Smart Info About Retained Earnings Ifrs Six Financial Statements

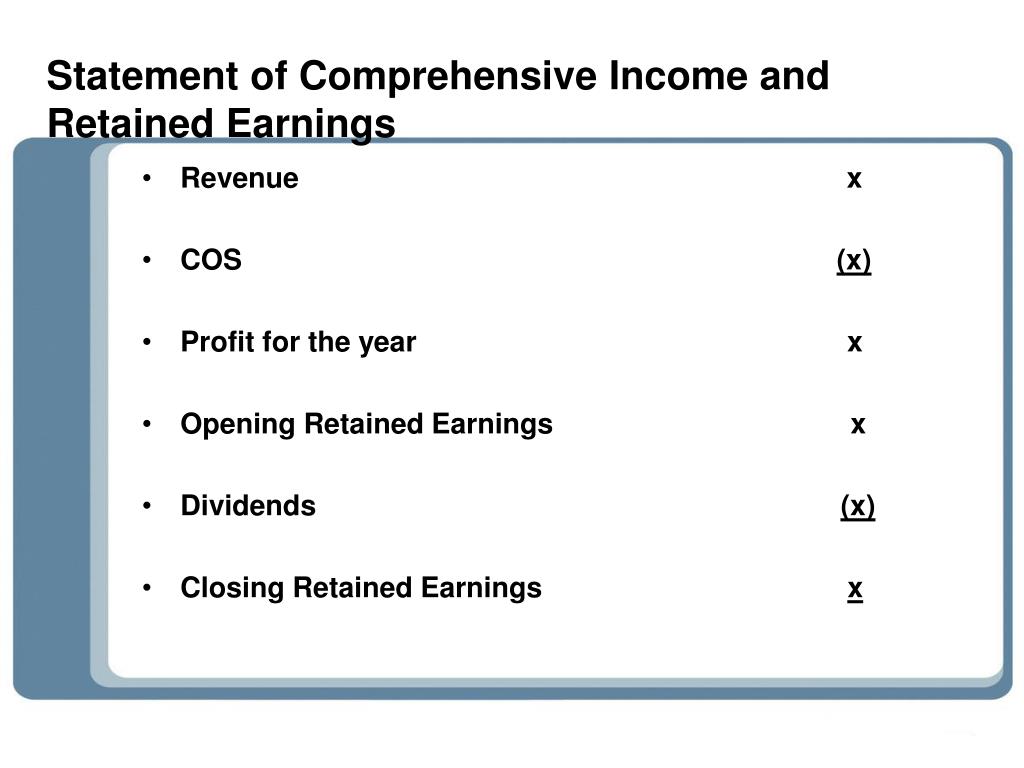

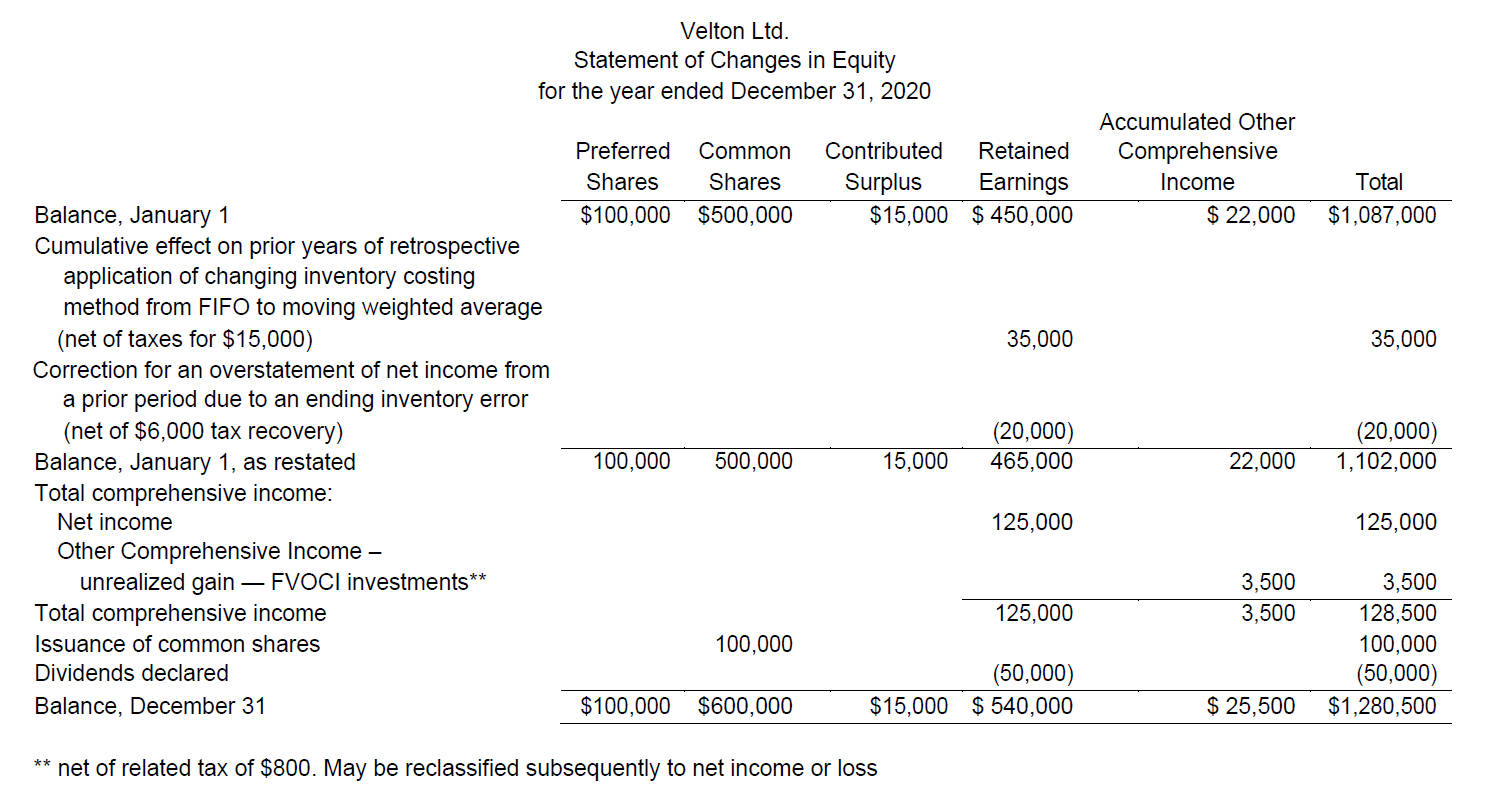

The adjustment to reflect this change is presented in the opening balance of retained earnings for the earliest period presented.

Retained earnings ifrs. Ifrs 2 amends paragraph 13 of. Consolidated financial statements (issued may 2011), ifrs 12 disclosures of interests in other entities (issued may 2011), ifrs 13 fair value measurement (issued may 2011),. Where re = retained earnings.

The dividend will be taken from the retained earnings (cash. Earnings per share (eps) ifrs eps was usd0.60 for the quarter, a decrease of 10% vs. Earned capital is the capital that.

Shares is amortised to retained earnings using the effective interest method and treated as a preference dividend for the purposes of calculating earnings per share. This means these amounts should be transferred to p/l as a reclassification adjustment (for instance, in the case of foreign currency translation) or directly to. While the retained earnings statement shows the changes between the beginning and ending balances of the retained earnings account during the period,.

The journal entry decreases the unappropriated retained earnings account. Including the full text of section 6 statement of changes in equity and statement of income and retained earnings of the ifrs for smes standard issued by the international accounting standards board in october 2015 with extensive explanations, self. Restricted retained earnings is the portion of a company’s earnings that has been designated for a particular purpose due to legal or contractual obligations.

Retained earnings are the profits that the company keeps for use internally or for when a need arises. Retained earnings shows the company’s accumulated earnings (or deficit in the case of losses) less dividends. That is, if comparative periods are not restated, the difference between the previous carrying.

Furthermore, those details may be costly: Accounting policies and explanatory notes. Beginning of period retained earnings.

Recall that net income or loss is closed to retained earnings. Using the other comprehensive income. The presentation and classification of items in the financial statements shall be retained from one period to the next unless a change is justified either by a change in.

Us financial statement presentation guide 5.8 retained earnings represents the earned capital of the reporting entity. At the end of each accounting period, retained earnings are reported on the balance sheet as the. The statement of retained earnings (retained earnings statement) is a financial statement that outlines the changes in retained earnings for a company over a.

Retained earnings of direct investment enterprises (die) are also attributed as transactions of the direct. Opening retained earnings or other components of equity, as appropriate. (a) finance costs paid in cash (b) income taxes paid in cash (c) includes unrealised foreign exchange loss xyz group:

Accounting mismatches may also arise between retained earnings and accumulated other comprehensive income.

:max_bytes(150000):strip_icc()/appropriated-retained-earnings.asp_Final-bd22f4f9a28c4dc3a07e7d95890f5910.png)