Neat Info About Unearned Service Revenue Income Statement Company Balance Sheet Example

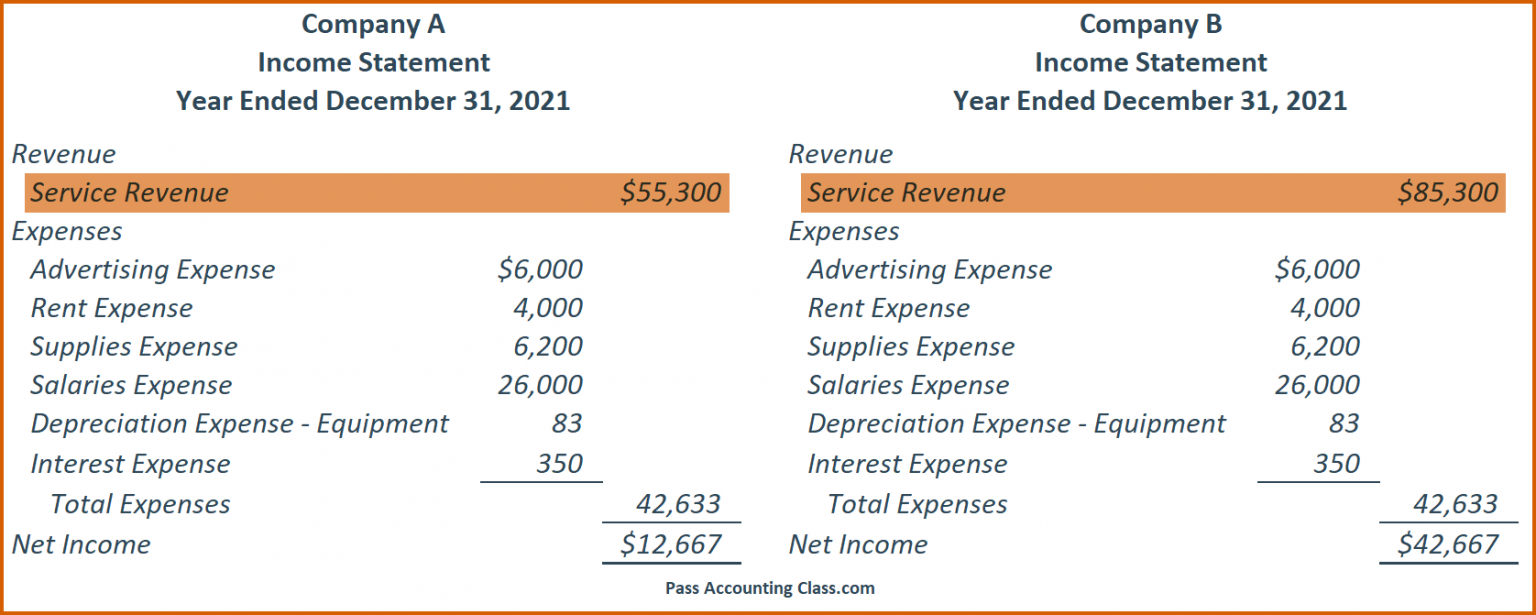

This refers to revenue a business receives before a service has been conducted.

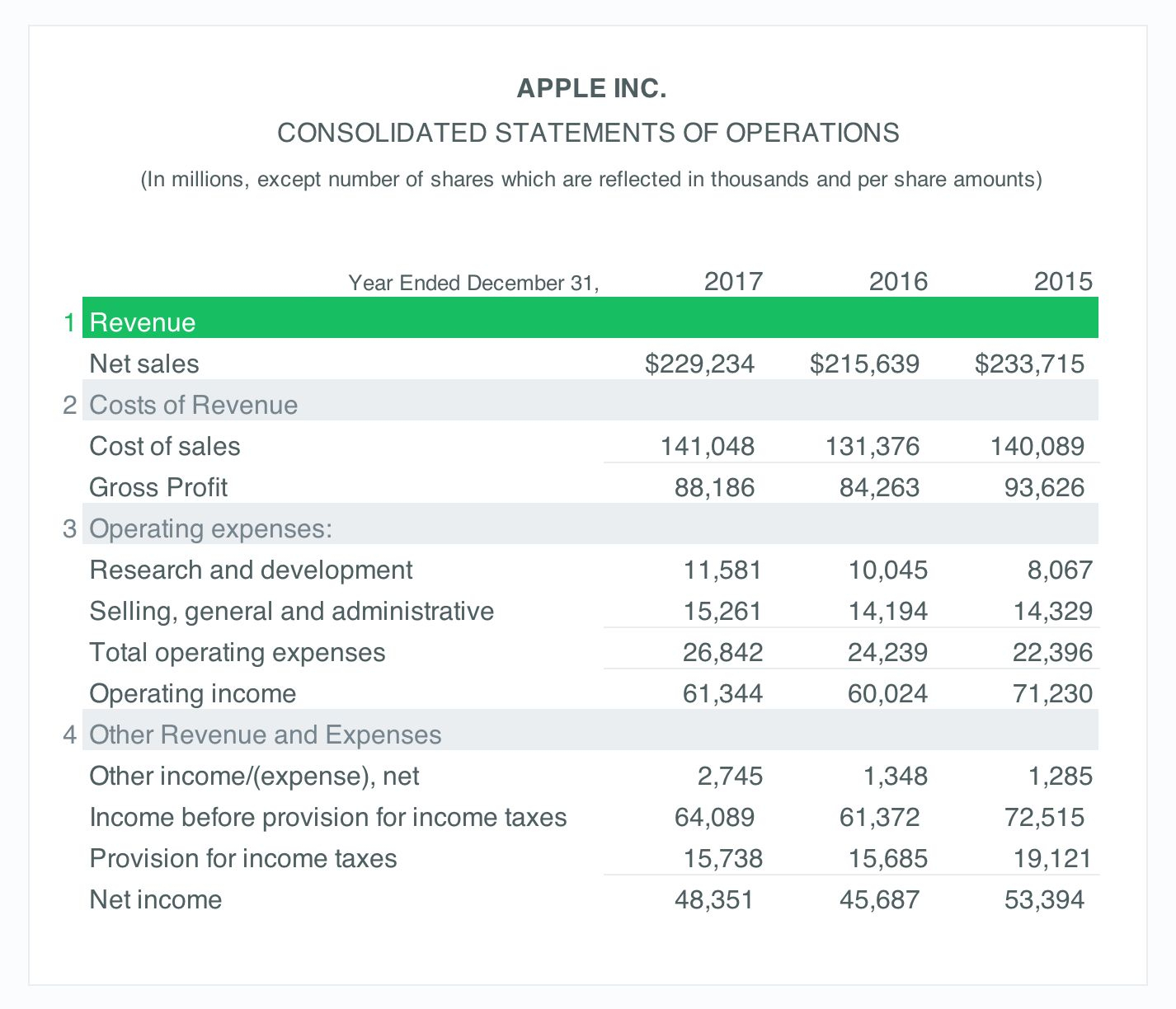

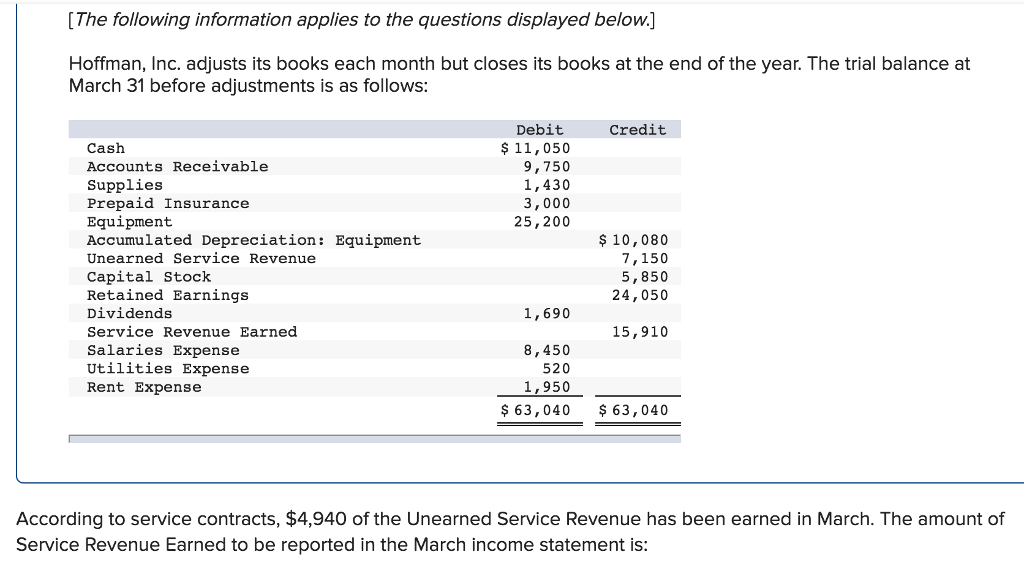

Unearned service revenue income statement. A balance sheet describes a company’s assets, liabilities, and equity or shareholders’ equity. Receiving funds early is beneficial to a company as it increases its cash flow that can. Balance sheet, income statement, and cash flow statement.

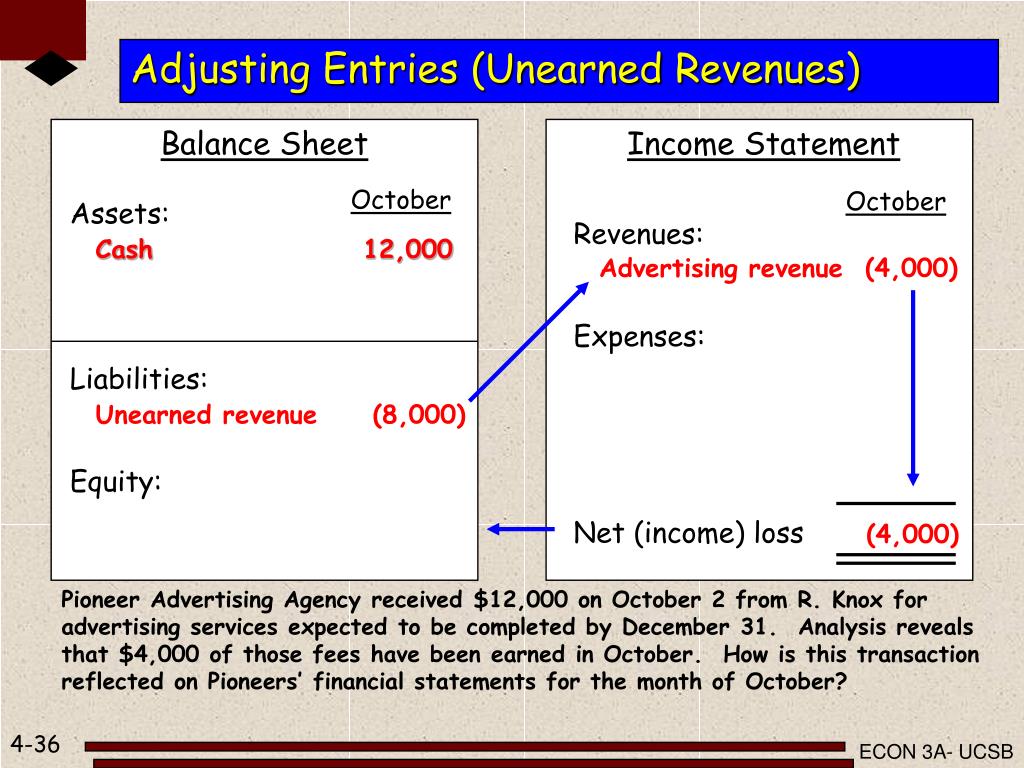

Unearned revenue is when you’re paid for goods or services you haven’t yet supplied. Unearned revenue is a liability, or money a company owes. Unearned revenue, also known as unearned income, deferred revenue, or deferred income, represents proceeds already collected but not yet earned.

Unearned income is a liability account in the balance sheet. As unearned revenues and expenses affect cash recognition, they are recorded in all three of the financial statements: To add service revenue to your income statement, simply follow the below steps.

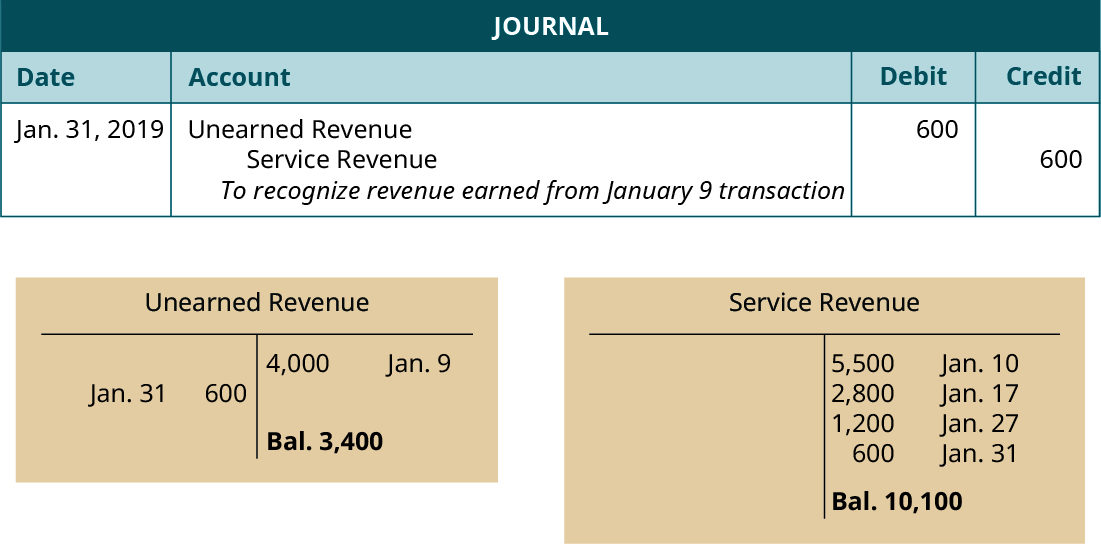

What is the definition of unearned revenue? Revenue must only be reported when it is unearned, which is due to the tax obligation on the revenue that is earned. There has been a decrease in the amount of unearned revenue.

Unearned revenue refers to the money small businesses collect from customers for their products or services that have not yet been provided. Here’s what you need to know about unearned revenue and how to record it in your financial statements. Once the service is performed or the product is delivered, it is transferred to the revenue account in.

See what you need to know about it. Unearned revenues do not go toward the revenues on the income statement because the money has not been earned. It represents an obligation to deliver goods or services in the future, for which payment has already been collected.

Only earned income can be included on an income statement. The unearned revenue of services is when the money is paid, but the. In simple terms, it is the prepaid revenue from the customer to the business for goods or services that will be supplied in the future.

Unearned revenue shows up in two places on the balance sheet. Unearned revenue is the money received by a business from a customer in advance of a good or service being delivered. For accounting purposes, revenue is recorded in the income statement, not the balance sheet.

This is why deferred revenue is also called unearned revenue. How does unearned revenue appear on the three financial statements? Such revenue, as with all financial transactions, is.

Is the money received by an individual or a company for services that have yet to be provided, or goods that are yet to be delivered. Unearned service revenue is income received by companies as payment for services or products to be provided in the near future. Once the product or service is delivered, unearned revenue becomes revenue on the income statement.

.webp)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/media/Is Unearned Revenue a Liability.jpg)