Real Tips About Cash Flow Accounting Income Projection Sample

Let’s look at a simple example together from cfi’s financial modeling course.

Cash flow accounting. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two. Cash outflows (expenses like rent and payroll) totaled $25,925. F ree cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a.

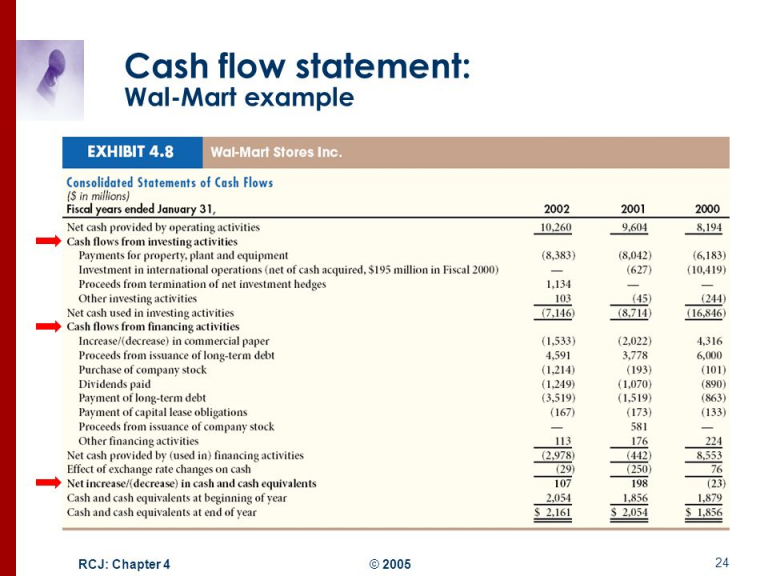

Cash received represents inflows, while money spent represents outflows. Cash flow is typically broken down into cash flow from operating activities, investing activities, and financing activities on the statement of cash flows, a common financial statement. The cfs highlights a company's cash management, including how well it.

Frequently asked questions (faqs) key takeaways. The statement of cash flows analyses changes in cash and cash equivalents during a period. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for ifrs measurements.

A company creates value for. Adjust for changes in working capital. The time interval (period of time) covered in the scf is shown in its heading.

The three main components of a. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. A cash flow statement is a financial statement that presents total data.

Cash flow is a measure of how much cash a business brought in or spent in total over a period of time. What is a cash flow statement? Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Simply put, it reports the cash inflows and cash outflows within your business during a time period, whether that’s over a week, a quarter, or a financial year. Ttm = trailing 12 months.

Let’s say a company called red bikes has just opened and earned a net income of $75,000 to start and generated additional cash inflows of $95,000. This leaves an ending cash balance of $144,075. There are many types of cf, with various important uses for running a business and performing financial analysis.

Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. Key takeaways a cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

A company's cash flow is the figure that appears in the cash flow statement as net cash flow (different company statements may use a different term). Docs free cash flow data by ycharts; A positive level of cash flow must be maintained for an entity to remain in business, while positive cash flows are.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)