Best Of The Best Info About Purchase Return In Income Statement P&l Definition

Increase in the balance sheet account inventory:

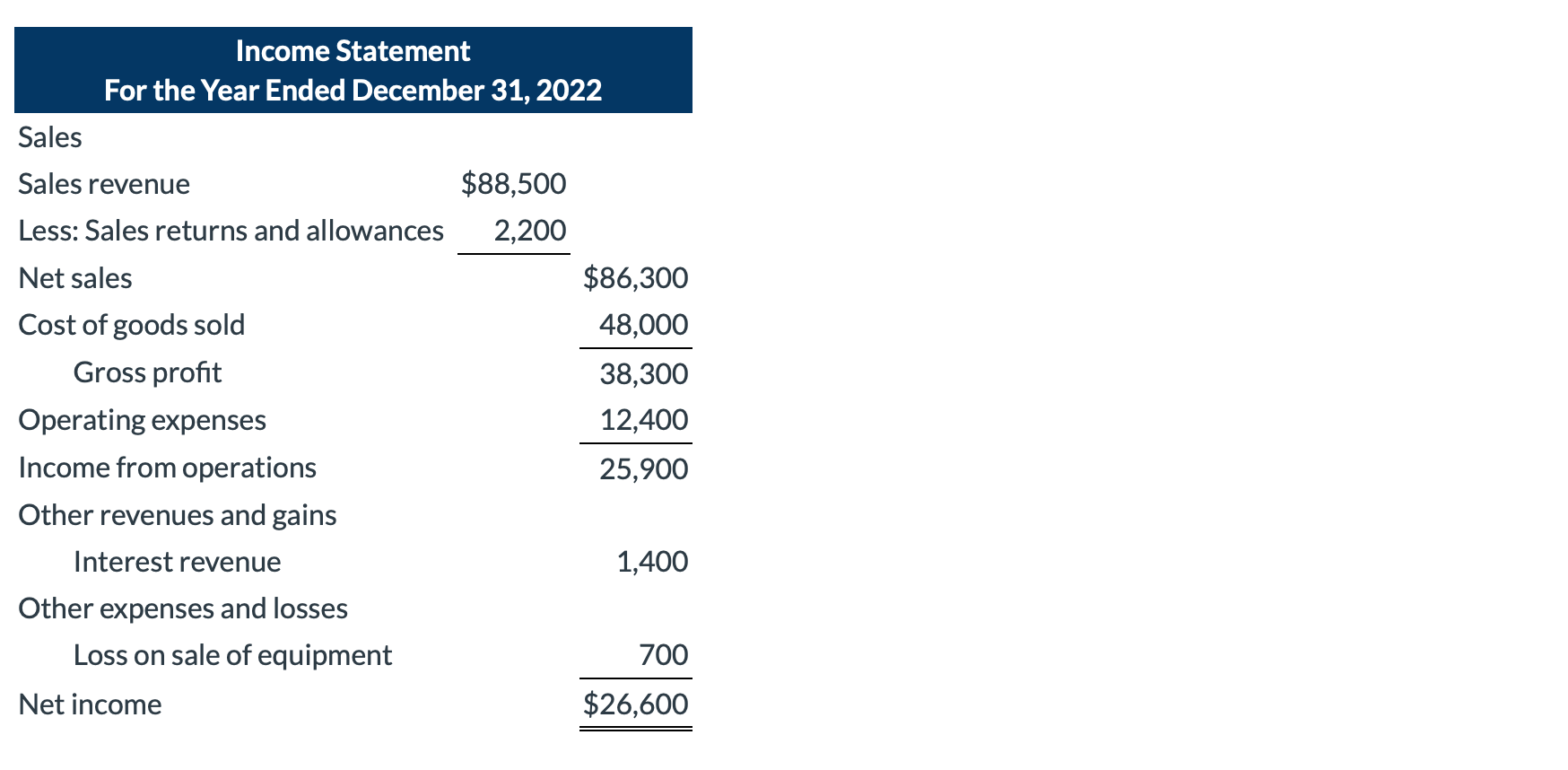

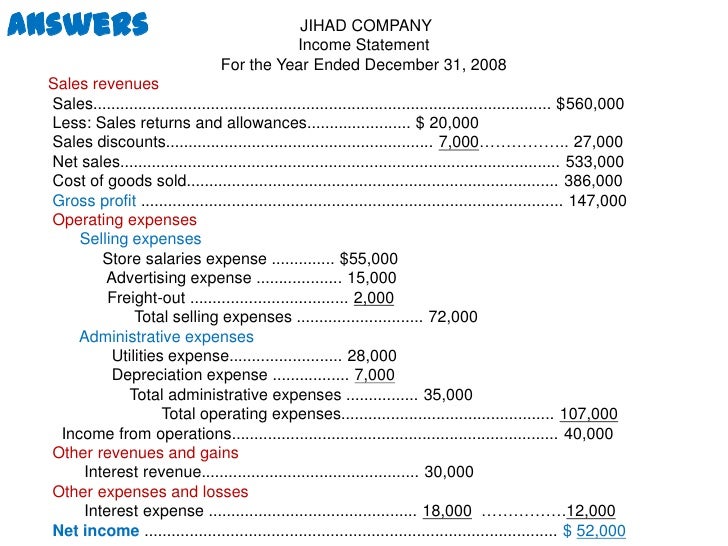

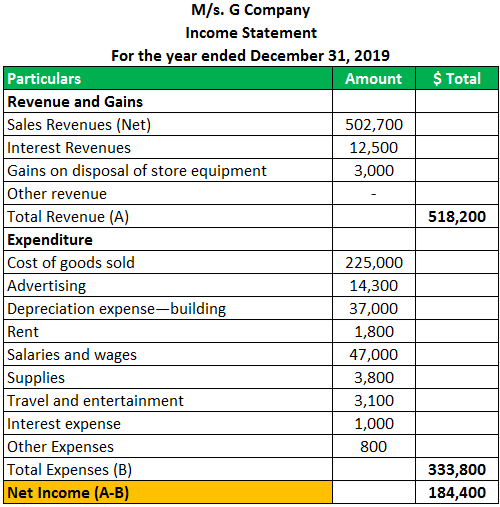

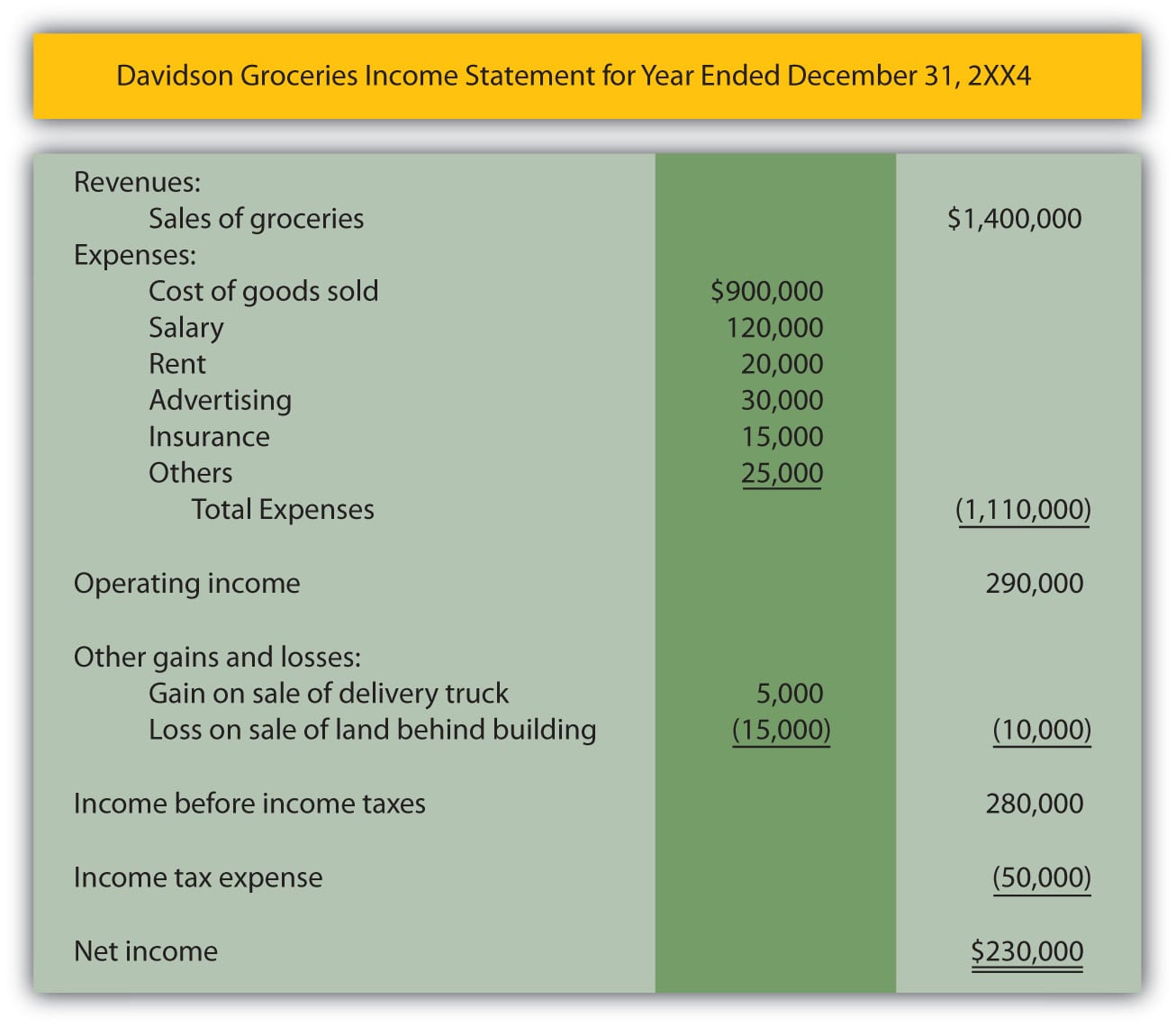

Purchase return in income statement. $5,000 (1,000 x $5) minus: The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Purchase returns and allowances journal entry is simple.

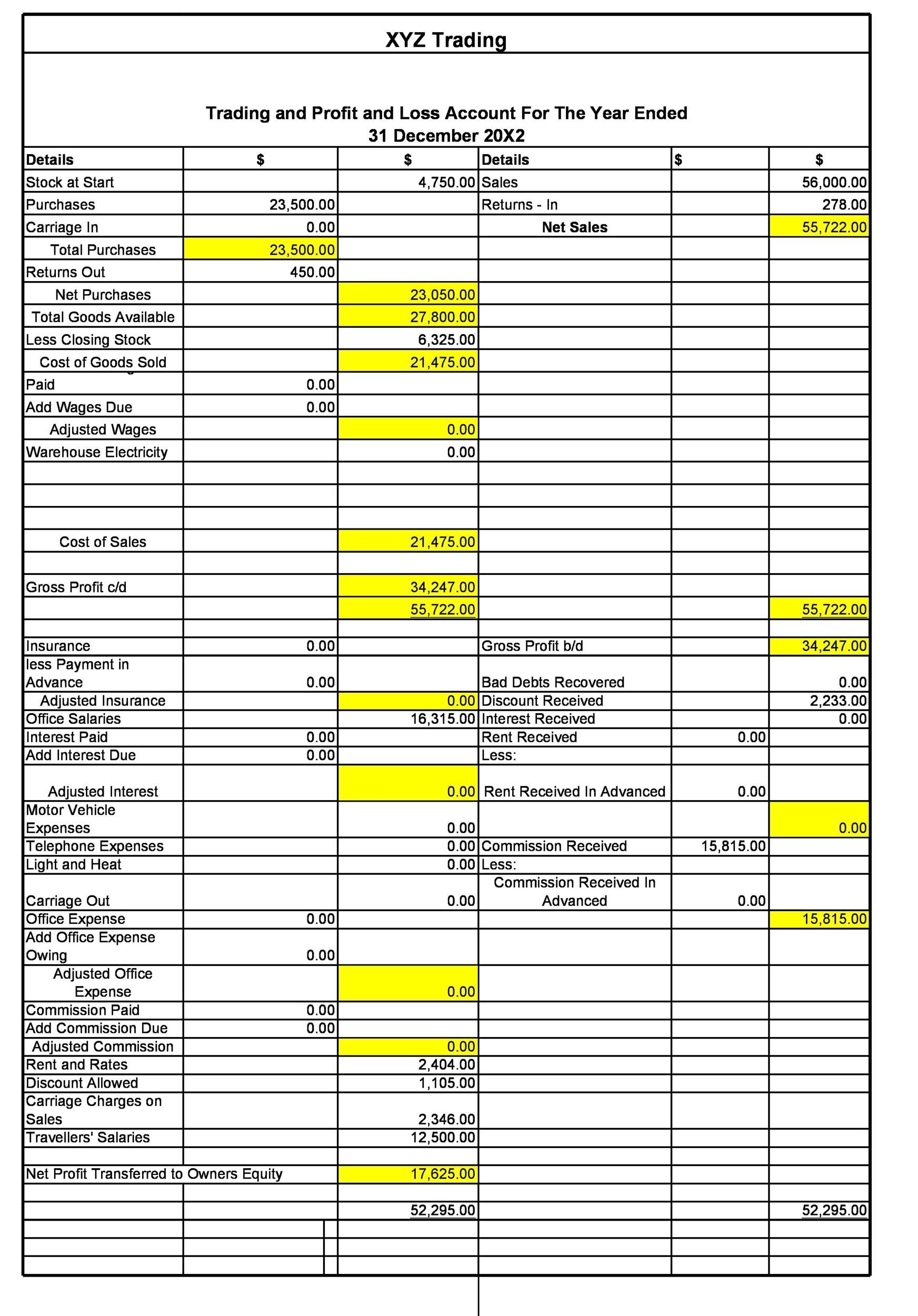

Purchase return journal entries explained. Return outwards or purchase returns are shown in the trading account as an adjustment (reduction) from the total purchases for an accounting period. November 13, 2023 what are purchase returns and allowances?

2 minutes of reading purchases returns, or returns outwards, are a normal part of business. A purchase return or allowance under perpetual inventory systems updates. A reduction in the cost of goods purchased that is allowed by the supplier based on the authorized return of goods.

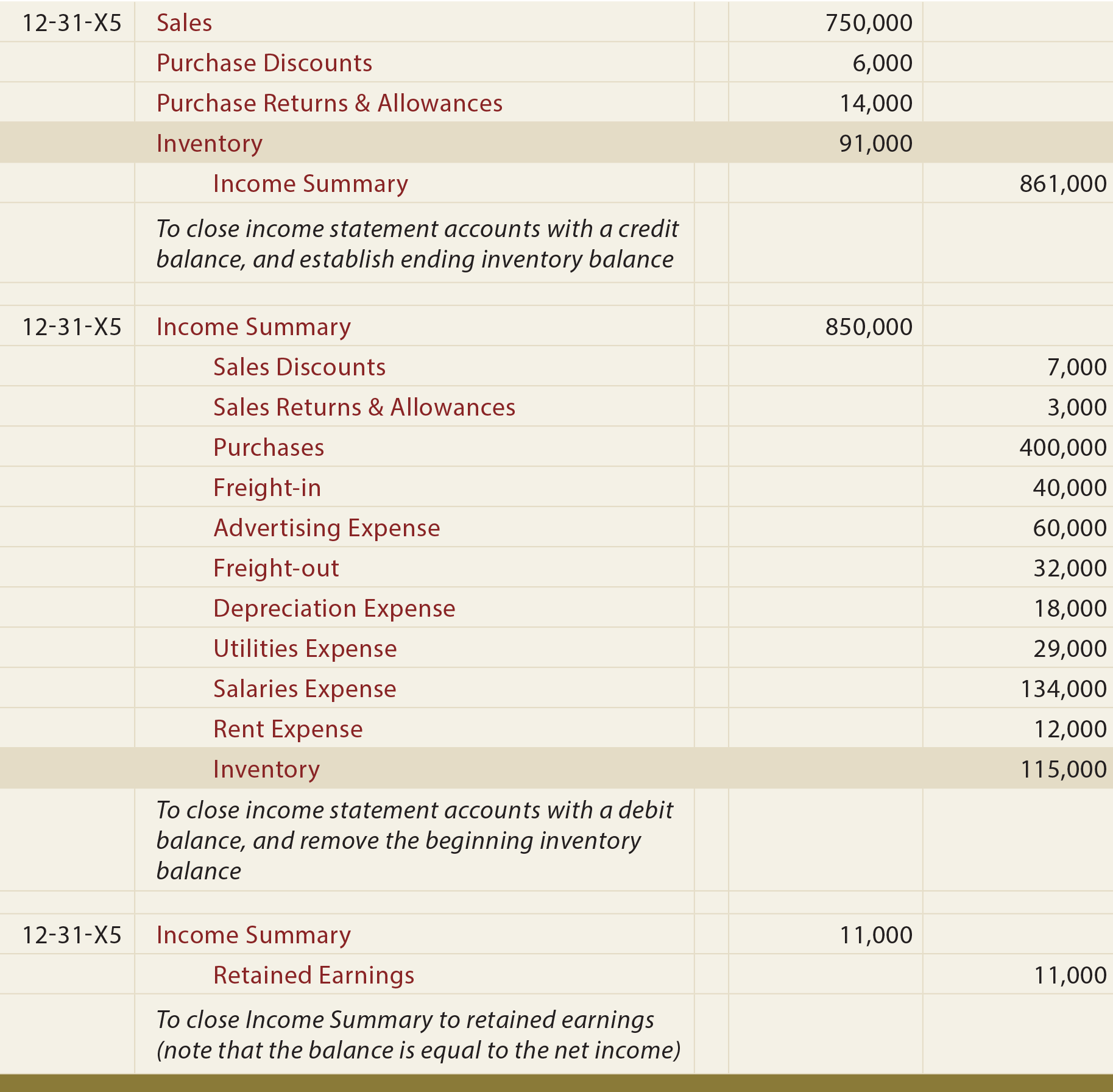

Amount from the income statement account purchases: Since the return of purchased. It is a temporary account used in the periodic inventory system to record the purchases of merchandise for resale.

In the periodic inventory system, the purchase returns and allowances are recorded into the purchase return and. As mentioned, these transactions do not impact the purchases account. It is not shown in the.

Definition of purchase return a purchase return occurs when a buyer returns merchandise that it had purchased from a supplier. Therefore, the purchases account will stay unimpacted. $400 (80 x $5) cost of goods sold:.

When a company returns goods to a supplier, it must also record the transaction as a purchase return. Updated july 03, 2021 reviewed by chip stapleton fact checked by michael logan cash purchases are recorded more directly in the cash flow statement than in the income. If you decide to offer the customer a purchase discount for paying upfront in cash, make sure that’s noted on your income statement or journal entry somewhere.

The above explanation provides a basis to record purchase returns and allowances. Instead, they offset it in the financial statements. Purchase returns or return outwards can be seen as a process where goods are returned to the supplier because of being defected or damaged.

Study guides accounting principles i purchases returns and allowances purchases returns and allowances when a purchaser receives defective, damaged, or otherwise. This account reports the gross amount of purchases of. The cost of goods sold is reported on the income statement under the perpetual inventory method.

Therefore, the supplier has to. It is therefore a kind of expense and is hence included in. Purchase return journal entries show that a company has directly reversed stock from their inventory back to their suppliers.