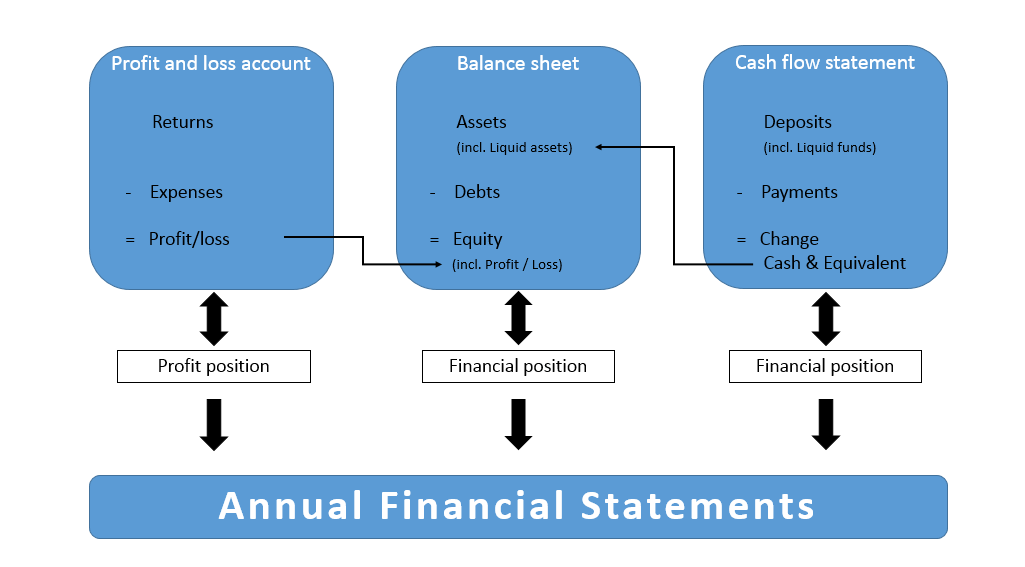

Stunning Tips About Difference Between Profit And Loss Statement Balance Sheet Realty Income

The balance sheet and p&l statement hold similar financial information;

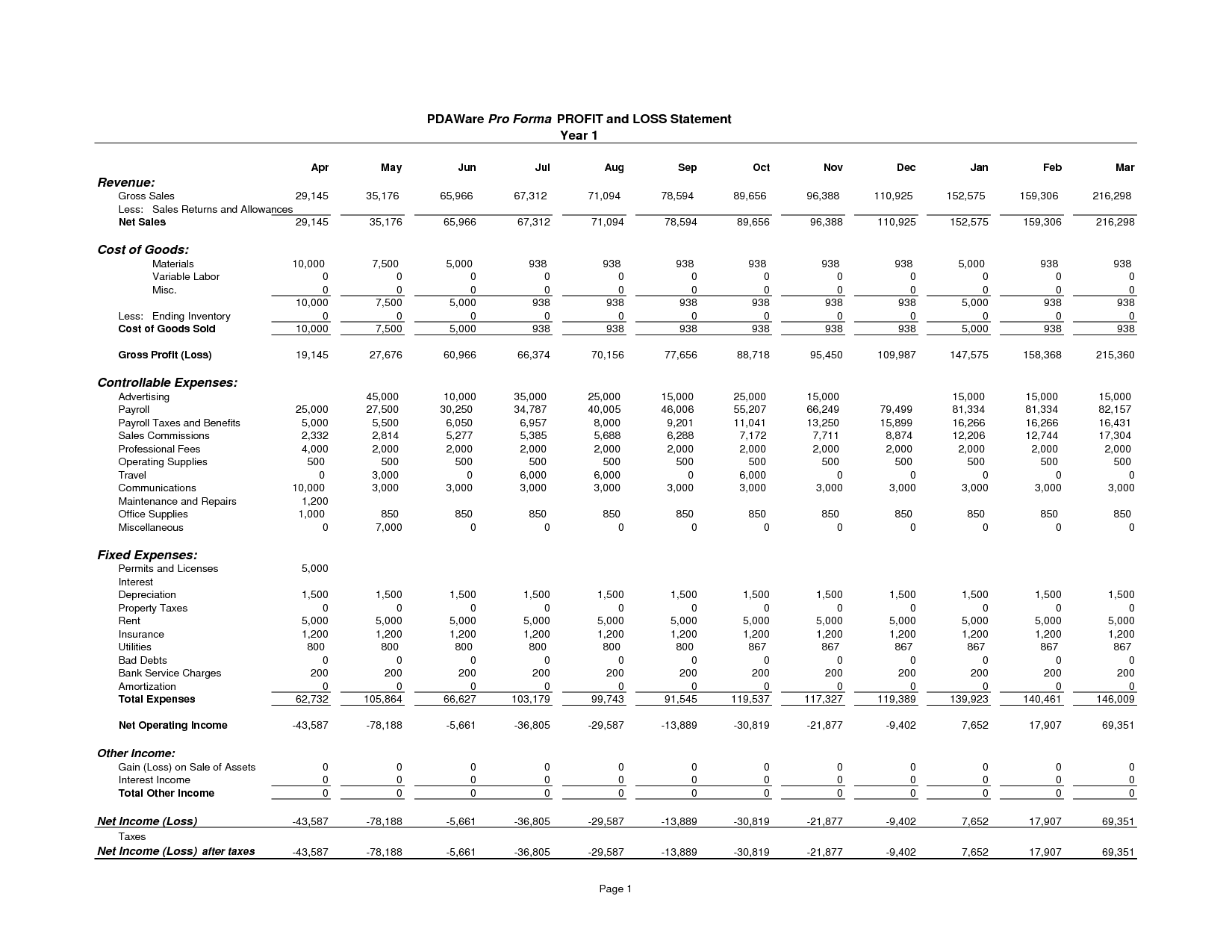

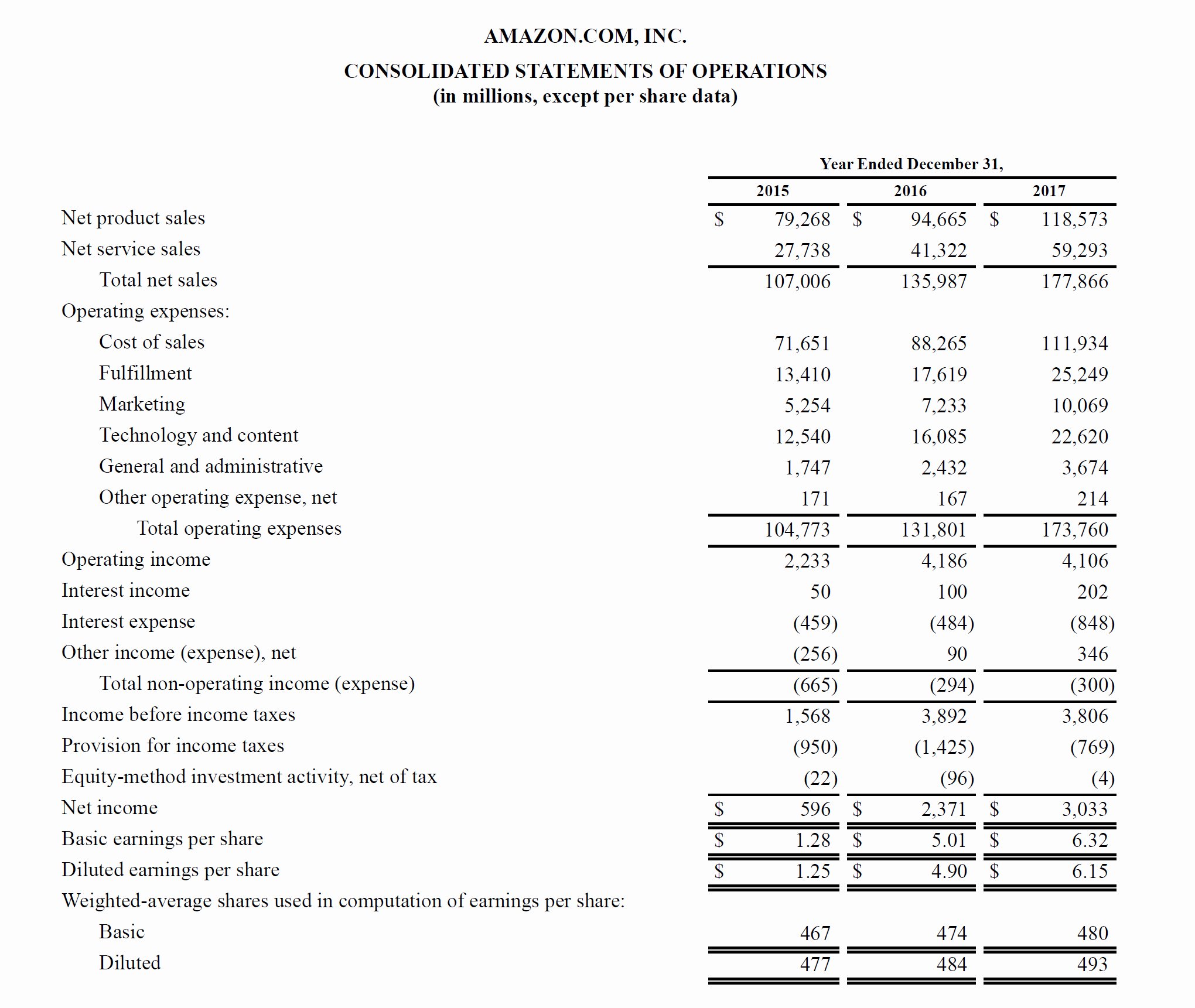

Difference between profit and loss statement and balance sheet. It’s sometimes referred to as an ‘income and expenditure account’ or a ‘statement of financial performance.’. A balance sheet is usually prepared at the end of a year or on the last day of the accounting year while the profit and loss statement is created by accountants in shorter business cycles such as each. Key takeaways the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

Key difference between a balance sheet and a profit and loss account (p&l) balance sheet vs profit & loss explained in the world of finance and accounting, understanding financial statements is crucial for any business. Companies and accountants can use these statements to assess the financial health of an organization. A balance sheet provides a snapshot of your company’s financial health at a specific moment in time.

Between in commerce balance sheet vs profit loss account balance sheet vs profit & loss account a balance sheet is a precise representation of the assets, equity and liabilities of the entity. A balance sheet can be defined as a financial statement that includes the assets, liabilities, and equity of the company. The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss statement summarizes information about revenues, and expenses.

Then, use that information to make plans for the future. How do you prepare a balance sheet? Such statements provide an ongoing record of a company's financial condition and are used by creditors, market analysts and investors to evaluate a company's financial soundness and growth potential.

Profit and loss statement vs balance sheet, what you need to know. It focuses on analysing the income and expenses incurred. Profit and loss statement for small business

It’s a snapshot of your whole business as it stands at a specific point in time. Profit and loss statement vs. A balance sheet is just as important because it shows a company's.

The main difference between a balance sheet and a profit and loss statement is the nature and scope of their financial contents. A balance sheet reports your assets/liabilities at a point in time so will never show if you've made a profit or loss. Profit and loss statement vs balance sheet:

A balance sheet is a. Key differences the profit and loss statement, commonly known as the income statement, plays a crucial role in illustrating a company's financial health by depicting its revenue, expenses, and net income or loss over a specific time frame. The balance sheet reflects the company’s financial position at a specific point, whereas the p&l reflects financial performance over a.

The key difference profit and loss statement vs balance sheet: The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. A p&l statement provides information about whether a company can.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. It captures a snapshot of the business’s assets, debts, and equity in a single moment, whereas a p&l statement demonstrates the performance of the overall business. A profit and loss account (p&l) reports the true financial position of the business, i.e.

.png)

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)