Spectacular Info About Types Of Balance Sheet Reconciliations Amazon Uk Financial Statements

Types of balance sheet reconciliations include:

Types of balance sheet reconciliations. Balance sheet reconciliation is a process of verifying the accuracy of information presented in the balance sheet. These reconciliations include the following: Gather documentation and records before you can look over your balance sheet and reconcile it, gather the proper documentation.

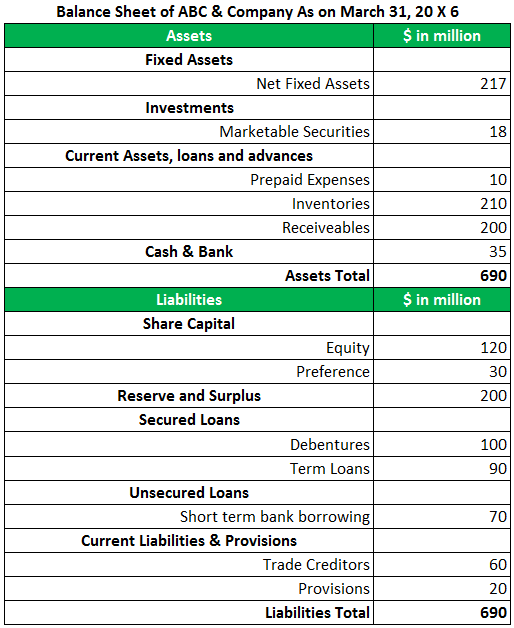

Collect relevant documents such as bank statements, credit card statements, invoices, receipts, and any supporting records. Among the most critical aspects of balance sheet. Balance sheets list assets and liabilities, and every transaction must be categorised as one or the other.

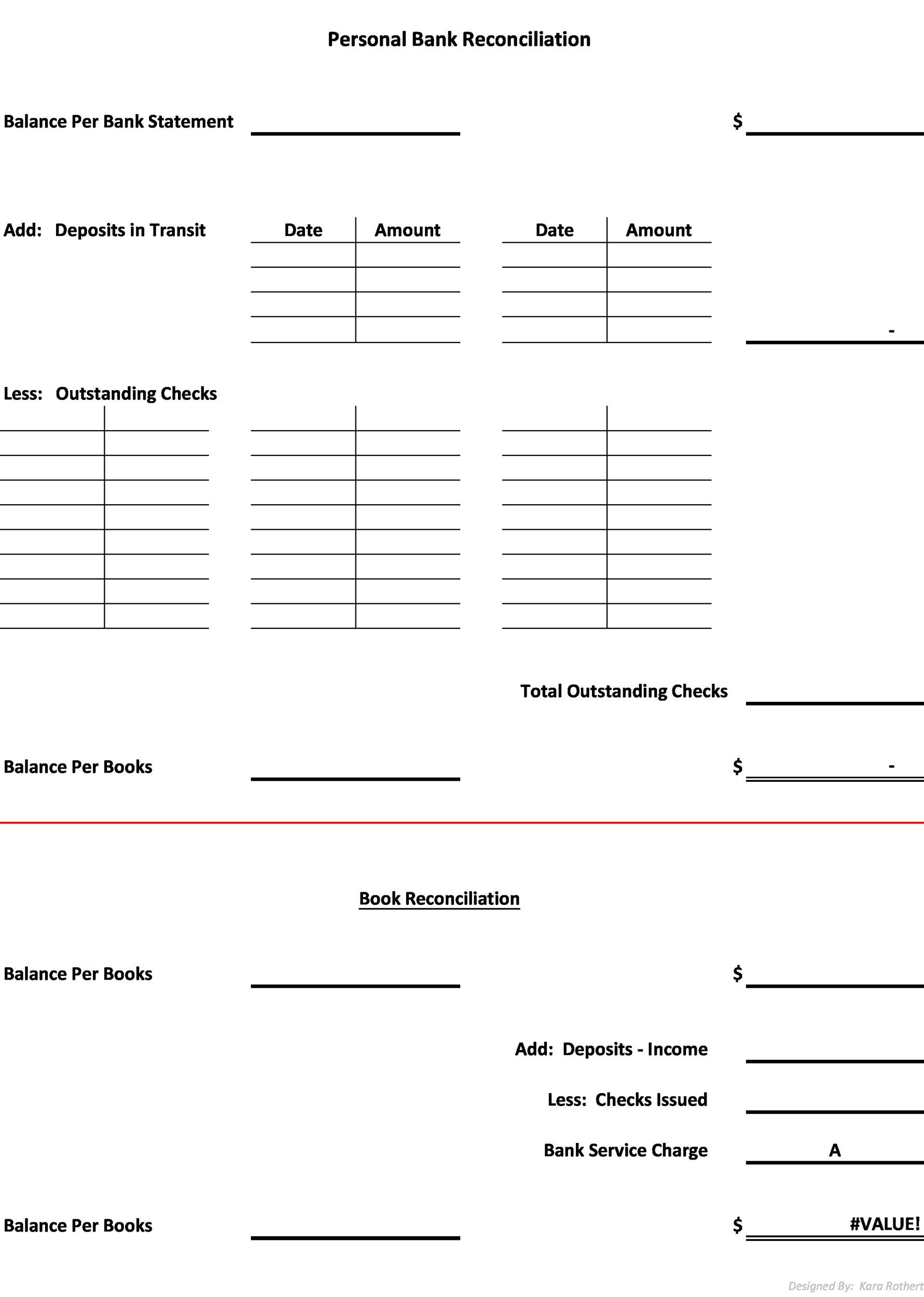

Reconcile and accrue into the next month. Here are some examples of balance sheet reconciliation: Businesses use their internal balance sheet accounts and compare them with external sources, like bank statements and supplier invoices, to ensure that everything aligns with the same dates.

A balance sheet reconciliation is the process of verifying the balances reflected on the balance sheet against supporting documentation. Common accounts include bank accounts, credit cards, accounts receivable, and accounts payable. The balance sheet is a compilation of various accounts that collectively depict a company’s financial health.

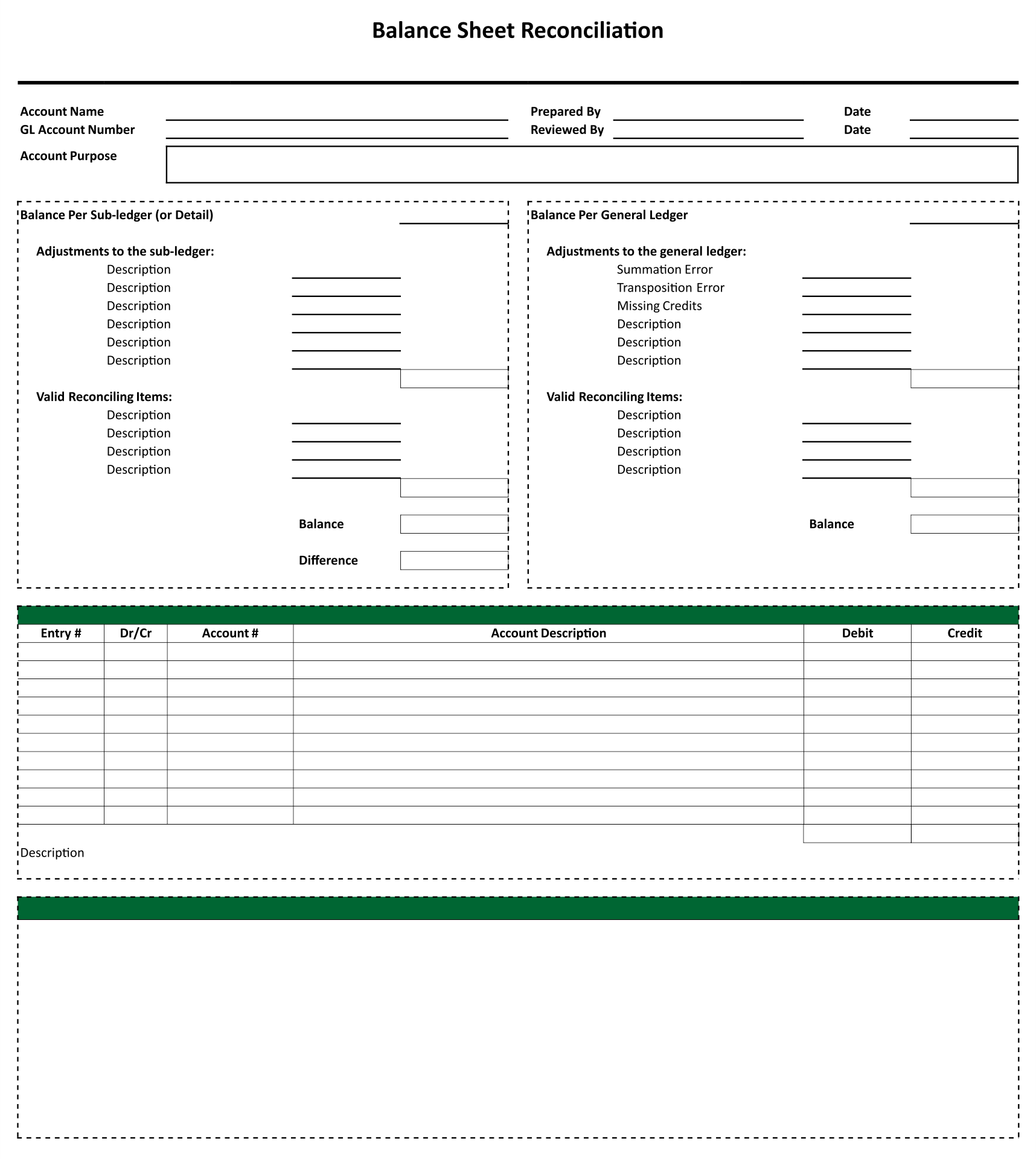

A balance sheet account balance reconciliation is the comparison of one or more asset or liability balances on the statement of financial position (also known as the “balance sheet”) to another source of financial data, such as a bank statement, a subledger or another system. Bank statements receipts current account balances other accounting and financial records It involves comparing the balances in the balance sheet with the general ledger and supporting documents such as bank statements, credit card statements, and invoices.

Account reconciliation is a critical step and key control for finance and accounting. Oct 11, 2023 financial close: The ideal situation is where the reconciliation is zero.

What are the types of balance sheet reconciliations? Check the different types of balance sheet reconciliation with examples Account reconciliation in accounting is when two matching sets of data are compared to ensure they are consistent and accurate.

Determine which accounts need reconciliation. When it comes to the types of reconciliation, two components prevail. Balance sheet reconciliation is simply a process that ensures the accuracy of a company’s financial statements.

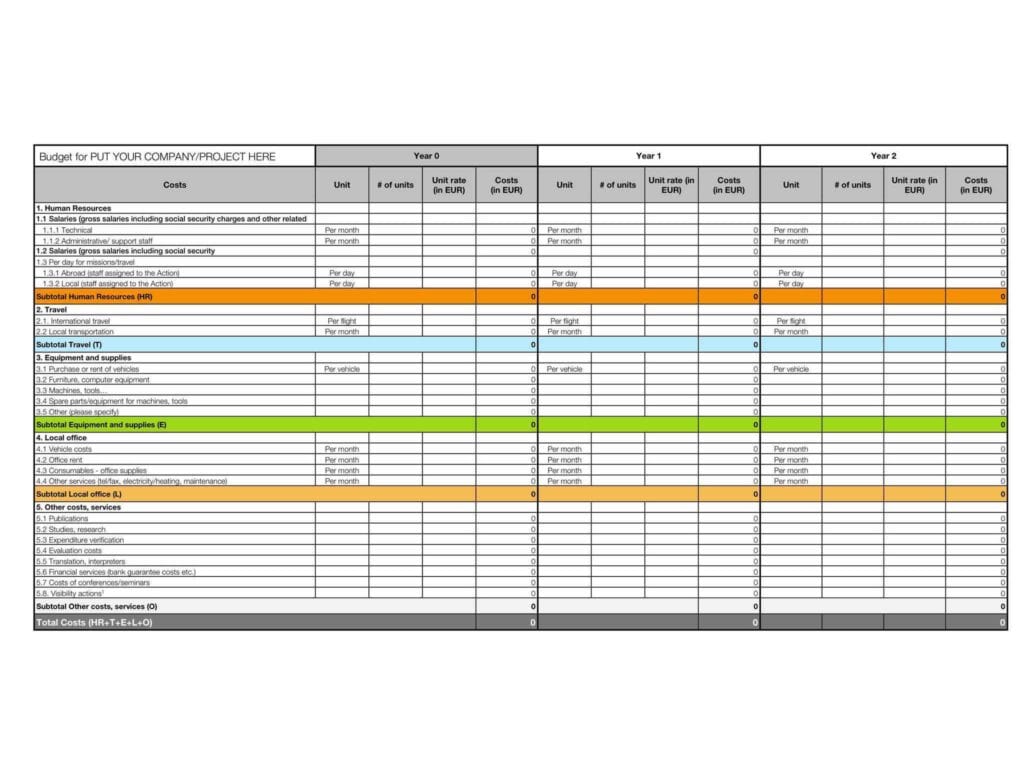

The vertical format tends to be more widely used, but both can fulfill the job! The following instructions provide best practice guidance for individuals responsible for reconciling balance sheet account balances on a quarterly basis. One of these basic procedures is monthly balance sheet reconciliations.

Essentially, reconciliation is done to verify that accounting for a certain period has been accurately portrayed on a company’s books. Balance sheet reconciliation is the process of reviewing transactions on your overall balance sheet, while bank reconciliations focus specifically on bank statements and cash accounts. Balance sheet reconciliations are simply a comparison of the amounts that appear on your balance sheet general ledger accounts to the details that make up those balances, while also ensuring that any differences between the two.