Top Notch Tips About Financial Statement Is Balance Sheet Accounting For Dividend And Retained Earnings

The biggest difference between a financial statement and a balance sheet is the scope of each.

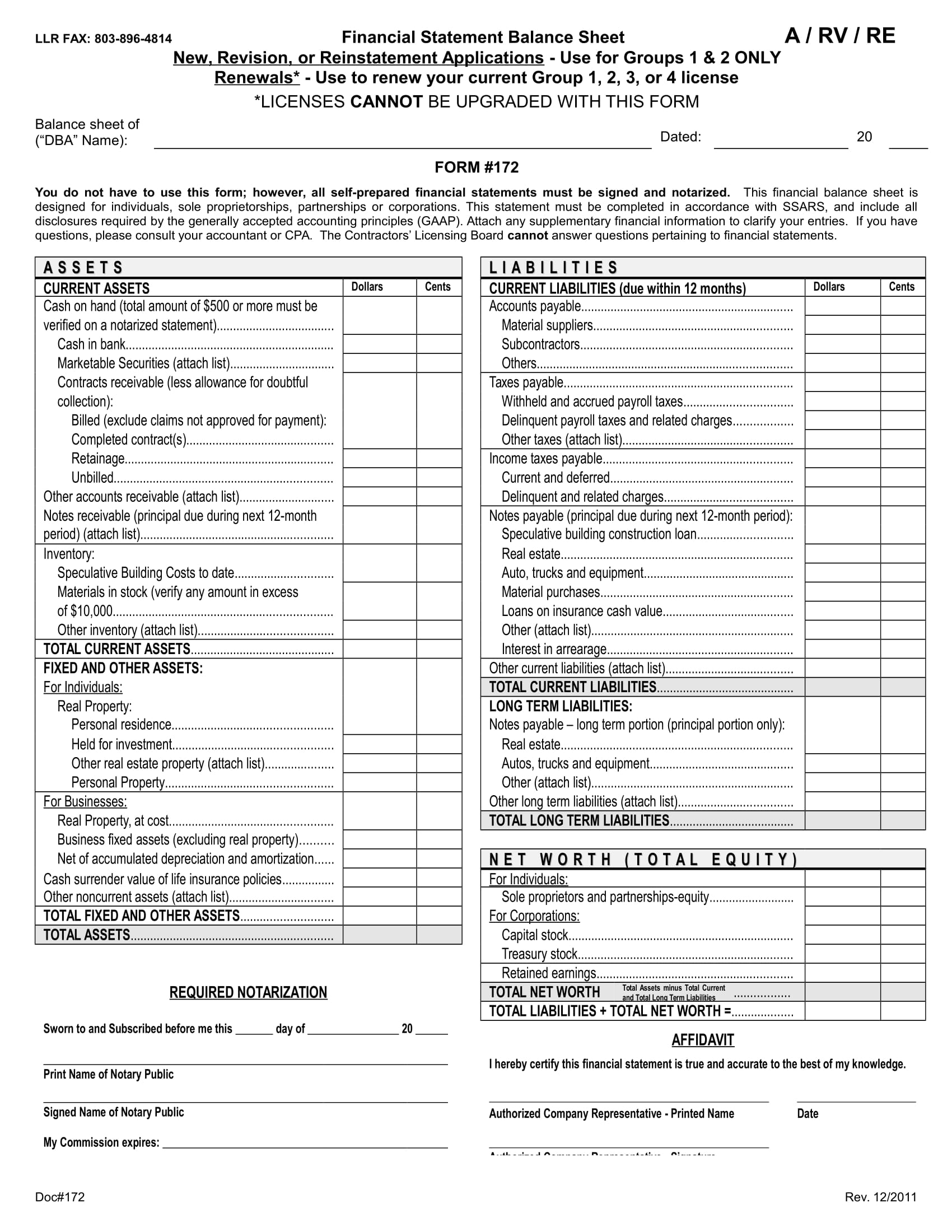

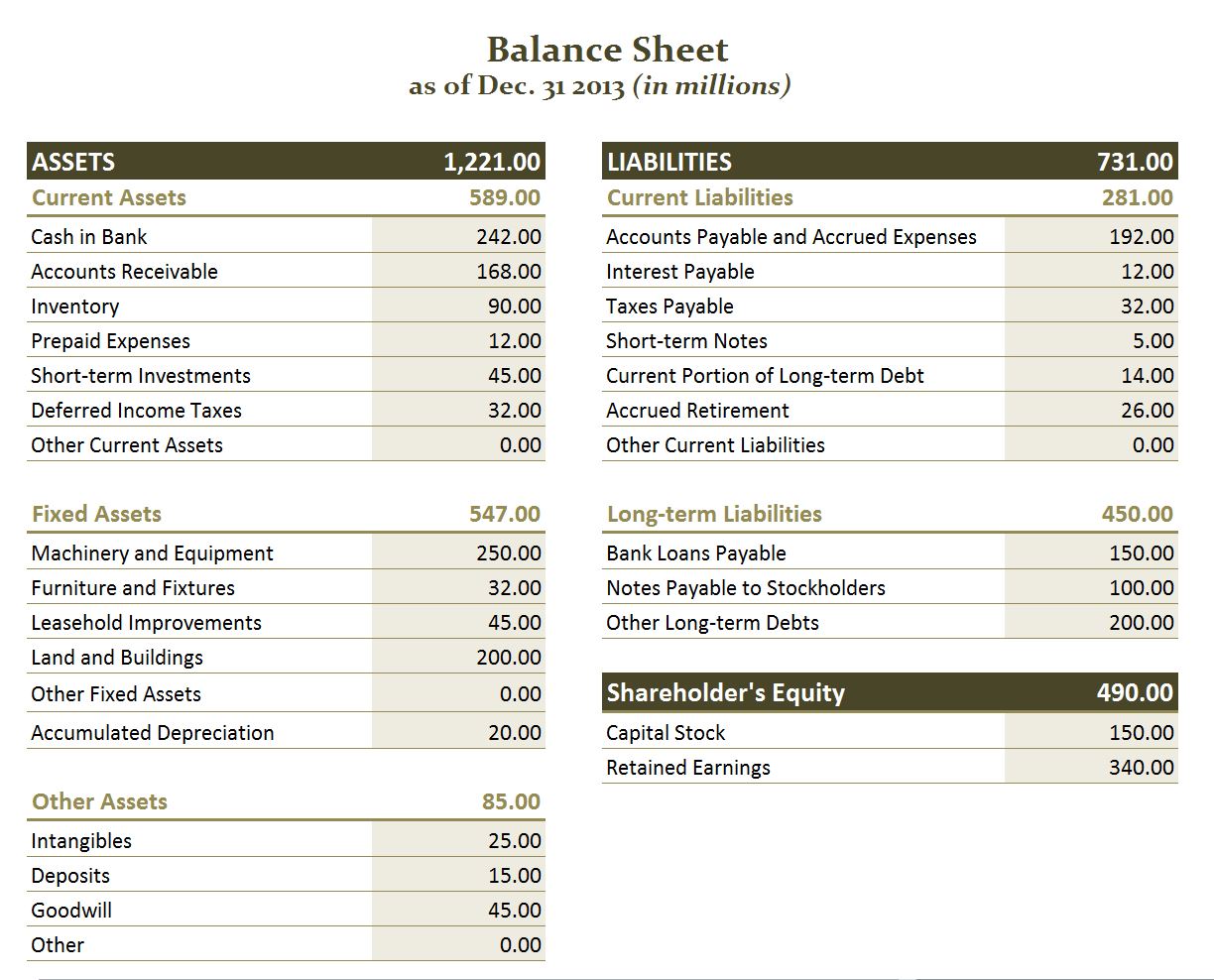

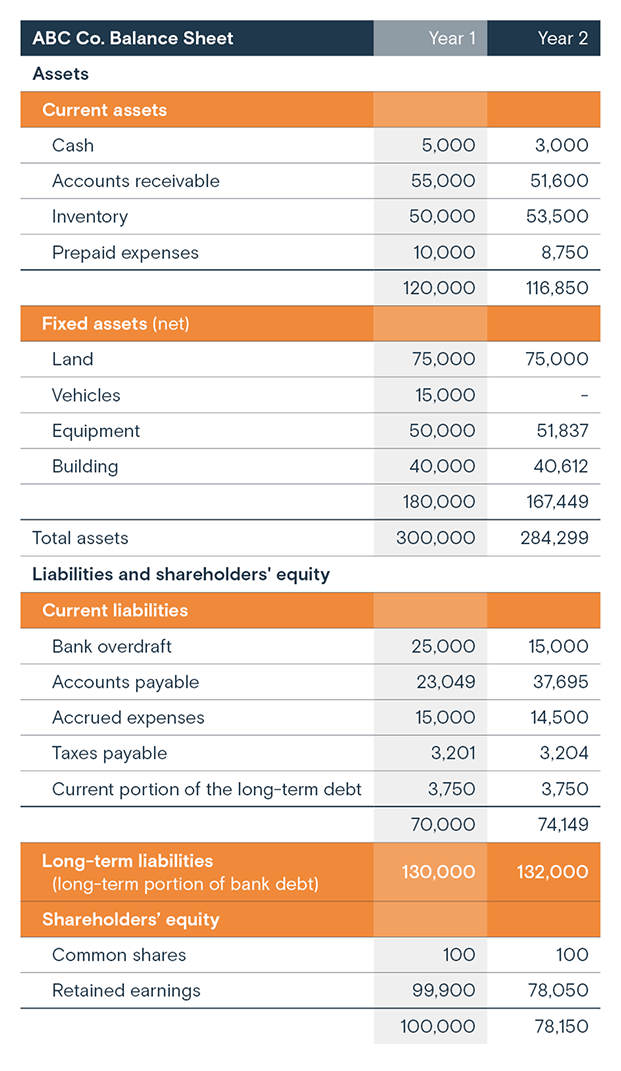

Financial statement is balance sheet. Does the balance sheet always balance? It provides a snapshot of the company’s financial position, indicating what it owns (assets), what it owes (liabilities), and the difference between the two (equity). A balance sheet is a statement of the financial position of a business that lists the assets, liabilities, and owners' equity at a particular point in time.

A balance sheet reveals the assets owned and debts owed by the entity, whereas financial statement reflects the health of the entity. Here is a closer look at each. The program, through which the central bank reduces assets on its balance sheet, is a form of monetary tightening that.

Learn more about what a balance sheet is, how it works, if you need one, and also see an example. View cero therapeutics' (nasdaq:cero) latest financials, balance sheet, income statement, cash flow statement, and 10k report at marketbeat. Export data to excel for your own analysis.

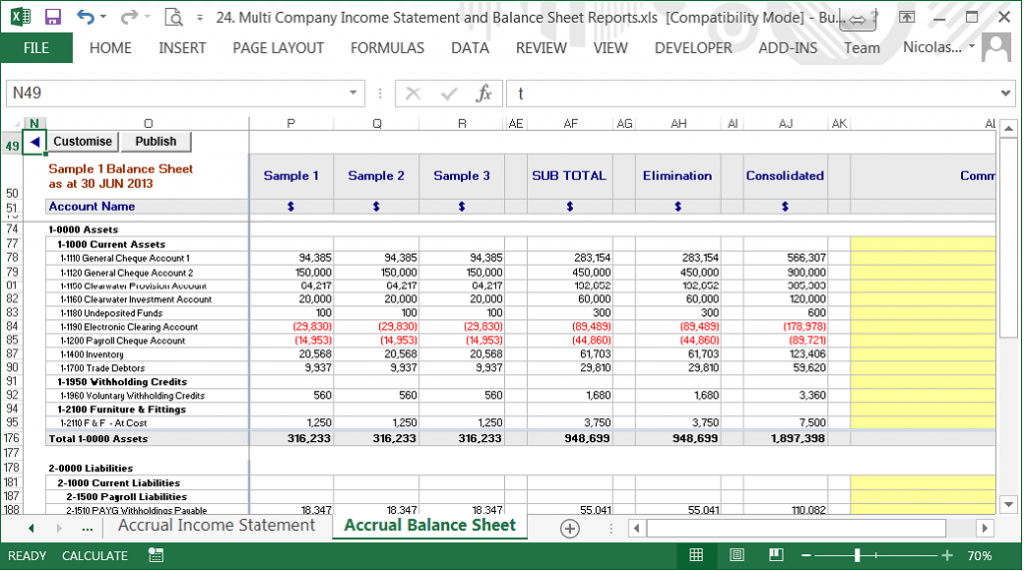

But the economy is moving towards a better balance. Financial statements vs. The income statement, balance sheet, and cash flow statement.

Zero) after release of €6.6 billion from provision for financial risks. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement. There are three financial statements that work together to create a complete picture of your business’s finances:

A balance sheet represents the financial condition of any entity at a particular date. Ecb reports loss of €1.3 billion (2022: With assets listed on the left side and liabilities and equity detailed on the right.

It provides a snapshot of a company's finances (what it owns and owes) as. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. Also referred to as the statement of financial position, a company's balance sheet provides information on what the company is worth from a book value perspective.

Key terms cash flow from operating activities financial statement analysis revenue gross profit gross income accounts payable It allows you to see what resources it has available and how they were financed as of a specific date. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

The balance sheet is split into two columns, with each column balancing out the other to net. What is a balance sheet? What is a balance sheet?

A balance sheet, at its core, shows the liquidity and the theoretical value of the business. The layout of a balance sheet reflects the basic accounting equation: The balance sheet provides an overview of assets, liabilities, and shareholders' equity as a snapshot in time.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)