Fun Tips About Dividend In Profit And Loss Account The First Section Of A Balance Sheet Represents Your

Understanding why dividends are not expenses.

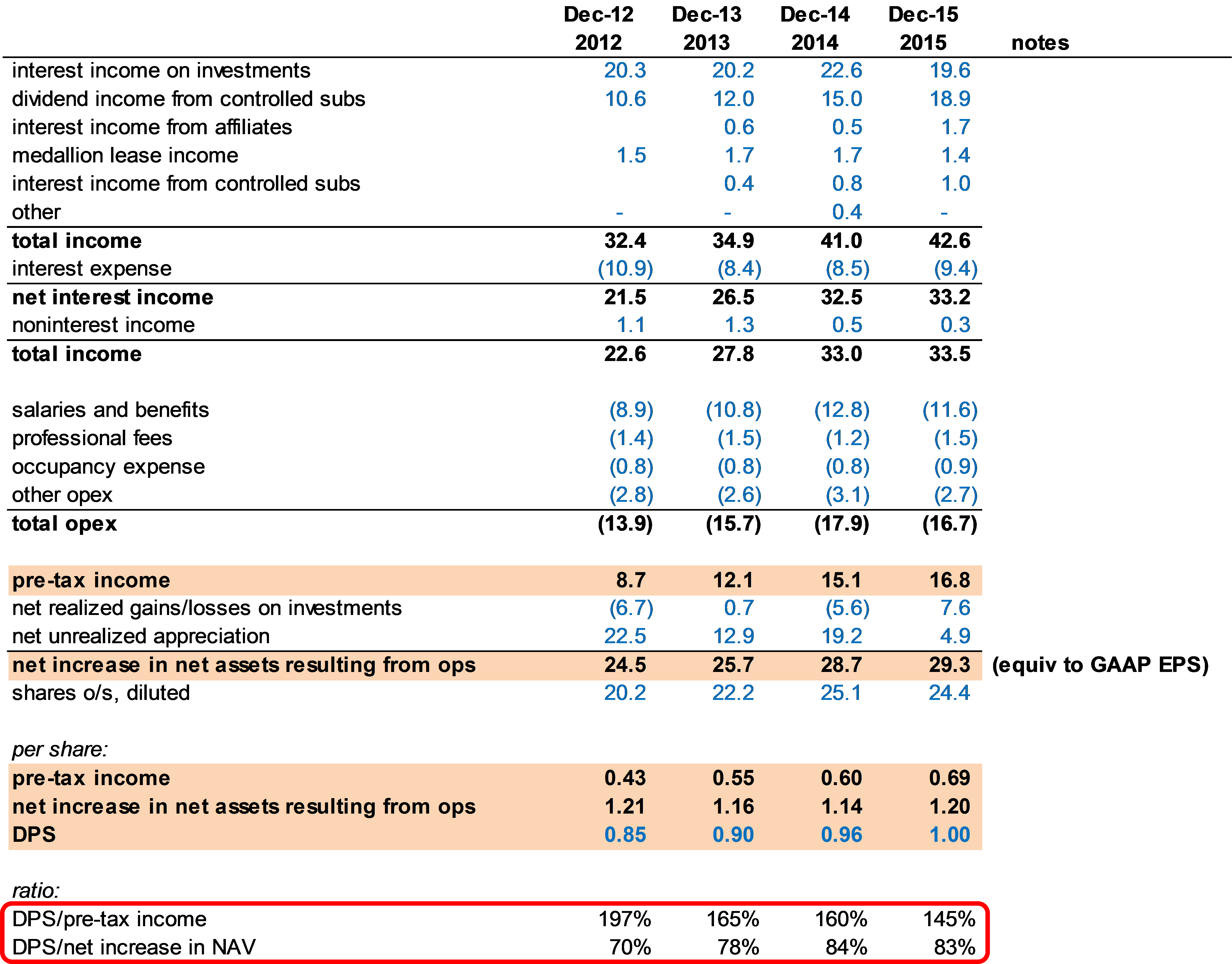

Dividend in profit and loss account. Dividends are paid out of profit after tax. A cash dividend is a sum of money paid by a company to a shareholder out of its profits or reserves called. Cash dividends can be made via.

The balance sheet in those annual accounts will often show “retained earnings” or “profit and loss reserves”. Photo by gavin young/postmedia. Companies are not required to issue dividends on.

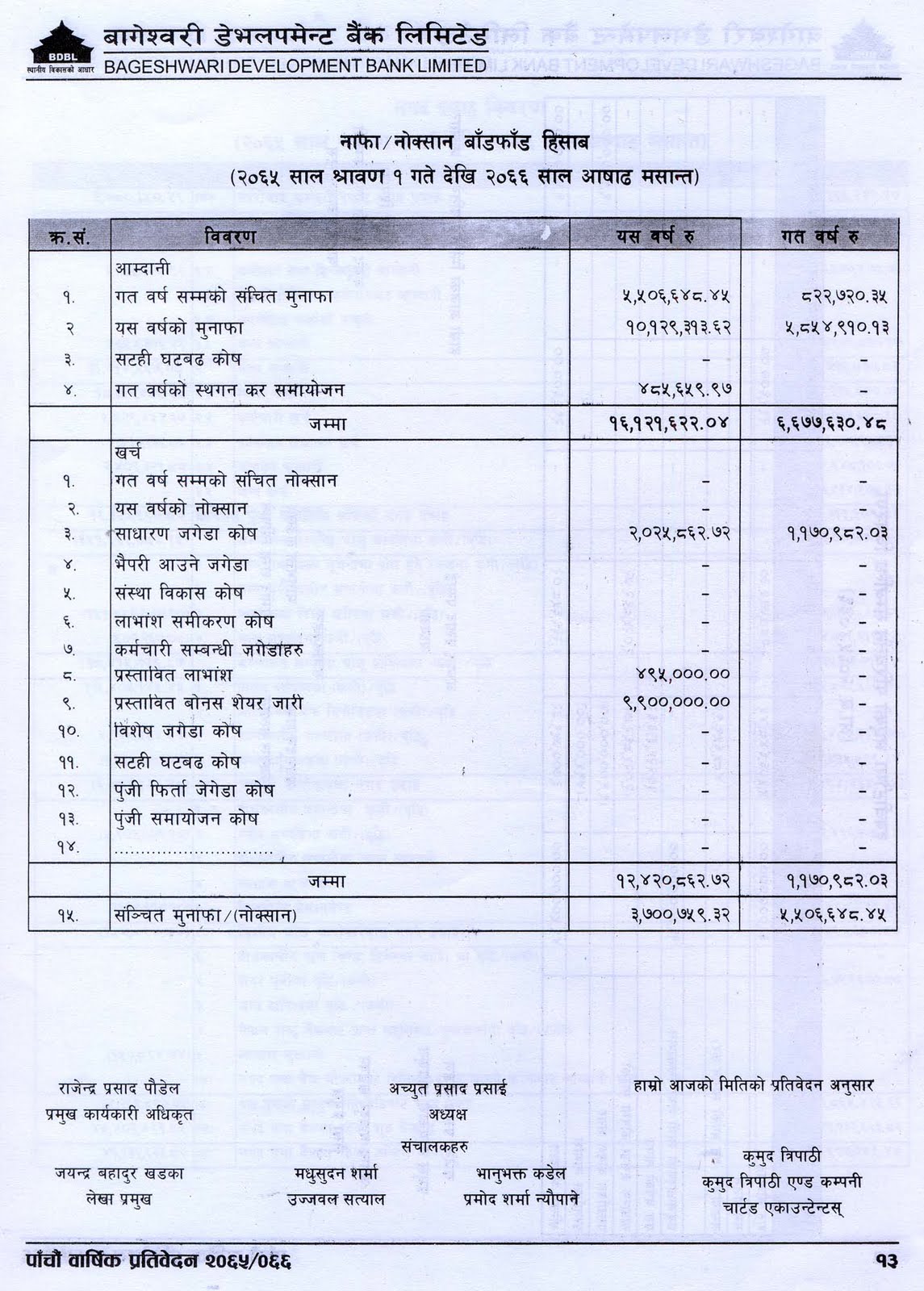

A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment. Dividends in the balance sheet. Mostly, the appropriation of profit and loss.

However, for micro companies the balance sheet will simply show a. Kuala lumpur (feb 22): Financial statements of a corporation the main financial statements of a corporation are:

It does not affect any. Stock dividends do not change the asset side of the balance sheet —only reallocates retained earnings to common stock. Paying the dividends reduces the amount of retained earnings stated in the balance sheet.

There will be an investment income amount in the parent’s column which needs to be eliminated. Csc steel holdings bhd recorded a net profit of rm10.49 million for its fourth quarter ended dec 31, 2023 (4qfy2023), compared with a net loss. A dividend is a share of profits and retained earnings that a company pays out to its shareholders and owners.

Accounting dividend is one of the most common accounting words that business owners and shareholders use. Dividends are a distribution paid out of a limited company’s retained profits. Net profit after tax (npat) grew 41% to us$3.3 billion.

So if a company had £10,000 undrawn profits at the start of the year and had made £1,000 of profits after tax so far this year, they might want to pay a dividend of £11,000 but it. But do you know what “dividend” means? Simply reserving cash for a future dividend.

Definition of dividends cash dividends are a distribution of a company's profits. Consolidated statement of profit and loss. That is the highest annual profit recorded.

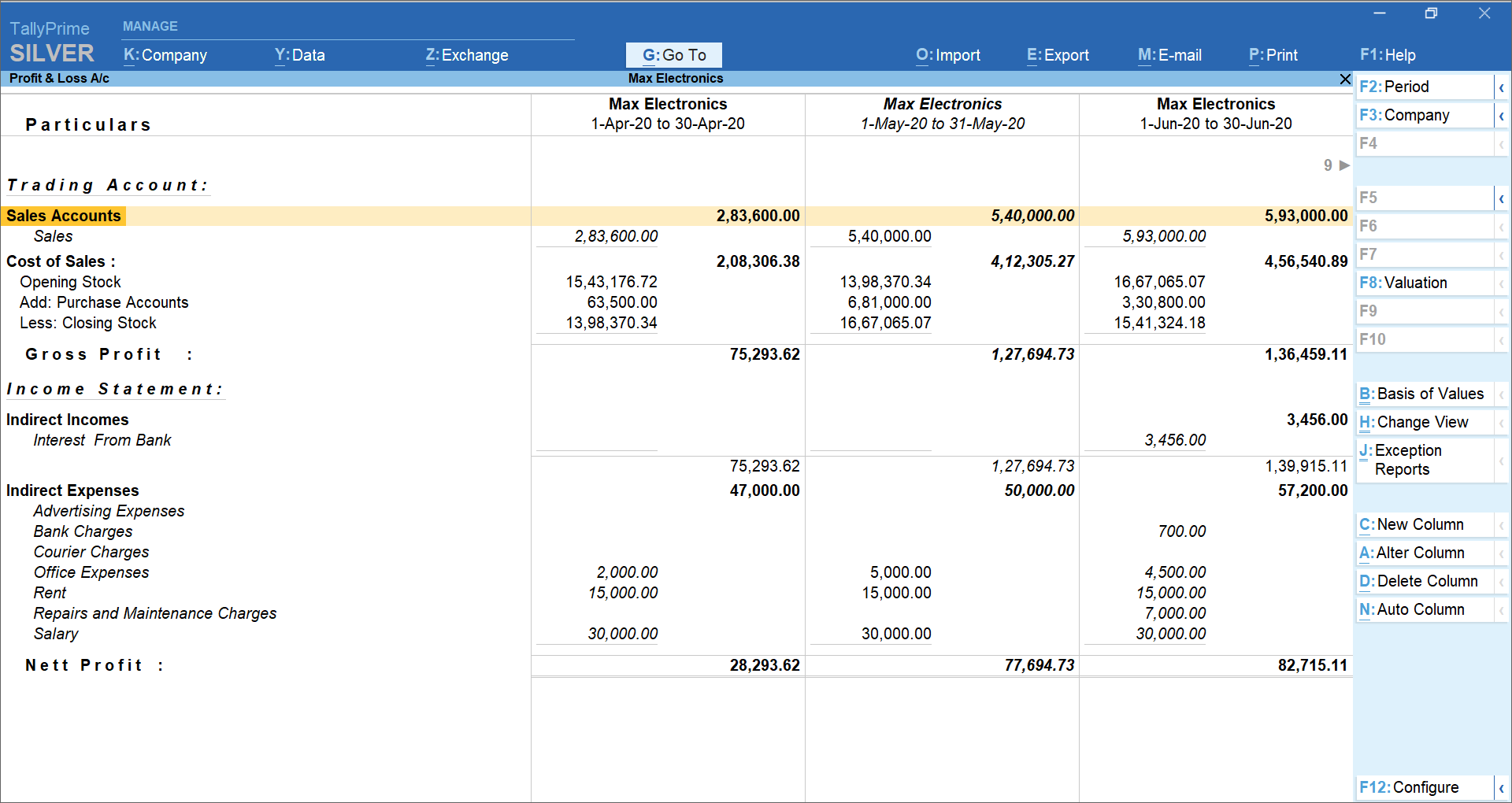

Free cash flow increased 68% to us$2.66 billion. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period,. For bookkeeping and reporting in xero, i think it is acceptable to show.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)