First Class Info About Two Types Of Profit Expense Statement Example

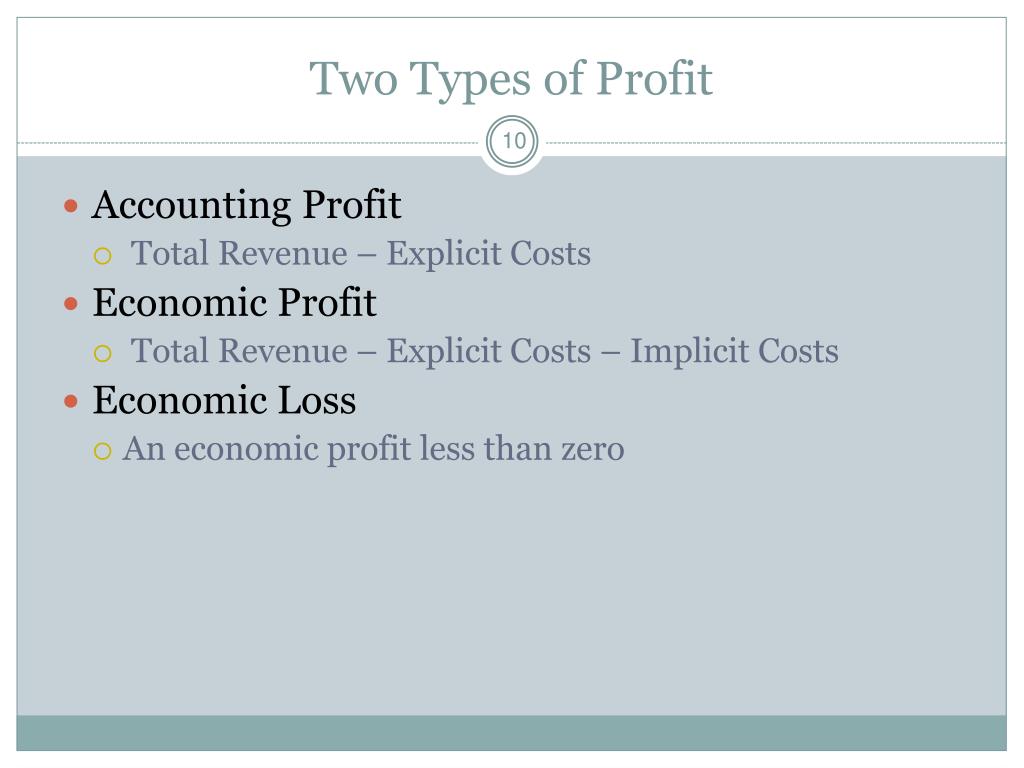

E economic profits are negative.

Two types of profit. A positive result is a profit, and a negative result is a loss. The third type accompanies the violation of perfect competition itself. Ebitda (which excludes depreciation) is.

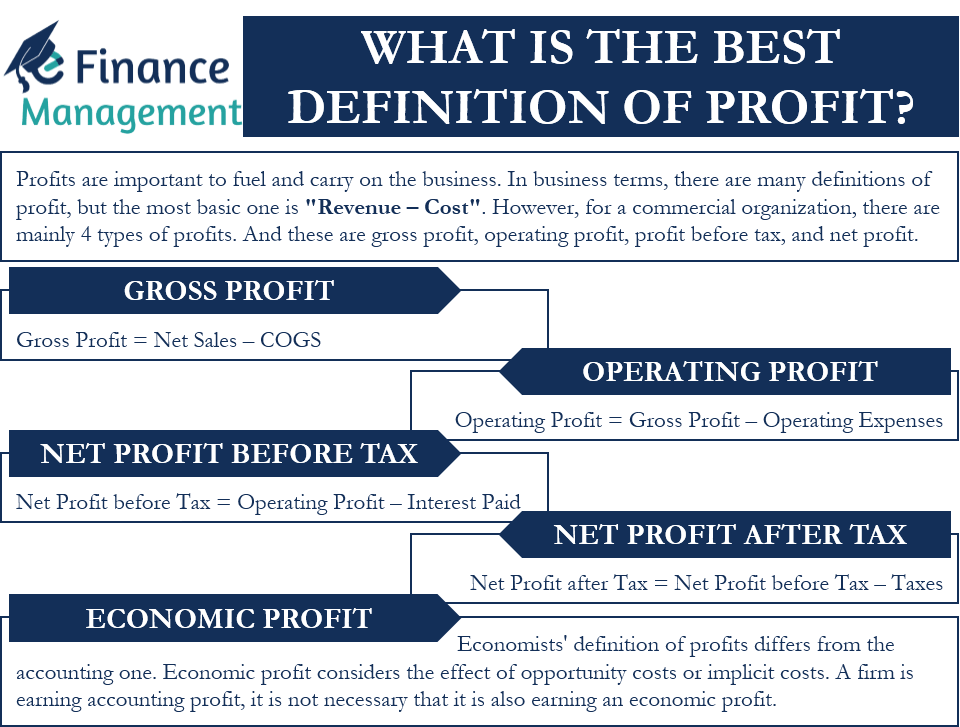

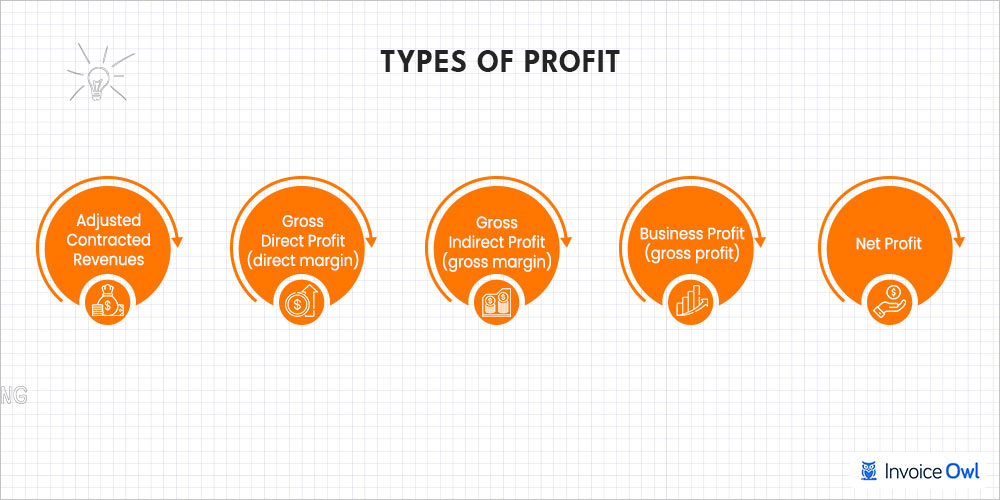

Types of profit. Gross profit is the profit earned by any company or any individual after removing the cost associated with selling and marketing the product from the selling price. A accounting profits are negative.

Thus innovations can be divided into two categories. There are three types of profit equations commonly used by businesses: Accounting profit and economic profit.

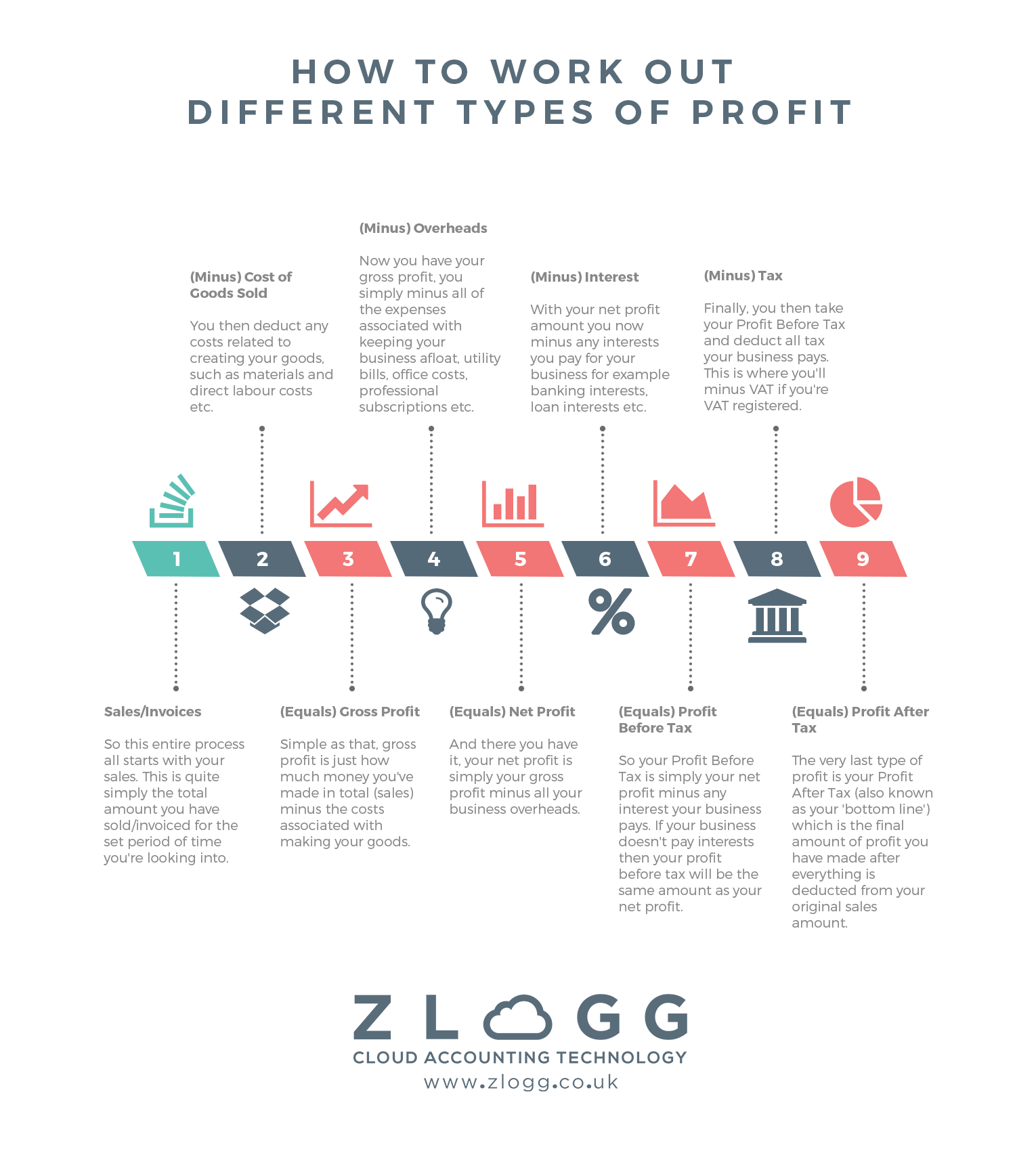

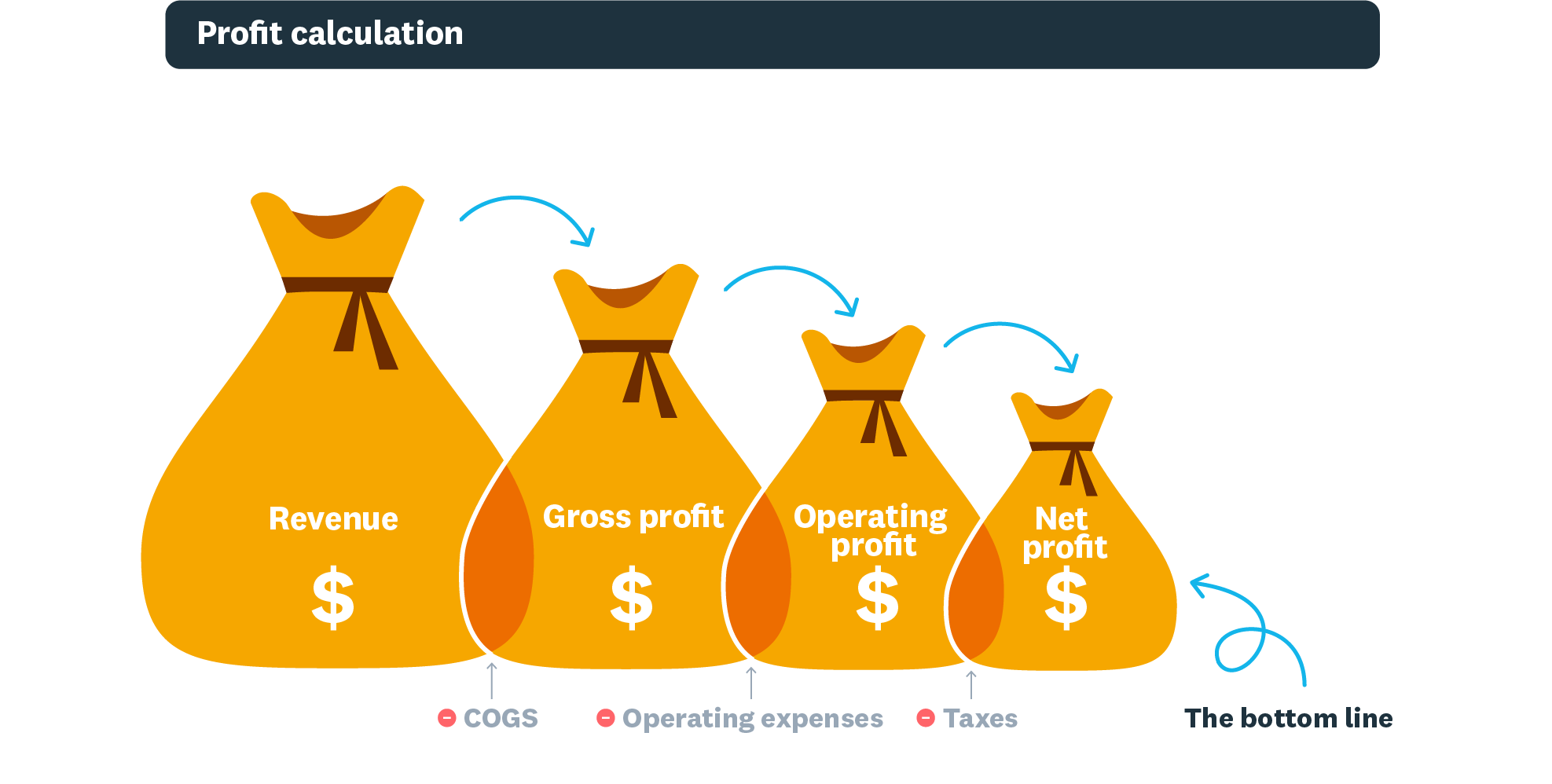

There are three kinds of profit used for business purposes. It means total revenue minus explicit costs—the. Gross profit is the value that remains after the cost of sales, or cost of goods sold (cogs), has been deducted from sales revenue.

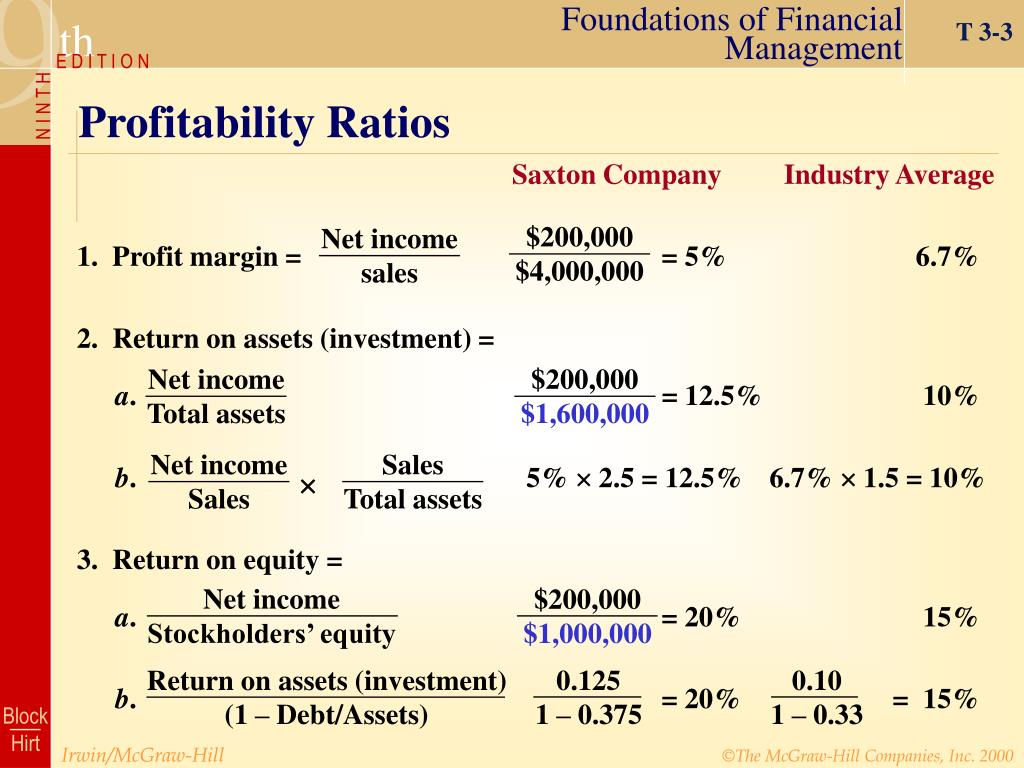

The three types of profit. Gross profit refers to a company's profits after subtracting the costs of producing and distributing its products. Katrina munichiello what is profit margin?

Margin ratios give insight, from several different angles, into a company's ability to turn sales into. It is a return that is calculated as a difference between revenue and costs, including both manufacturing and overhead expenses. Accounting profit is a cash concept.

Gross profit determines how well a company can earn a profit while. As such, a company is profitable if its revenue exceeds its expenses. D economic profits equal zero.

Net profit and gross profit. Expressed as a percentage, it. Different types of profit there are three main measures of profit.

Net profit includes all costs. Dubal holding llc (dh), the investment arm of the dubai government in the commodities and mining, power and energy, and industrial sectors, recorded a net. There are two parts to a company's profitability:

It is the gain amount from any kind of business activity. Variable costs are only those. The other two are the balance sheet and the cash flow statement.