Impressive Info About Retained Earnings Formula On Balance Sheet 3 Activities In Cash Flow Statement

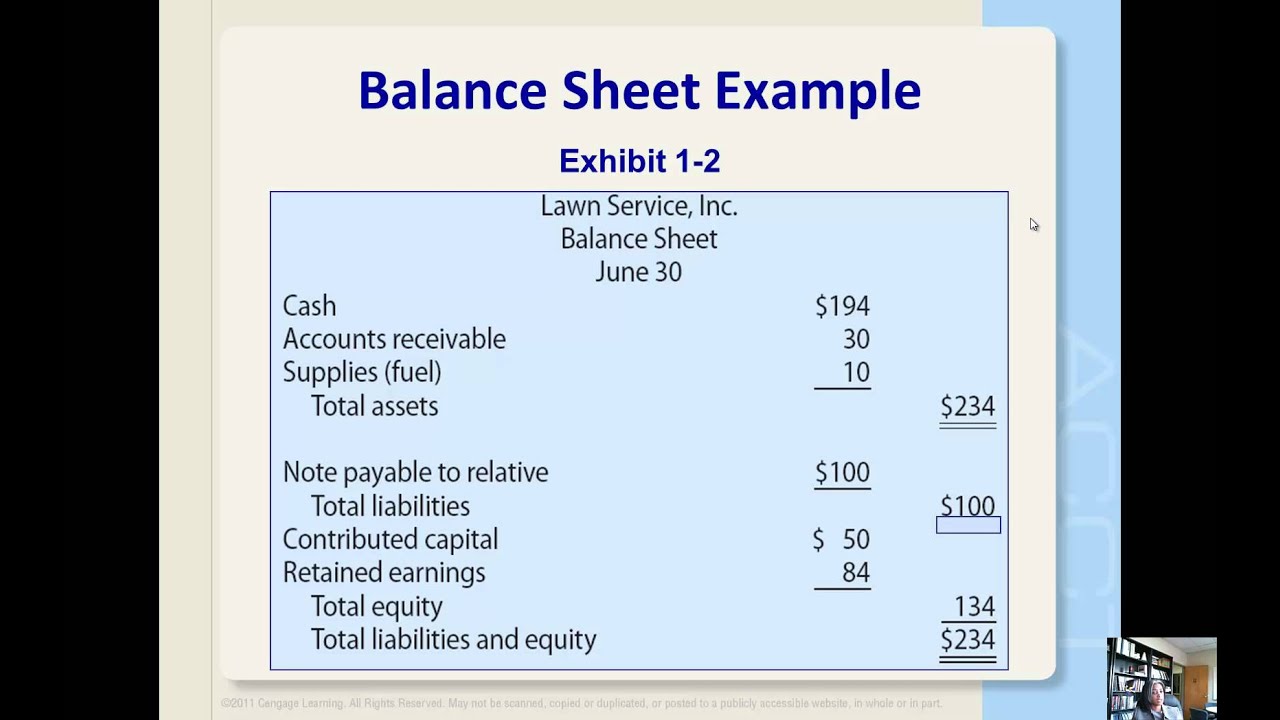

Within the owners’ equity section, there may be several stock categories listed on a company’s balance sheet:

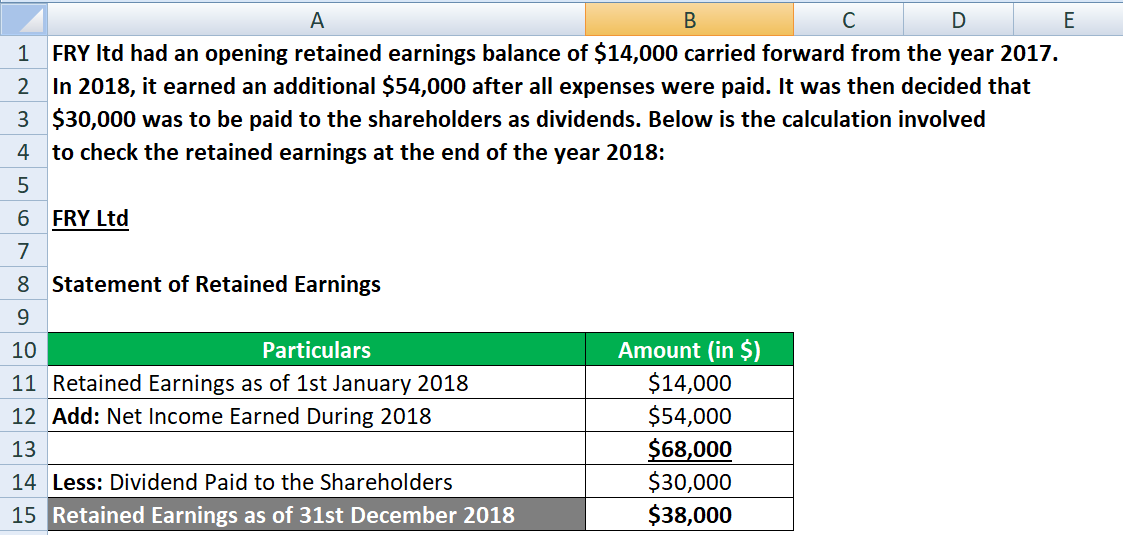

Retained earnings formula on balance sheet. The retained earnings formula is fairly straightforward: You’ll also find the company’s ending balance here, which is usually calculated after a single accounting period. Learn its uses and how to compute it through the given sample calculations.

To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. How can a company use the profit when they are liable to pay it to the business owners (shareholders)? The formula is as follows:

Essentially, you find your retained earnings by adding together your beginning holdings and your net income or loss for the accounting period, and then you subtract all dividends paid out (both cash and stock). Retained earnings can be found on the right side of a balance sheet, alongside liabilities and shareholder’s. Starting retained earnings + loss dividends paid/net income = total retained earnings.

To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted. In the same period, it reported $60 billion in shareholder equity and $100 billion in net income. The formula is as follows:

+ $1,200,000 beginning retained earnings + $500,000 net income Most companies retain a part of their earnings for reinvesting or other purposes. It is called retained earnings, and this article will be all about retained earnings, recognition, calculation, measurement, and classification.

The interpretation of financial statements example of the retained earnings formula abc international has $500,000 of net profits in its current year, pays out $150,000 for dividends, and has a beginning retained earnings balance of $1,200,000. To illustrate how to calculate retained earnings on a balance sheet, imagine a firm starting the year with $50 million in retained earnings. Retained earnings are calculated by subtracting distributions to shareholders from net income.

Retained earnings are noted on the balance sheet under accumulated income from the previous year minus shareholder dividends. Calculating retained earnings on your balance sheet is very simple. Retained earnings on a balance sheet.

Steps to prepare a retained earnings statement 28, 2022, which is the end of the company's 2022 fiscal year. An electronics manufacturer reports retained earnings of $30 billion on aug.

Take the second quarter retained earnings, add the company's net income for the third. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. Retained earnings formula and calculation.

Retained earnings are calculated by adding the current year’s net profit (if it’s a net loss, then subtracting the current period net loss) to (or from) the previous year’s retained earnings (which is the current year’s retained earnings at the beginning) and then subtracting. Begin with the retained earnings balance at the start of the period, as shown on your previous year's balance sheet. Retained earnings appear on the balance sheet under shareholder’s equity.