Fabulous Tips About Discontinued Operations On Income Statement Loss Of Disposal Fixed Assets

![[Solved] Oriole, Inc. has the following data for the year ended](https://i.ytimg.com/vi/S_K-wG8eVwc/maxresdefault.jpg)

In such a case, the company needs to account for the.

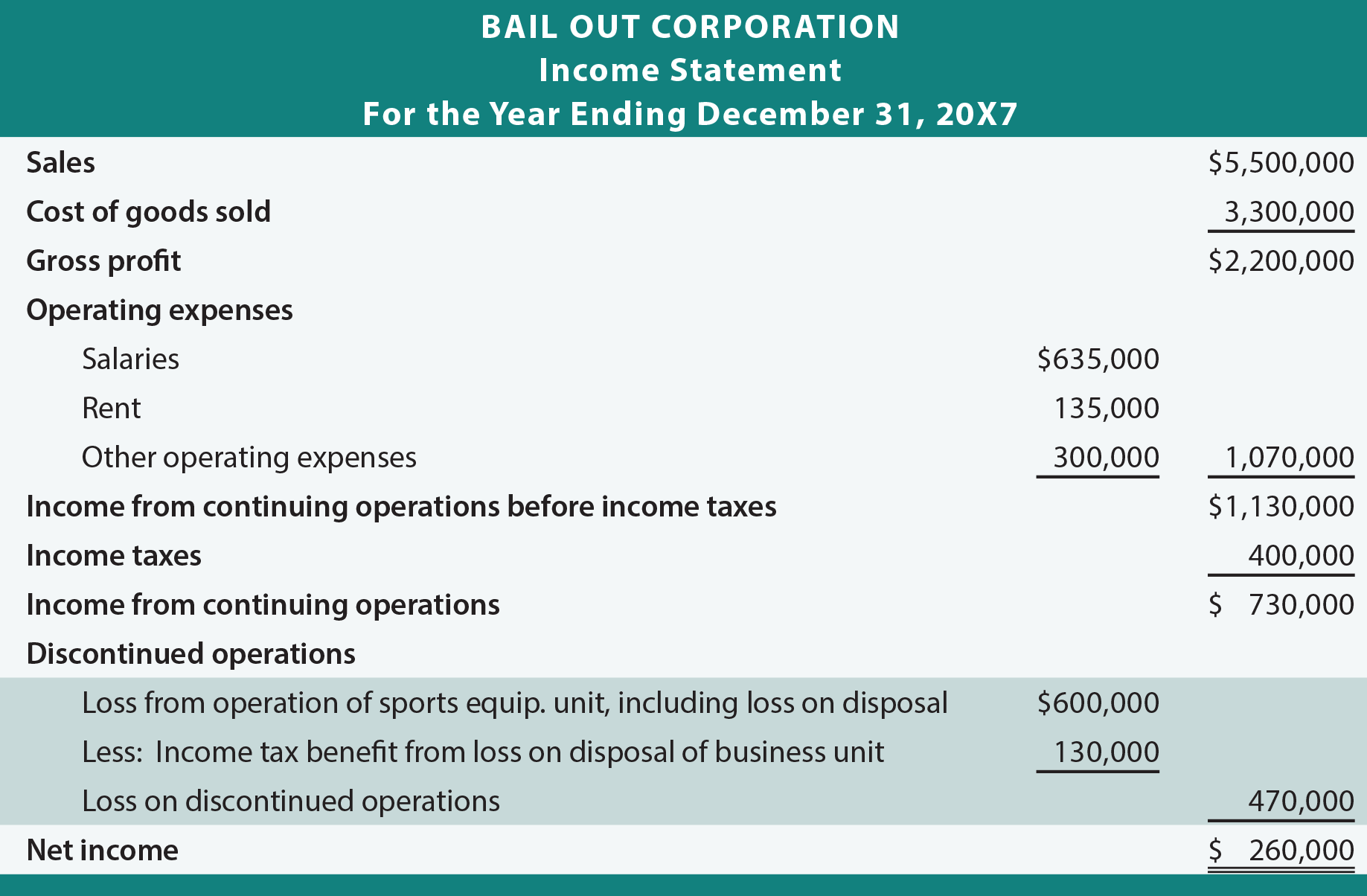

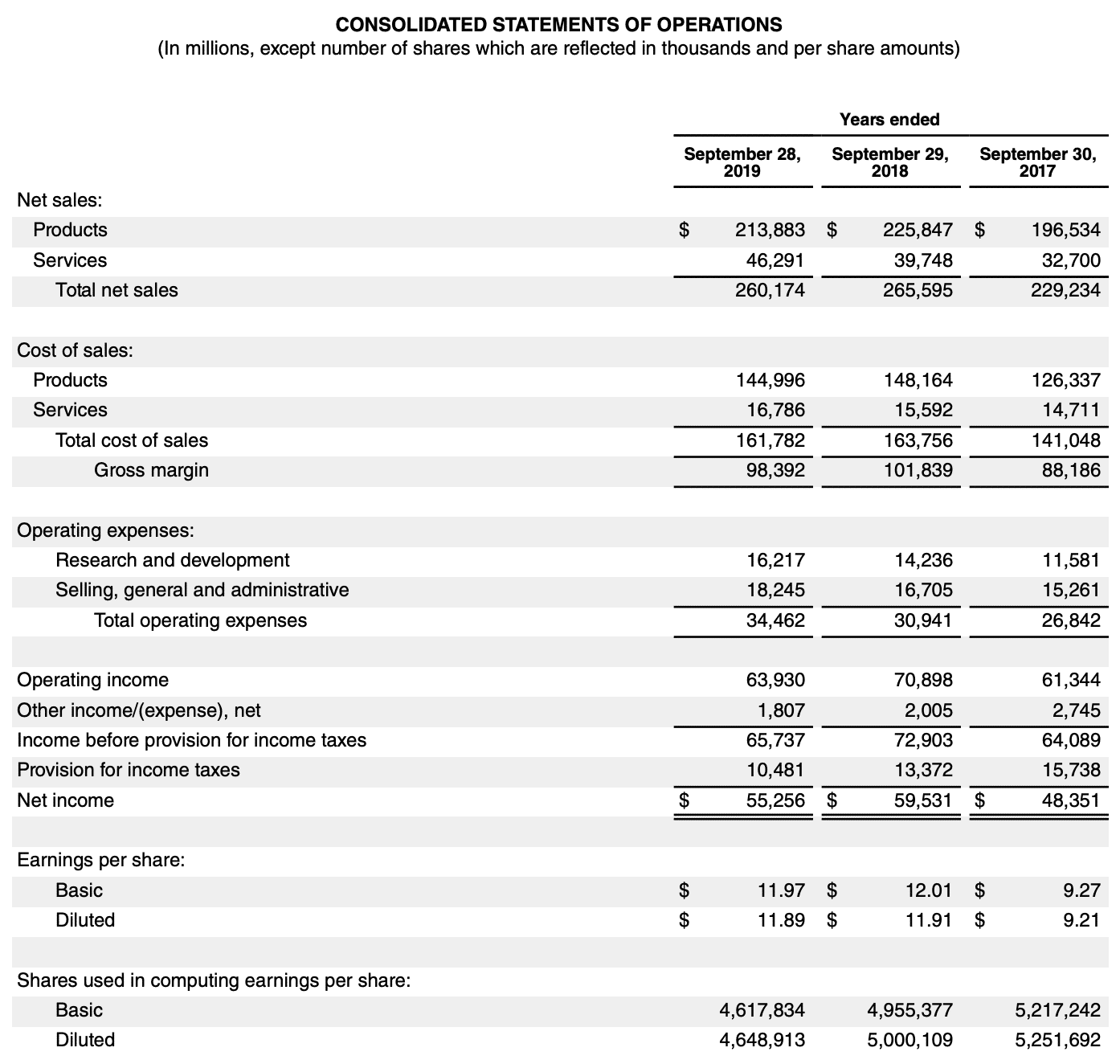

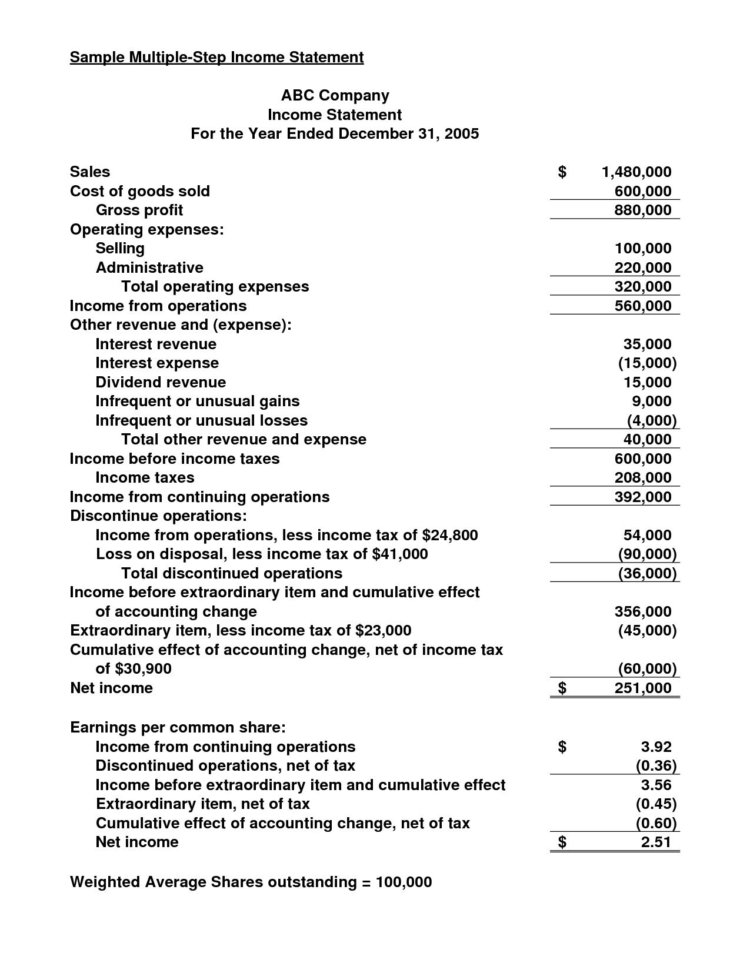

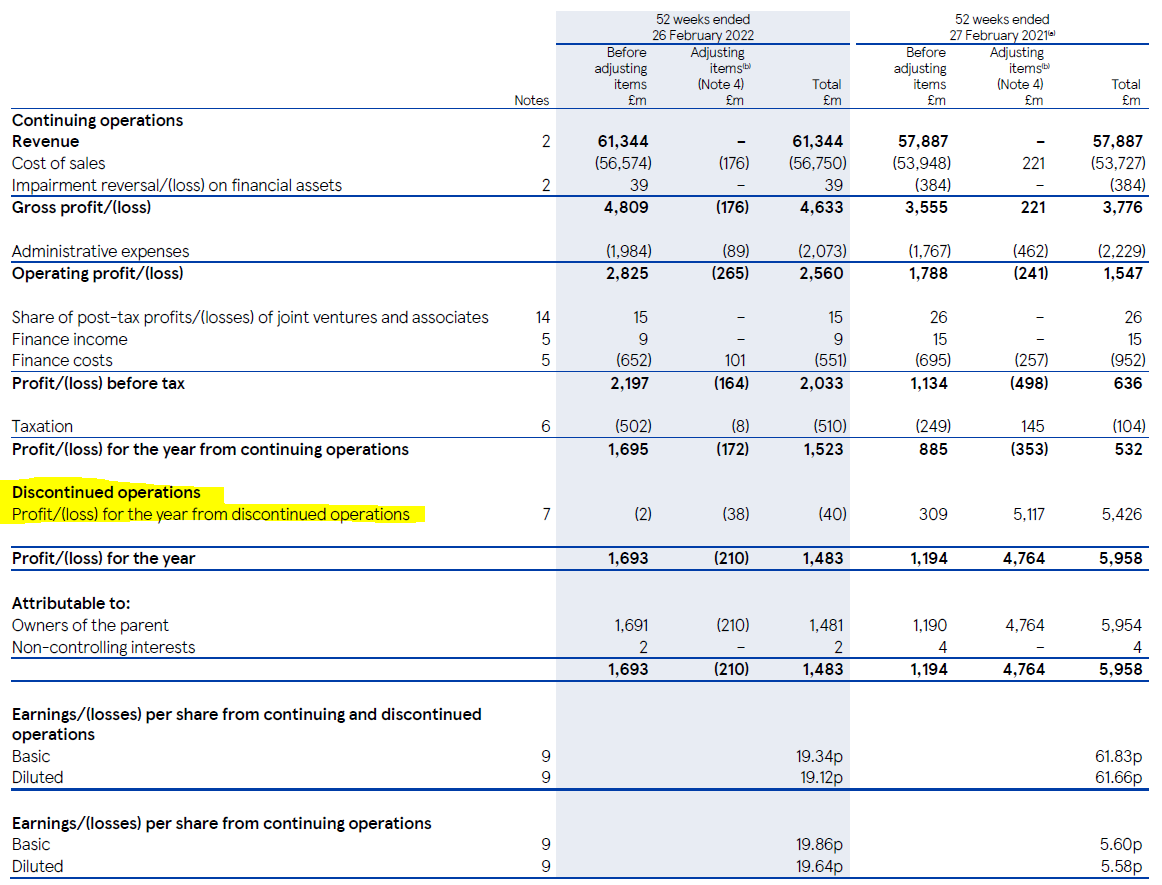

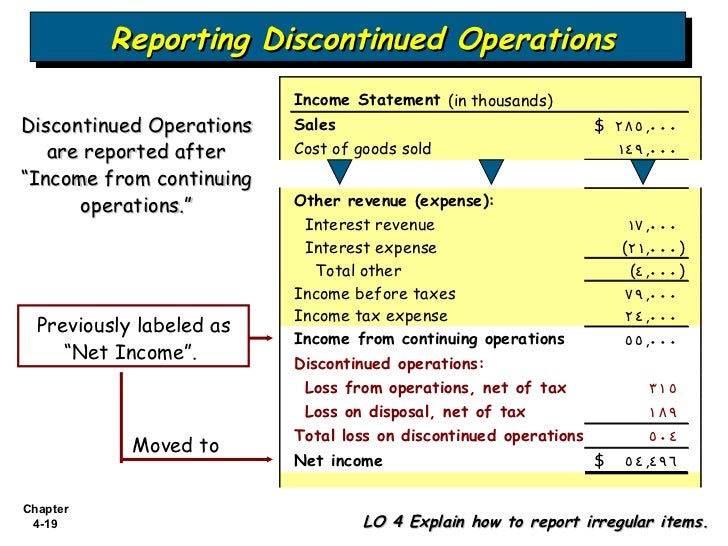

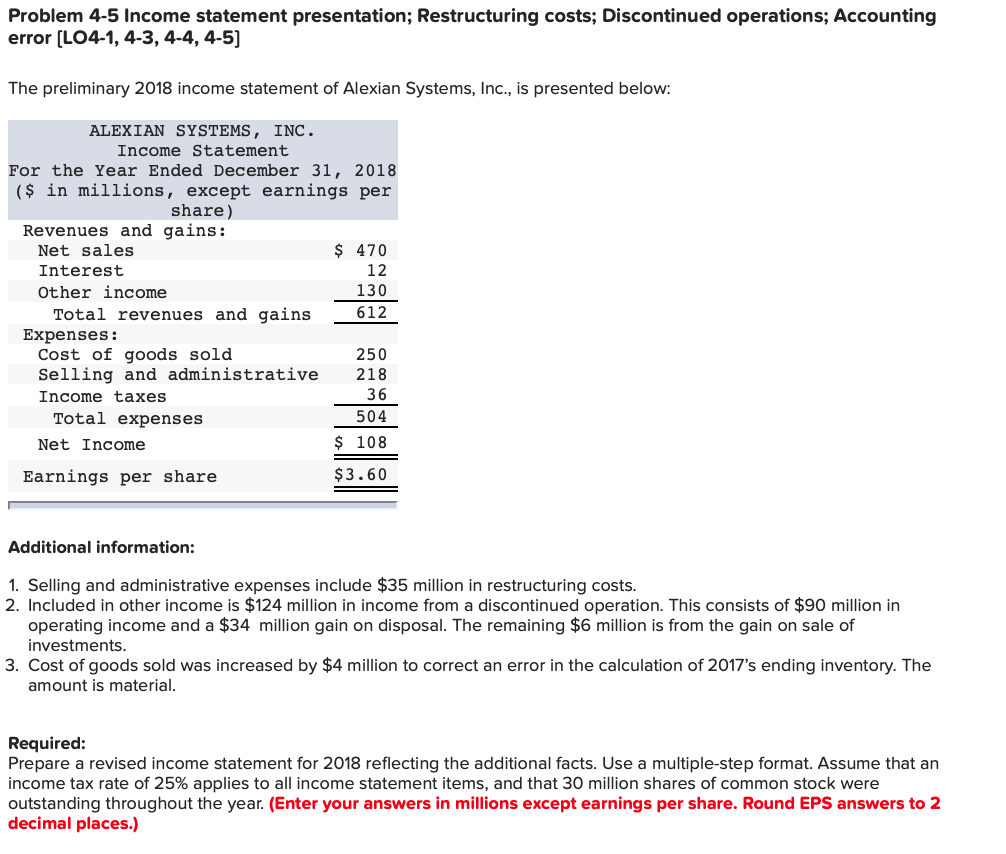

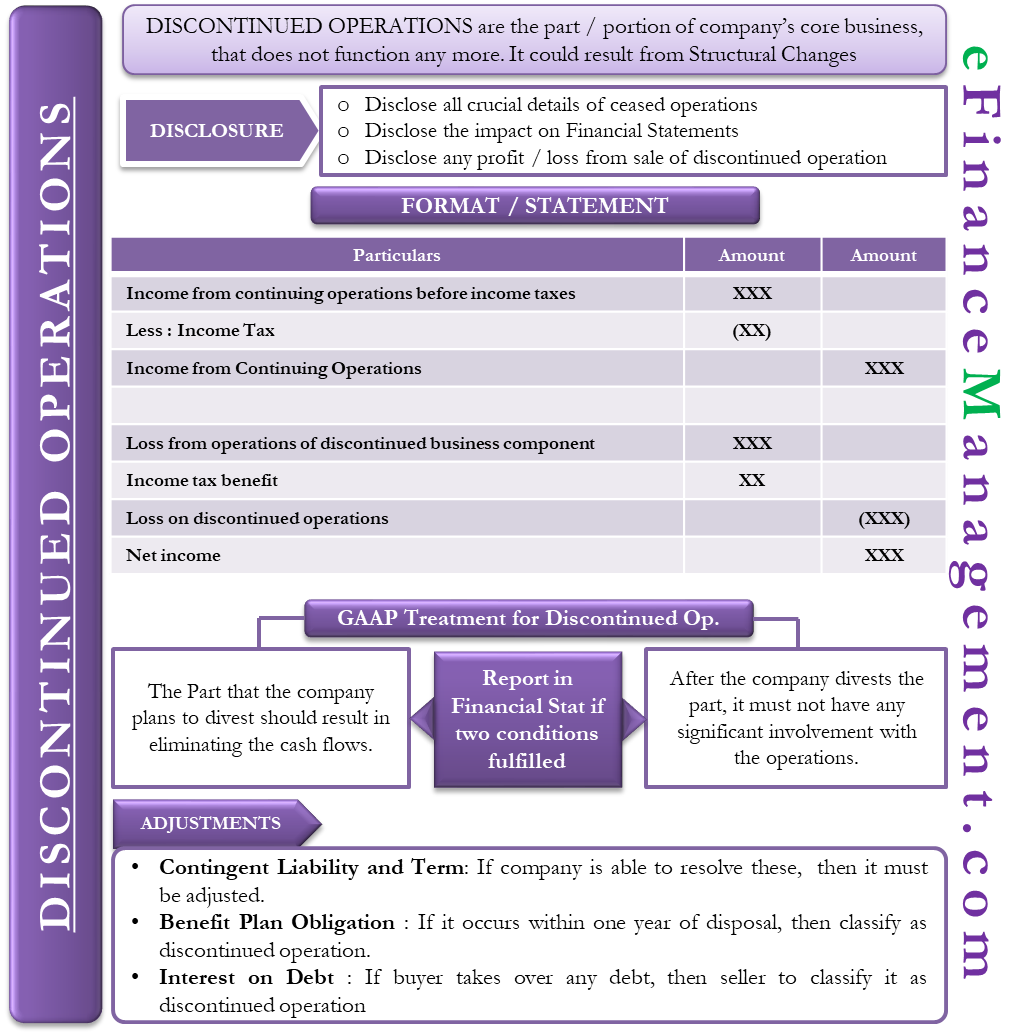

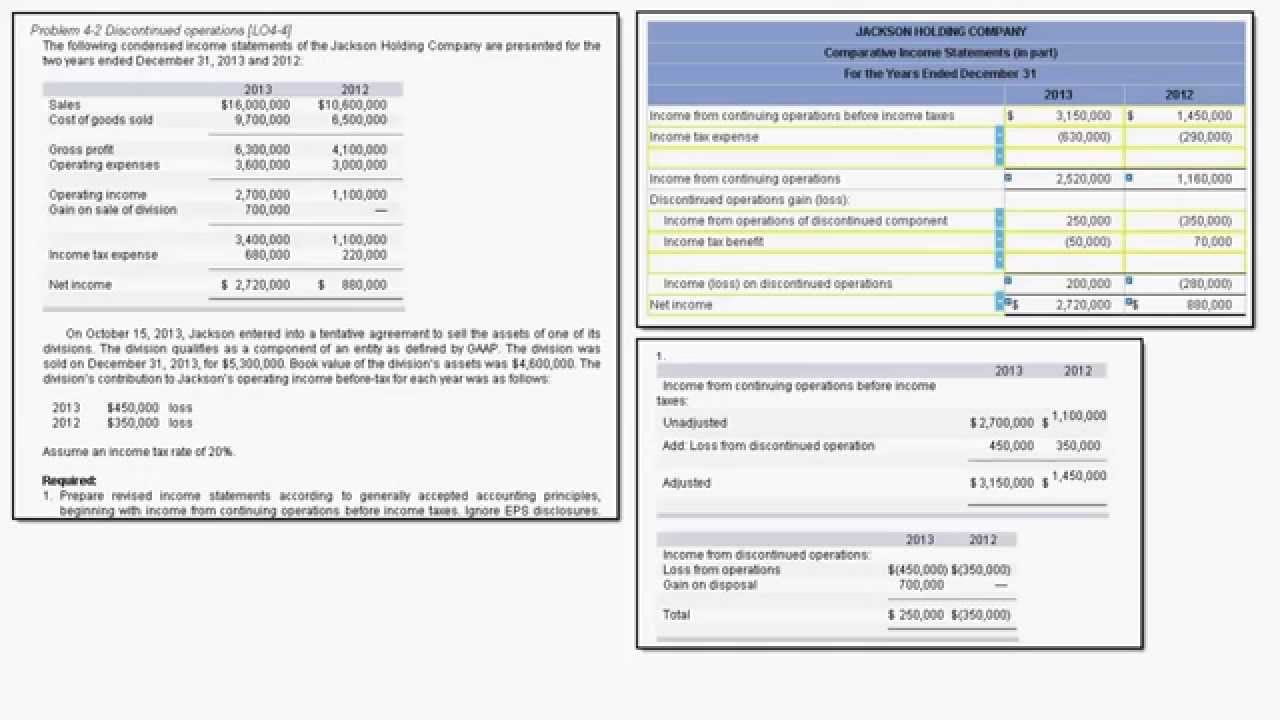

Discontinued operations on income statement. A discontinued operation is defined by ifrs 5.32 as a component of an entity that: Instead of presenting income taxes parenthetically on the income statement, the entity may show the pretax income (loss) from discontinued operations and the income tax. For accounting purposes, all the gains and losses for that division must be.

Discontinued operations refers to the shutdown of a division within a company. A discontinued operation is a separate major business division or geographical operation that the company has disposed of or is holding for sale. Discontinued operations is a term used in accounting to refer to parts of a company’s business that have been.

Income statement requirements. Discontinued operations can impact how you read an income statement. Ifrs 5 prohibits the retroactive classification as a discontinued operation, when the discontinued criteria are met after the end of the reporting period.

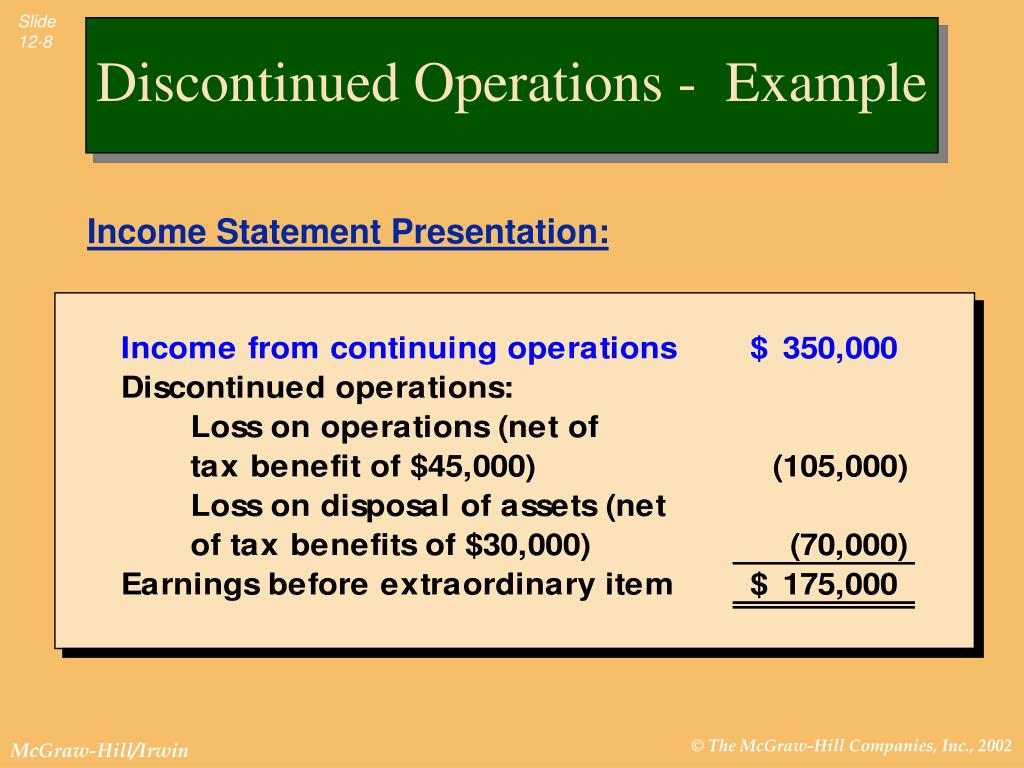

The net income or loss from the discontinued operations is entered in the income statement as a separate line item, typically labeled as “discontinued. In april 2001 the international accounting standards board (board) adopted ias 35 discontinuing operations, which had originally been issued by the international. But as the product belongs to the group, it cannot be disclosed.

The management accountant is analyzing whether this should be treated as discontinued operation. A reporting entity’s assessment of whether a component qualifies for discontinued operations reporting should occur when the component initially meets the. Discontinued operations are the results of operations of a component of an entity that is either being held for sale or which has already been disposed of.

Has either been sold or is classified as held for sale, represents a distinct major business. A reporting entity with a component that meets the conditions for discontinued operations should report the results of operations of the component, less applicable income taxes (benefit), as a separate component of income before. These items need clear presentation according to.