Best Of The Best Info About Tax Rate In Income Statement Audit Firm For Sale

Forecasting income taxes.

Tax rate in income statement. Tax expenses are calculated by multiplying the appropriate tax rate of an individual or business by the income received or generated before taxes, after factoring. Clause 10 amends section me 1(3)(a) to increase the prescribed amount from $34,216 to $35,204. The prescribed amount is used in the formula that determines the minimum.

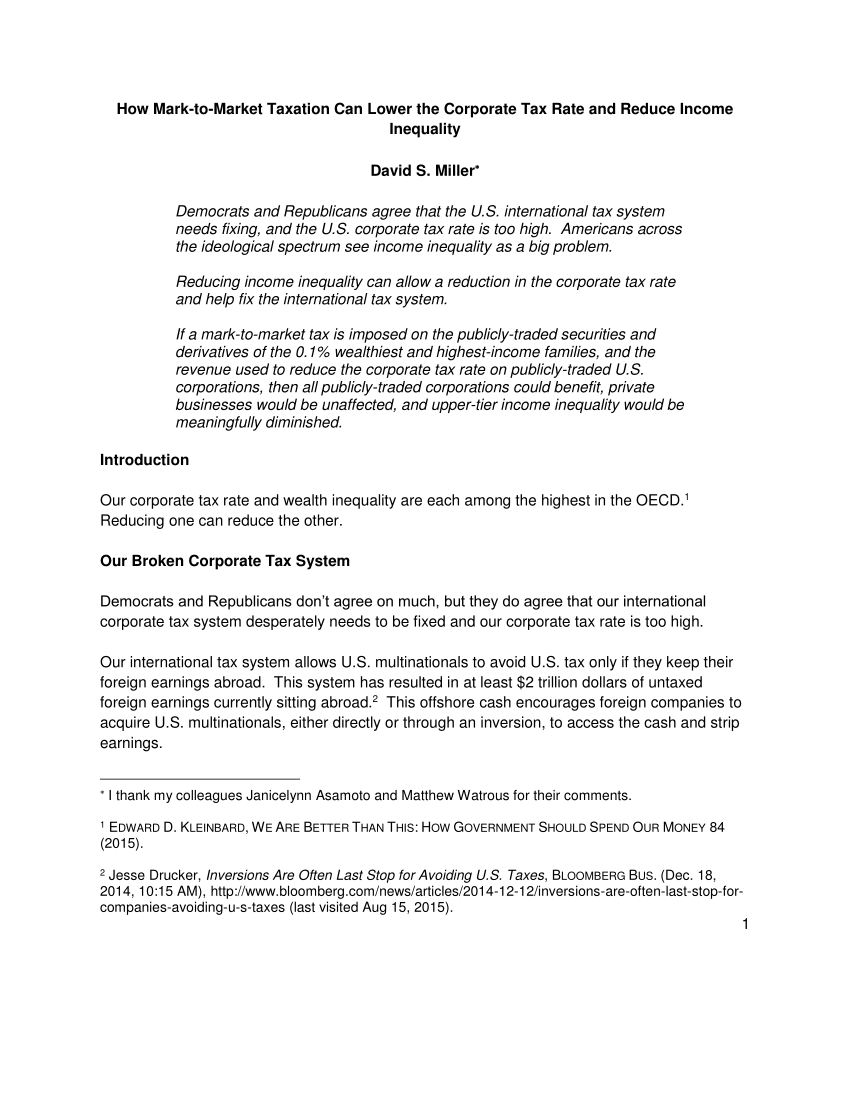

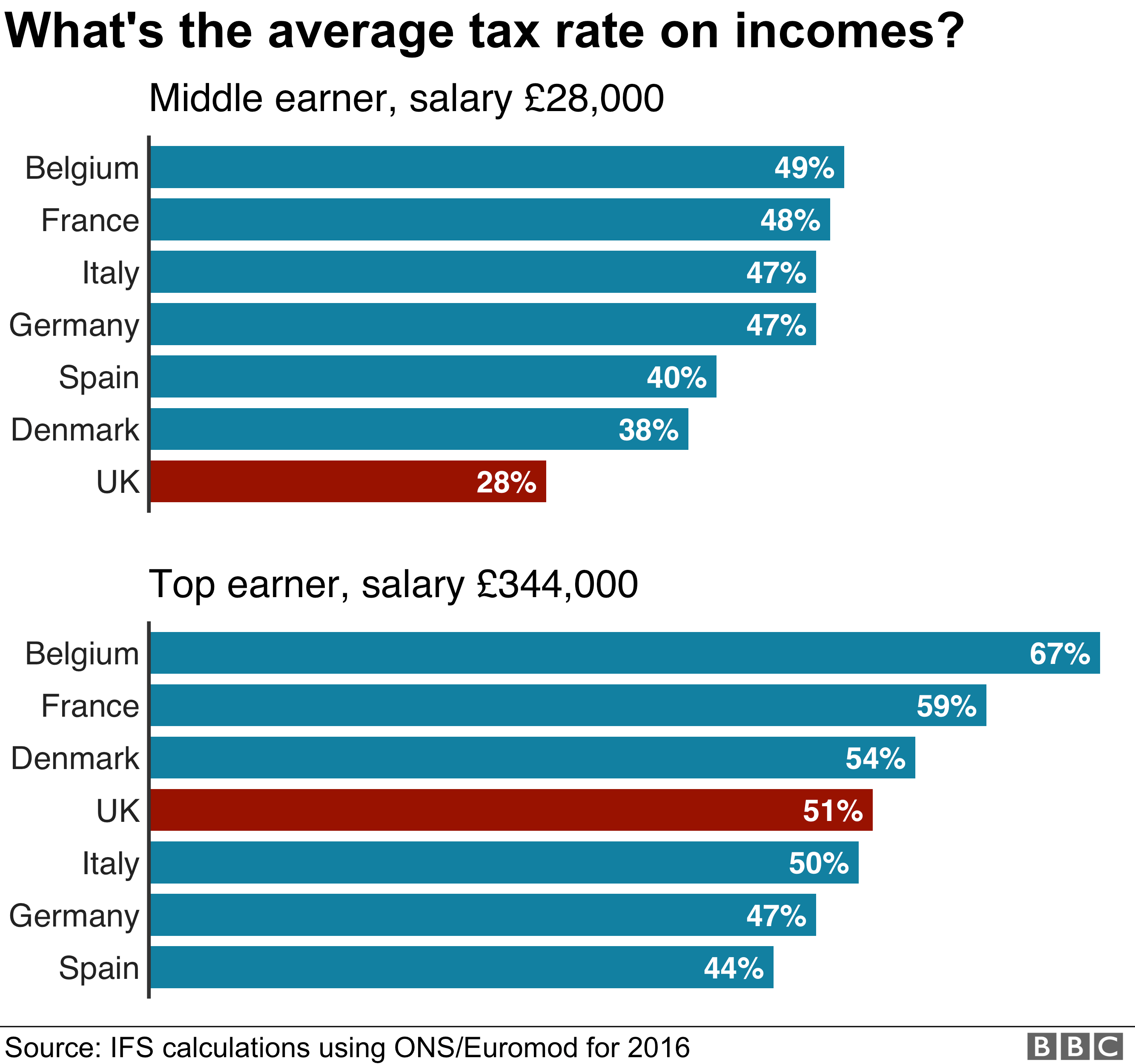

Mtr is significantly higher than the etr of 18.4% and it can be. Dividend tax and capital gains tax. In the example, $35,000 divided by $100,000 equals an effective tax rate of 0.35 or 35 percent.

Below is a screenshot from one of. The balance sheet, the income statement, and. Personal income tax (pit) rates;

The federal rate is 35% and the state taxes are 0.8%, giving an mtr of 35.8% (35% + 0.8%). It shows all revenues and expenses of the company over a specific period of time. Firstly, the taxable income of the individual.

For example, if your company had a total taxable income of $1. Key takeaways income before taxes, or pretax earnings, is a business's net income after all operating expenses—but not taxes—have been paid. Personal income tax (pit) due dates;

However, there are times where tax rates historically are not. The income statement, also called a profit and loss statement, is one of the major financial statements issued by businesses, along with the balance sheet and cash. To estimate a company's tax rate from the income.

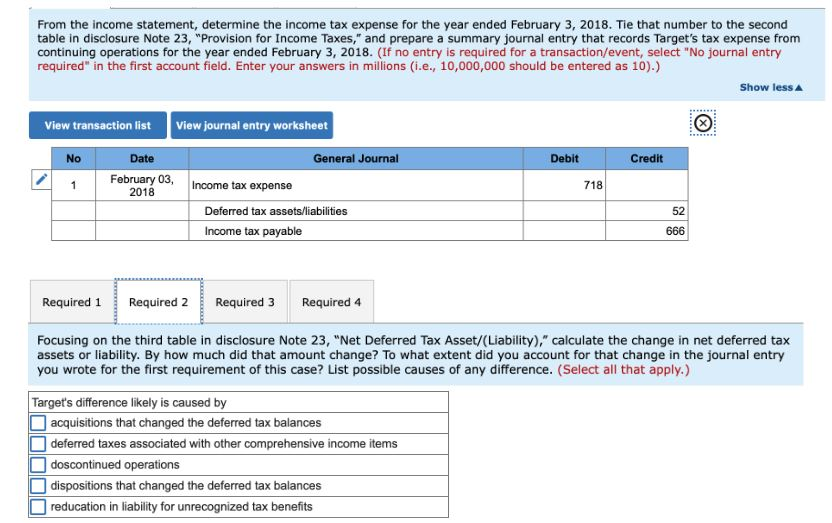

Corporate income tax (cit) due dates; Tax expense by including all of the above (and more, if necessary), you can arrive at net income, or the bottom line of the income statement. Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the.

Divide taxes paid by net profit to calculate the effective tax rate percentage. Input the appropriate numbers in this formula: How to determine the tax rate from an income statement marginal rate versus effective rate.

Taxable income x tax rate = income tax expense. Learn how to calculate taxable income, tax deductions, and marginal tax. An income statement summarizes a company's financial performance.

Updated may 27, 2021 reviewed by charlene rhinehart taxes appear in some form in all three of the major financial statements: Companies have both a marginal tax rate and an effective tax rate. 7/2021, which overhauls the country’s existing tax structure.