Great Info About Calculating Income Statement Cash Flow For Non Profit Organisation

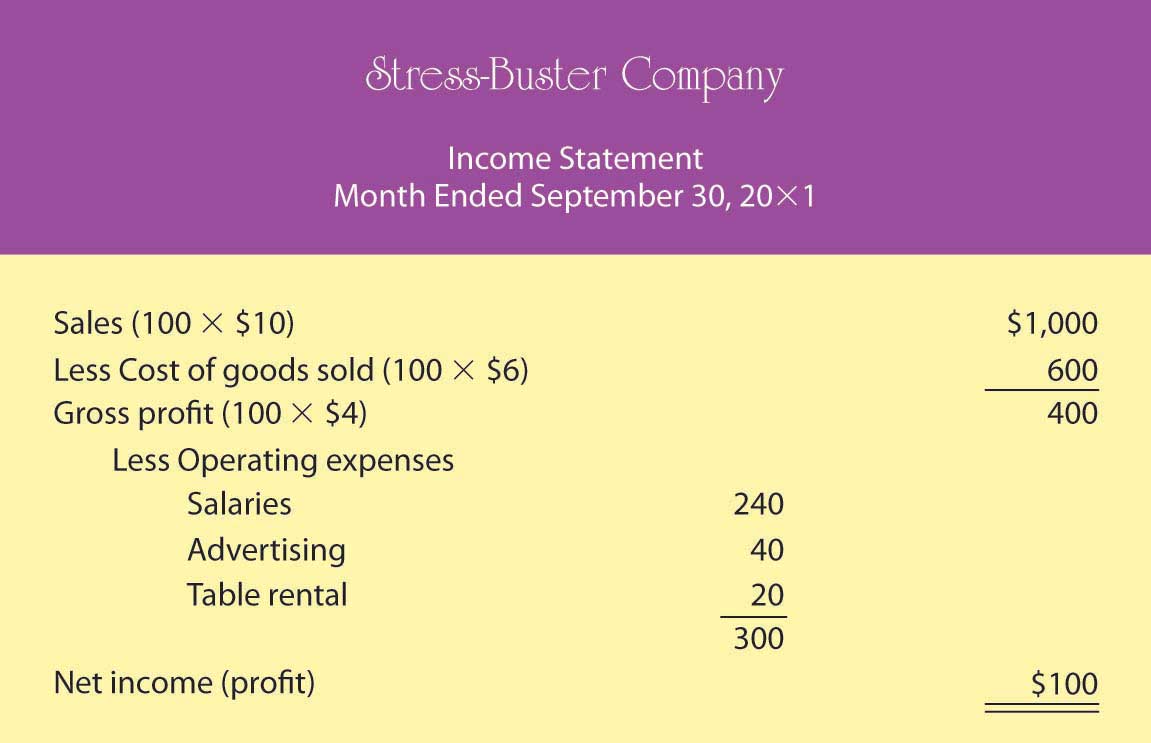

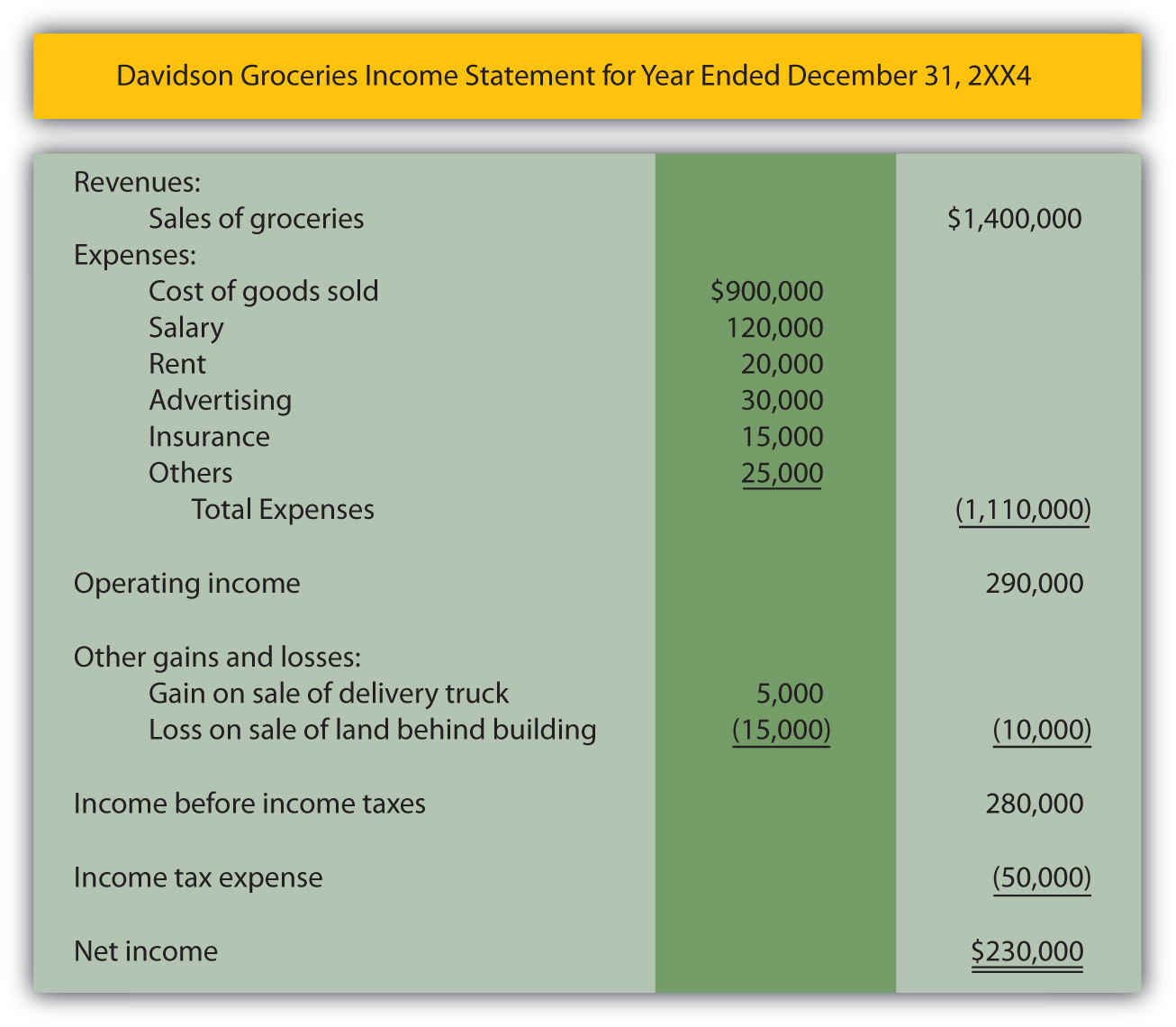

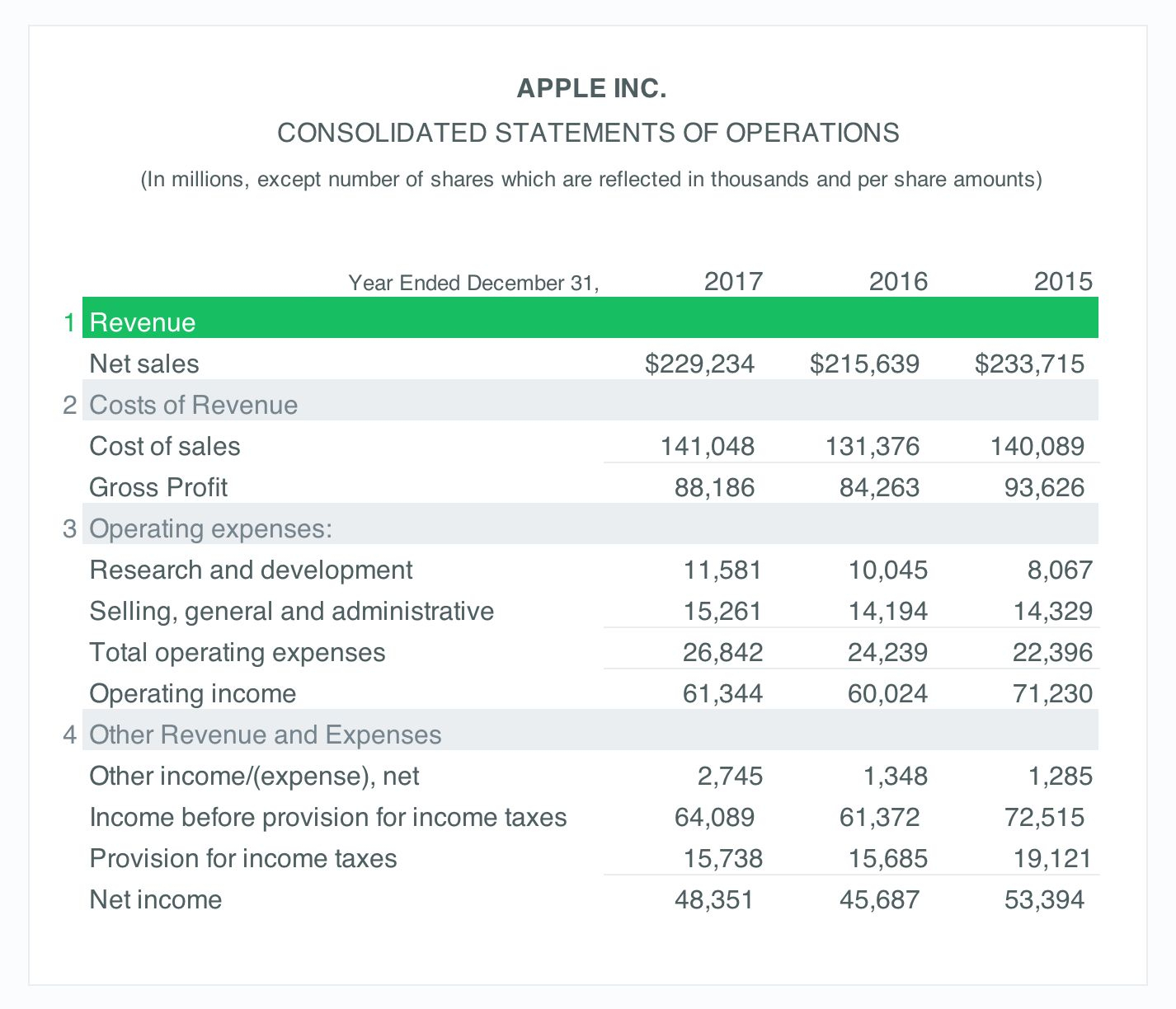

And this is an annual income statement.

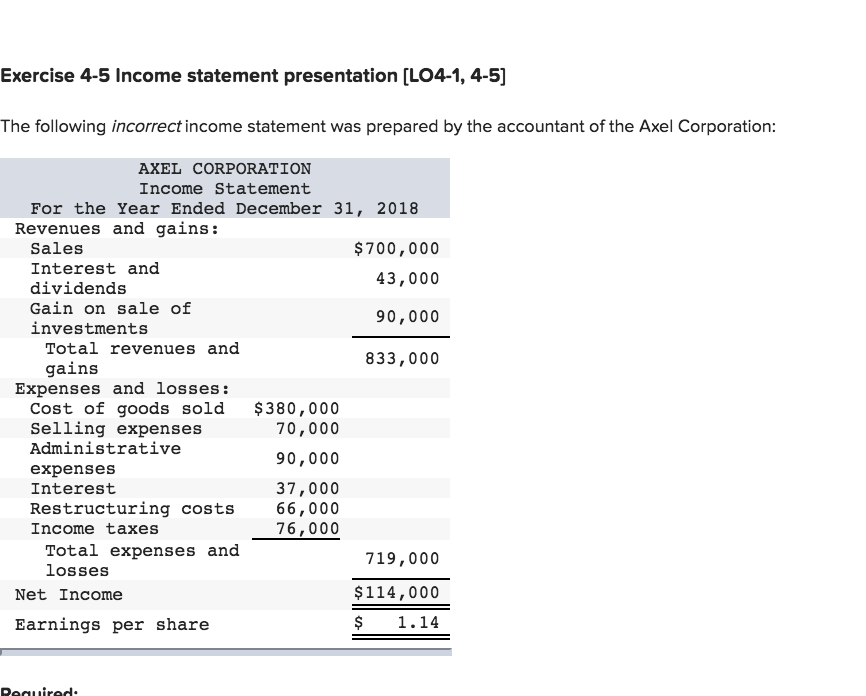

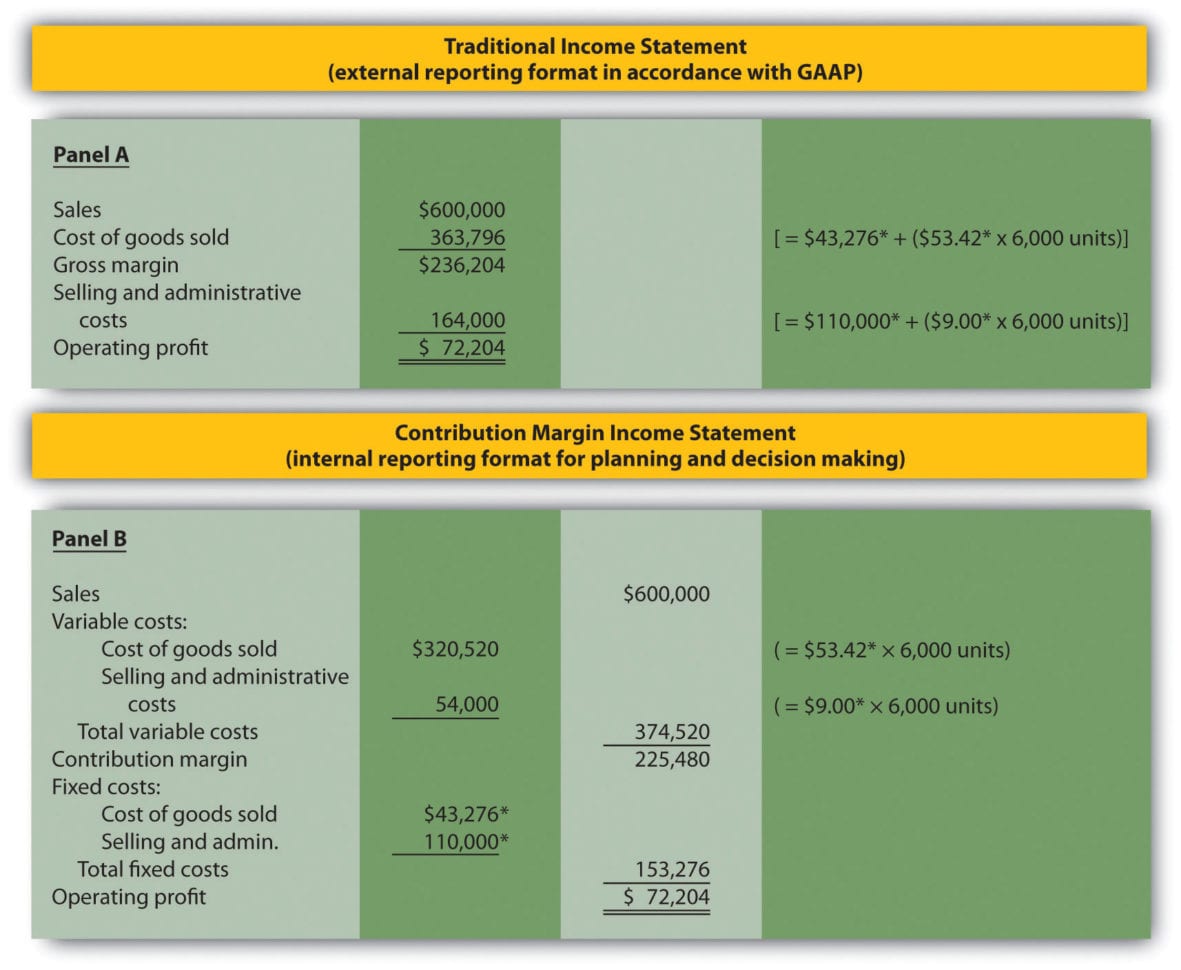

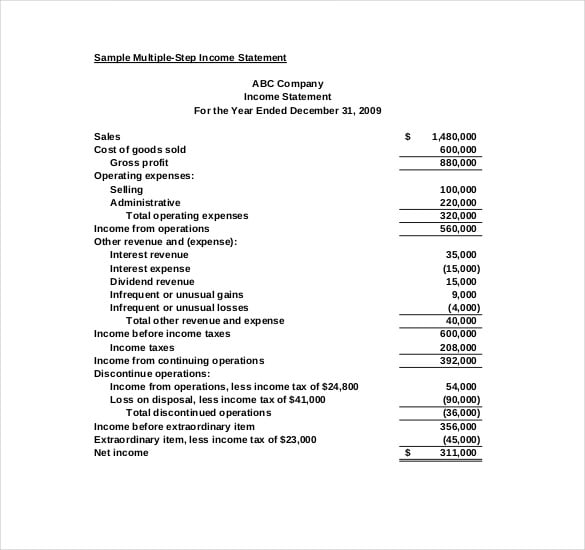

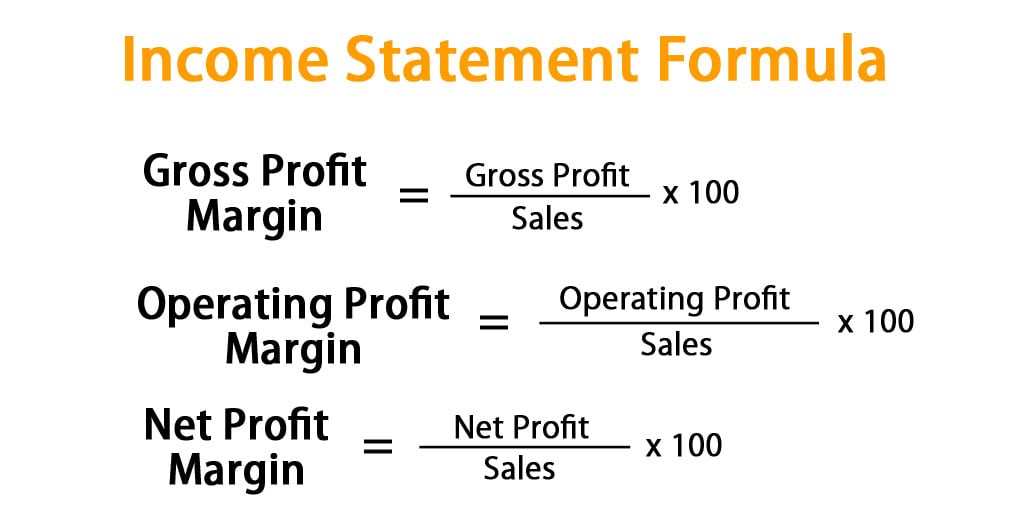

Calculating income statement. Mechanically, there are two common approaches for. Definition income statement formulas are ratios that you can calculate using the information found on a company's income statement. And obviously, a company that has no debt will have no interest expense, but in this case, we do.

Choose a time period for your income statement. Core finance financial accounting when it comes to financial statements, each communicates specific information and is needed in different contexts to. So let's see, if we have.

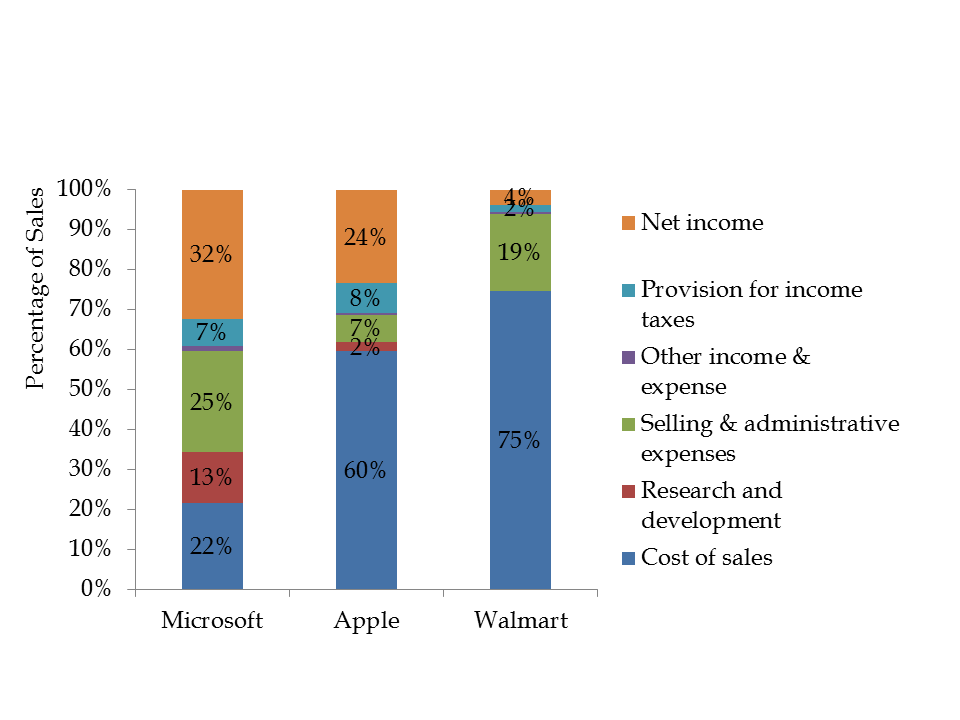

Components of an income statement: This calculation shows investors and creditors the overall. The “top line” of the income statement, we first.

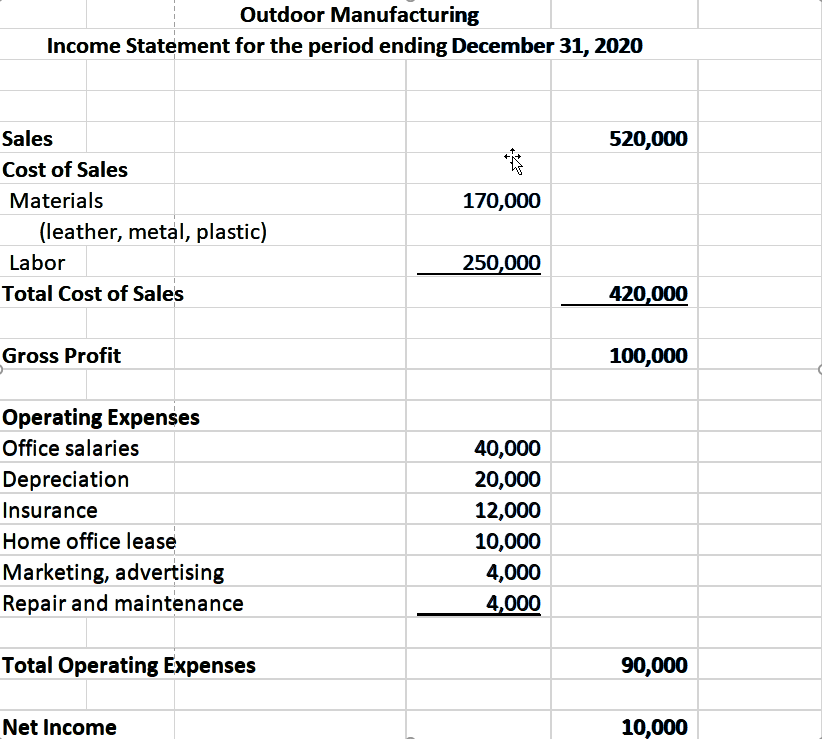

$20,000 net income + $1,000 of interest expense = $21,000 operating net income. Calculating net income and operating net income is easy if you have good. The income statement calculates the net income of a company by subtracting total expenses from total income.

The income statement shows profit and loss over a specific reporting period, such as a year. This is the total income generated by the company from its core operations, such as the sale of goods. Investors use this effective tax rate to compare the.

An income statement (also called a profit and loss statement, or p&l) summarizes your financial transactions, then shows you how much you earned and how much you spent. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative. An effective tax rate is the quotient of a taxpayer's total tax expense divided by their taxable income.

The first step in calculating an income statement is to identify the reporting period for which you want to create the statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)