Simple Tips About The Contribution Income Statement Comparative Horizontal Analysis

As shown above, single individuals enter the partial contribution range when magi reaches $146,000 in 2024, up from $138,000 in 2023.

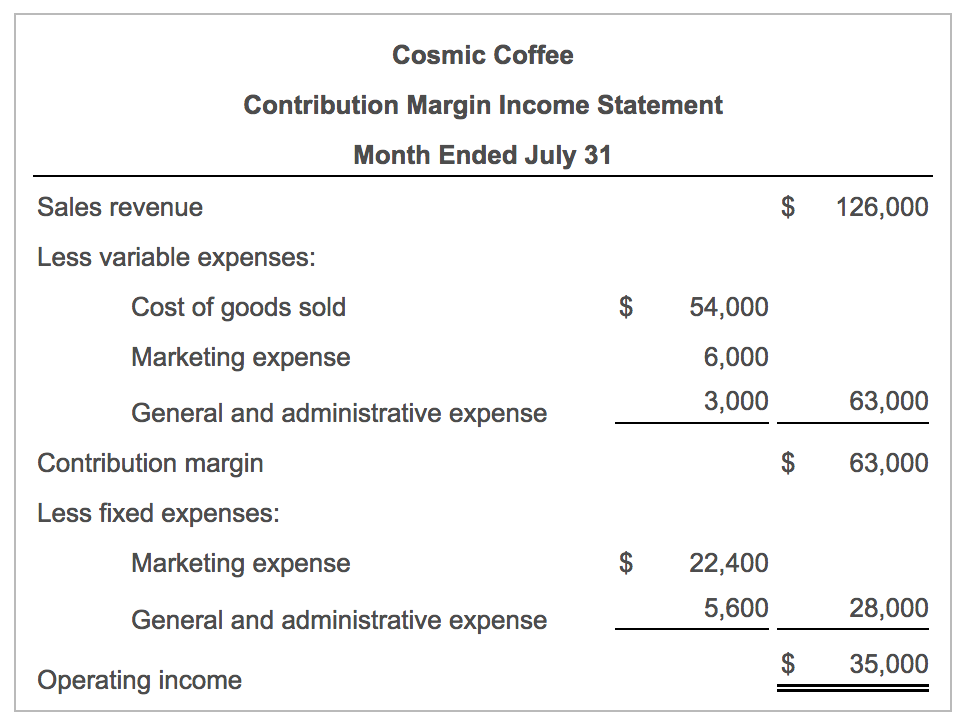

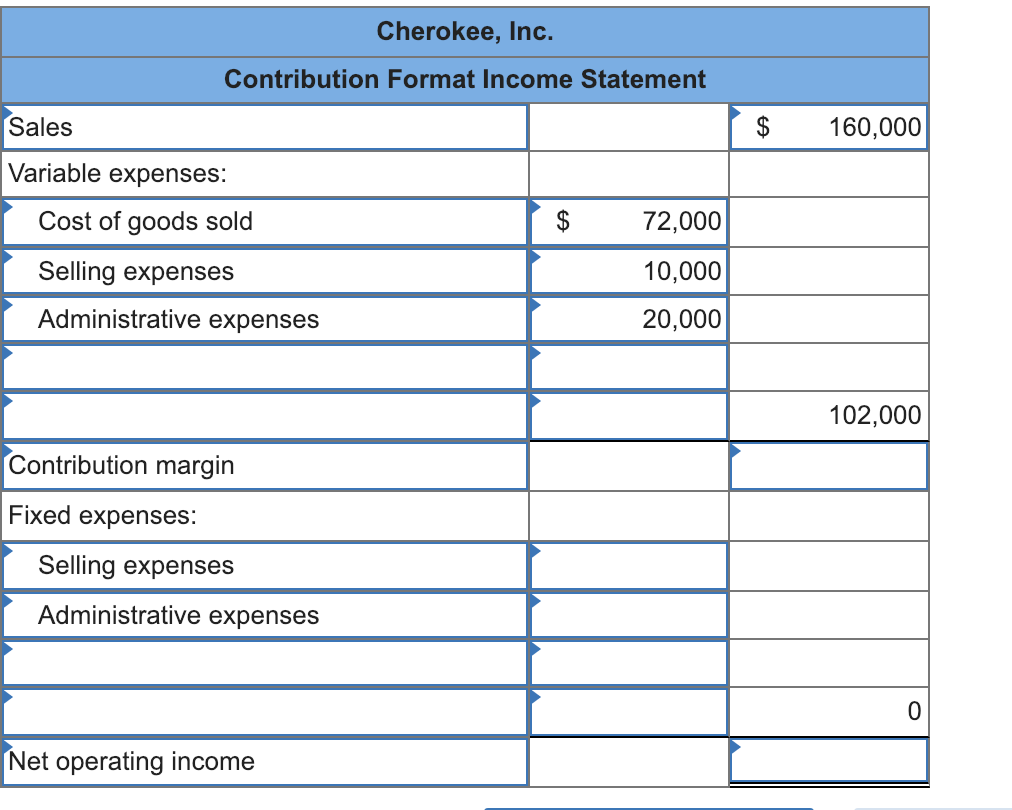

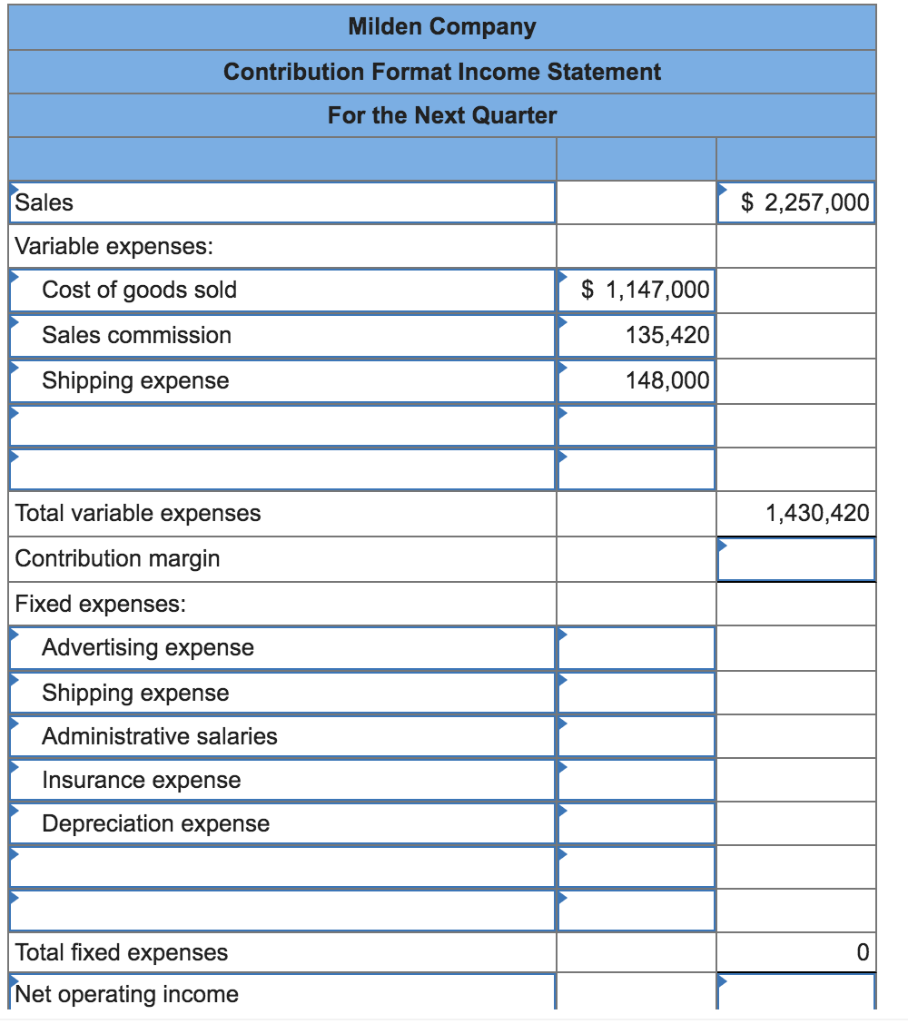

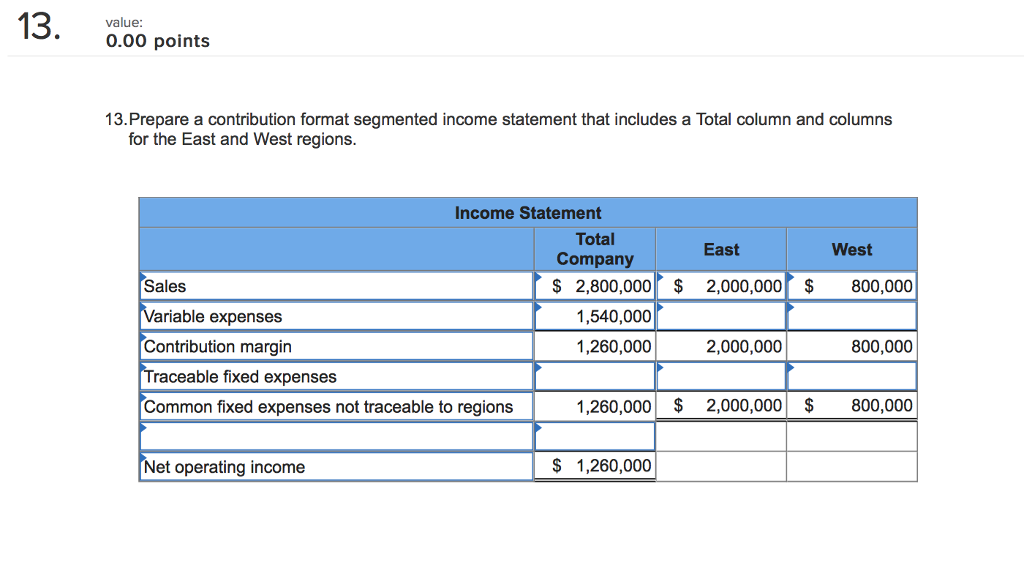

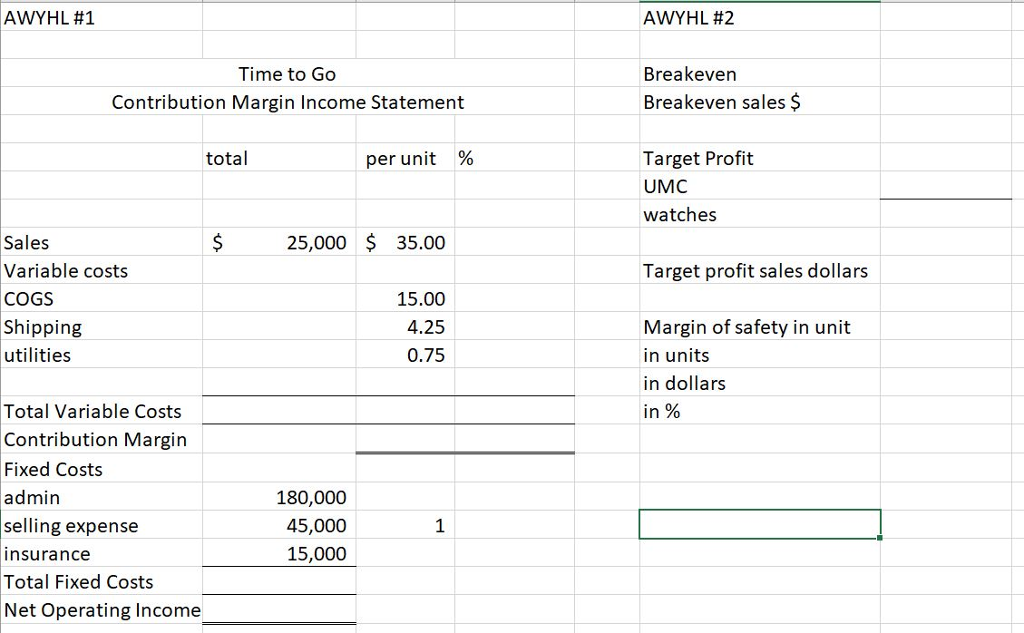

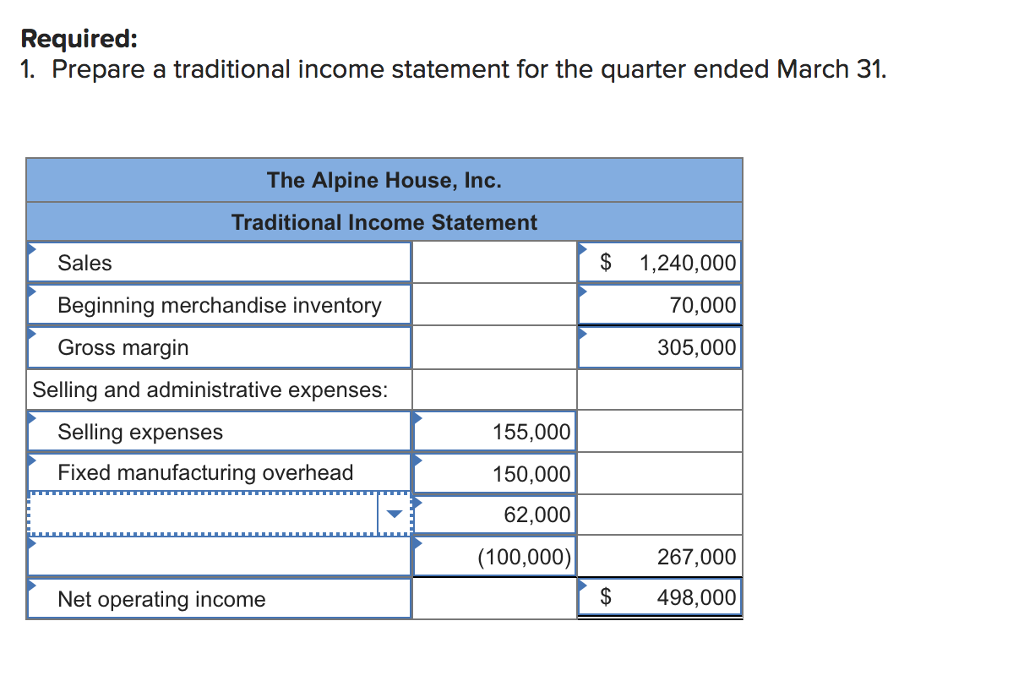

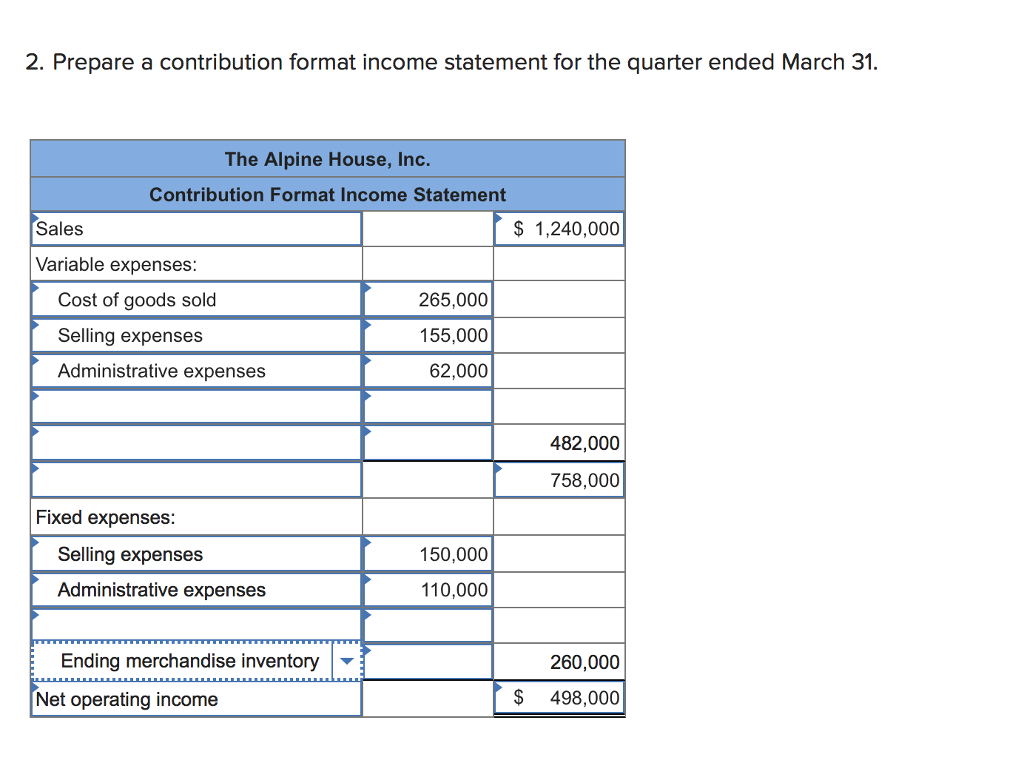

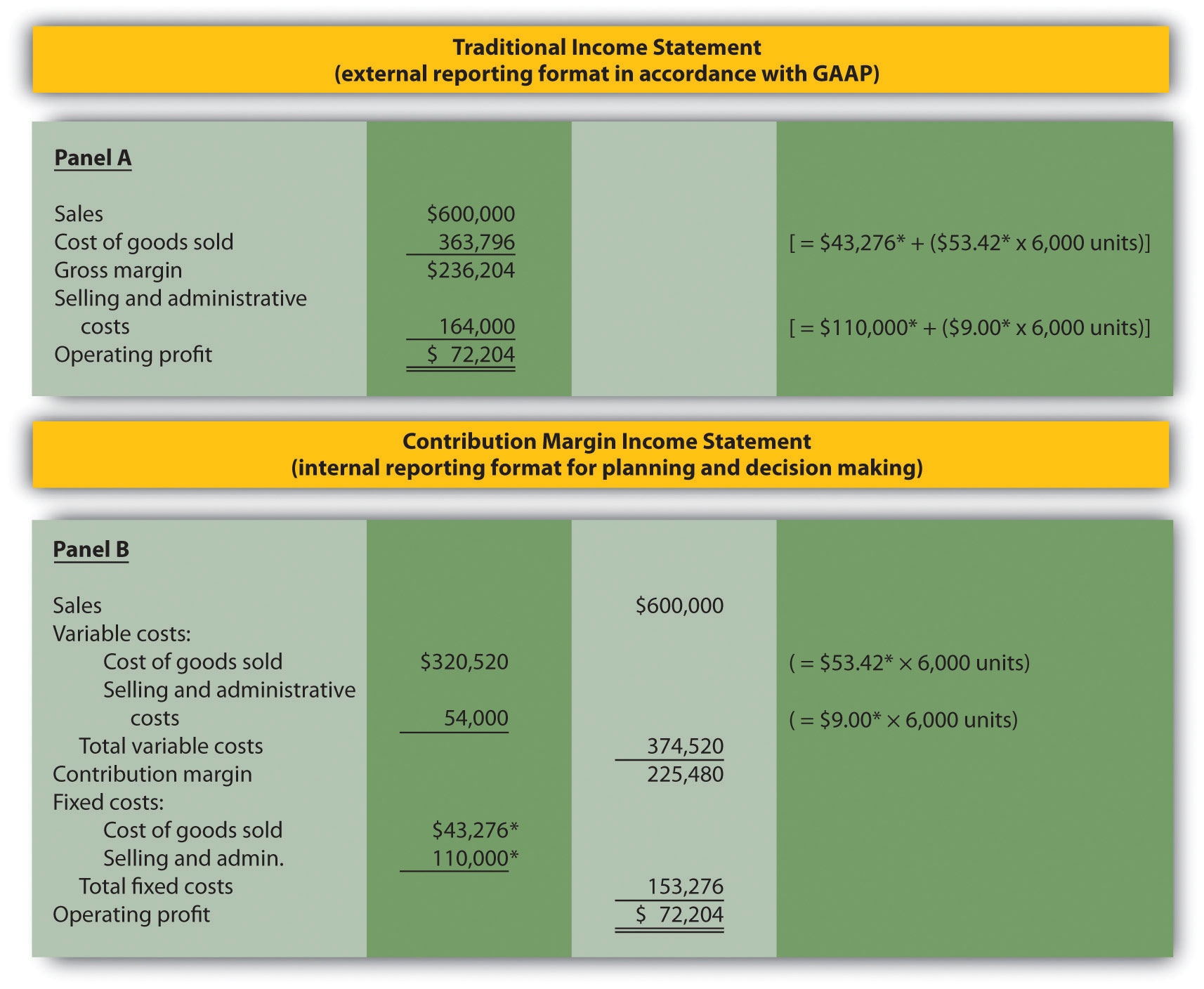

The contribution income statement. What is the contribution margin income statement? Notice that all variable expenses are direct expenses of the segment. Recall that the variable cost per unit remains constant, and variable costs in total change in proportion to changes in activity.

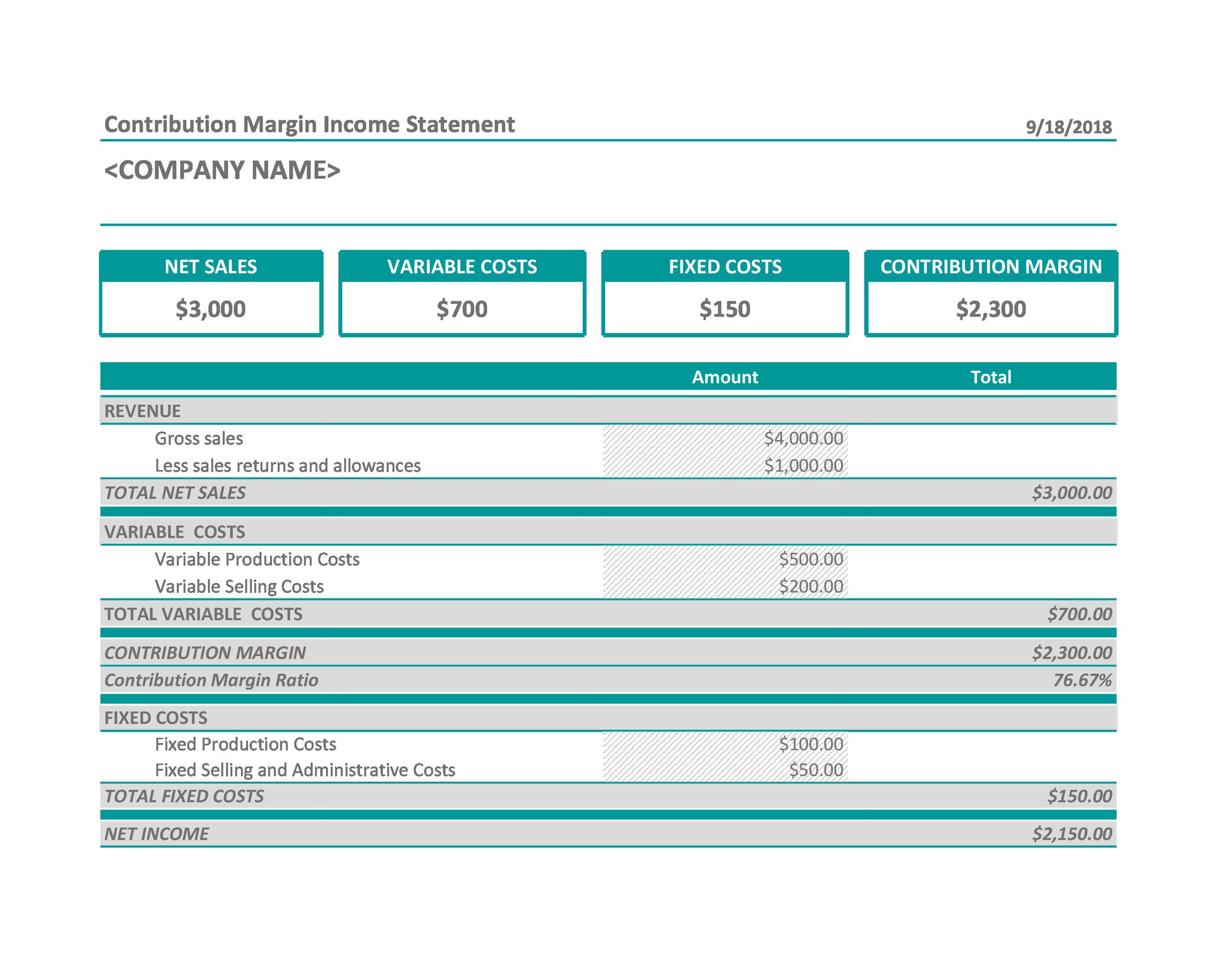

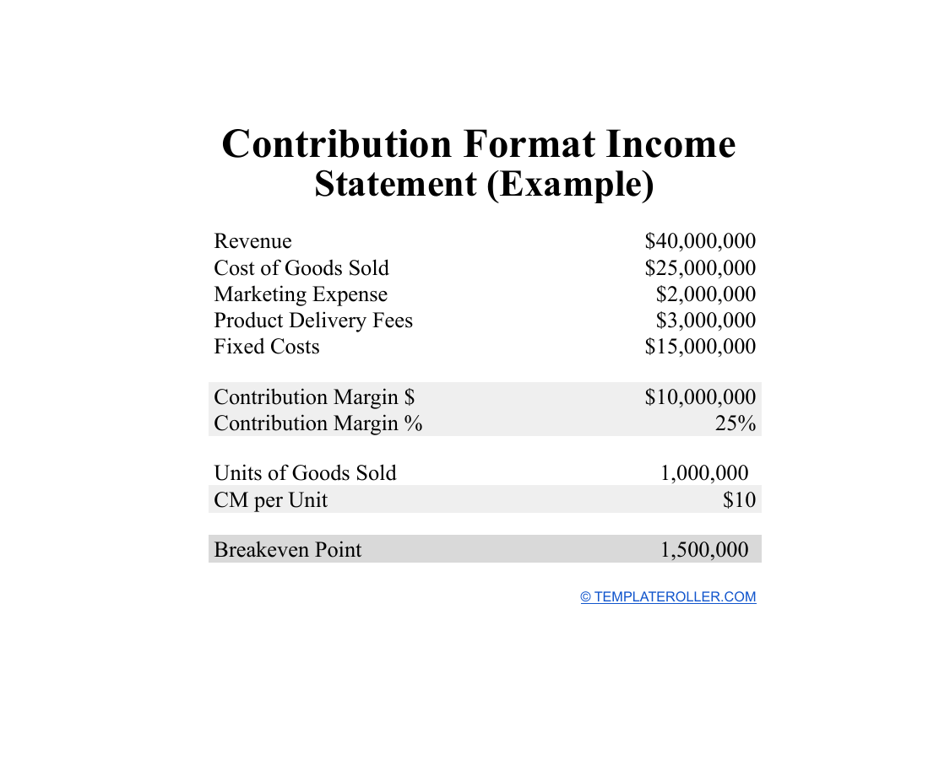

It then subtracts variable costs from net sales to. In the contribution margin income statement, we calculate total contribution margin by subtracting variable costs from sales. The contribution margin income statement helps leaders understand whether the company is profitable.

A contribution margin income statement separates fixed and variable business expenses and shows the revenue generated after those two categories of expenses have been paid. The cpf contribution rates for those aged 55 to 65 will be raised by a further 1.5 percentage points in 2025. Here we discuss components, the format of contribution margin income statement along with an example, advantages, and disadvantages.

Statement of retained earnings example; As a result, the contribution margin for the period is $700,000, and the company’s income for the period is $520,000. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit.

Understanding this can empower a company to optimize its financial strategy. It is the amount remaining that will contribute to covering. The contribution margin income statement is a useful tool when analyzing the results of a previous period.

In a contribution margin income statement, a company's variable expenses are deducted from sales to arrive at a contribution margin. The contribution margin income statement obtains the result of the number of contributions after deducting variable expenses from income. The phrase contribution margin can also refer to a per unit measure.

The contribution margin income statement. (2%) of the maximum fund salary, or mfs, now p10,000. Calculation of the contribution margin and the company’s income.

A contribution margin income statement is a document that tallies all of a company’s products and varying contribution margins together. The contribution margin represents sales revenue left over after deducting variable costs from sales. The contribution margin income statement separates variable and fixed costs in an effect to show external users the amount of revenues left over after variable costs are paid.in other words, this is a special income statement format that lists variable costs and fixed costs in order to calculate the contribution margin of the company.

A contribution income statement is a financial tool that separates variable costs from fixed costs, highlighting the contribution margin of sales revenue. Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount. You will be notified after the transfer of all sa savings to your ra and/or oa, and closure of your sa in early 2025.

No action is required from you now. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products. A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin.