Build A Info About Gaap Accounting For Reimbursed Expenses Last Date Of Audited Balance Sheet

Total expense & other (income) 25,964 (508) (282) 25,174:

Gaap accounting for reimbursed expenses. Revenue is not always earned at the time of sale. During the three months ended december 31, 2023, net cash provided by operating activities was $543.3mm and net income was $301.6mm ($6.93 /diluted share). Gaap was superseded by the new revenue standard.

The board noted that the new revenue standard provides a framework, similar to current u.s. A potential insurance recovery should be evaluated and accounted for separately from the related loss and should not in any way affect the recorded amount of the loss. In the second transaction the employee is reimbursed and the accounting equation is as shown below.

Gaap accounting for third party reimbursements: Spenmo team aug 23, 2021 all businesses incur expenses to fund their operation. The $600 outcome has a 75% probability, 15% for $500 and 10% for $400.

They’re a reflection of transparency and integrity in financial reporting. For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. As such, recognition timing differences could rise.

Then you can record the money you spend in which your clients reimbursed you as a reimbursable expense transaction. Check this guide on reimbursable expense accounting now! In this case one balance sheet asset account (cash) decreased by 200 when the employee was paid.

Gaap requires that revenues be realized or realizable and earned. That is, entities need to determine whether a preproduction contract is within the scope of asc 606. Expects durable, efficient growth in 2024 chicago, feb.

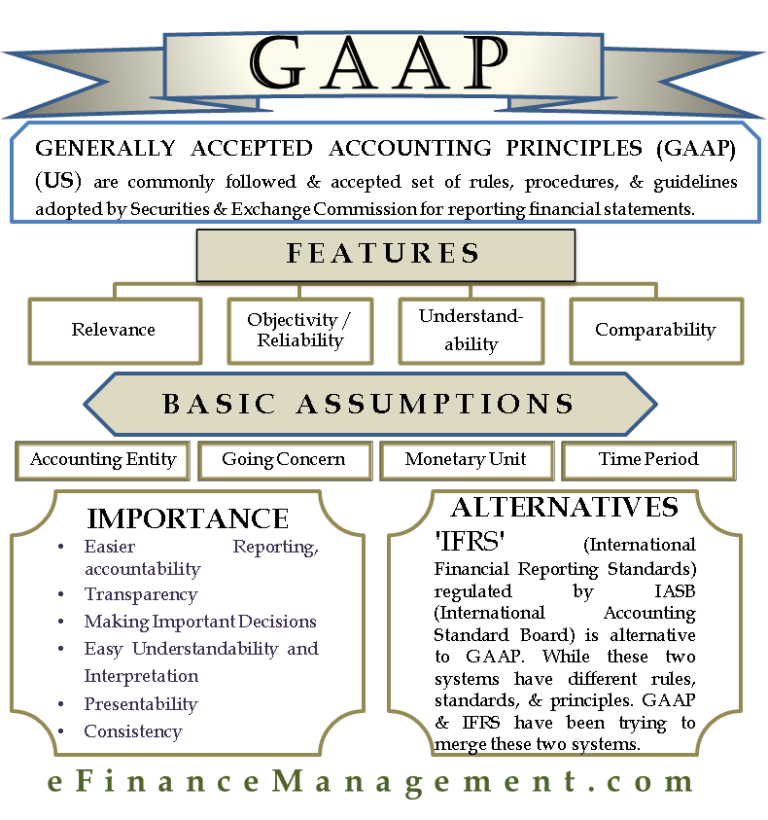

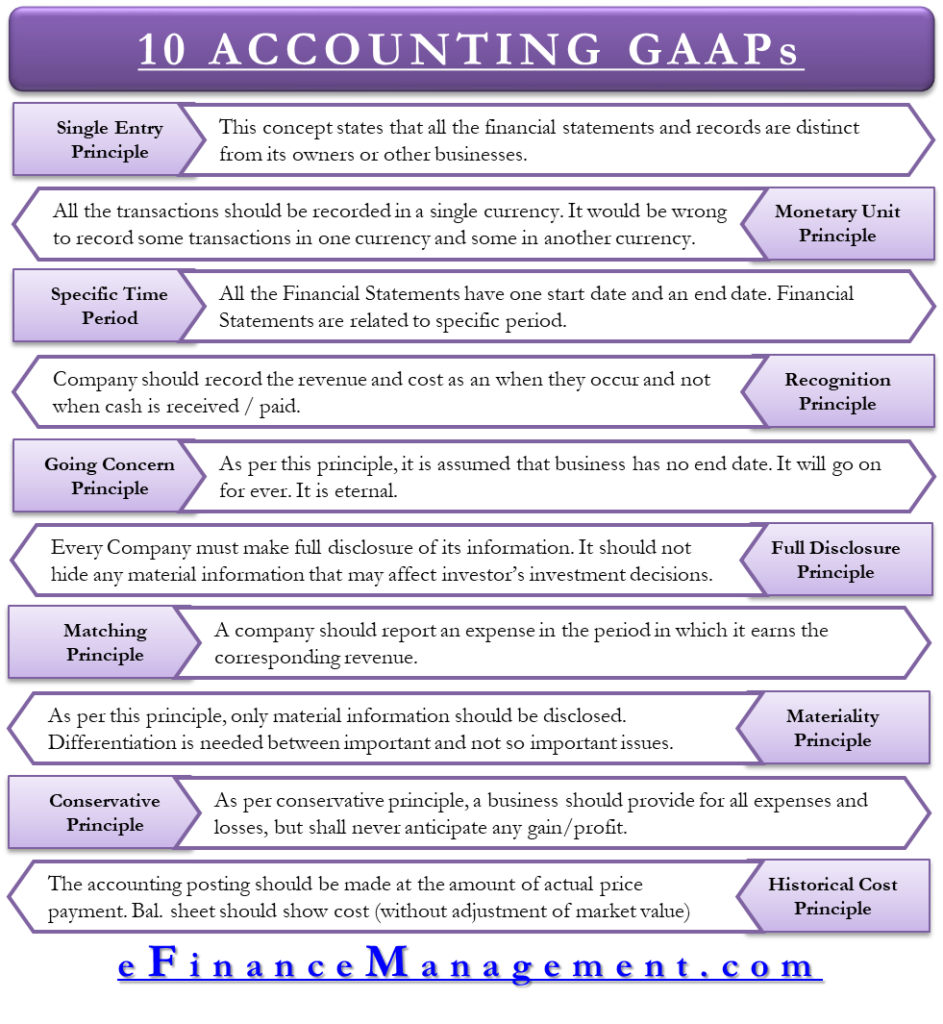

The generally accepted accounting principles (gaap) are a set of accounting rules, standards, and procedures issued and frequently revised by the financial accounting standards board (fasb. If a customer agrees to reimburse you for certain expenses, then you can record the reimbursed expenses as revenue. Pretax income from continuing operations:

The act of compensating or refunding an organization for a previous expense, incurred by the organization, which was not an expense belonging to the organization (usually through cash or check). Generally accepted accounting principles (gaap) basis, net income for the first quarter of fiscal year 2024 was $449.1 million, or $2.89 per diluted share, compared to $271.5 million, or $1.75 per diluted share, for the first quarter of fiscal year 2023. Exchange transactions october 14, 2021

On a u.s. Adjusted ebitda was $480.9mm, adjusted. 9.7 accounting for government grants 9.9 levies 9.8 reimbursement and contingent assets publication date:

Selling, general & administrative expenses: These principles constitute preferred accounting treatment. Realizable means that you have collected assets or can lay claim on assets in exchange for goods or services.

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

![PCGR principes comptables généralement reconnus [Guide complet]](https://i0.wp.com/www.iedunote.com/img/1119/gaap-rule-principles-assumptions-in-accounting-gaap.jpg)