Sensational Info About Cash Flow From Investing Activities Indirect Method Other Receivables In Balance Sheet

When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items:

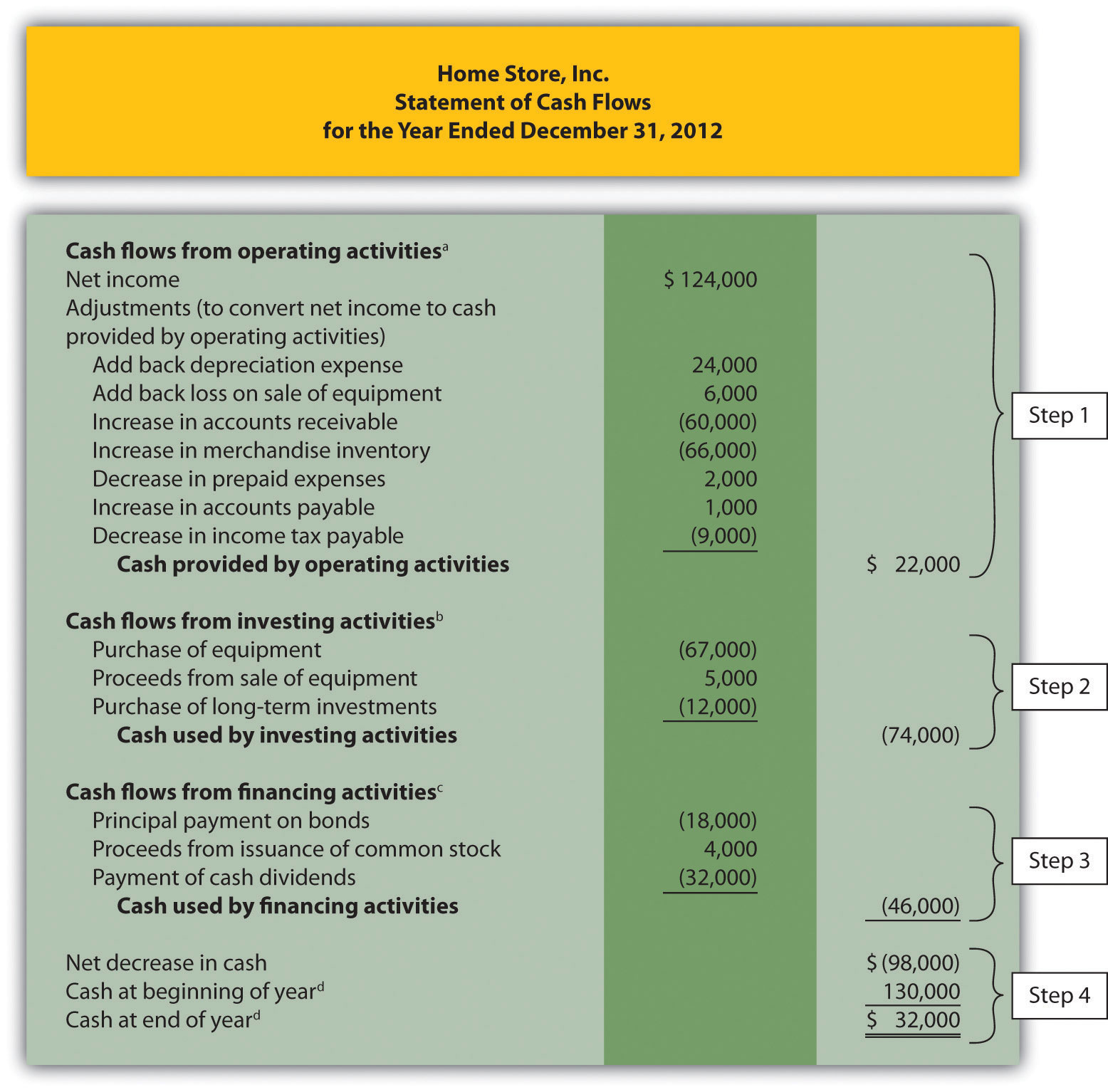

Cash flow from investing activities indirect method. Begin with net income from the income statement. Cash flows from operating activities. Cash flows from investing activities.

$22,300.00 changes in current operating assets and liabilities: The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. You can gather this information from the company’s balance sheet and income statement.

To eliminate this gain, the $40,000 amount must be subtracted. Cash flow indirect method: Using the indirect method, operating net cash flow is calculated as follows:

Begin with net income from the income statement. In applying the indirect method, a negative is removed by addition; In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow.

Let's take a closer look at the formulas from the above section with an example. Determine net cash flows from operating activities. Begin with net income from the income statement.

Start with net income after tax from the income statement. Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash flows. After that, the three steps demonstrated previously are followed although the mechanical process here is different.

Steps of operating activities section of the cash flows statement by using indirect method: What is the indirect method? Under the indirect method, the calculation of cash flows from operating activities begins with net income, which is then adjusted for changes in balance sheet accounts to arrive at the amount of cash generated or lost by operating activities.

Add back noncash expenses, such as depreciation, amortization, and depletion. It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: Determine net cash flows from operating activities.

Key takeaways cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. We will be using the indirect method to prepare the operating activities section. The indirect method is based on accrual accounting and is generally the best technique since most businesses use accrual accounting in their.

Cash flows from financing activities. Such as depreciation, amortization, interest expenses, loss on sales of fixed assets and investment. Using the indirect method, operating net cash flow is calculated as follows:

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)