Unbelievable Tips About Prepaid Expense Cash Flow Formula For A Balance Sheet

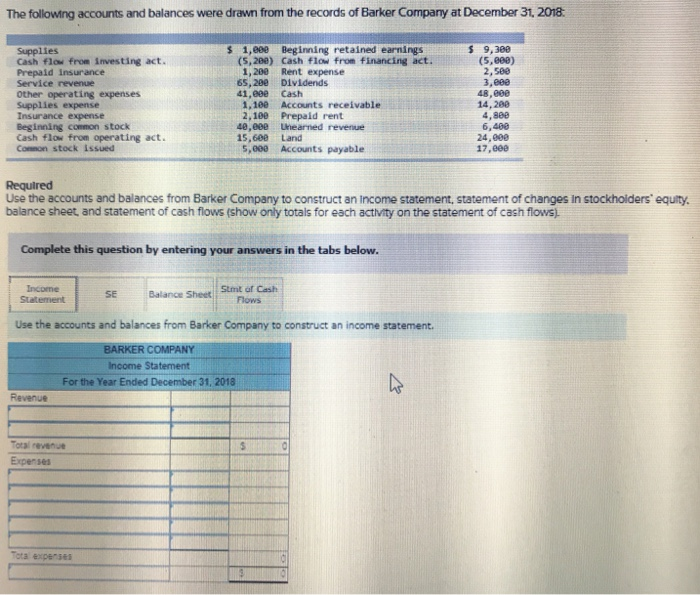

![[Solved] The following accounts and balances were drawn from the](https://media.cheggcdn.com/study/b55/b555cd81-461f-4a51-a135-c73f5a68e75d/image.png)

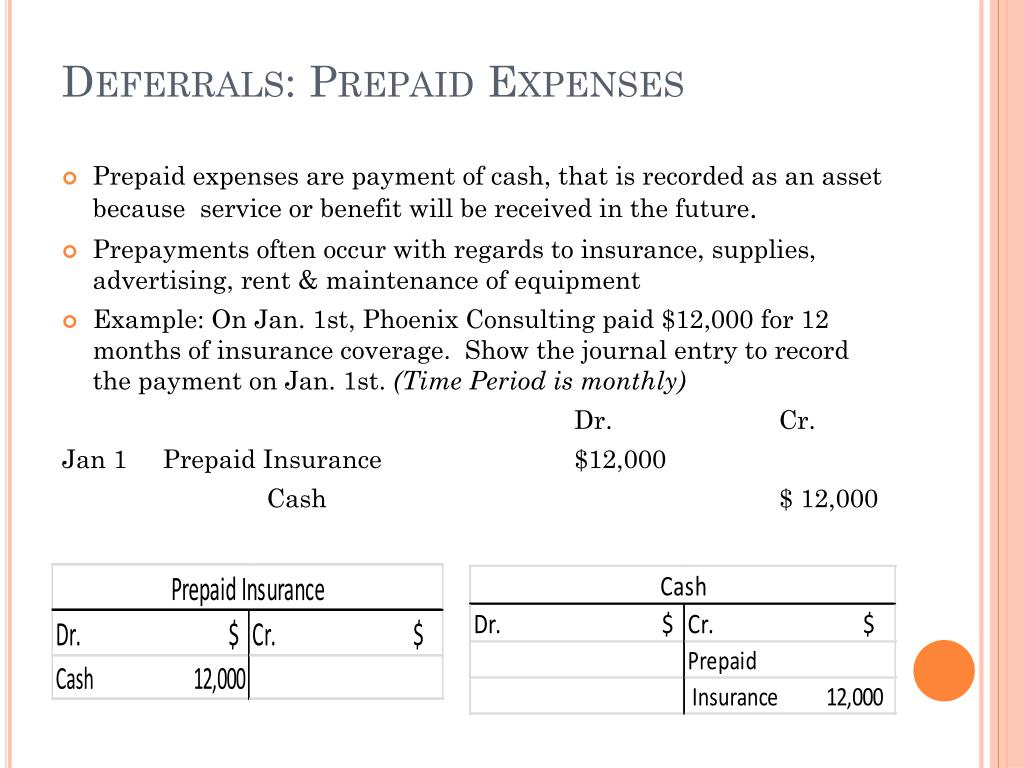

Debit prepaid expenses (asset) and credit cash/bank.

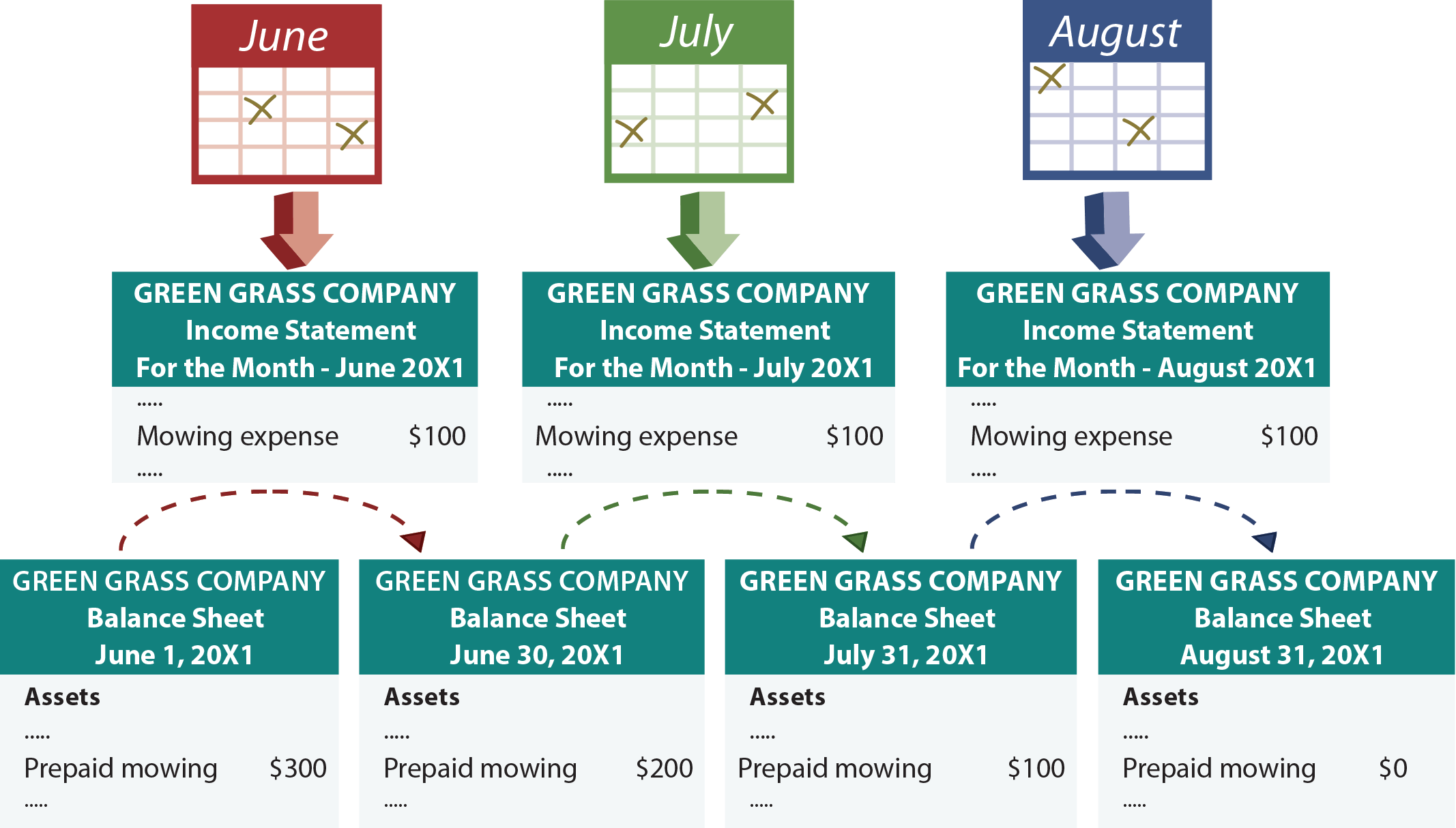

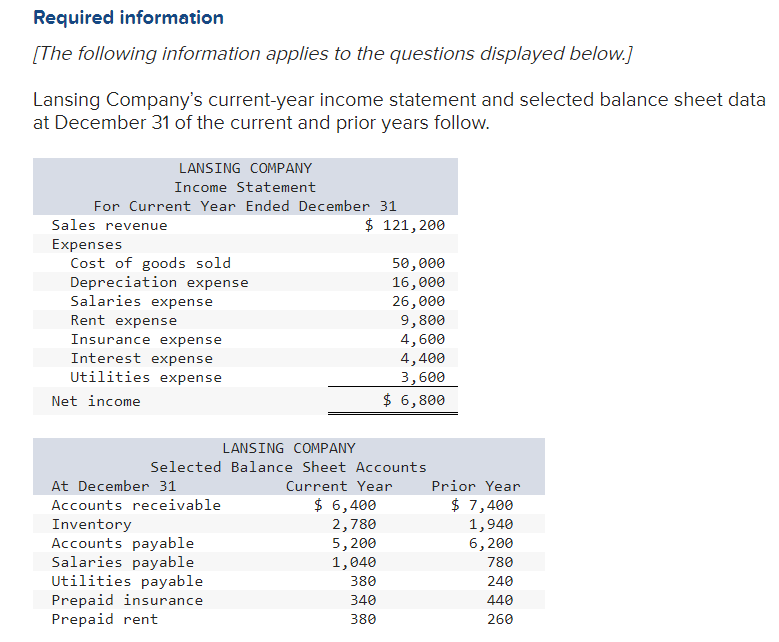

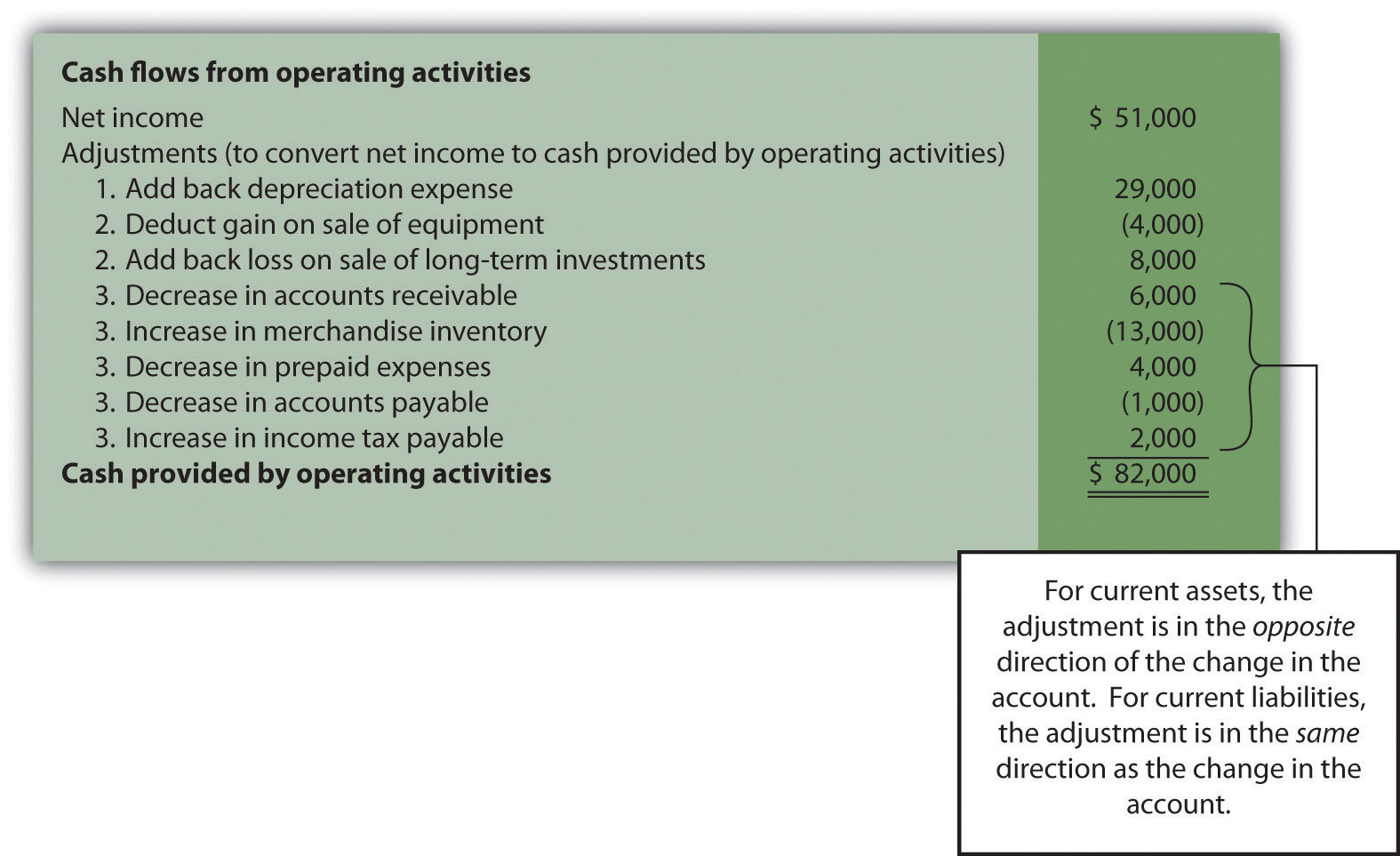

Prepaid expense cash flow. Additionally, we have $52,600 net income on the income statement and a $4,800. Operating expenses are typically paid on a monthly basis, which is why any reduction in prepaid expenses will immediately benefit cash flow for the current month. A prepaid expense is an expense that has been paid in advance but from which no gain has yet been realized.

Prepaid expenses = prepaid expenses % of opex × operating expenses however, if the connection between upfront payments and operating expenses (sg&a). Effective cash flow management. Prepaid expenses refer to costs incurred by a business for goods or services that are yet to be received or consumed.

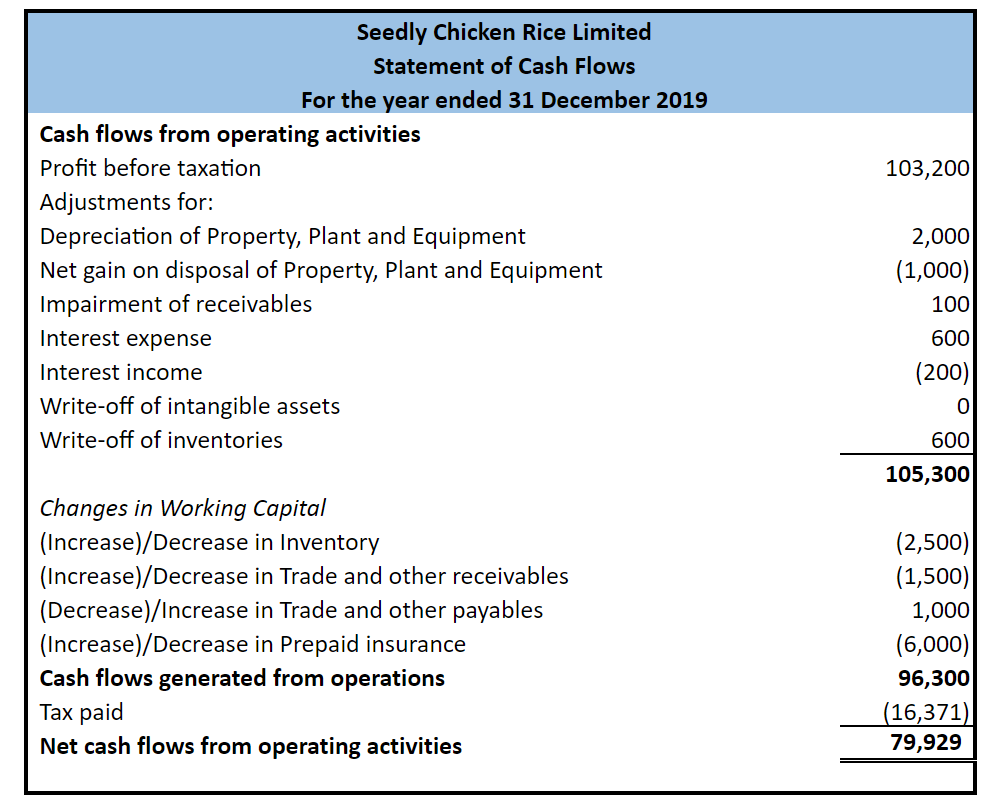

They help to track cash. Prepaid expenses impact cash flow by involving an initial outlay, reducing cash on hand. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within.

A prepaid expense refers to an expenditure that a company pays in advance before it receives the related benefit or service. By marshall hargrave updated october 17, 2023 reviewed by david kindness fact checked by vikki velasquez expenses that are used to make payments. How do prepaid expenses affect cash flow and budget?

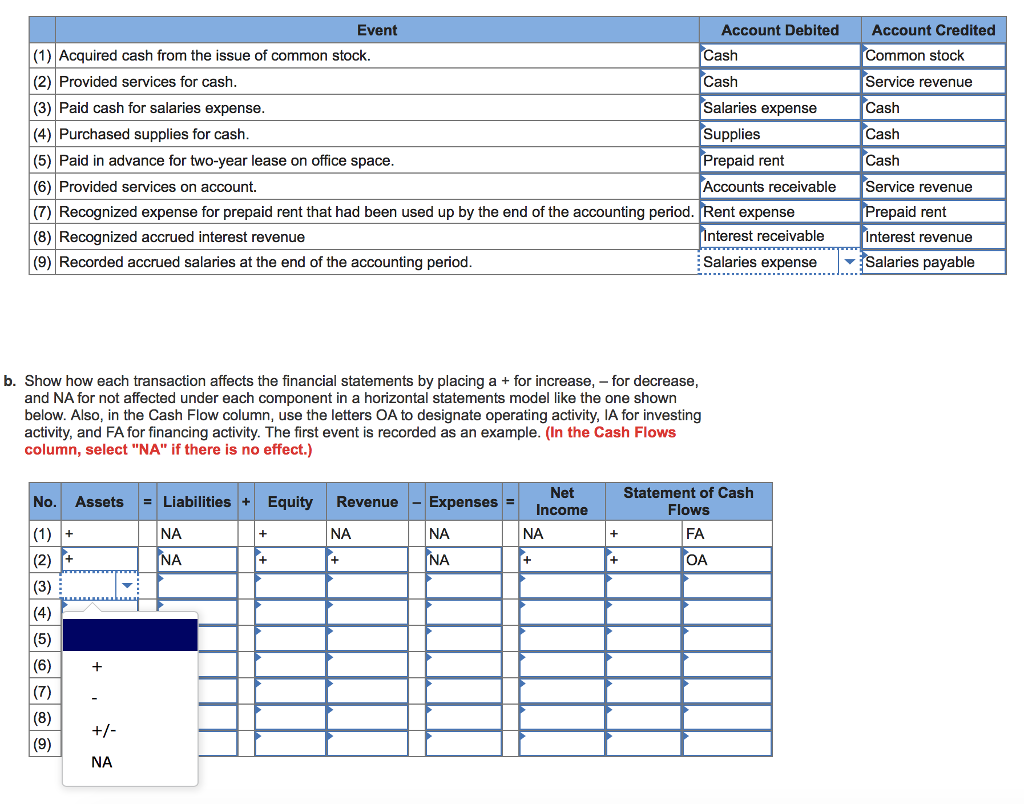

Accounting for prepaid expenses accrual basis vs. Debit expense account and credit prepaid expense. Simplifying prepaid expenses adjustment entry with an example.

Journal entry for prepaid spending. And as a result, we have a $5,300 increase in prepaid expenses and other changes as in the table below: Yes, prepaid expenses are considered as cash outflows because they involve the payment of cash in advance.

These expenses are initially recorded as. Prepaid expenses are productive to a company’s accounting records, and it is crucial to understand their application in a financial statement. Their primary purpose is to allocate costs.

Follow these steps: By paying expenses ahead, you can better understand and predict how. Recording a prepaid expense requires a prepaid expense journal entry that accurately records the transactions in the accounting.

However, they aid in budget. Cash basis presentation on the. Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future.

Prepaid expenses are a crucial component of accounting and. Prepaid expenses are a great way to manage your cash flow and budgeting more effectively. Prepaid expenses allow businesses to spread out costs over time.