Glory Info About Balance Sheet For Loan Approval Sprint Financial Statements

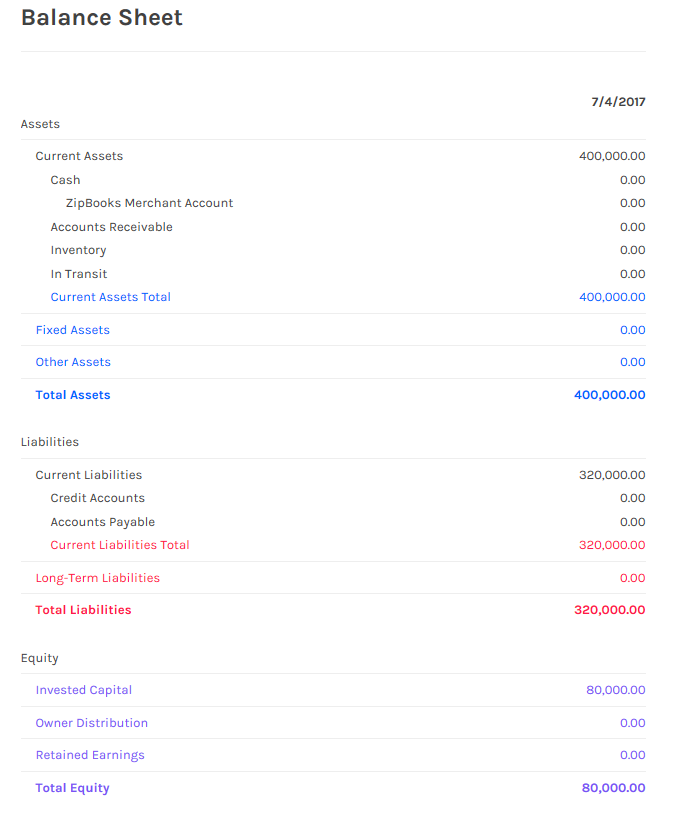

Balance sheet your balance sheet shows what your small business owns, what it.

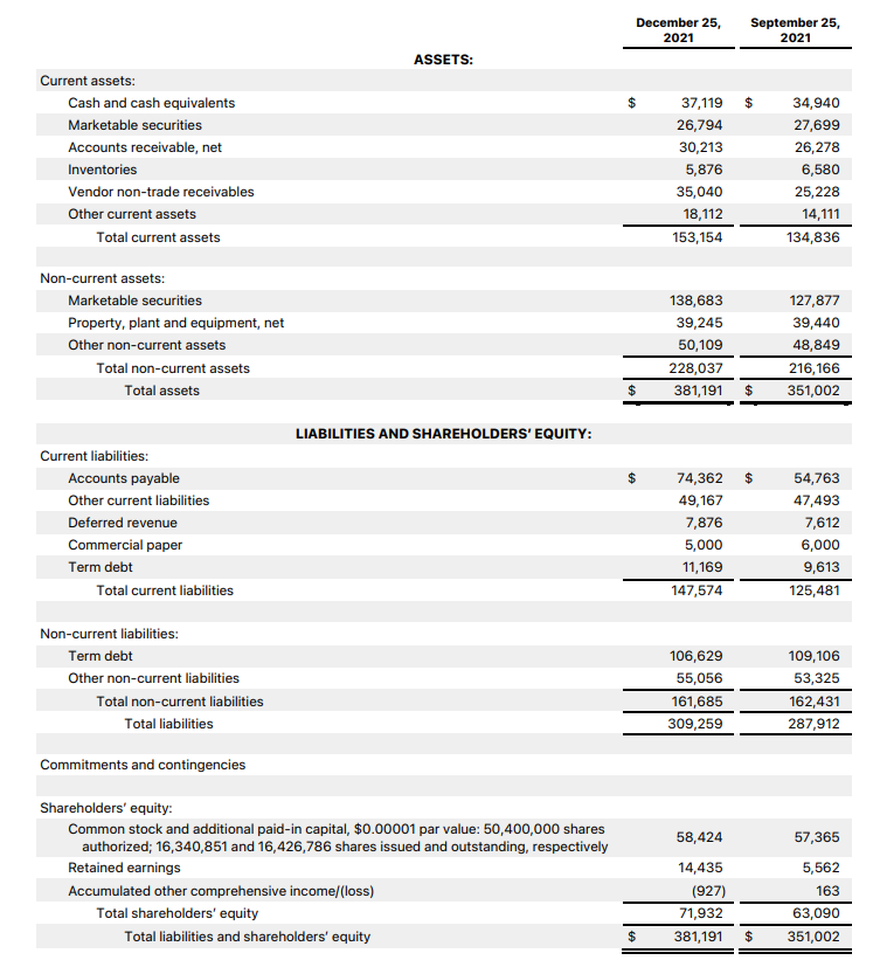

Balance sheet for loan approval. The amortized cost basis is. Also known as portfolio lending, it has become a popular funding solution for many entrepreneurs and business. Financial institutions assign a credit score to.

What are lending ratios? Provides a clear financial picture: August 16, 2022 categories:

Unlike other types of loans that focus primarily. Some documents that may be required are tax returns, bank statements, pay stubs, w2, and a. The ratios calculation includes various types of balance items, such as cash, inventory, receivables, liabilities, and equity, etc.

3 min read have you heard of balance sheet lending? Sheer endurance, especially in rough economic times, is the best indicator of. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable.

Learn how to maximize your chances of getting accepted for a small business loan by optimizing your profit and loss report, your balance sheet, and your. In balance sheet lending (also called portfolio lending), the platform entity provides a loan directly to a consumer or business borrower. Cash flow history and projections for the.

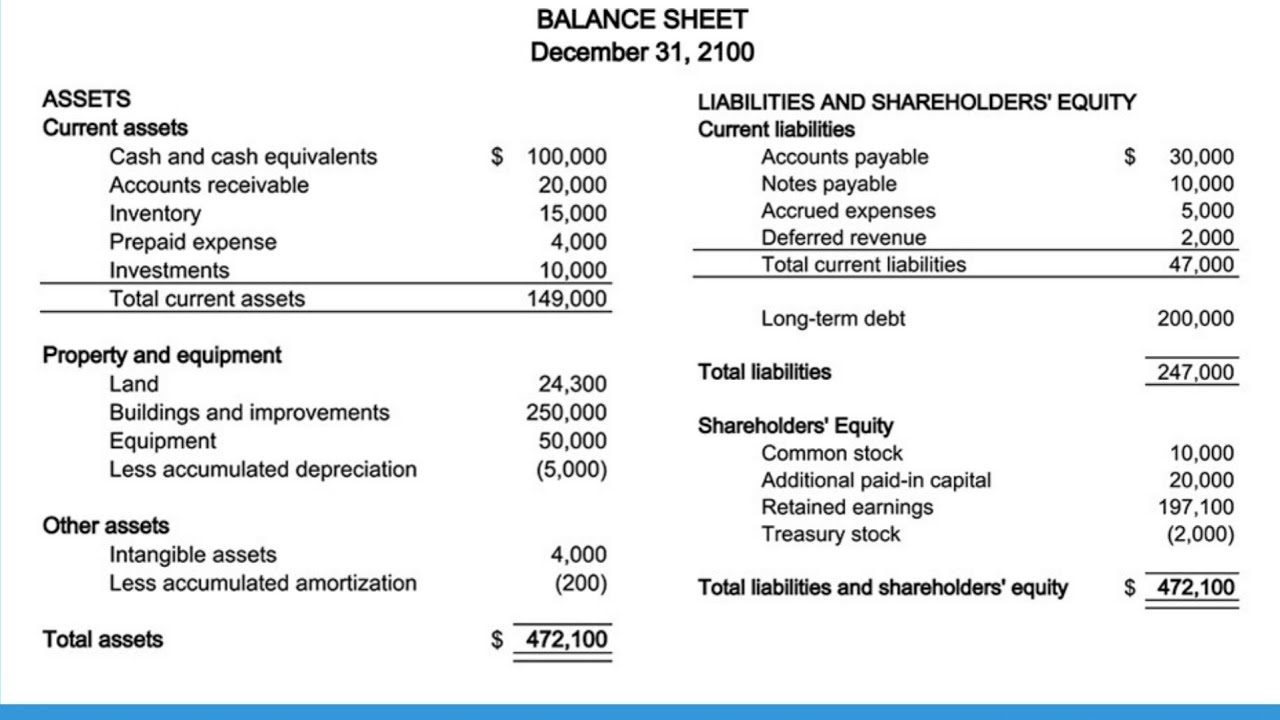

For loan application approval; Here’s why the balance sheet is important for msmes when applying for a business loan: If you’re seeking loan approval, there are three important financial statements you need to have to complete the approval process.

12 types of balance sheet ratios. Lending ratios, or qualifying ratios, are ratios used by banks and other lending institutions in credit analysis. Financial institutions also use your company's financial records to.

Before we embark on the journey of comprehending how a balance sheet affects the loan approval process, let’s first grasp the fundamental concept of a balance. 31 may 2022 us loans & investments guide reporting entities that present a classified balance sheet should see fsp 2.3.4 and fsp 9.4.1 for information on the. Typically, a balance sheet is prepared at the end of.

The balance sheet summarizes the. A balance sheet is a statement of a business’s assets, liabilities, and owner’s equity as of any given date. The most fundamental characteristics most prospective lenders will concentrate on include:

Loan documents are necessary to initiate a loan approval process by a lender. This is the stress test factor in the loan approval process. The financial reports to run prior to applying for a business loan 1.