Supreme Tips About The Trial Balance Is Prepared On Managerial Sheet

Here are the steps involved in preparing the trial balance for preparing a trial balance, it is required to close all the ledger accounts, cash book and bank book first.

The trial balance is prepared on. A trial balance is a list of all accounts in the general ledger that have nonzero balances. April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

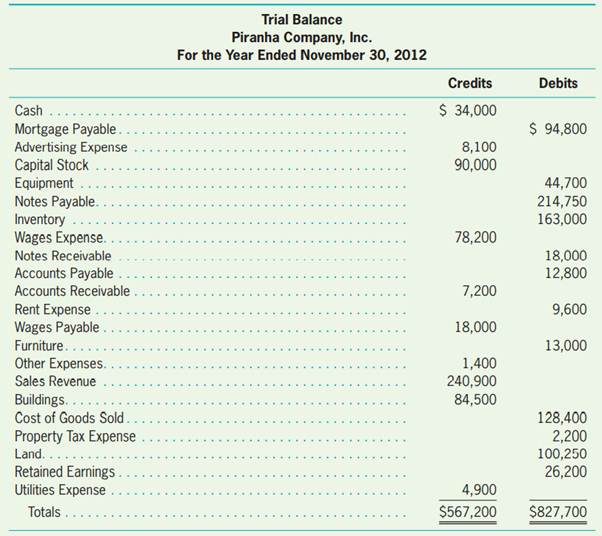

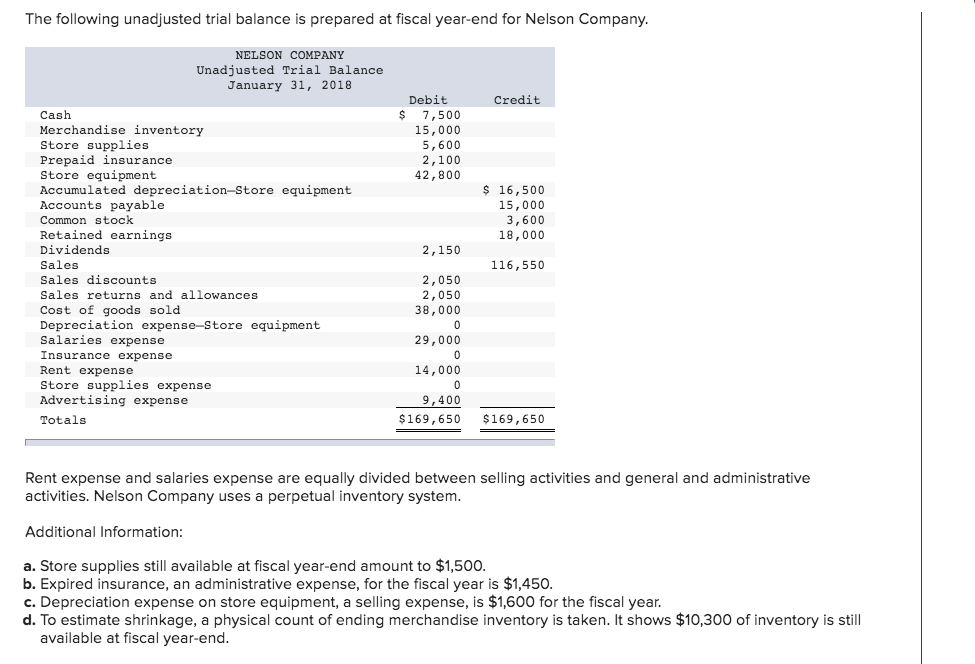

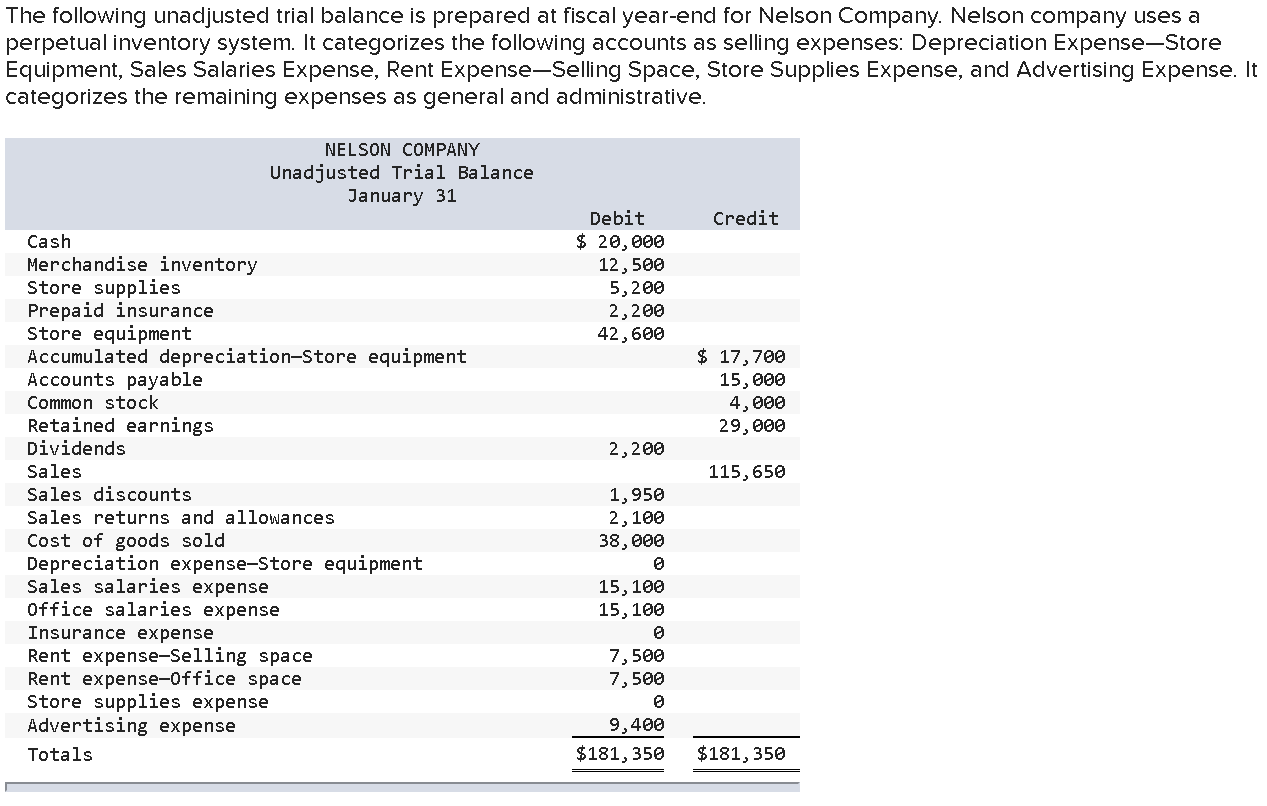

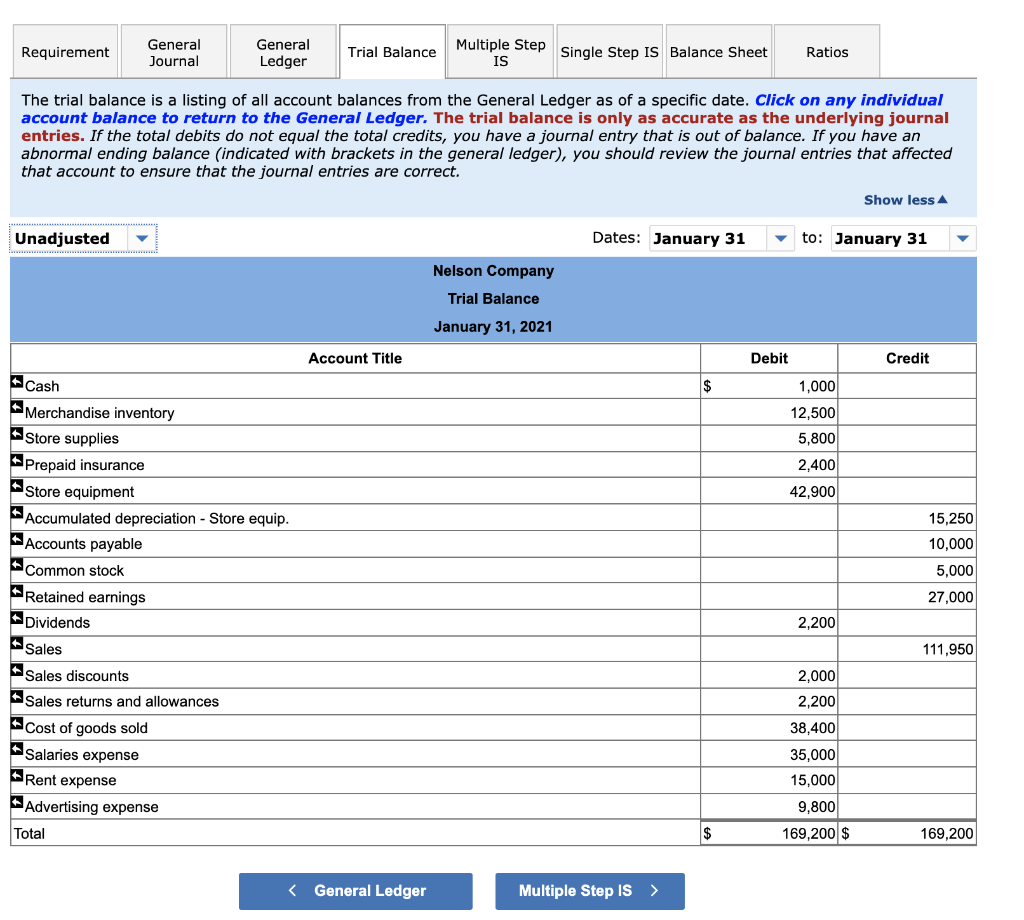

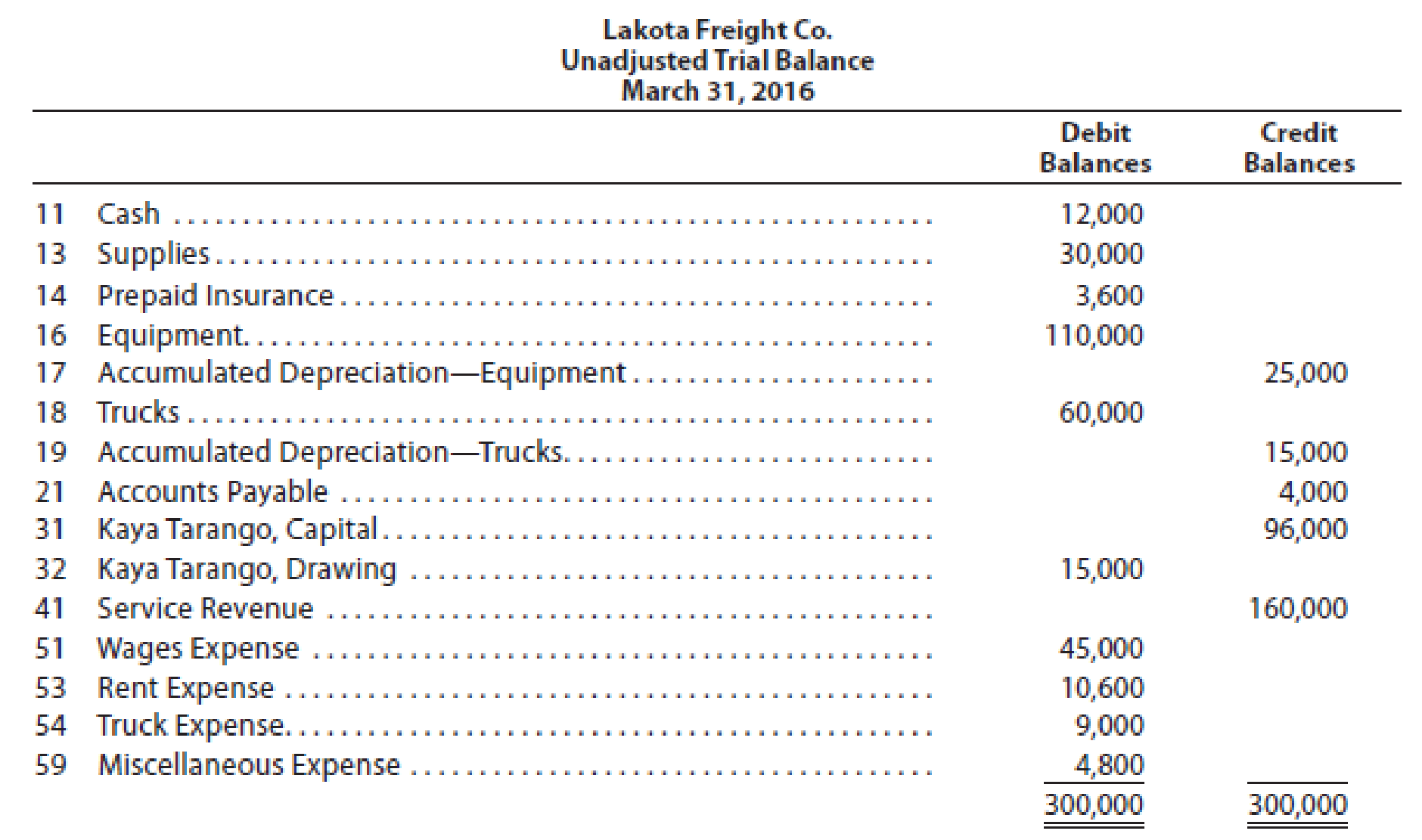

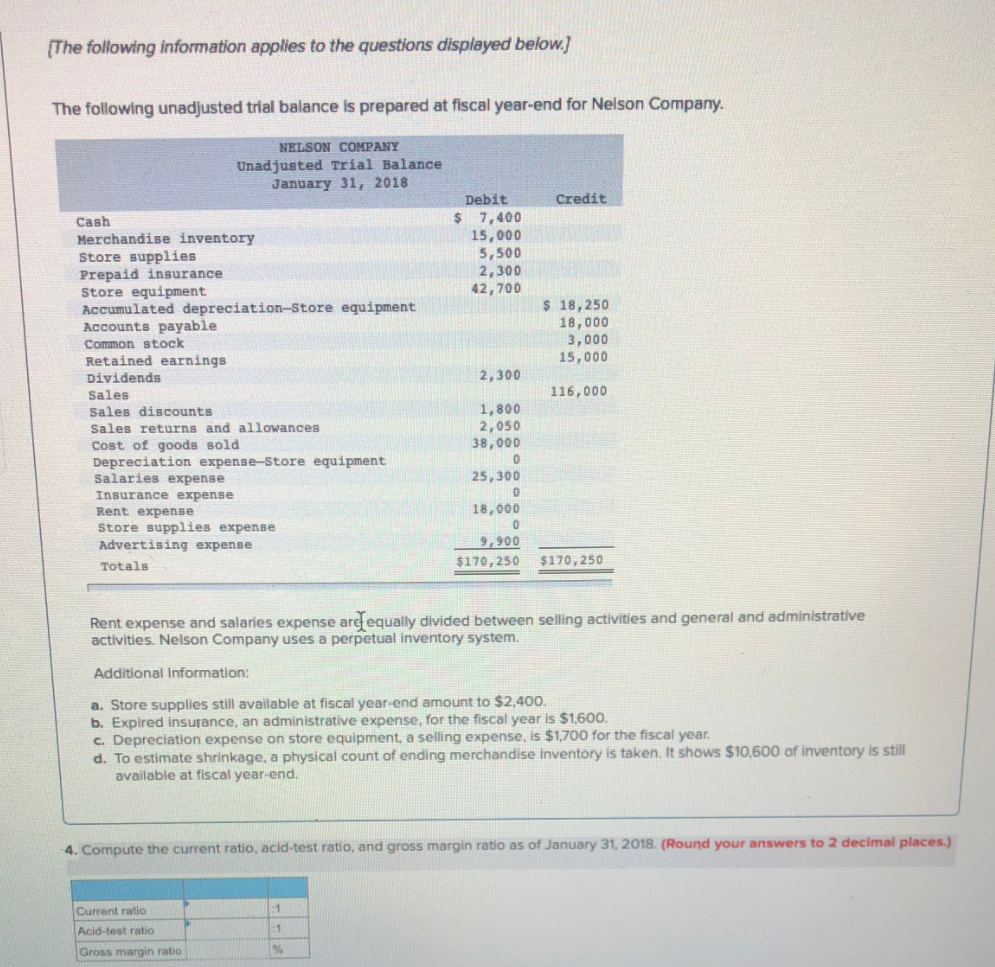

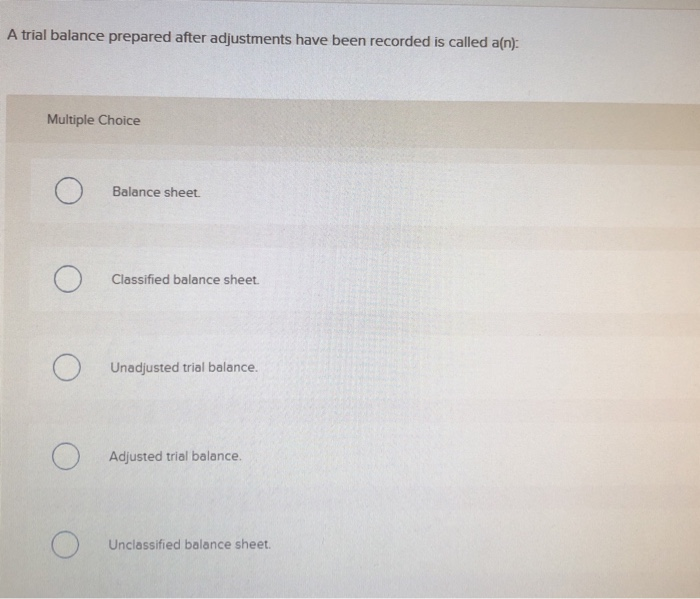

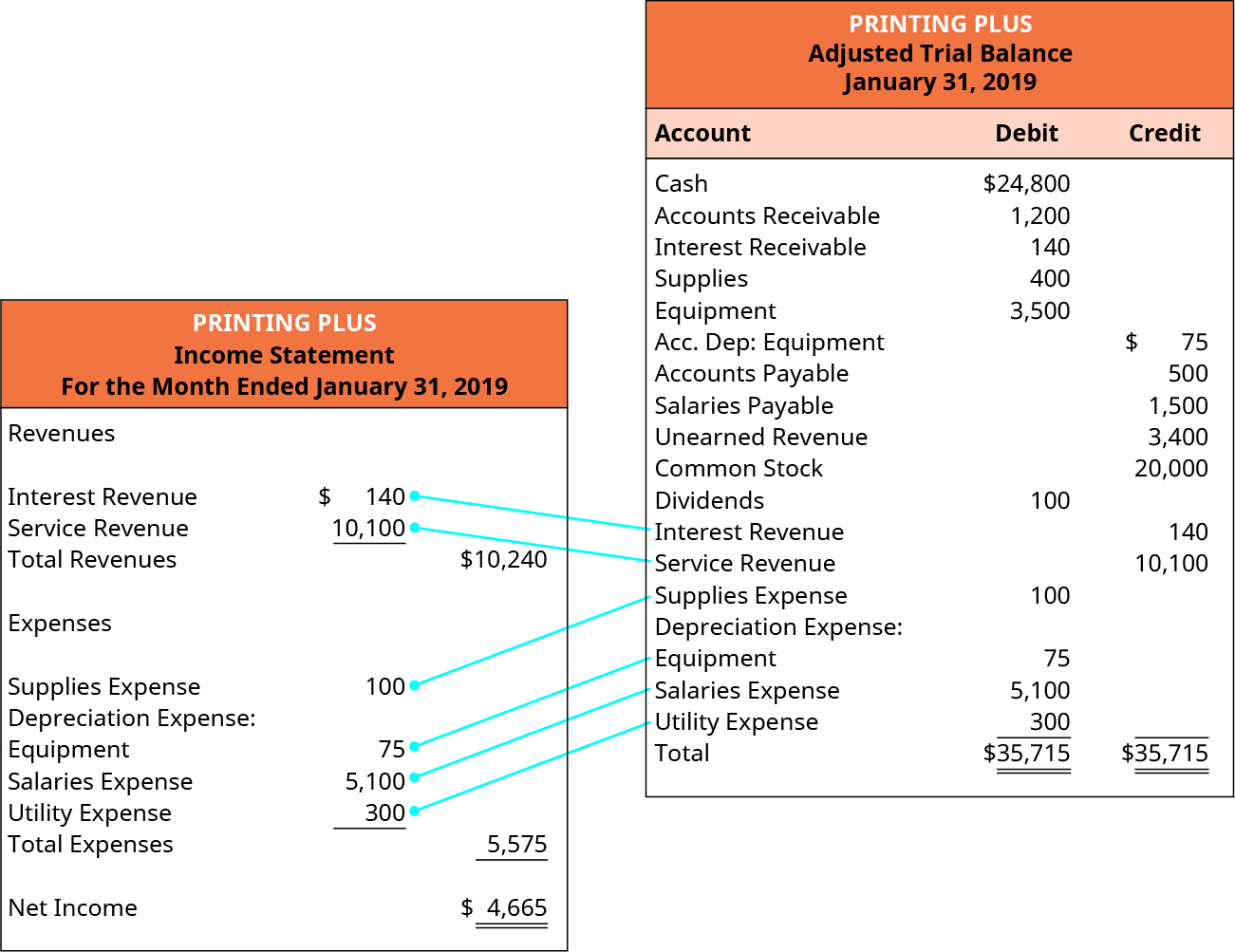

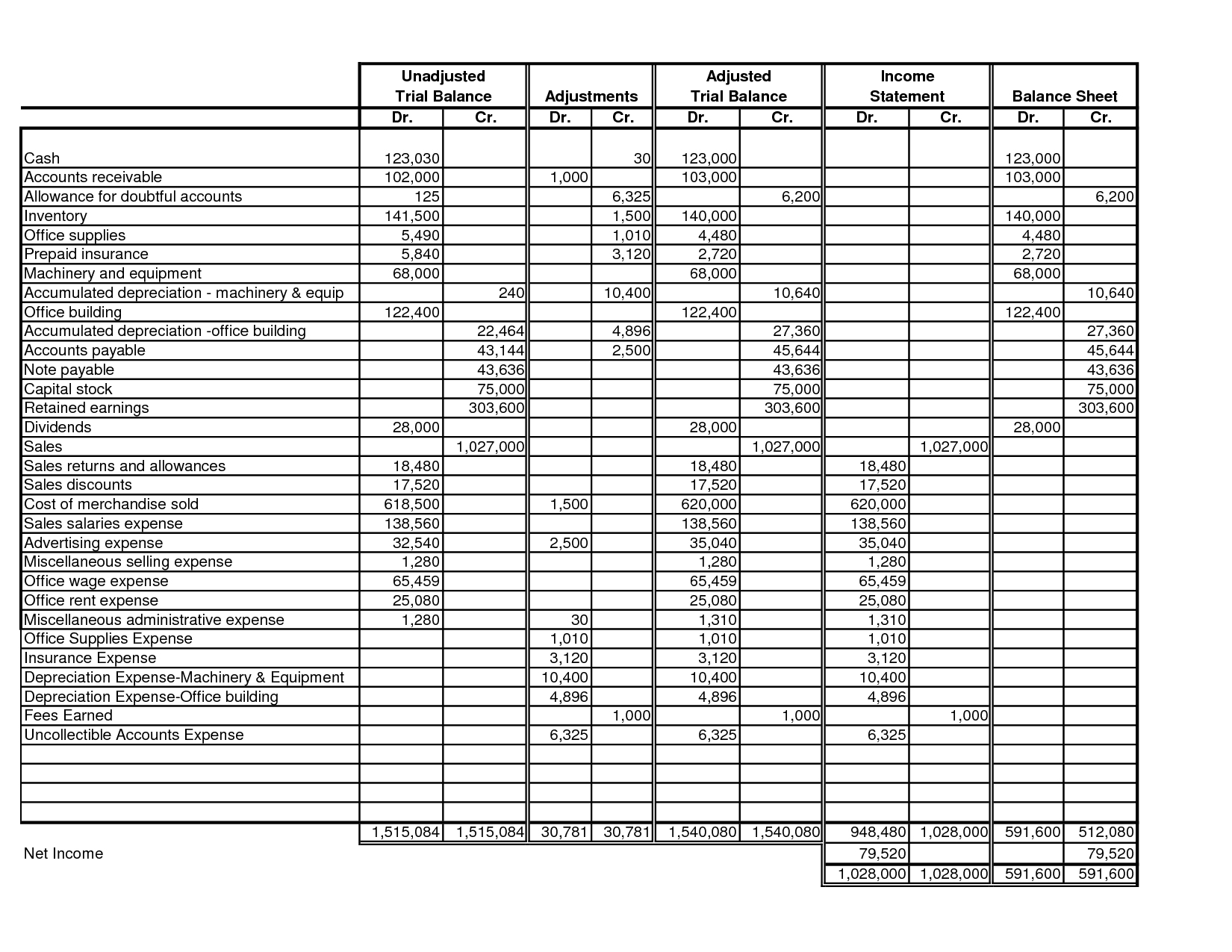

The trial balance is prepared after the subsidiary journals and journal entries have been posted to the general ledger. It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced. After the preliminary unadjusted trial balance, also known as the trial balance, is prepared, accountants review it and determine if corrections are required for determining adjusted balances.

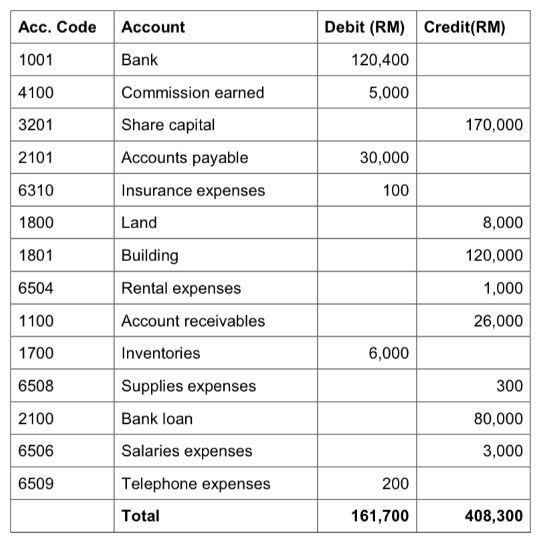

Account number, name, debit balance, and credit balance. A trial balance contains three columns: If you find you have an unbalanced trial balance, in other words, the debits don't equal the credits;

All journal entries are posted in their respective ledger accounts. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. Then you have an error in the accounting process.

The trial balance format is easy to read because of its clean layout. Accountants use a trial balance to test the equality of their debits and credits. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

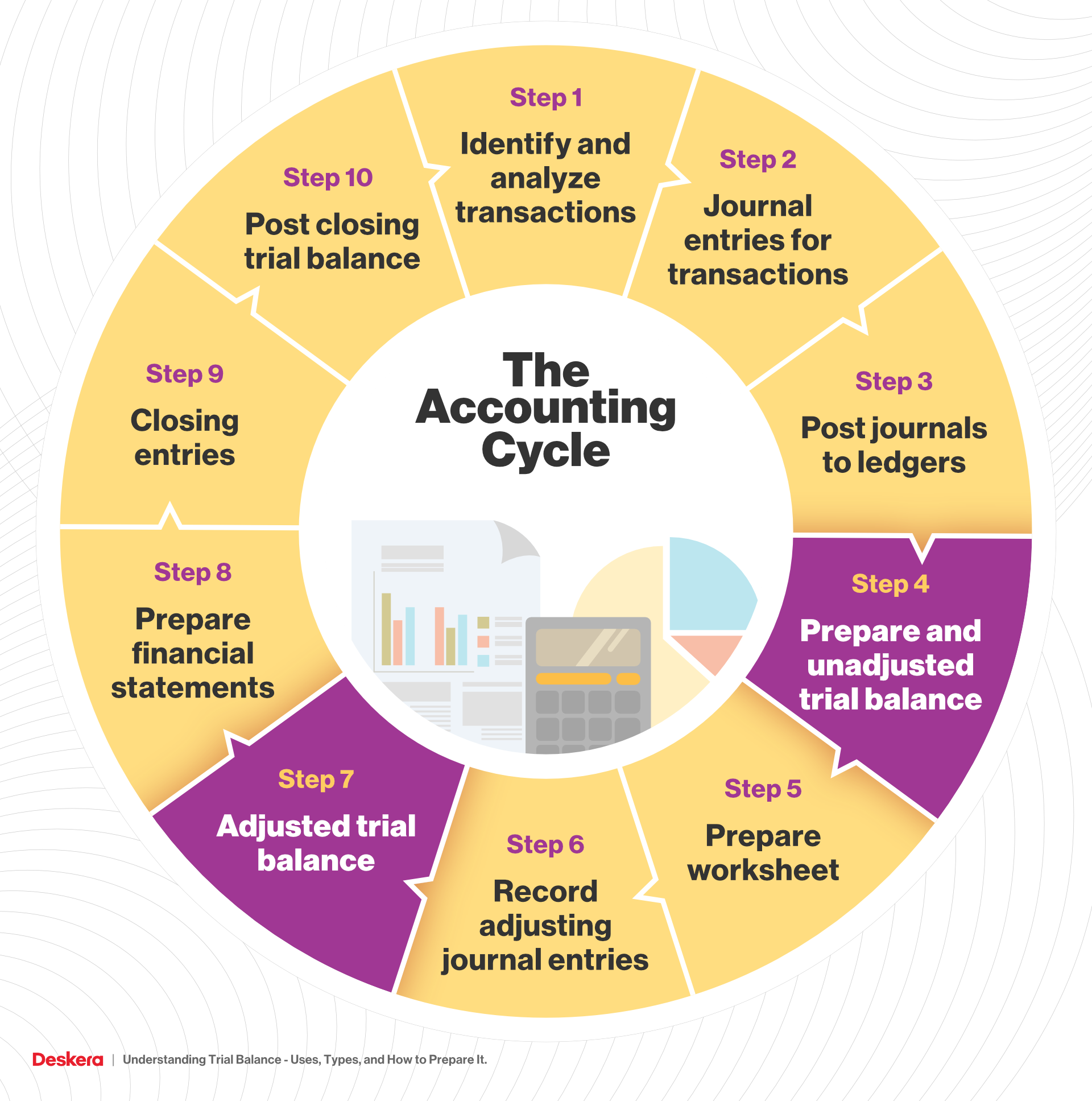

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. In a nutshell, a trial balance is an informal accounting statement, prepared with the help of ledger account balances. Trial balance is prepared after the transactions are first recorded in the journal and then subsequently posted in the general ledger.

Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. It’s always sorted by account number, so anyone can easily scan down the report to find an account balance. To prepare a trial balance, follow these steps:

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. A trial balance is prepared after all the journal entries for the period have been recorded. The entrepreneur/learner should recall that in the accounting cycle, once the ledger accounts have been established and balances extracted, the next step is to prepare a trial balance.

In trial balance, all the ledger balances are posted either. Trial balance is a statement summarizing the closing balance of all the ledger accounts, prepared with the view to verify the arithmetical accuracy of ledger posting. A company prepares a trial balance.

Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. A trial balance only checks the sum of. The following are the steps to take when preparing a.