Ace Info About The Accrual Basis Of Accounting Is Most Useful For Sample Balance Sheet Nonprofit Organization

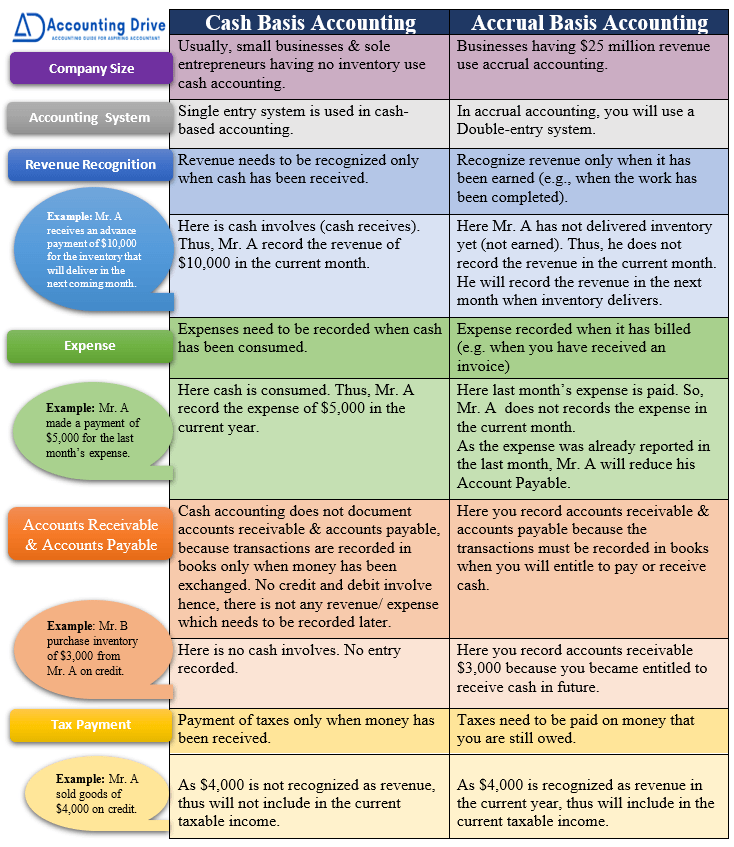

Accrual accounting is required for companies with average revenues of $25 million or more over three years.

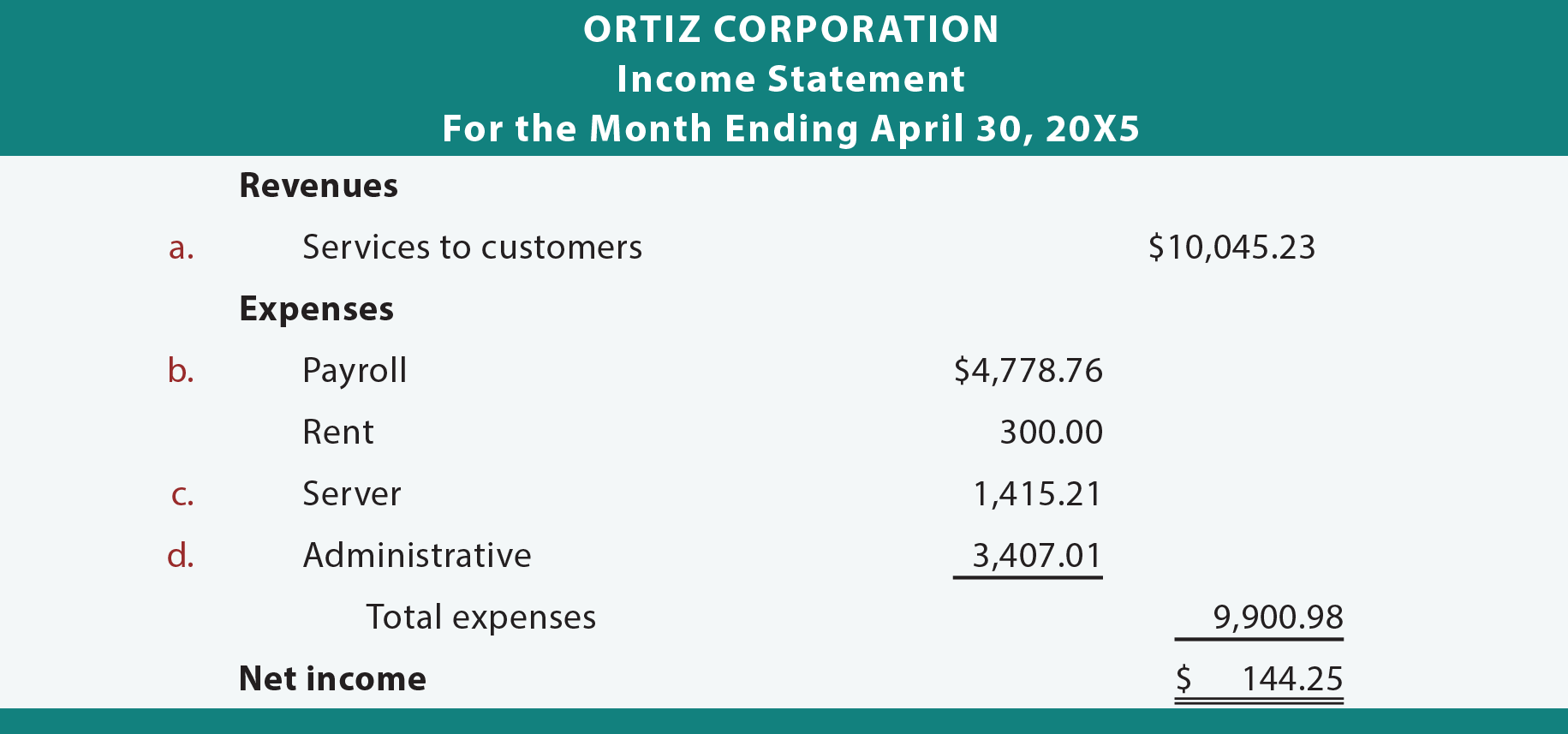

The accrual basis of accounting is most useful for. Accrual accounting provides a more accurate view of a company's health by including accounts payable and accounts receivable. What is the accrual basis of accounting? For instance, assume a company performs services for a.

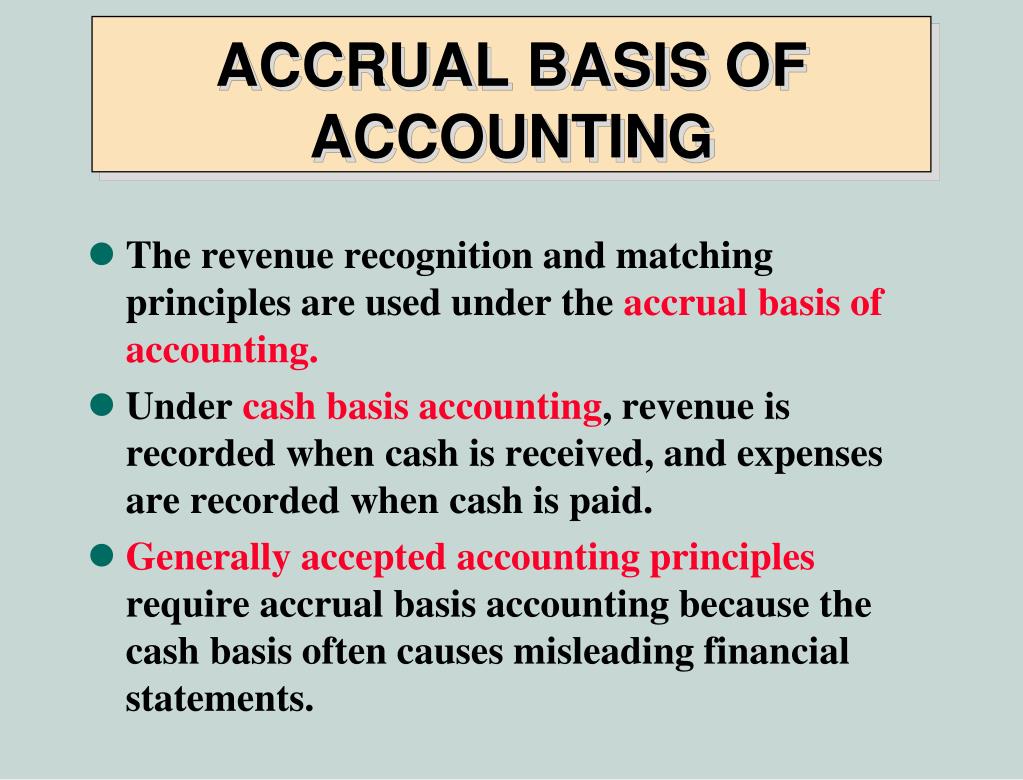

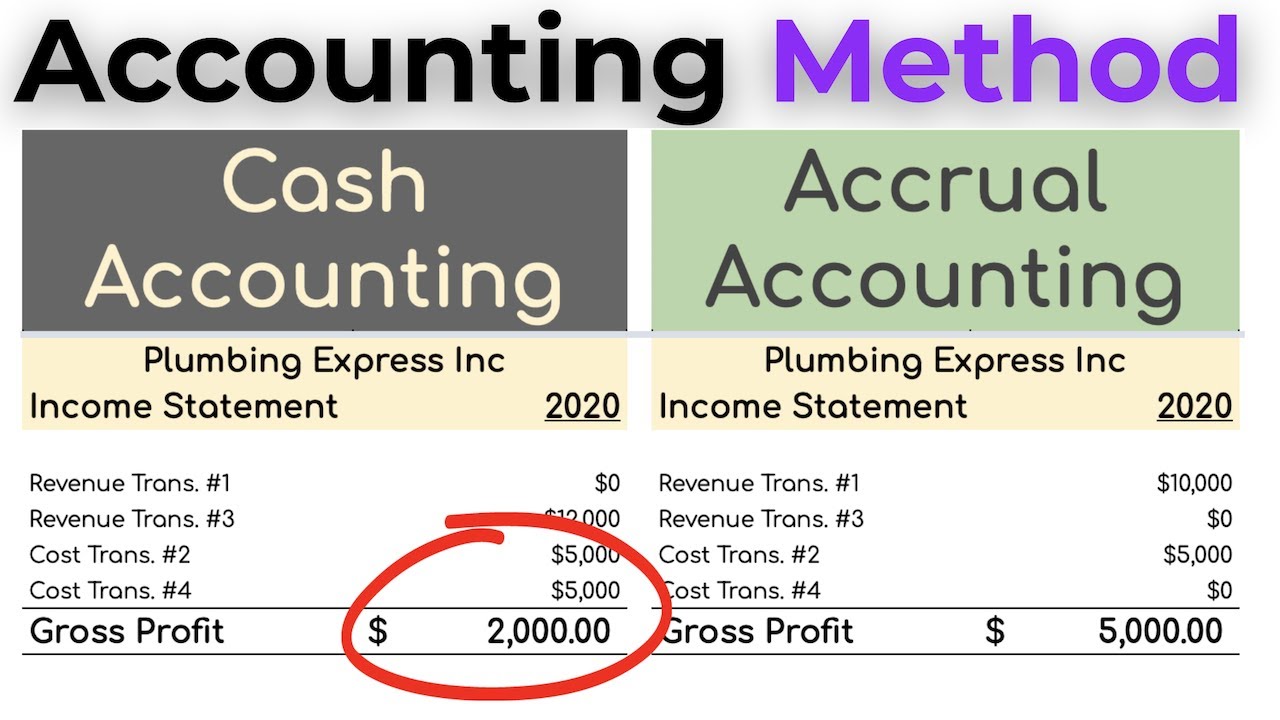

Determining the amount of income tax an entity should pay b. Accrual basis accounting is the method that produces the most helpful and accurate financial statements. The use of this approach also impacts the balance sheet, where receivables or payables may be recorded even in the absence of an associated cash receipt or cash payment,.

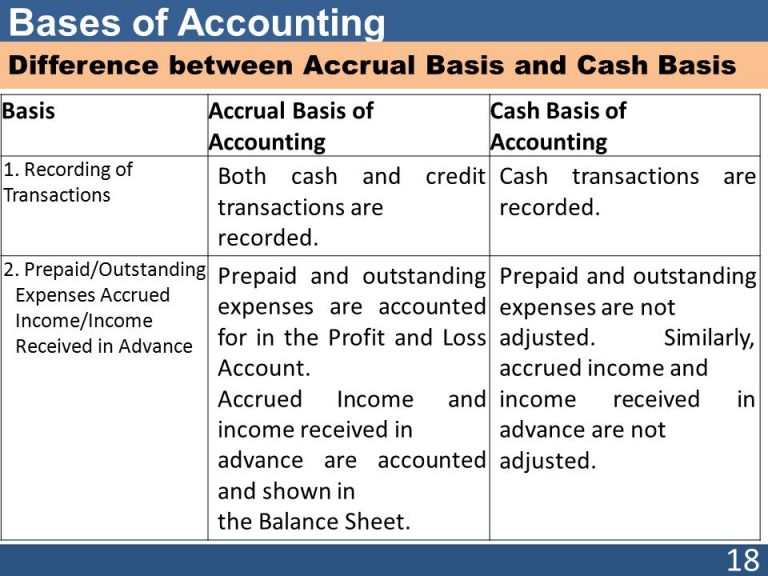

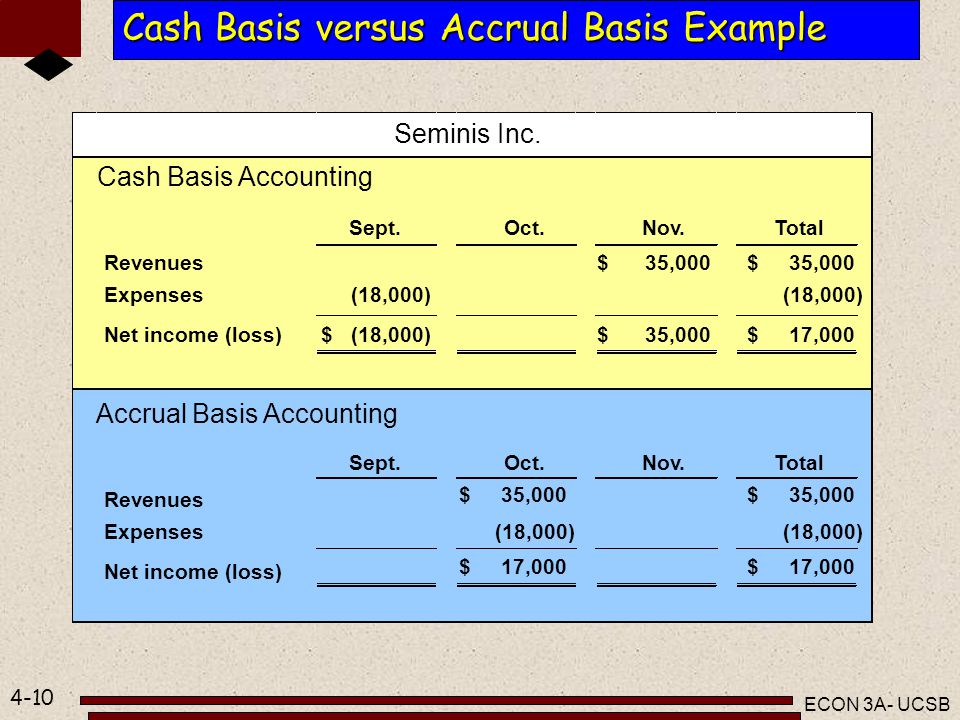

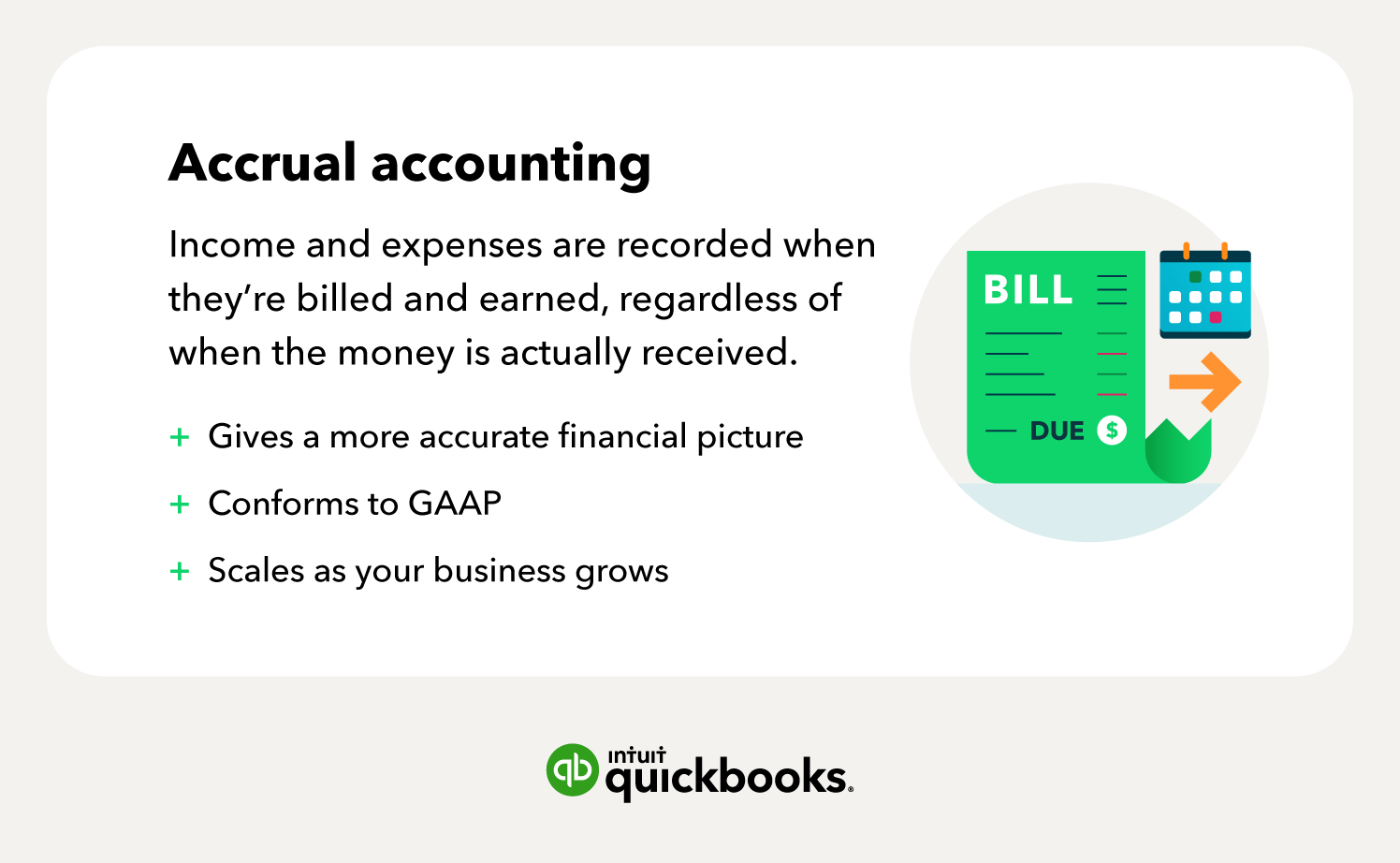

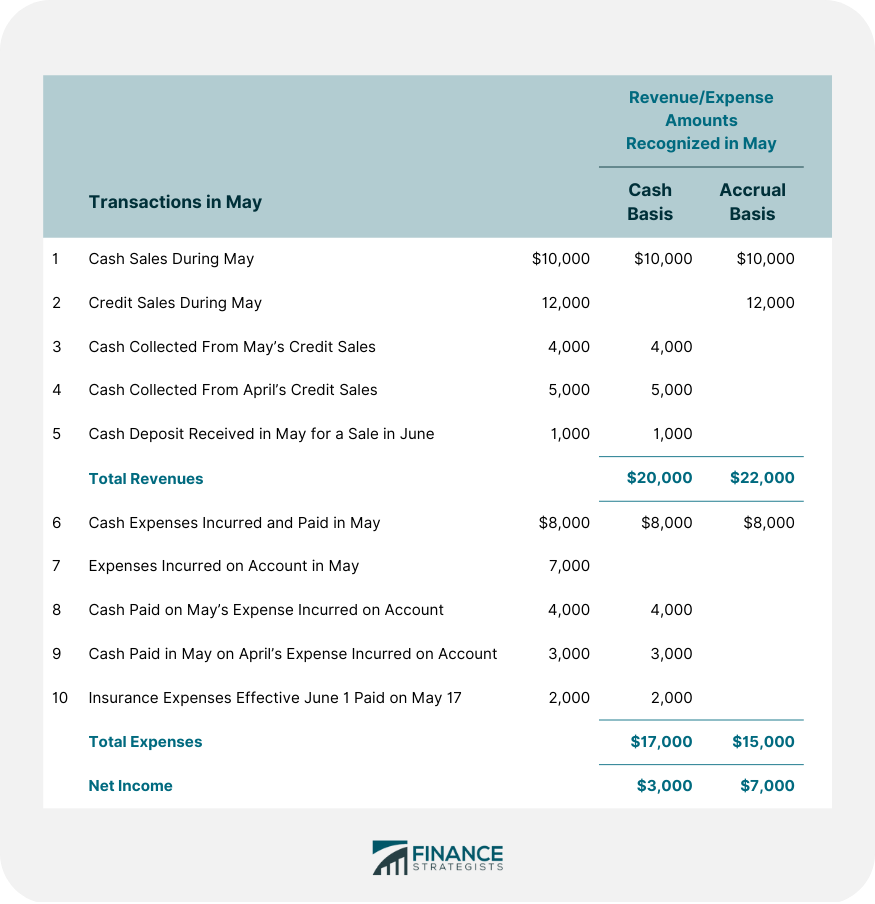

The accrual basis of accounting recognizes revenues when earned (a product is sold or a service has been performed), regardless of when cash is received.expenses are recognized as incurred, whether or not cash has been paid out. Advantages and disadvantages of accrual basic accounting. A detailed edit history is available upon request.

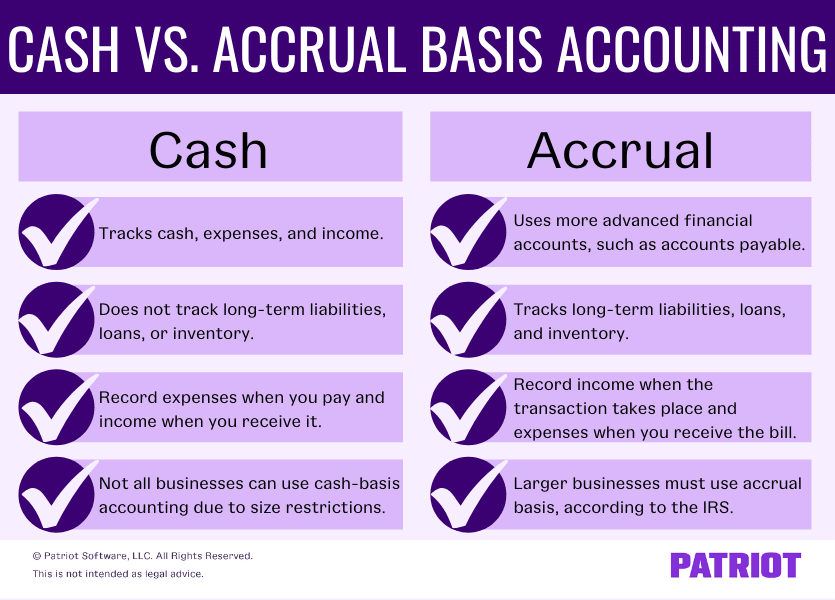

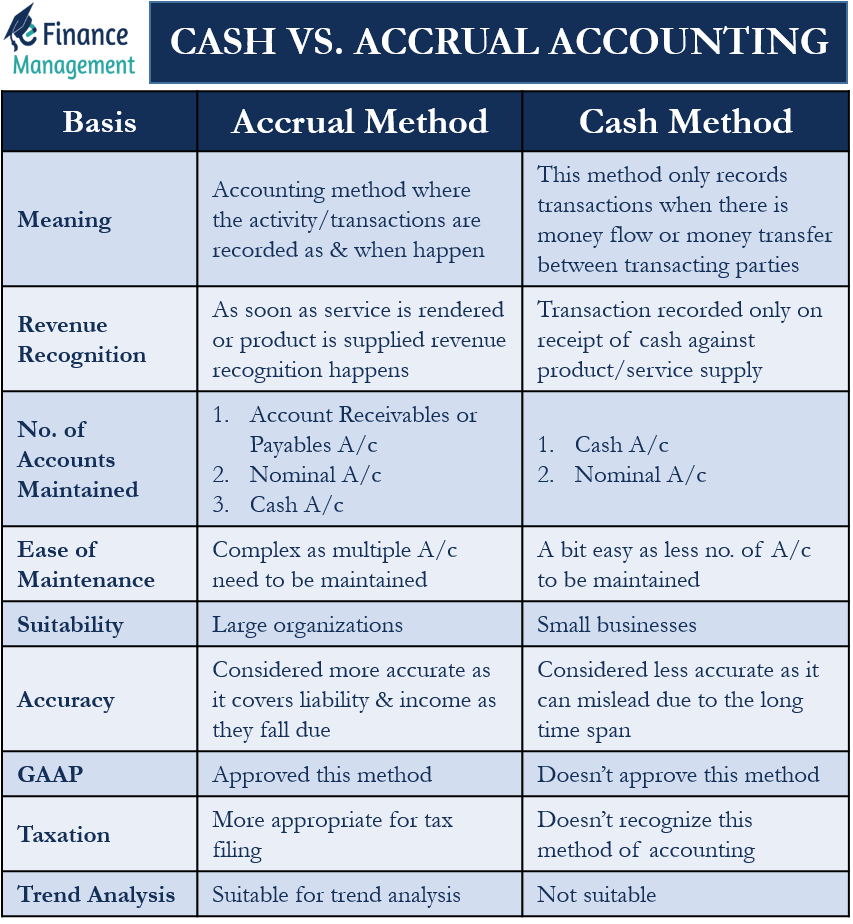

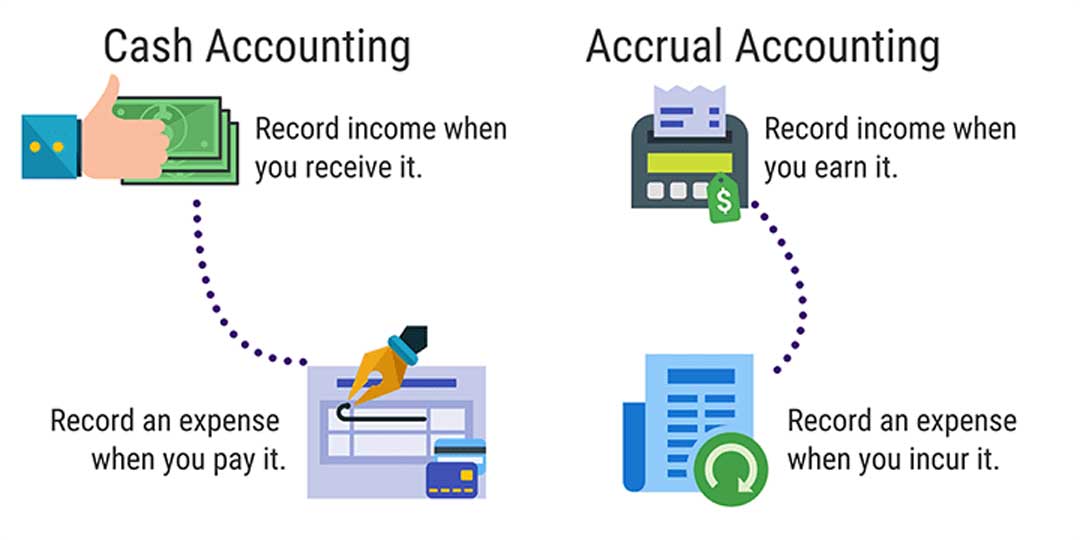

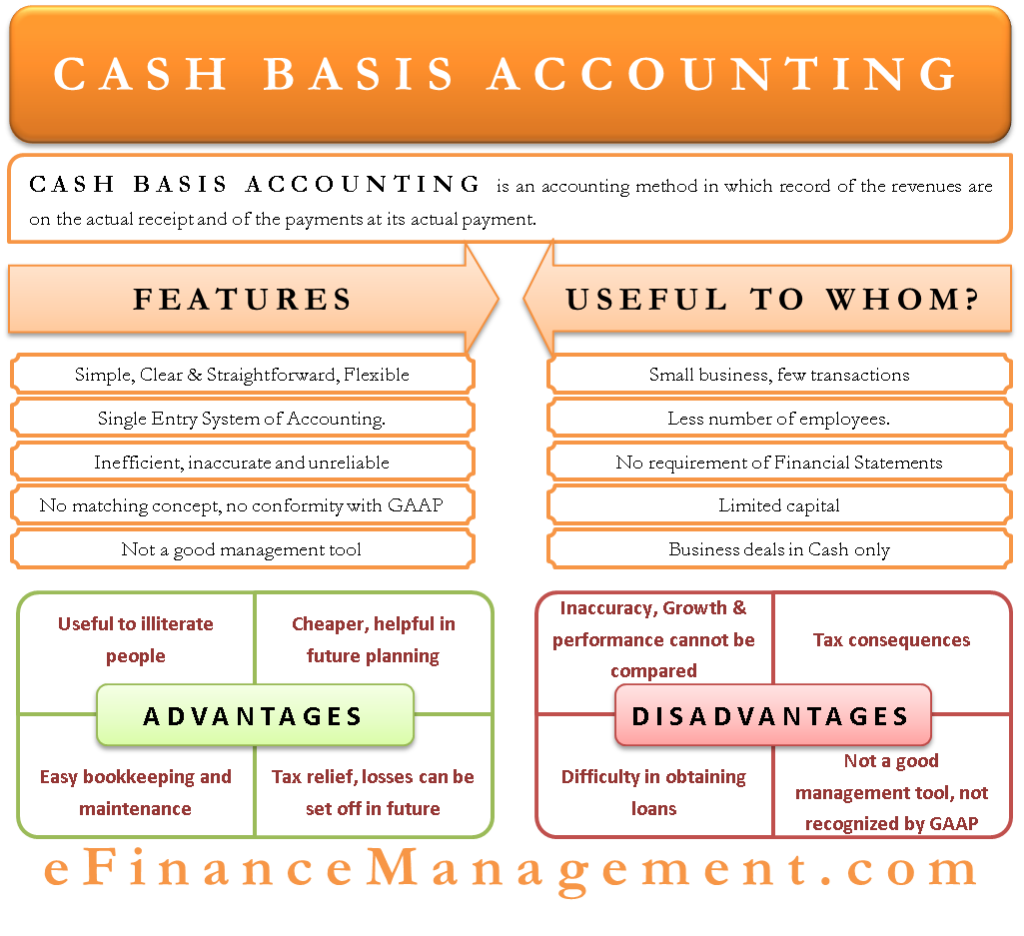

Accrual basis accounting is one of two leading accounting methods and the preferred bookkeeping method for providing an accurate financial picture of a company’s business operations. Cash accounting is the other accounting method, which recognizes transactions only. The accrual basis of accounting is most useful for a.

The accrual basis of accounting is the concept of recording revenues when earned and expenses as incurred. Financial position, financial performance, cash flow, changes in net. We need a more sophisticated way to track how much we owe, who owes us, and what we own.

The accrual basis of accounting recognizes revenues when earned (a product is sold or a service has been performed), regardless of when cash is received. Expenses are recognized as incurred, whether or not cash has been paid out. Most companies use the accrual basis of accounting.

The accrual method is the more commonly used method by large. Applying this approach also affects the balance sheet, allowing you to recognize accounts receivable or payable even if you do not receive or pay the associated cash. Accrual basis accounting recognizes business revenue and matching expenses when they are generated—not when money actually changes hands.

Think of accrual basis accounting as an economic picture of our business, rather than just tracking cash that comes in and out. Learn about the goal of financial statements, the definition of the accrual. Abstract this paper reviews the field of accounting conservatism measurement and the development of research on accounting conservatism measurement, so it is useful to develop insight into the emerging accounting conservatism measurement and outline future research.

This is one of the most essential concepts in accrual basis accounting, since it mandates that the entire effect of a transaction be recorded within the same reporting period. A manager's guide to finance & accounting access your. The accrual basis of accounting is most useful for:

By the end of this article, you know what accrual basis accounting is, how it works, if it’s better than cash basis accounting, and, drum roll, please—if it’s right for your business. The accrual basis of accounting is the concept of recognizing and recording revenue as income earned and recognizing costs as expenses that are incurred. The accrual method of accounting is based on the matching principle, which states that all revenue and expenses must be reported in the same period and “matched” to determine profits and losses for the period.

:max_bytes(150000):strip_icc()/final5468-d59a89b4ff49437d99fe74b841514308.jpg)