Outrageous Info About Company Audited Accounts Financing Activities

A company’s annual accounts for the financial year must be audited…unless the company is exempt from audit.

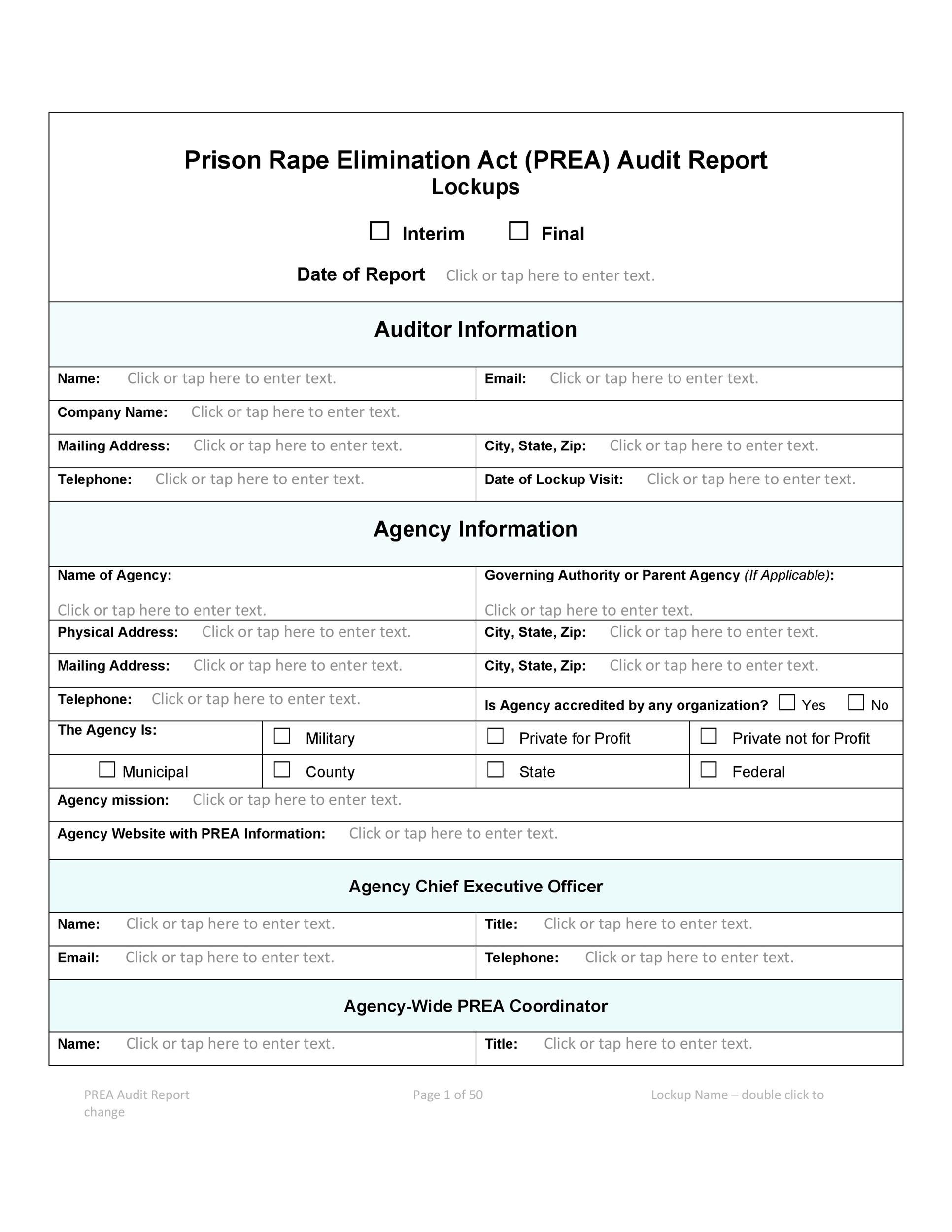

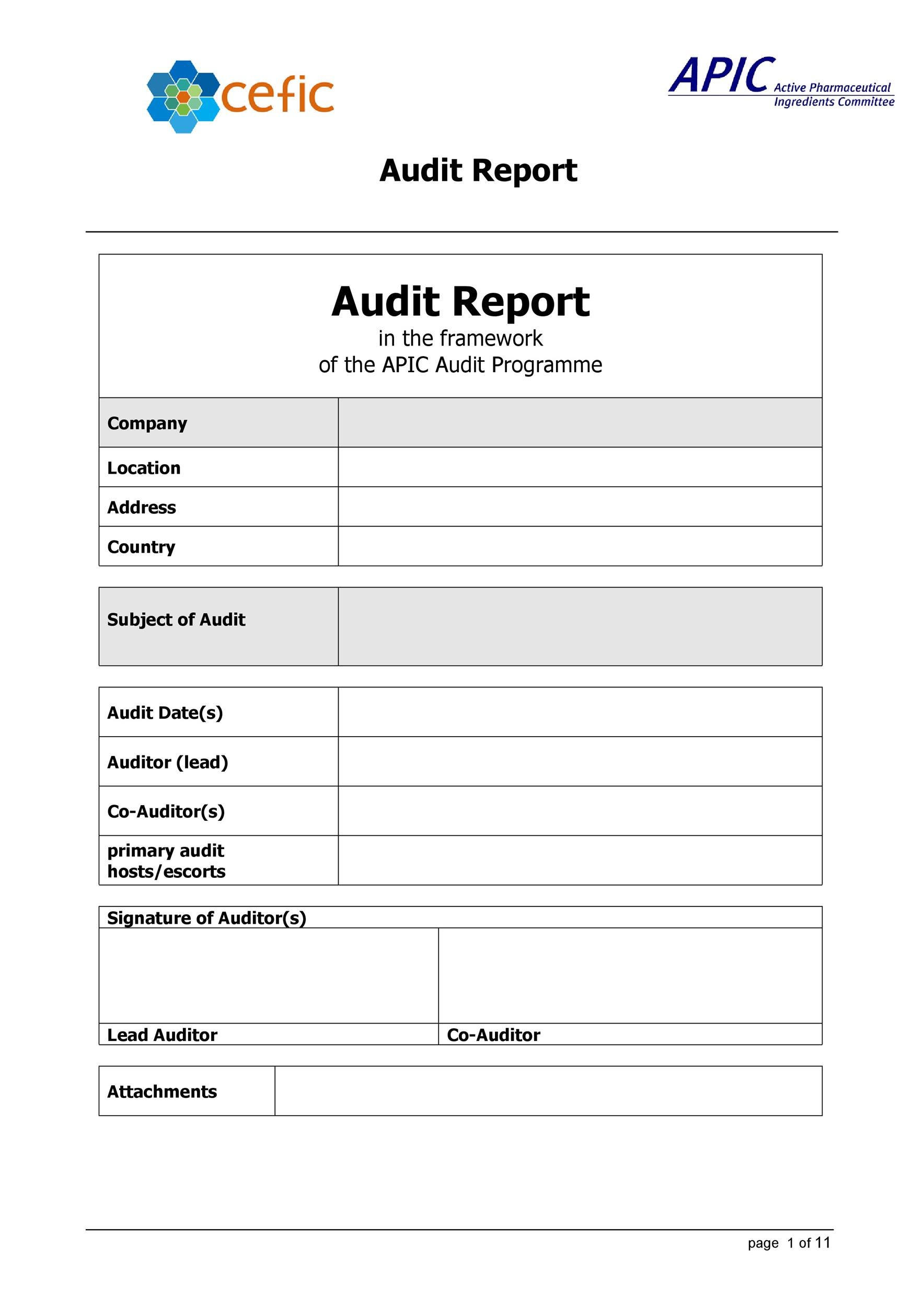

Company audited accounts. Conduct an audit, also referred to simply as auditing standards. You may not need to get an audit of your private limited company’s annual accounts. Audits can be performed by internal parties and a government entity, such as the internal revenue service (irs).

The agm will be held at 11:30 am on 25 march 2024 at the offices of hardide plc, 9 longlands road, bicester, oxfordshire ox26 5ah. Audits provide investors and regulators with confidence in the accuracy of a corporation’s financial reporting. All the audits look at are the accounting books and financial statements for public companies and businesses, most of which have to go through the auditing of accounts once every year, mandated by law.

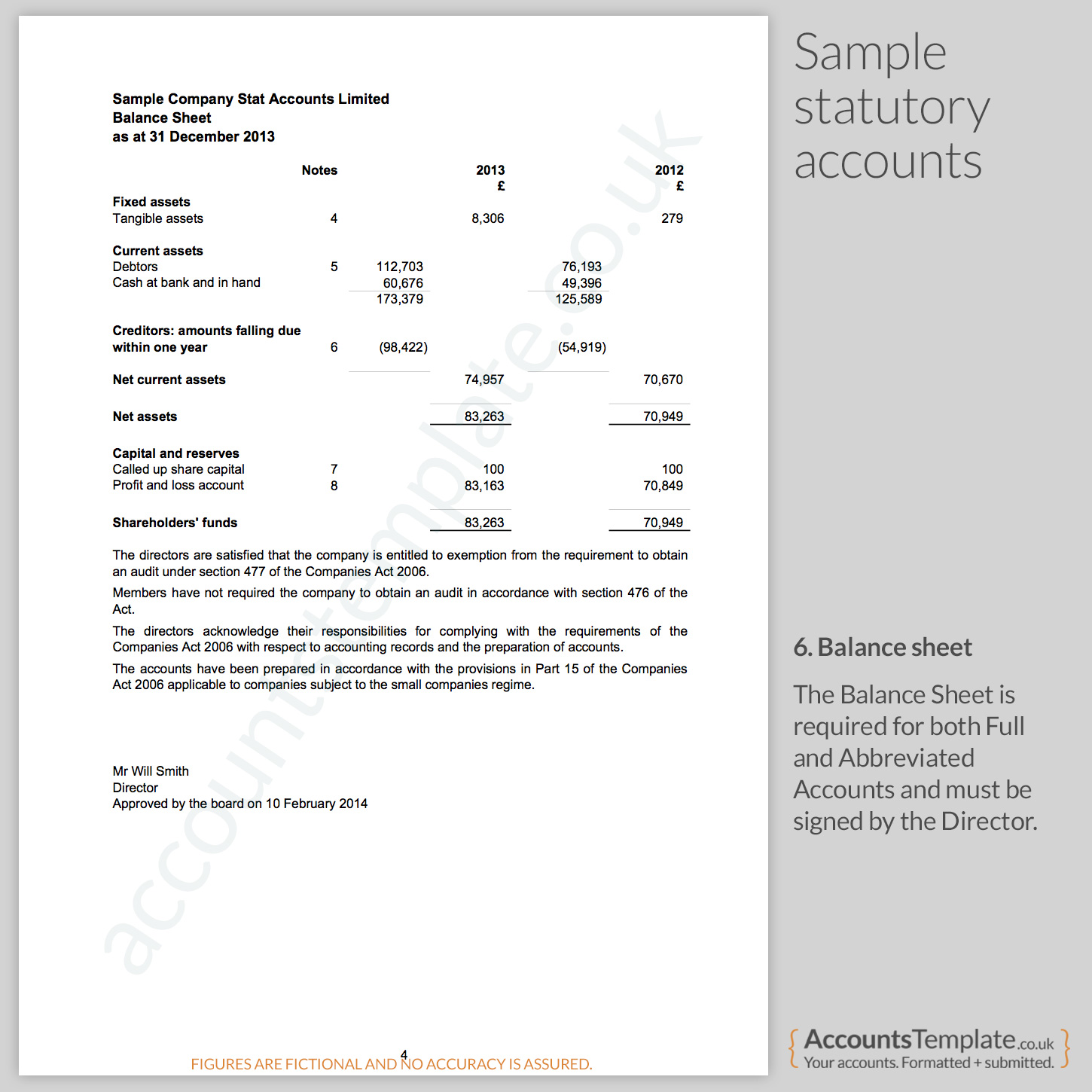

And, this should always be the starting point. If you are a small. The companies act 2006 states that a company’s annual accounts for a financial year must be audited unless the company is exempt from audit (s475).

In other words, small company and micro entity do not need to audit their accounts. An auditor is an official whose job it is to carefully check the accuracy of business records. Planning is crucial, and additional time needs to be taken to adequately prepare for an audit.

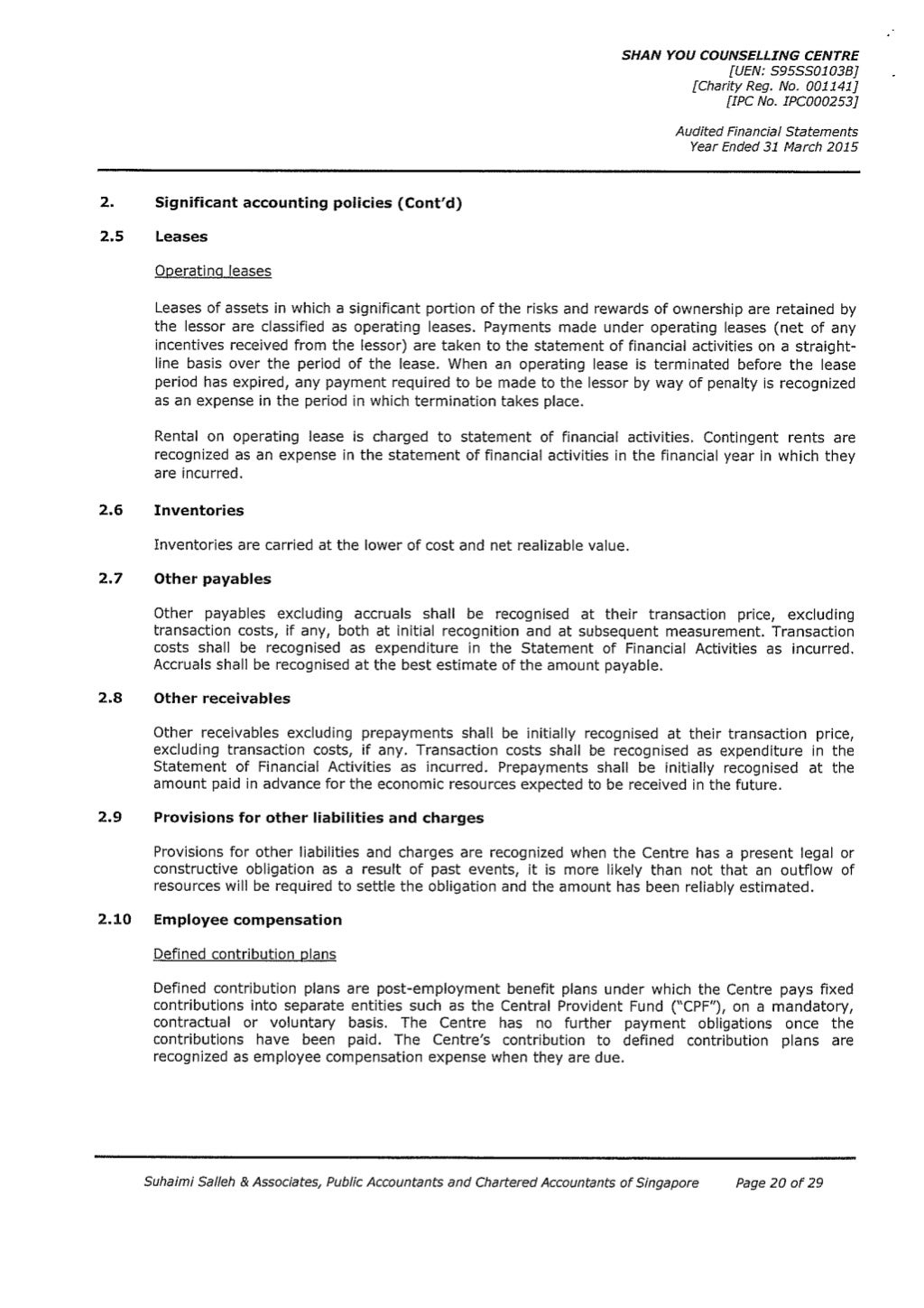

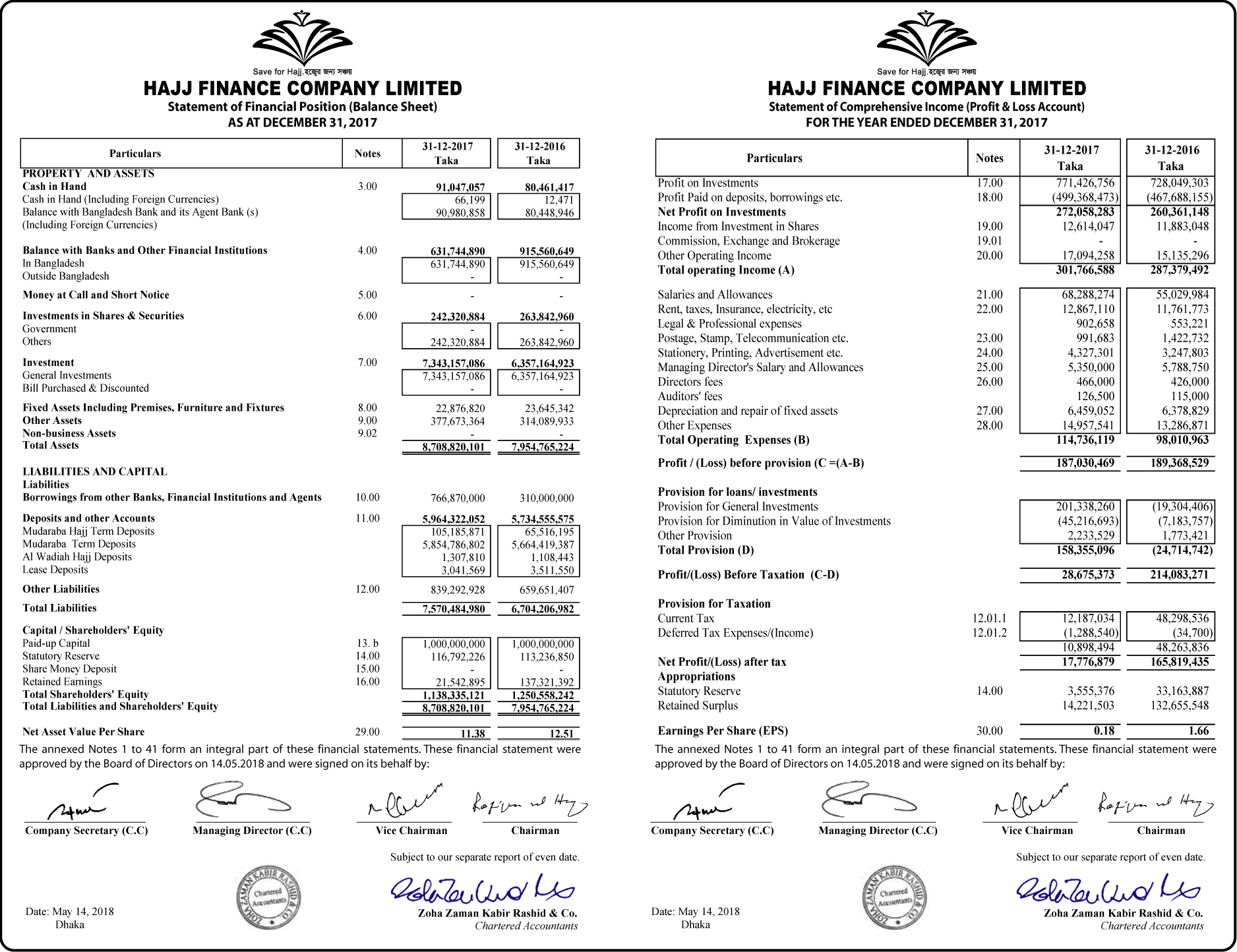

The accounting audit process is designed to ensure that the financial statements are examined thoroughly and accurately, providing stakeholders with confidence in the reliability of the financial information. An audit is the review or inspection of a company or individual's accounts by an independent body. You should read this guidance.

It may be a few months or a few weeks, depending on the complexity of financial records. In this section the corporate reporting faculty provides an overview of uk financial reporting regulation for different types of company.

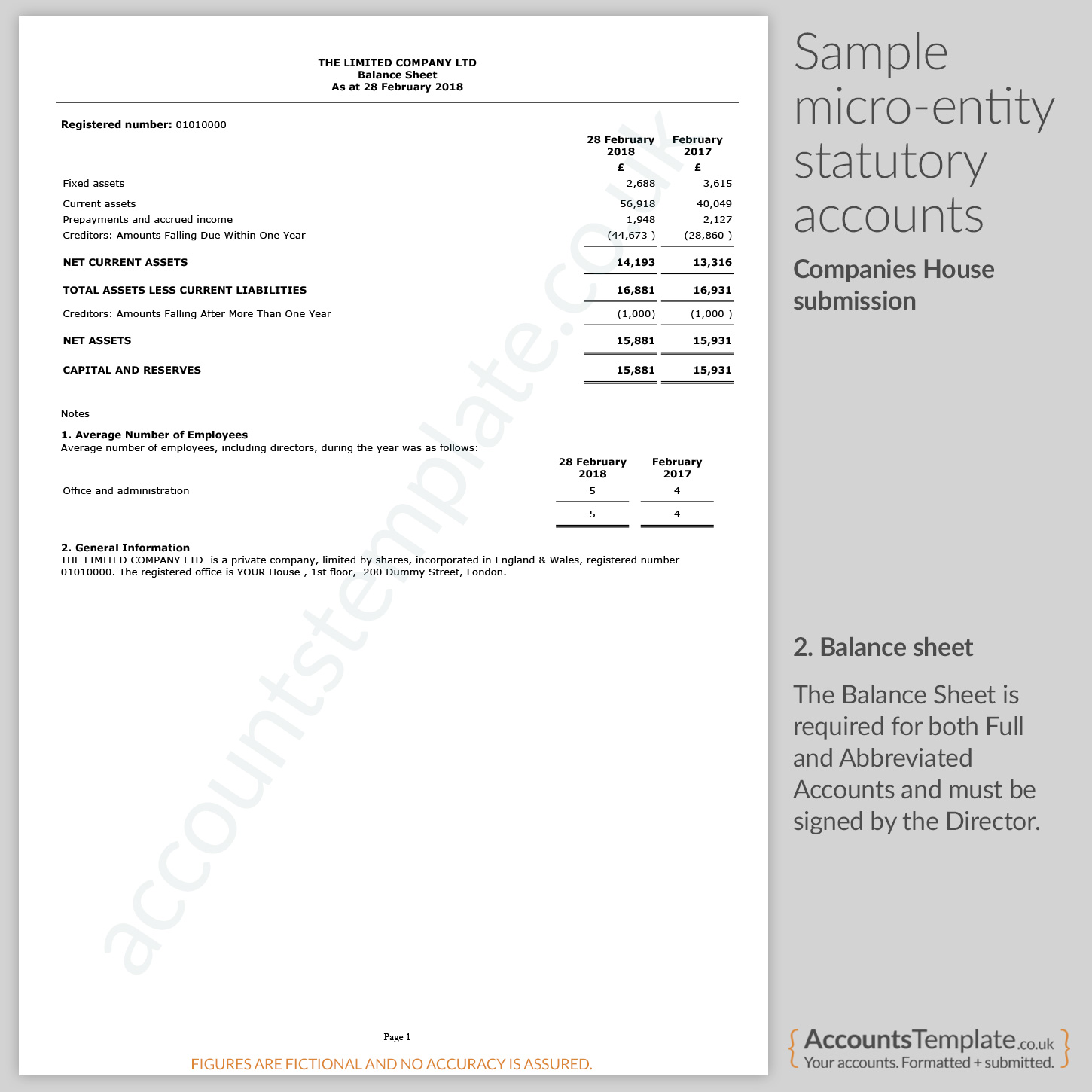

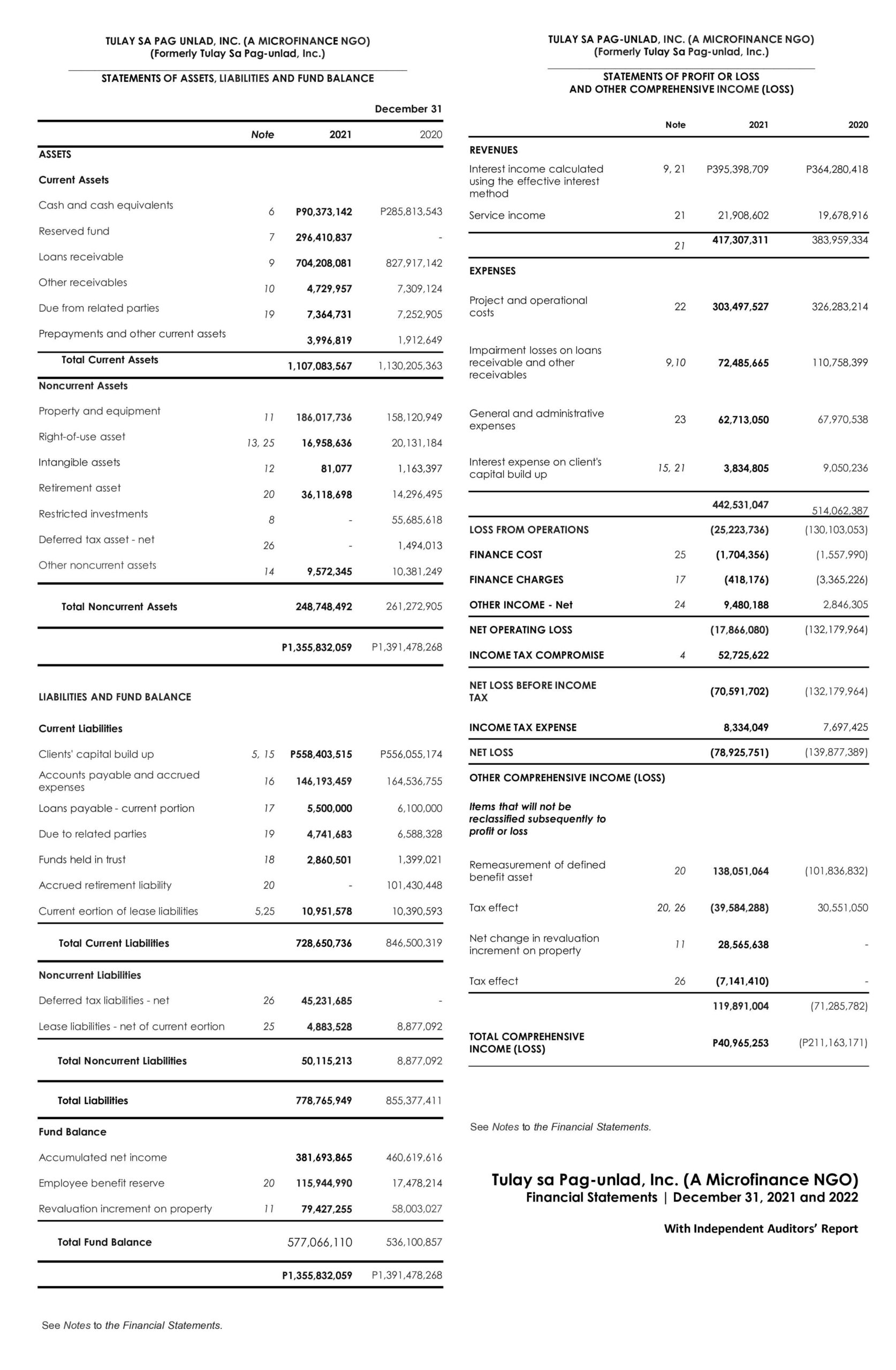

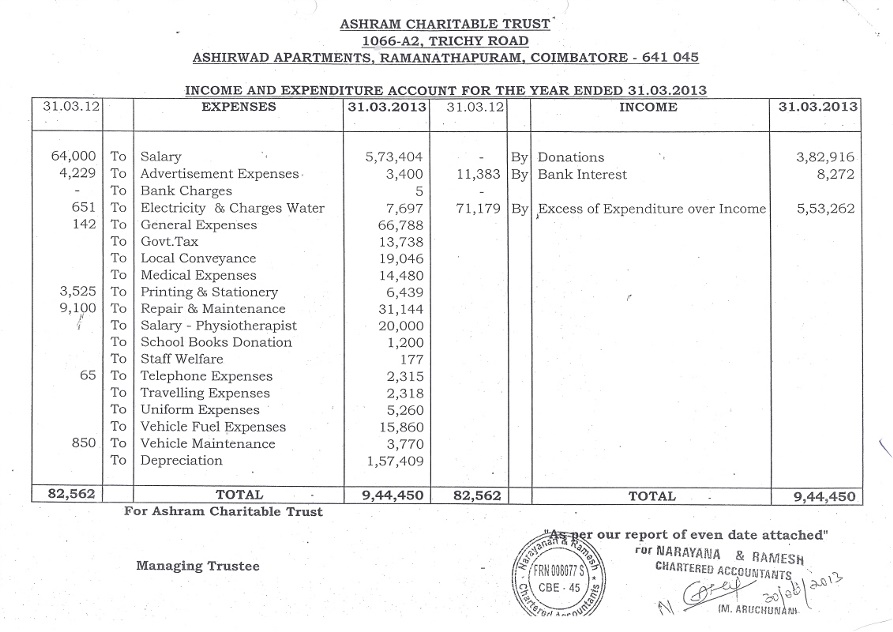

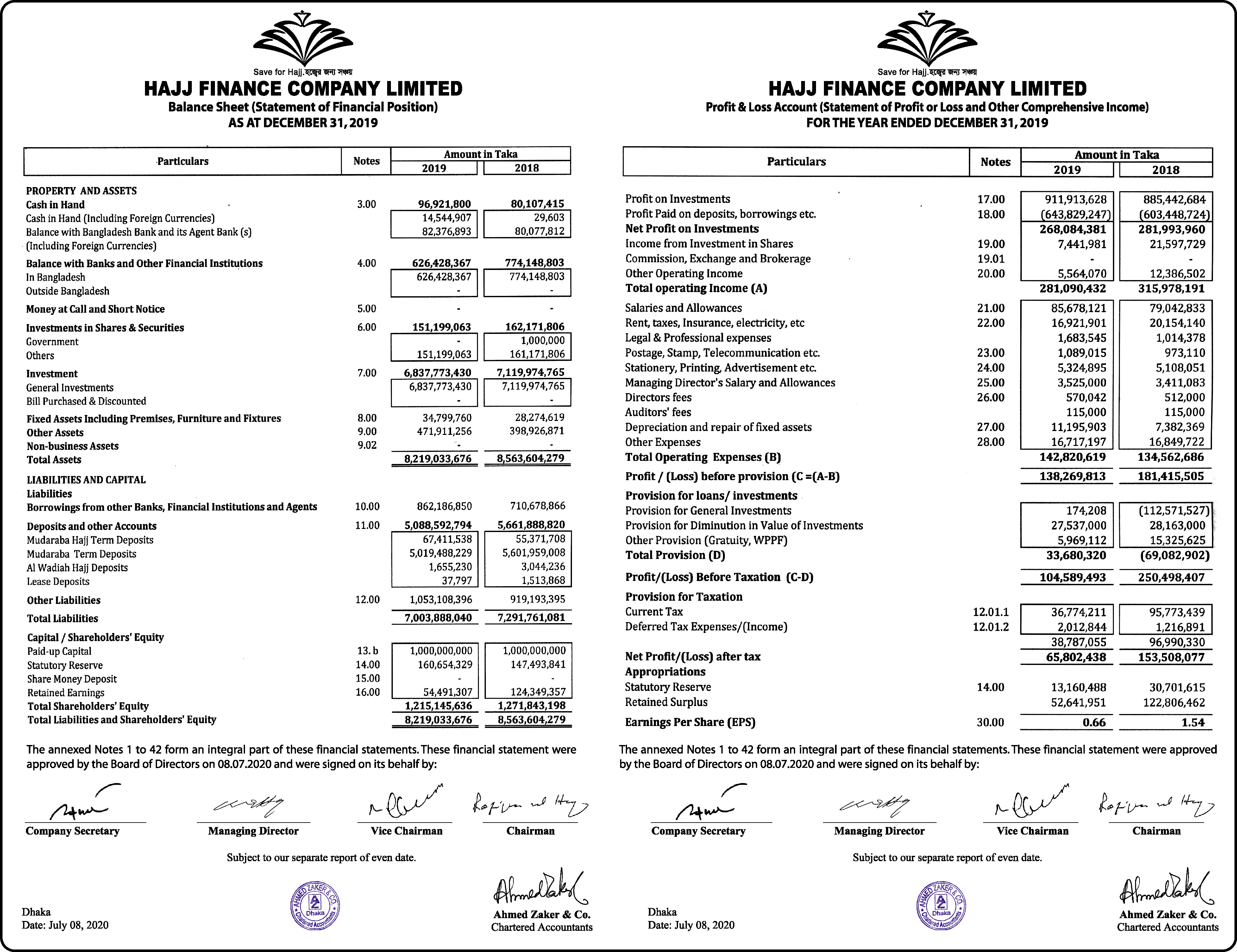

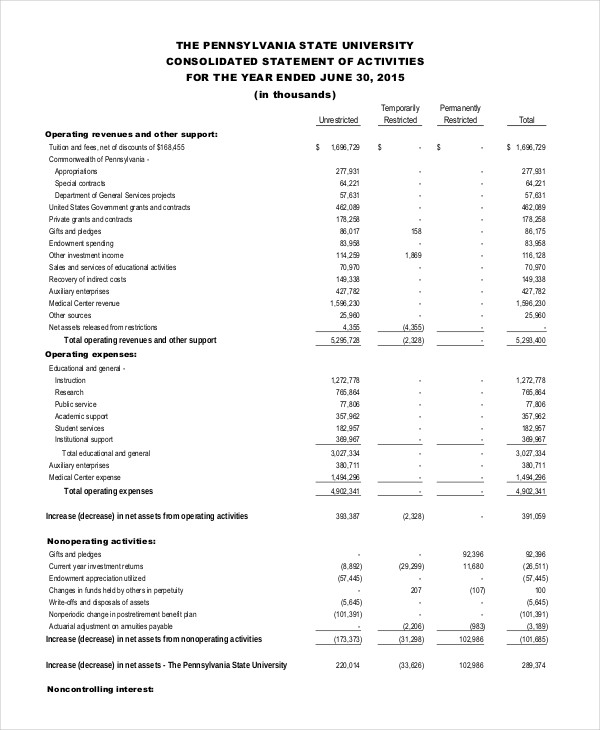

Example financial statements and disclosure checklists for uk gaap available from the icaew library. An audit is an examination of the financial statements of a company, such as the income statement, cash flow statement, and balance sheet. An auditor might be either an internal auditor , external auditor or independent auditor for.

Audited accounts are financial statements verified and checked by an independent, registered auditor who is a qualified individual trained in doing so. The average annual net price of the universities in this ranking amounts to about $17,500. Cost of an online accounting degree.

New york — capital one financial said it will buy discover financial services for $35 billion, a deal that would bring together two of the nation's major credit card companies as well as. However, some companies even if they are small companies and micro. Companies house accounts guidance updated 5 april 2023 this guidance tells you about the accounts a company must deliver every year to companies house.

Public companies are obligated by law to ensure that their financial statements are audited by a registered certified public accountant (cpa). When the financial results which a company compiles have been checked by an accountant qualified to conduct an audit, known as an auditor, they are known as audited accounts. Audit exemption for private limited companies.