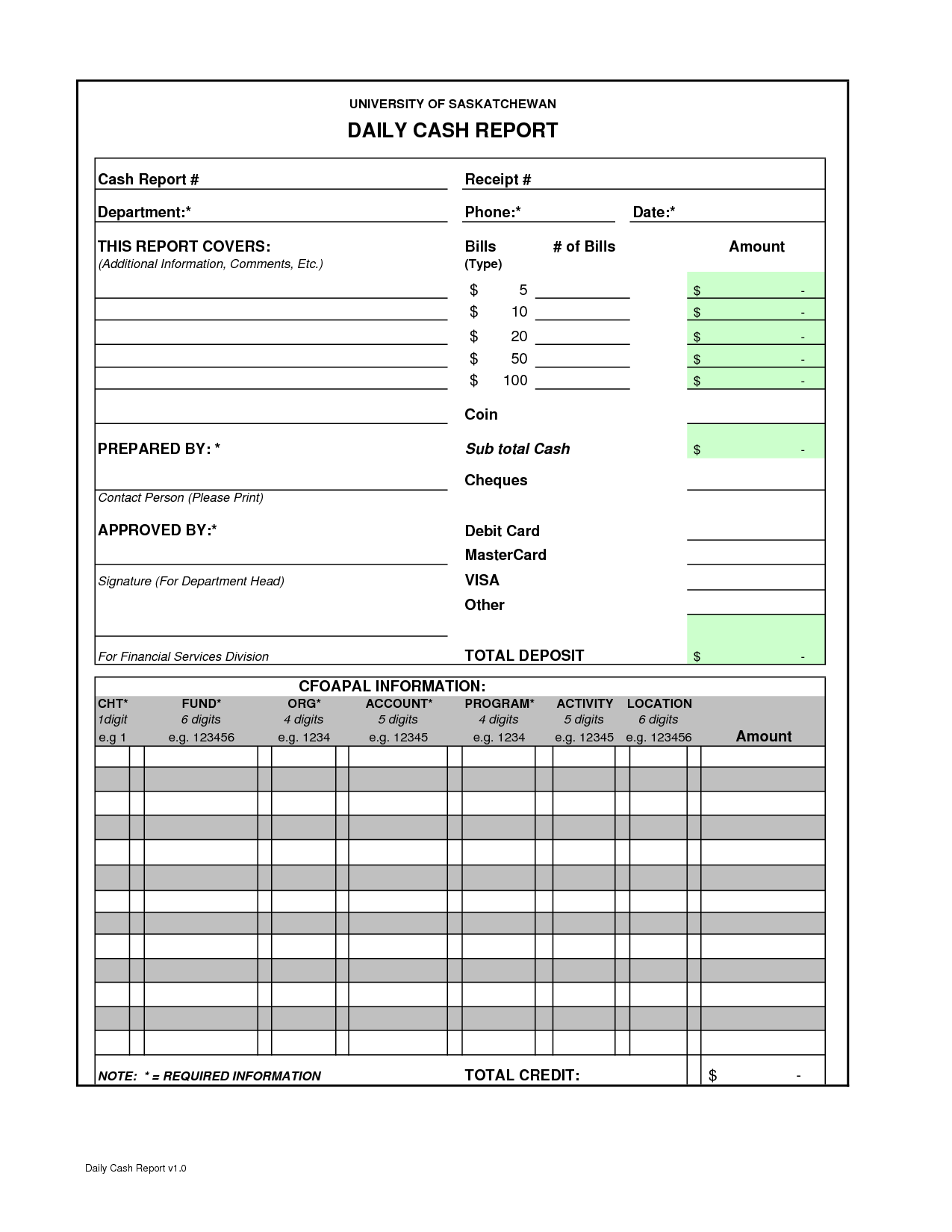

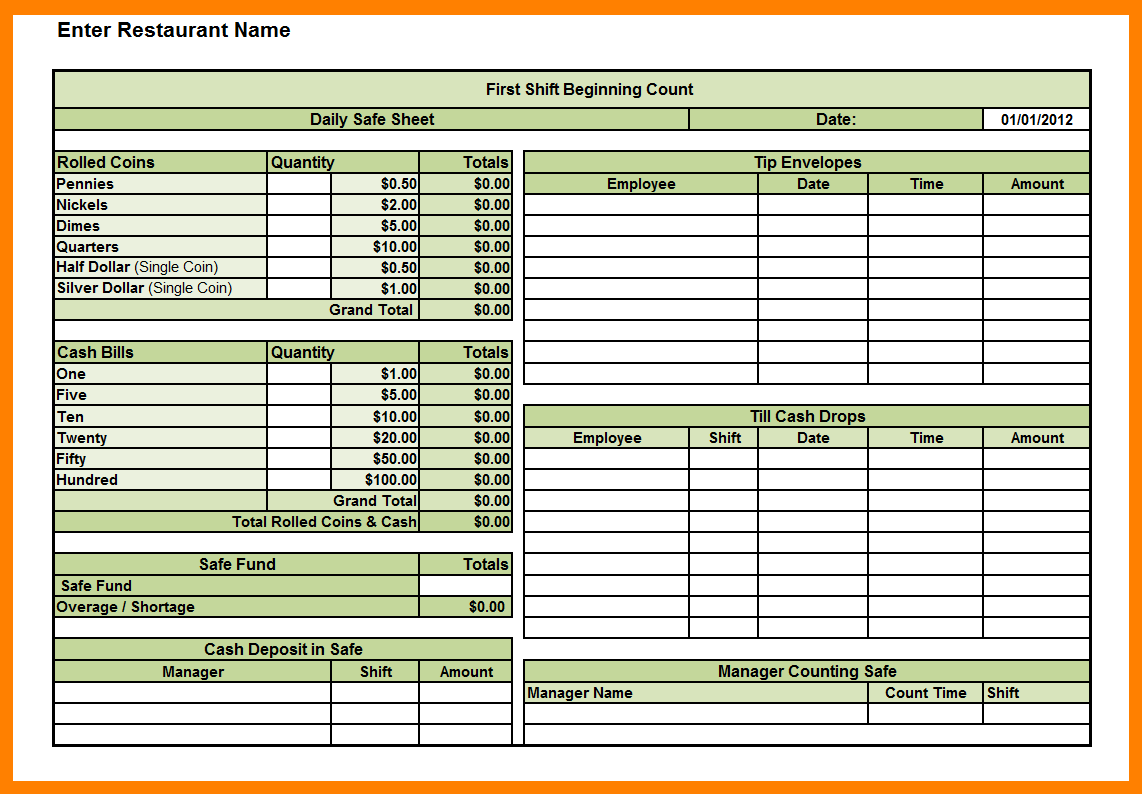

Cash flow from operations typically includes the cash flows associated with sales, purchases, and other expenses. Yes, you can use an excel cash flow template to help you create a cash flow statement.

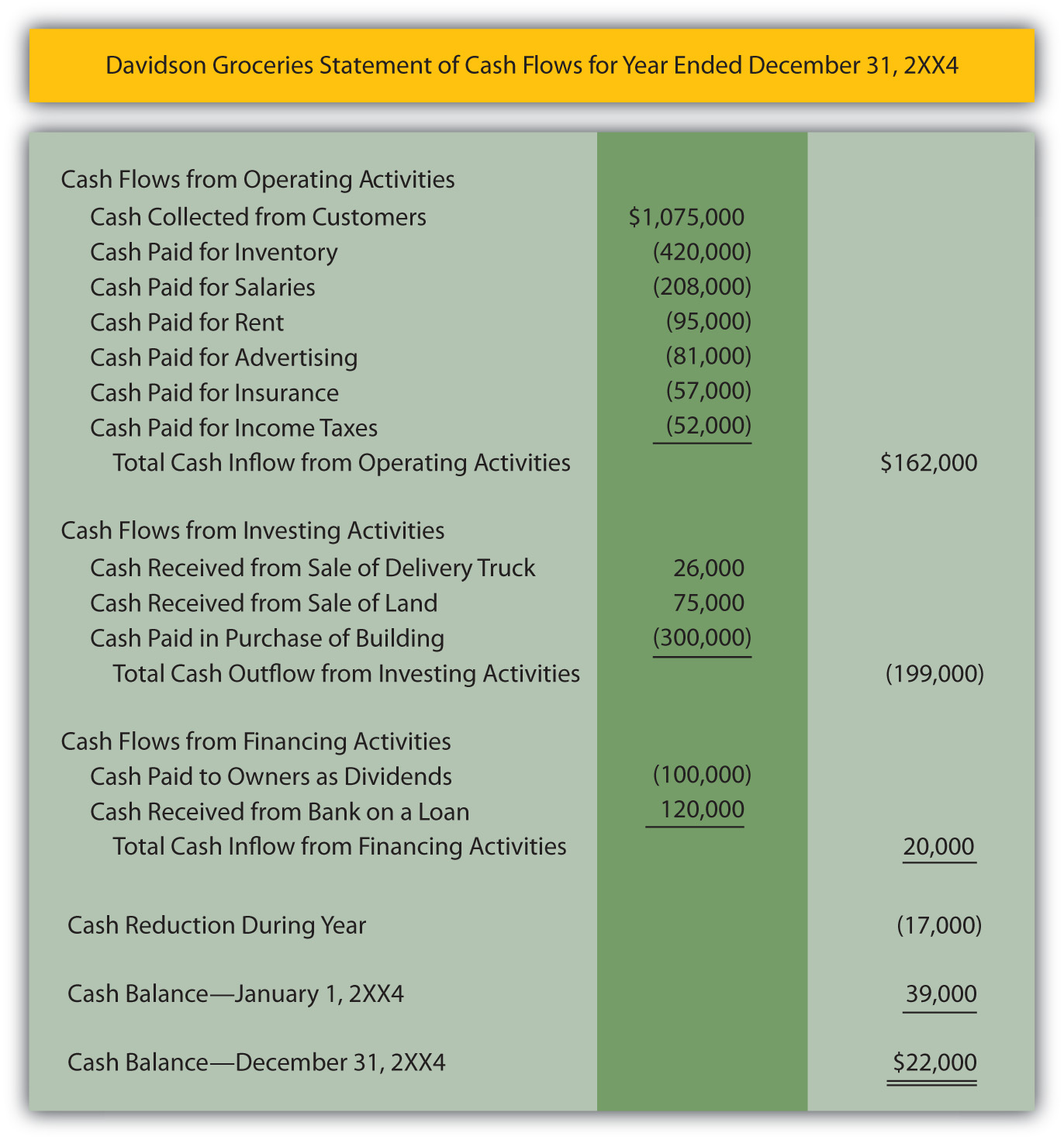

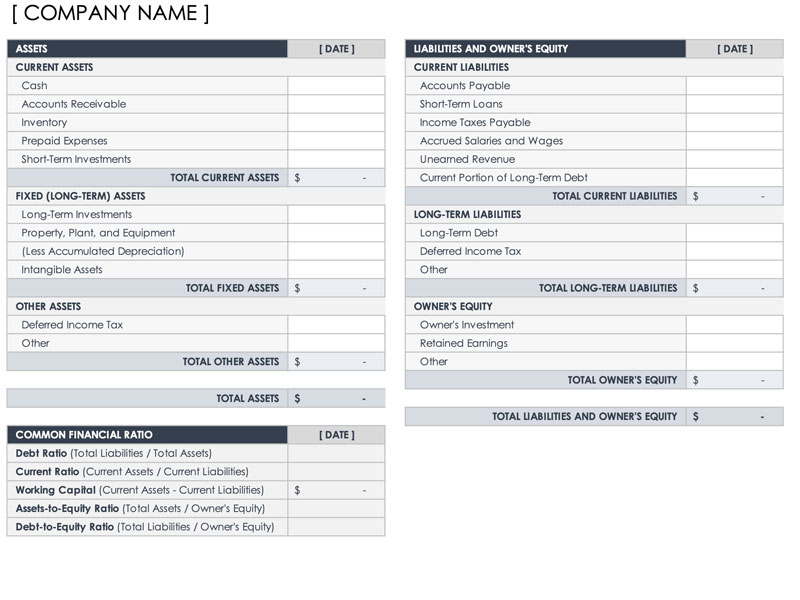

Smartsheet offers additional excel templates for financial management, including business budget templates. Cash flow reconciliation template. It categorizes cash inflows and outflows into three main categories:

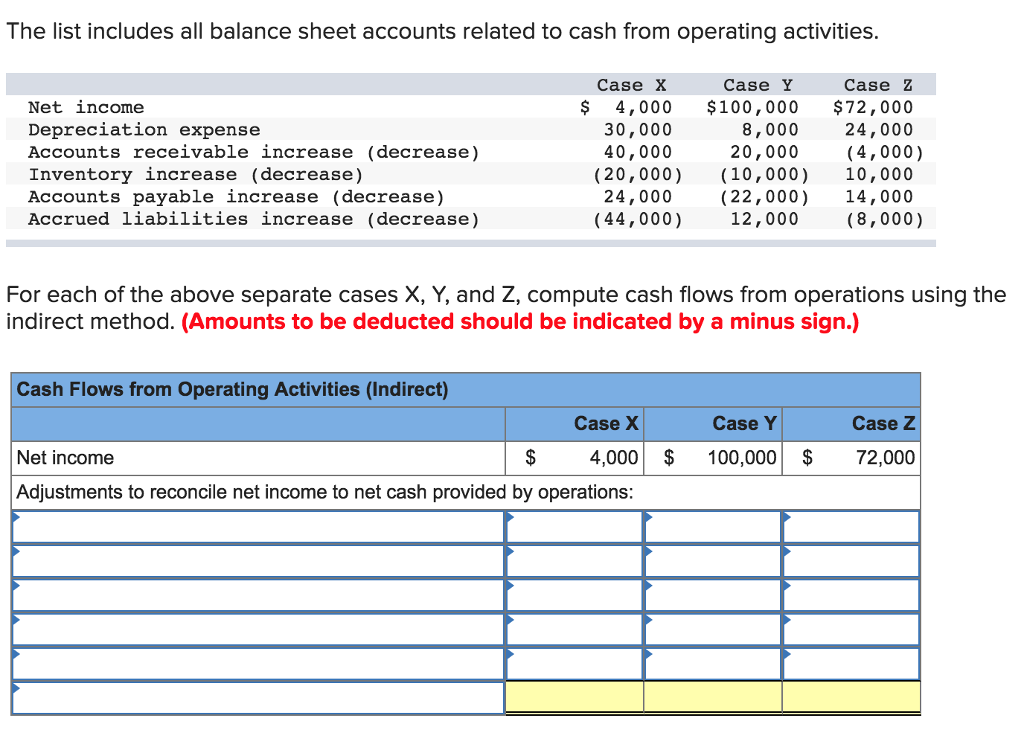

Download cash flow statement excel template. Included on this page, you’ll find details about the following: Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year;

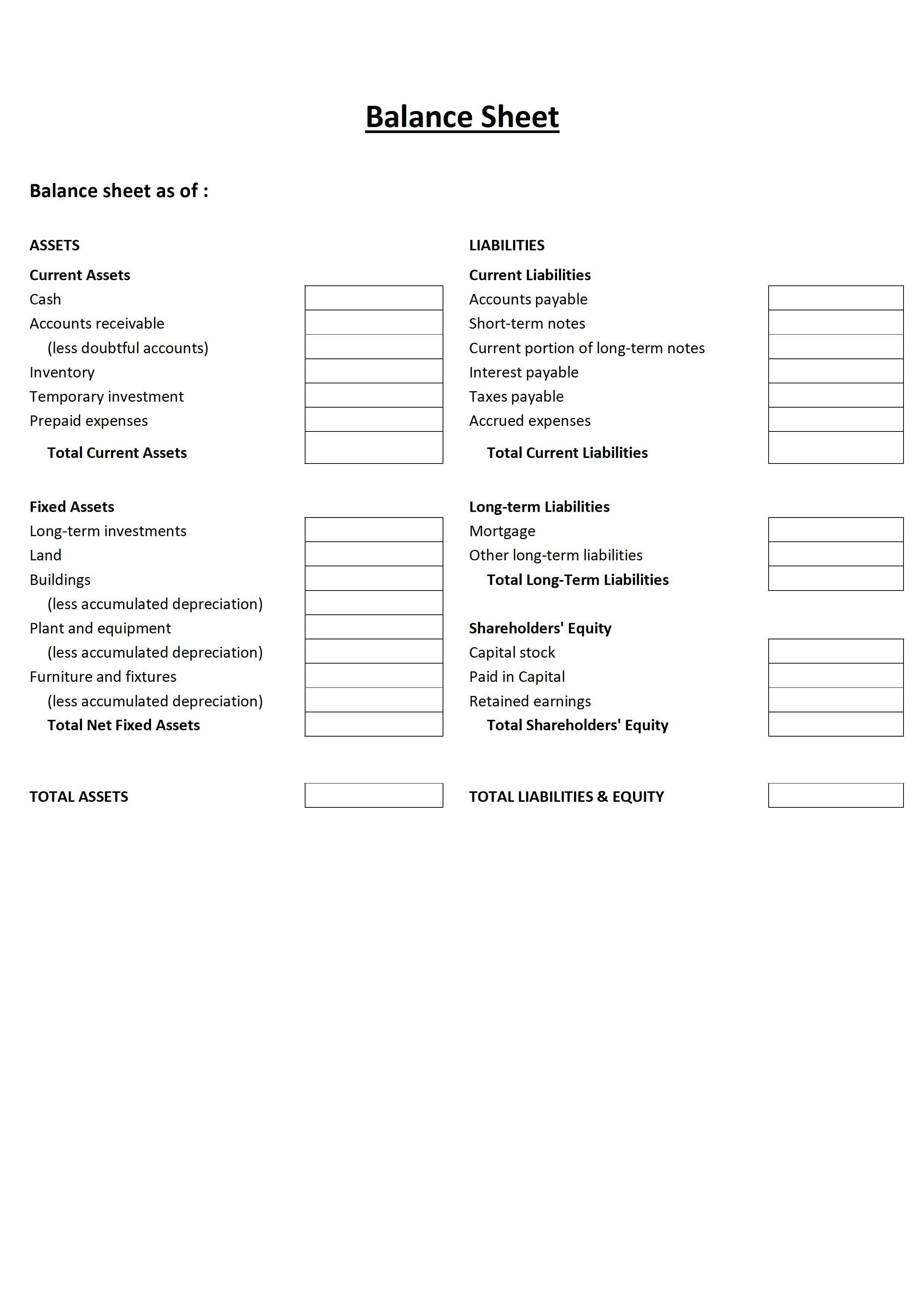

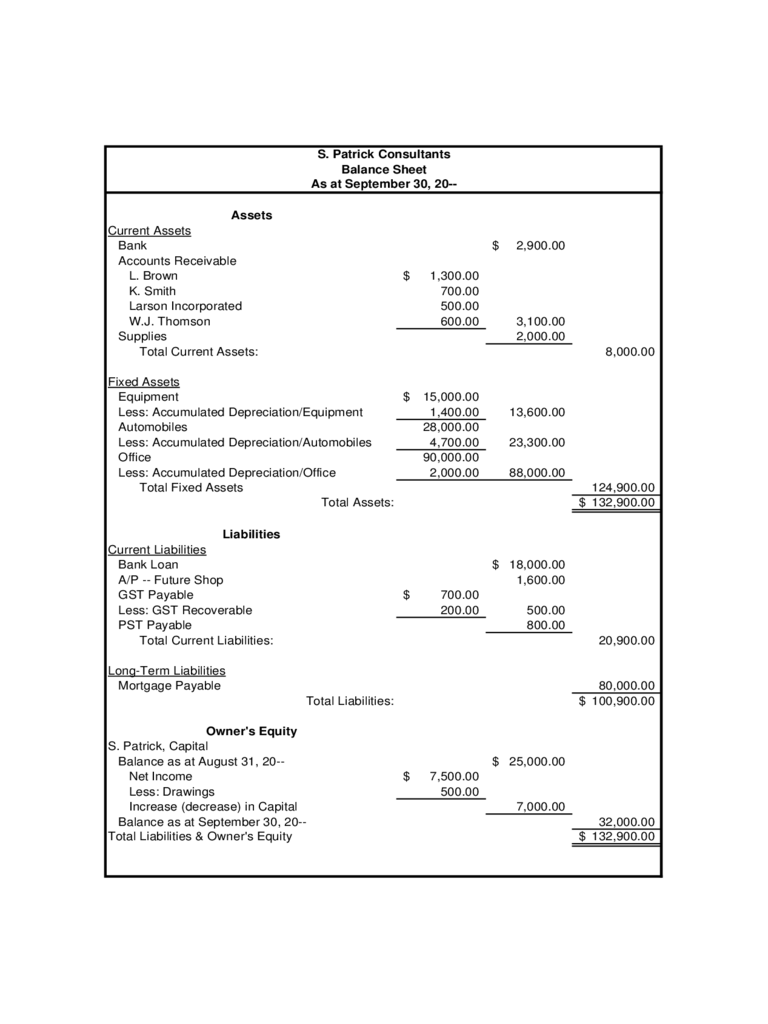

It’s used together with the income statement and balance sheet to give you a full financial picture of your business. Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Perhaps the most important line of the cash flow statement is the net cash flow from operations.

Moreover, this template provides the cash flow from operating, investing, and financing activities. The net operating assets formula is simple but powerful. So for example, the income from book sales generated by a book store or the income from a cleaning appointment generated by a cleaning service would be considered income from the core business.

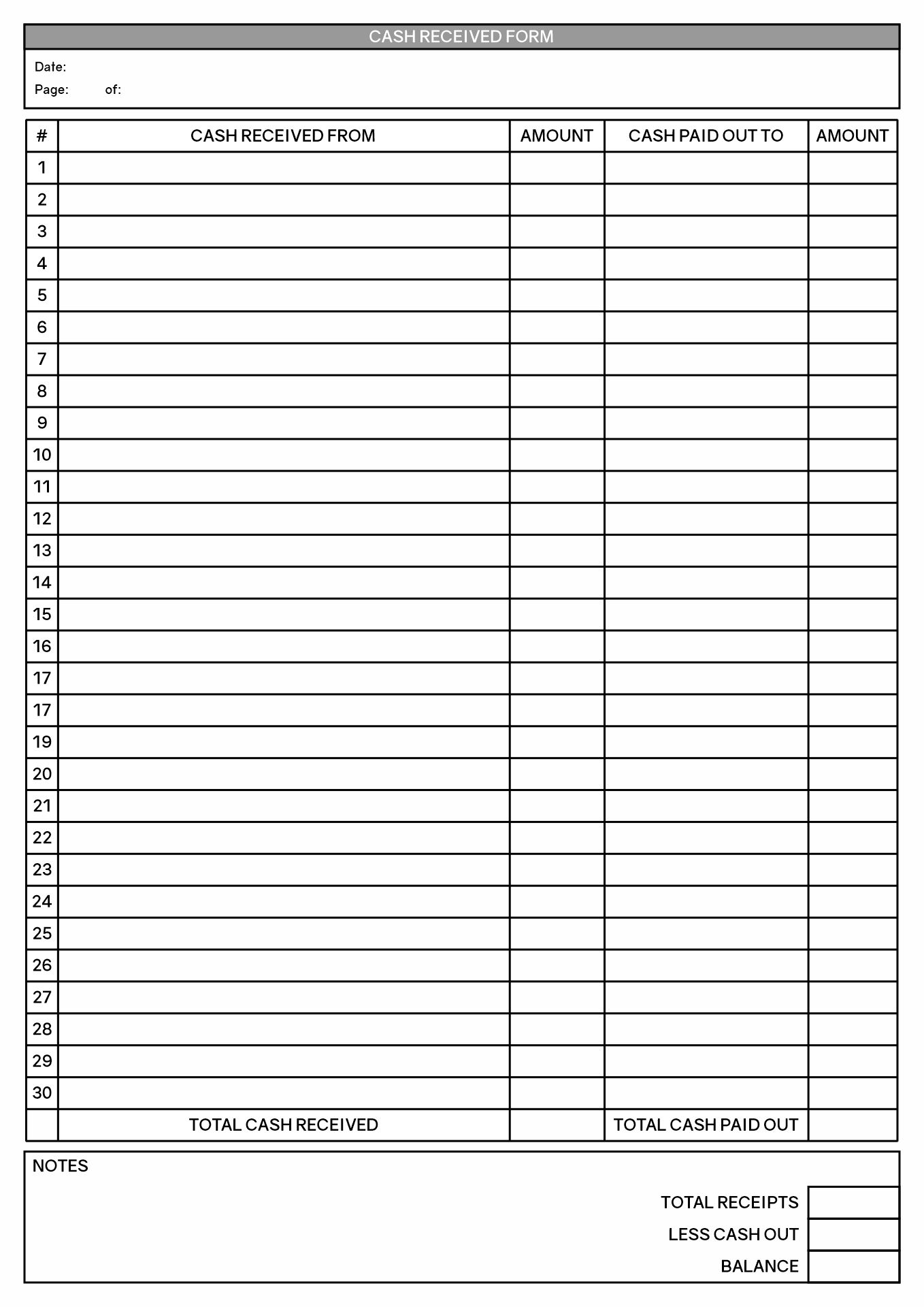

Insert the amounts pertaining to the applicable items in the list below. Cash flow table definition. The statement of cash flows acts as a bridge between the income statement and balance sheet by how money has moved in and out of the business.

Also, give the amount of cash in column c. Start calculating operating cash flow by taking net income from the income statement. Receipts from sales of goods and services, interest payments, income tax payments, payments made to suppliers of goods and services used in production, salary and wage payments to employees and more.

Three main sections of statement of cash flows: Operating activities include buying and selling inventory, paying salaries for your staff, and covering operating expenses like rent, rates and utilities for your business property. Cash flow from operating activities, investing activities, financial activities, and cash flow summary.

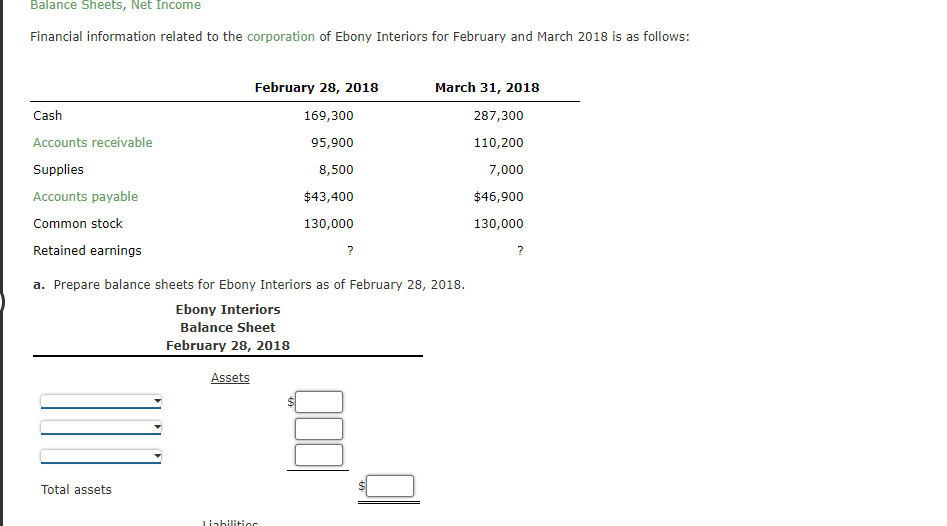

This section of the statement is associated with the current assets and current liabilities sections of the balance sheet, as well as the revenue and expenses section of the income statement. Examples of operating cash flow statements and how you can use your company’s balance sheet and income statement to determine your operating cash flow; Operating activities, investing activities, and financing activities.

![[Solved] Required a. For the balance sheet, identify how](https://media.cheggcdn.com/media/1fa/1fa88419-d3af-4dc0-ae82-cc7695ce9b66/phpfl6iz4)