Casual Tips About Profit And Loss Account Entry How To Find The Common Stock On A Balance Sheet

For earning the net profit, a businessman has to incur.

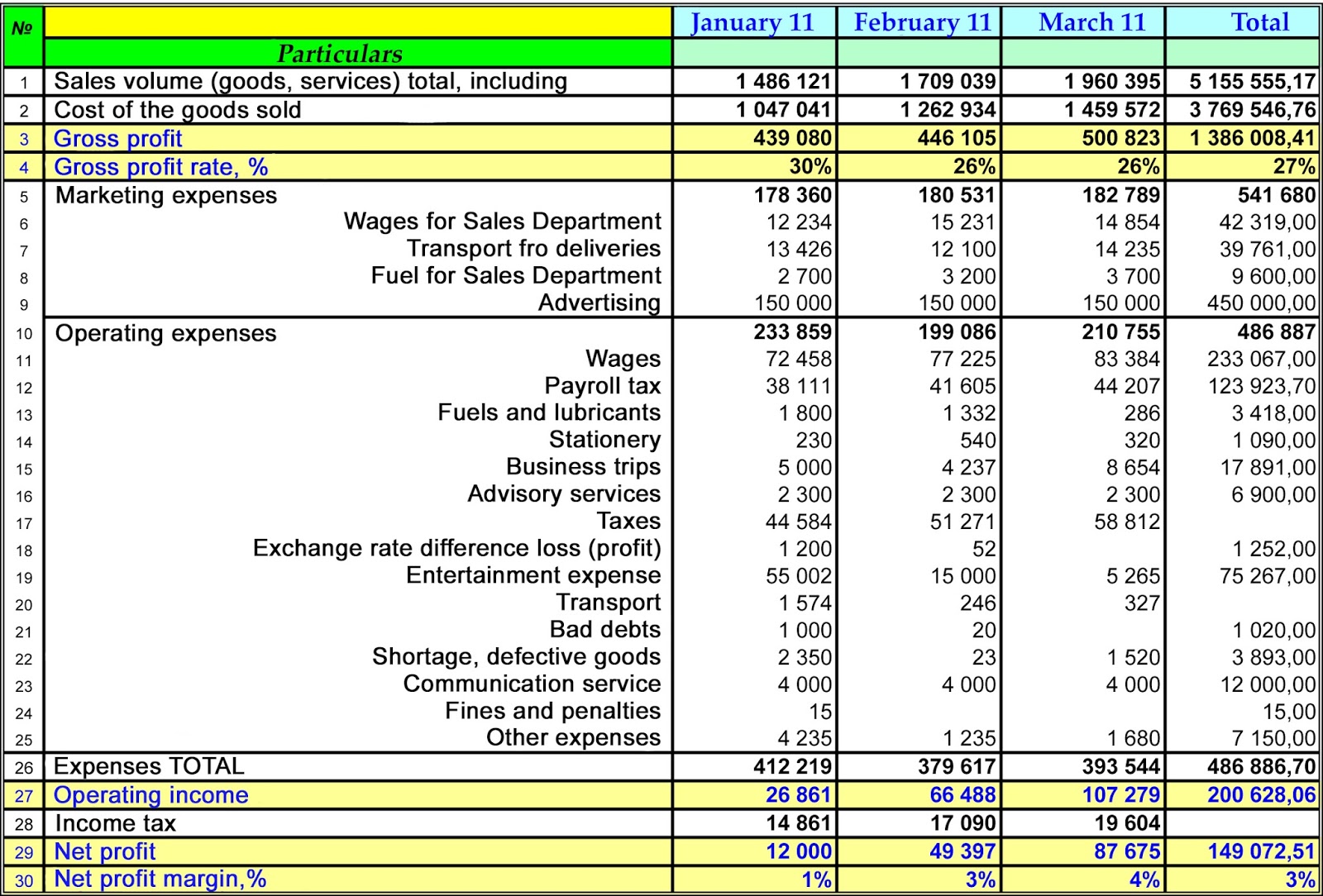

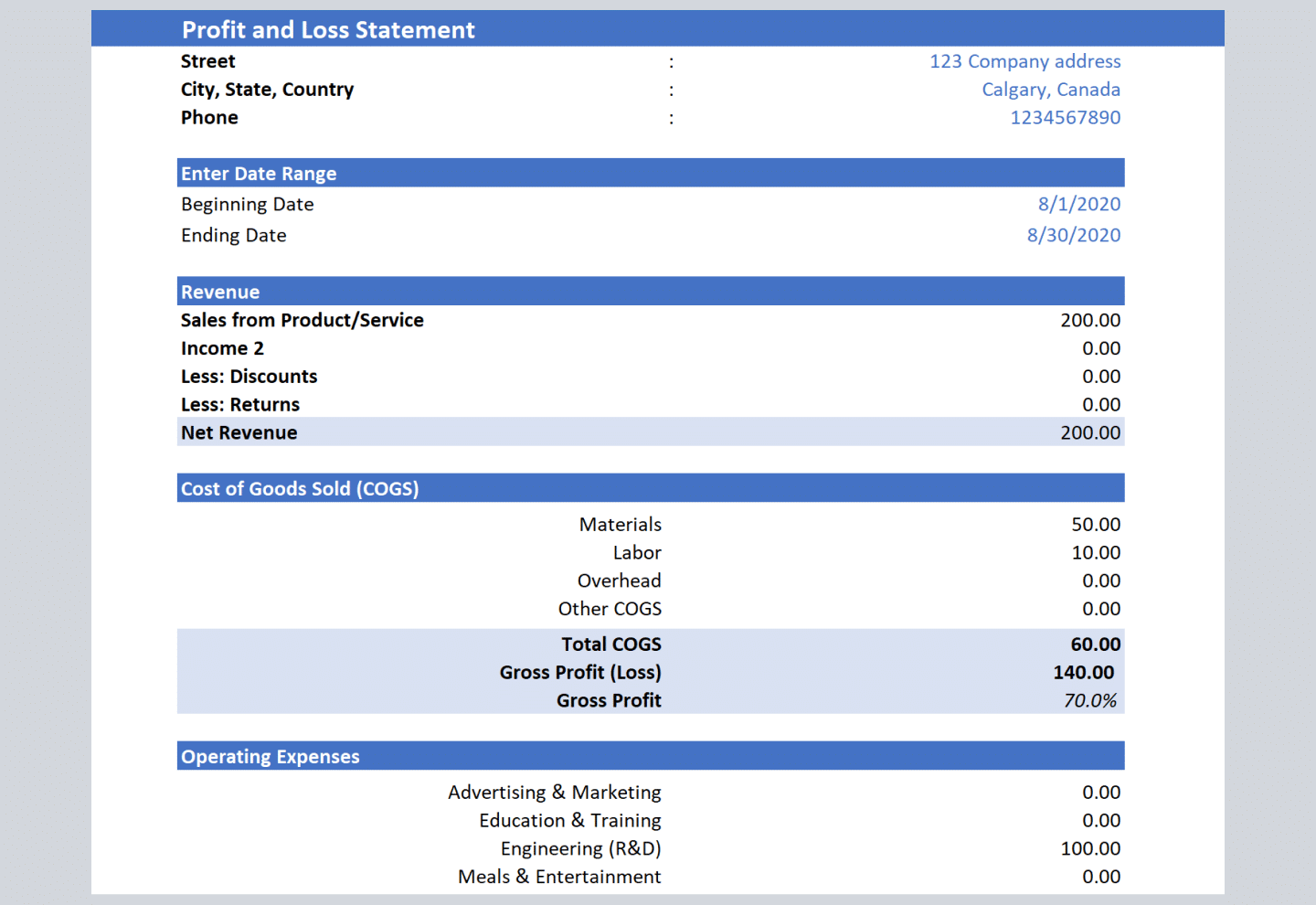

Profit and loss account entry. The p&l account is a component of final accounts. A profit and loss account in report form (and according to the nature of expense method) mentions sales revenue as the first item. All the items of revenue and expenses.

Understand what the profit and loss account is. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Profit and loss account is made to ascertain annual profit or loss of business.

It is prepared to determine the net profit or net loss of a trader. It's balance indicates either a profit (net profit) or a loss (net loss). Only indirect expenses are shown in this account.

The motive of preparing trading and profit and loss. Credit the various expenses accounts appearing in the. Fy profit attributable 465.8 million baht versus loss 8.03 billion baht.

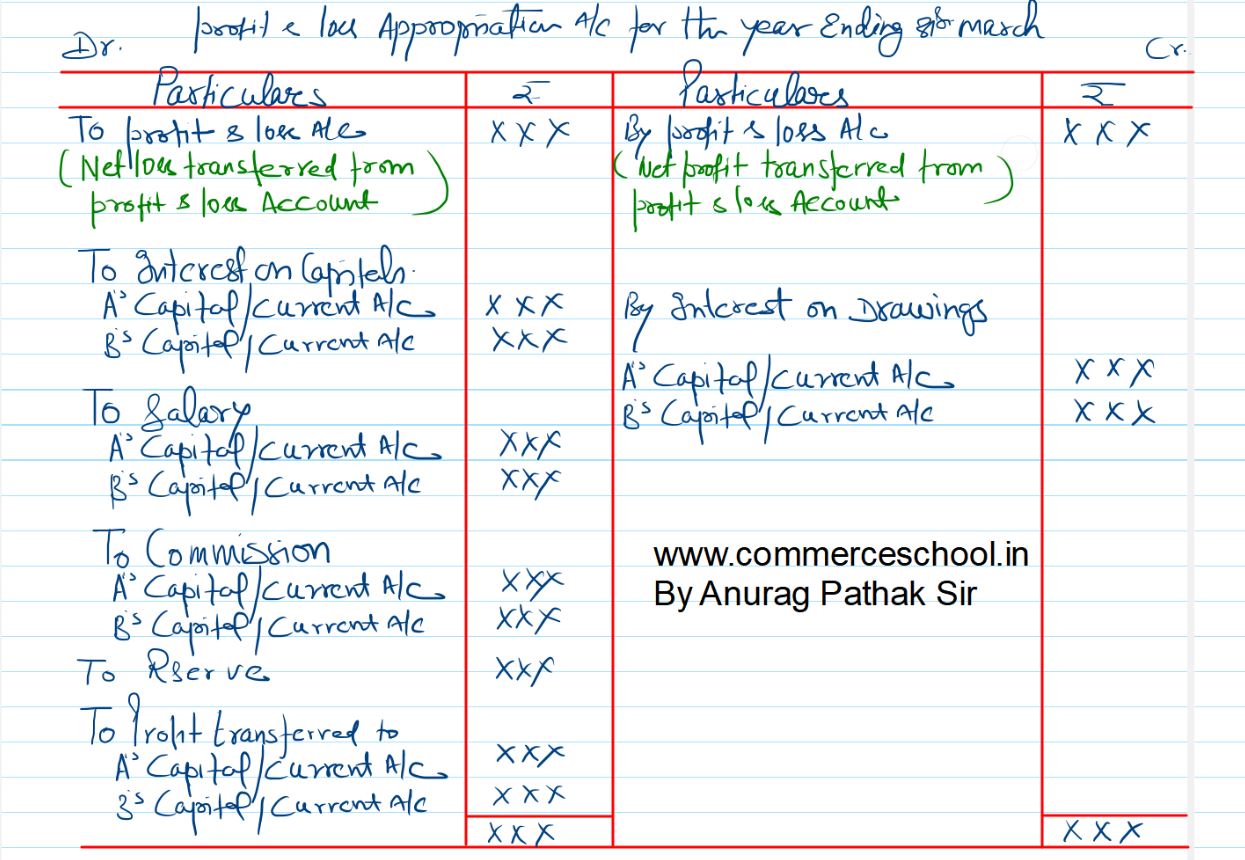

Following is the profit and loss account of pqr for the year ending dec 20yy in the above example, the debit total is 20,000, and the credit total is 10,000. The following entry is made when the profit and loss account shows a net. The profit and loss account is opened by recording the gross profit on the credit side or gross loss on the debit side.

Each business wants to know the operating results (profits) from its operations. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Trading and profit and loss account:

It is closed at the end of the accounting. (1) expenses accrued and outstanding, e.g.,. The closing entries for completing the profit and loss account are the following:

Electric carmaker rivian plans to cut 10% of its salaried workforce. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A p&l statement provides information.

Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns. Profit and loss account. The balance in the profit and loss account represents the net profit or net loss.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. We need to pass a few adjusting entries to eliminate the effect of outstanding or prepaid expenses or income. (1) debit the profit and loss account: