Marvelous Info About Profitability Ratios Explained Comparative Financial Statements With Different Year Ends

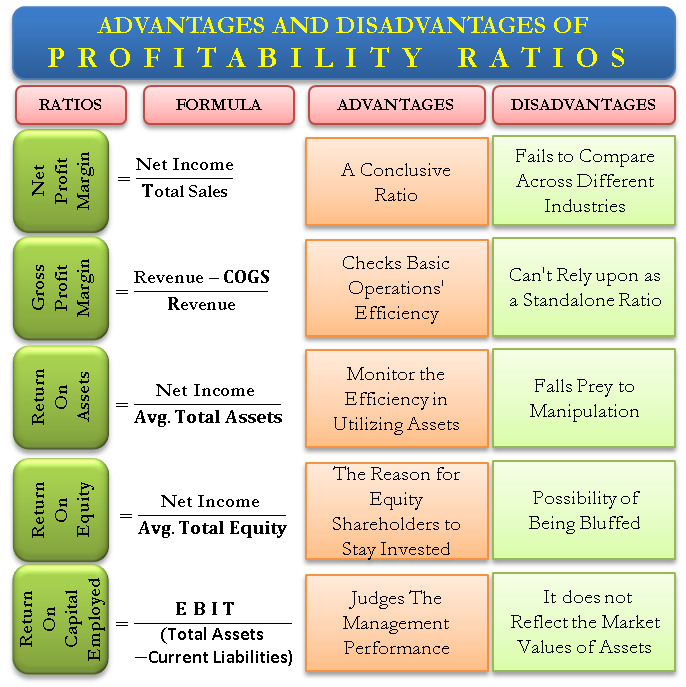

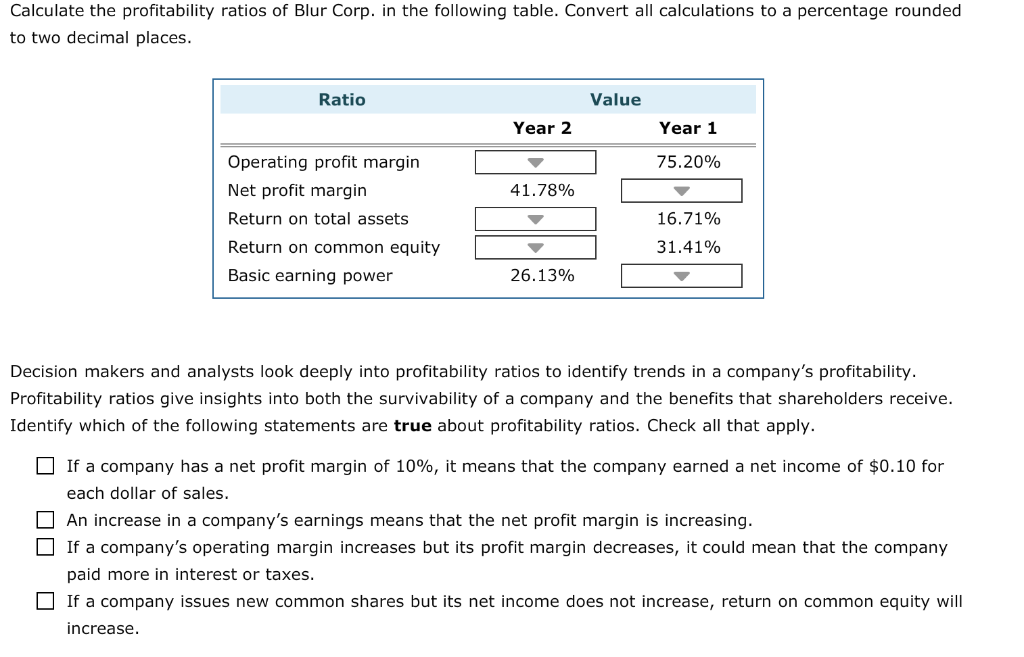

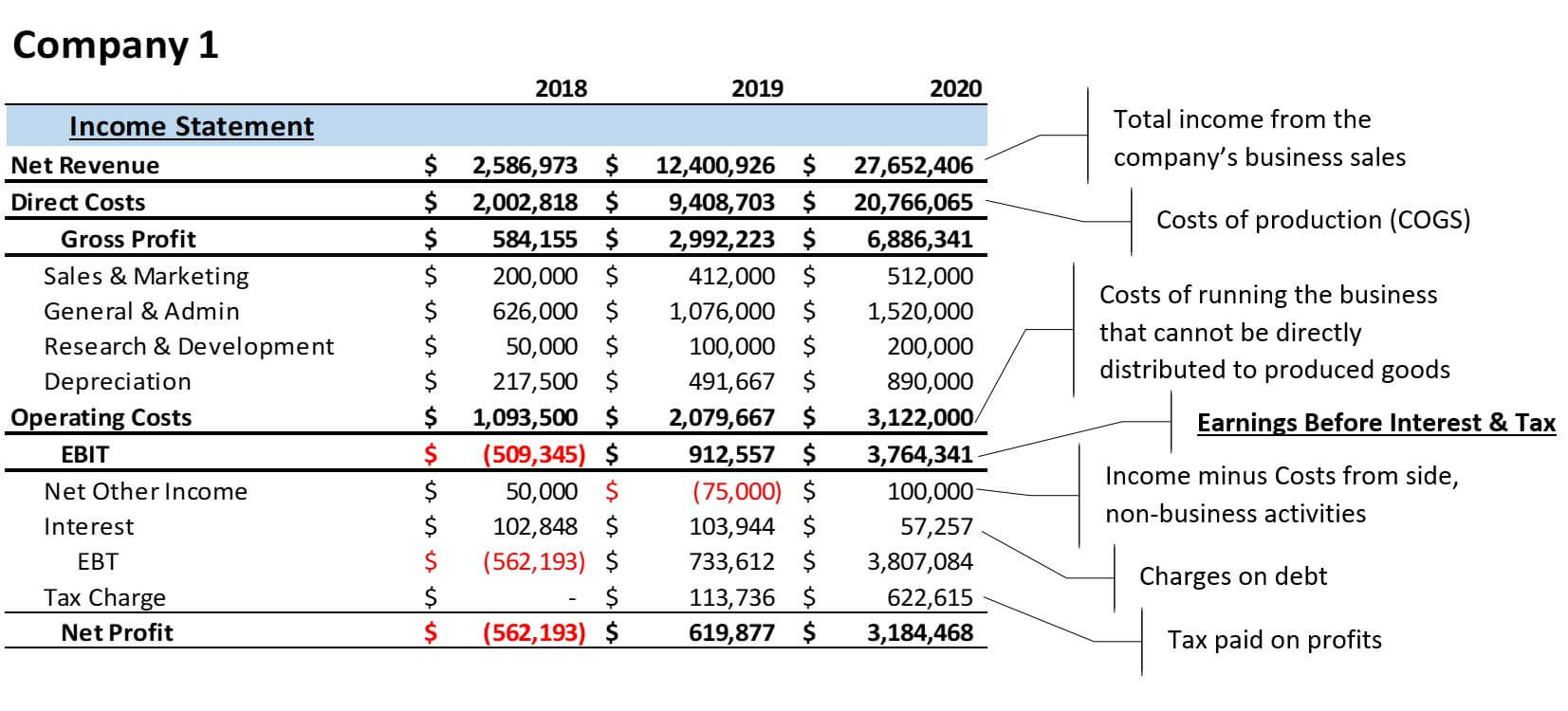

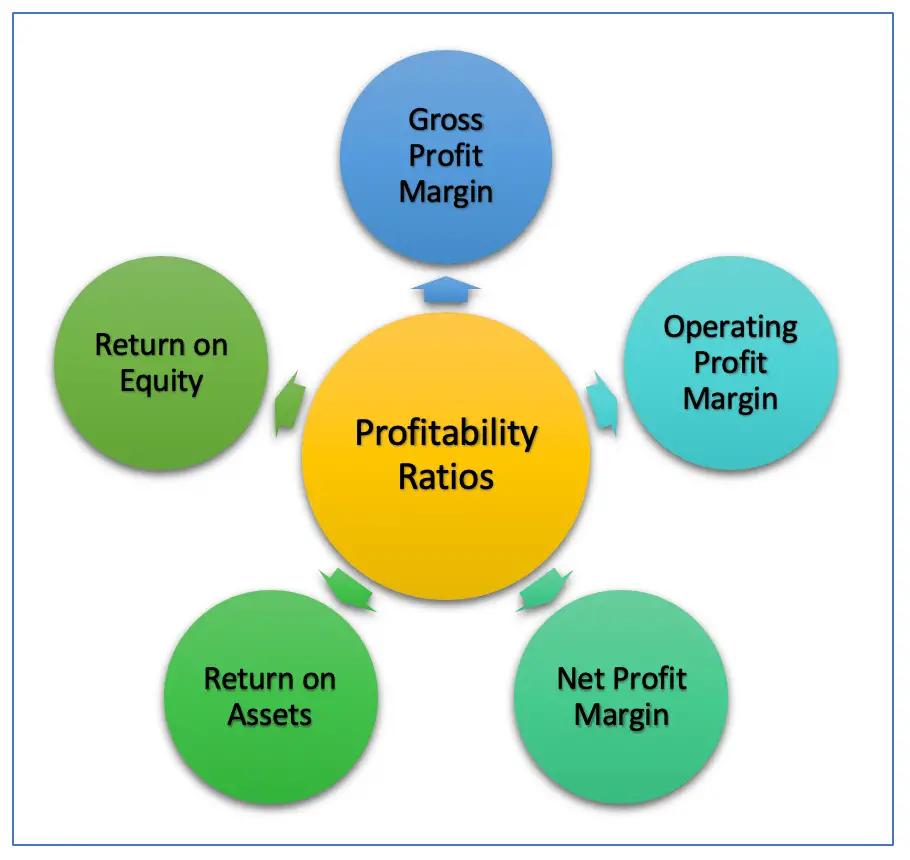

Profitability ratios are key indicators to analyze the performance and liquidity of the company and are derived using income statements.

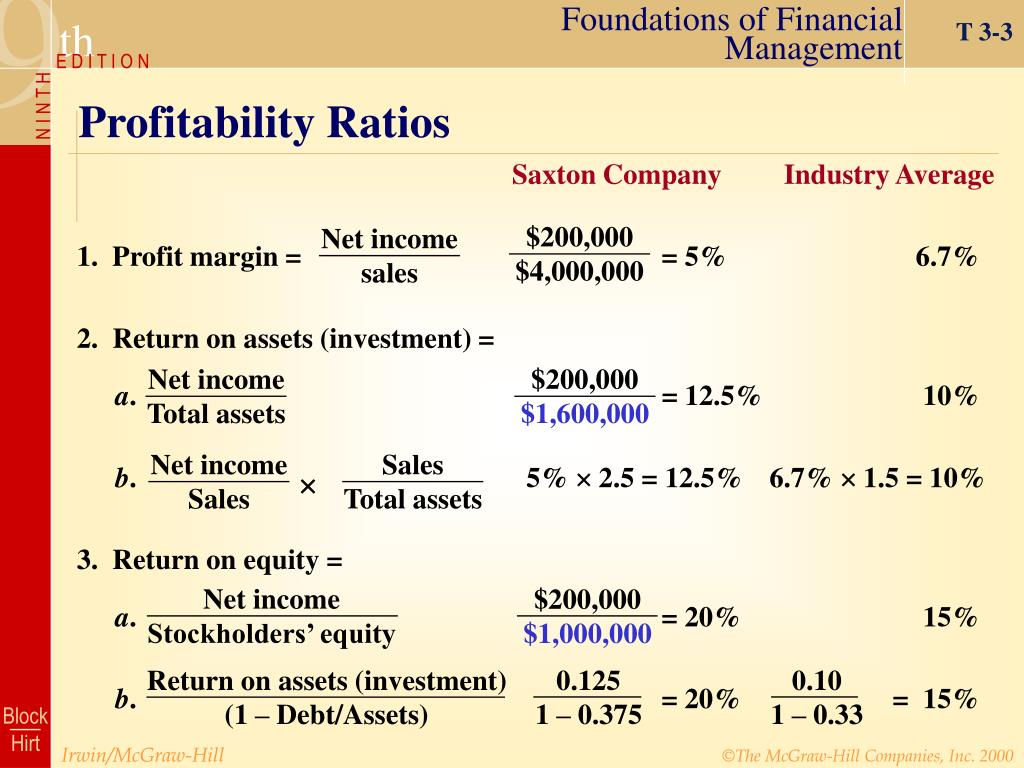

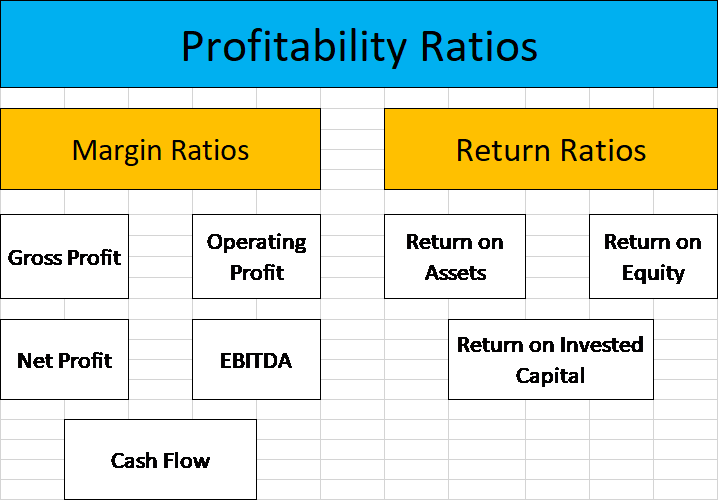

Profitability ratios explained. Profitability ratios market value ratios uses and users of financial ratio analysis analysis of financial ratios serves two main purposes: The ability to analyse financial statements using ratios and percentages to assess the performance of organisations is a skill that will be tested in many of acca’s. Profitability ratios look at the returns earned by a business both in terms of its trading activities (sales revenue) and also how much is invested in earning.

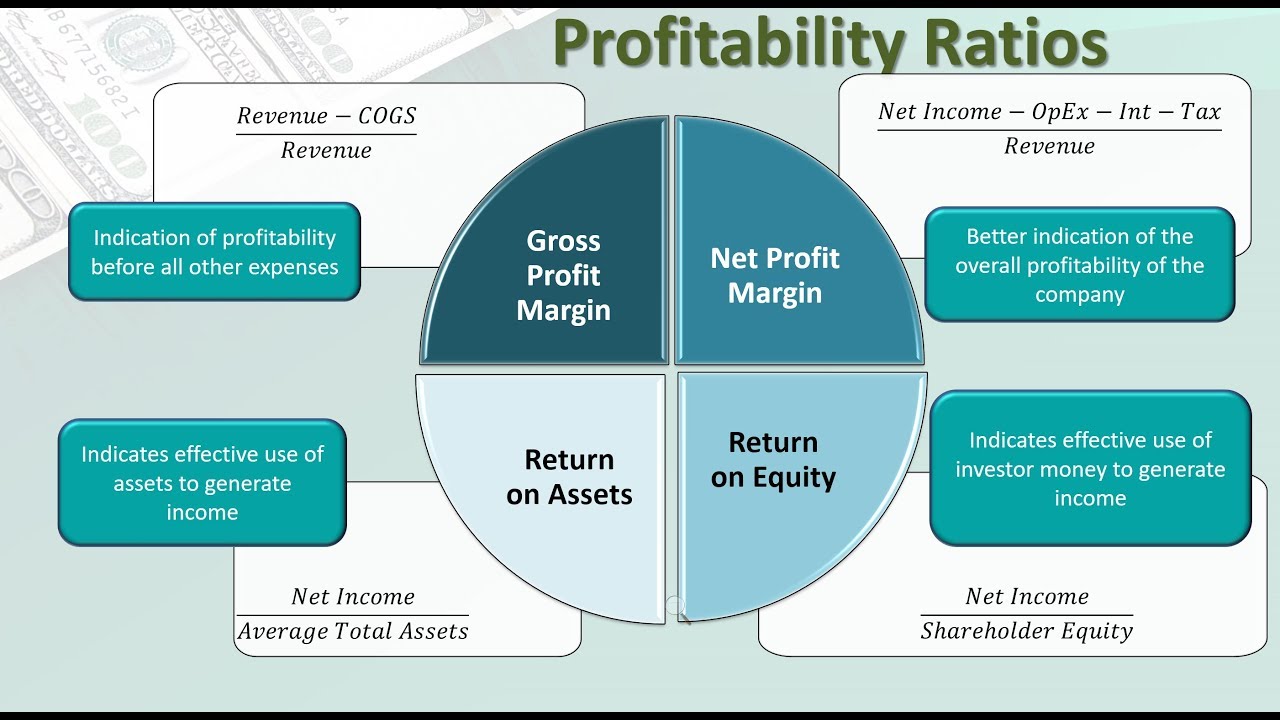

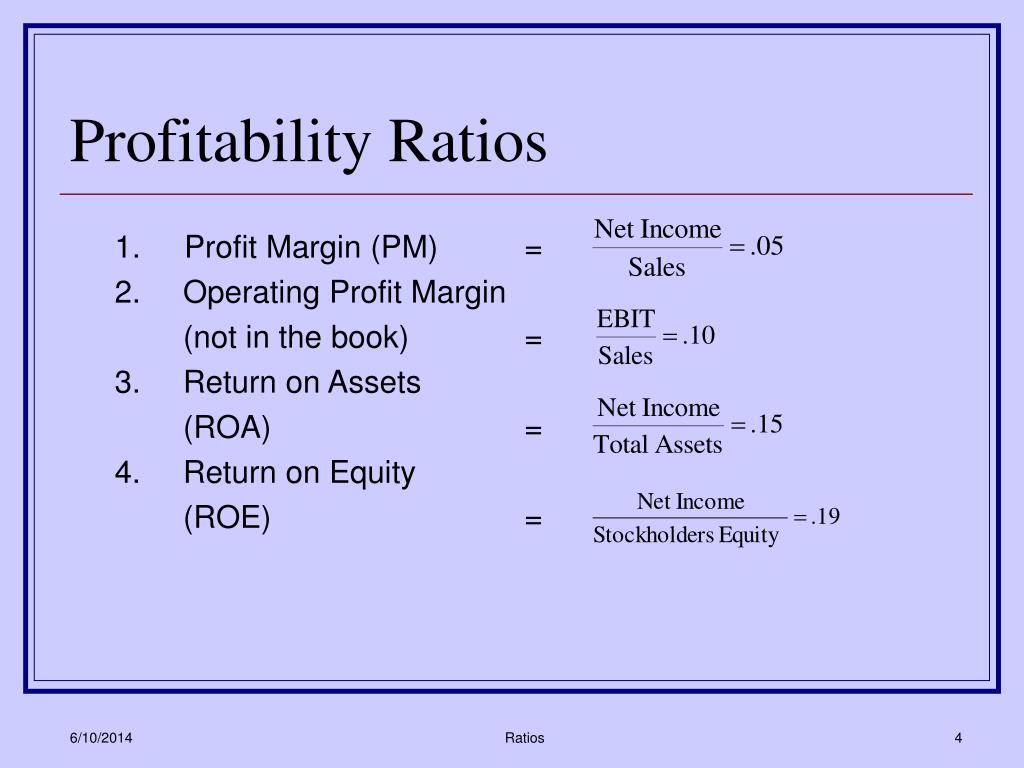

Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to. Profitability ratios, as discussed and illustrated below, show a company's overall efficiency in using its assets and performance at the end of each quarter or. What are profitability ratios?

The fourth classification of ratios are known as profitability ratios. Make informed decisions about your investments using profitability ratios, liquidity ratios, solvency ratios, and valuation ratios. A profitability ratio or return establishes a relationship between an operating or financial.

Profitability ratios are a class of financial metrics that are used to assess a business's ability to generate earnings relative to its revenue, operating costs, balance sheet assets, or shareholders' equity over time, using data from a specific point in time. Profitability ratios explained | financial ratios tutor2u 237k subscribers subscribe subscribed 268k views 7 years ago ratio analysis (a level & ib business). It is also used to determine the.

The return on average equity, therefore, involves the denominator being. This ratio is an adjusted version of the return of equity that measures the profitability of a company. Given those enormous losses, many people questioned whether uber could ever make money,” ceo dara khosrowshahi explained this week in a conference call.

Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such. They are among the most popular metrics used in. Profitability ratios are used to determine how profitable is a given company as compared to a different company.

Profitability ratios are a type of accounting ratio that helps in determining the financial performance of business at the end of an accounting period. The three profitability ratios that are most.