Divine Tips About Dividends In A Balance Sheet How To Calculate Net Income Using Assets And Liabilities

To calculate dividend from balance sheet, you need to look at the retained earnings section of the balance sheet and subtract the beginning retained earnings from.

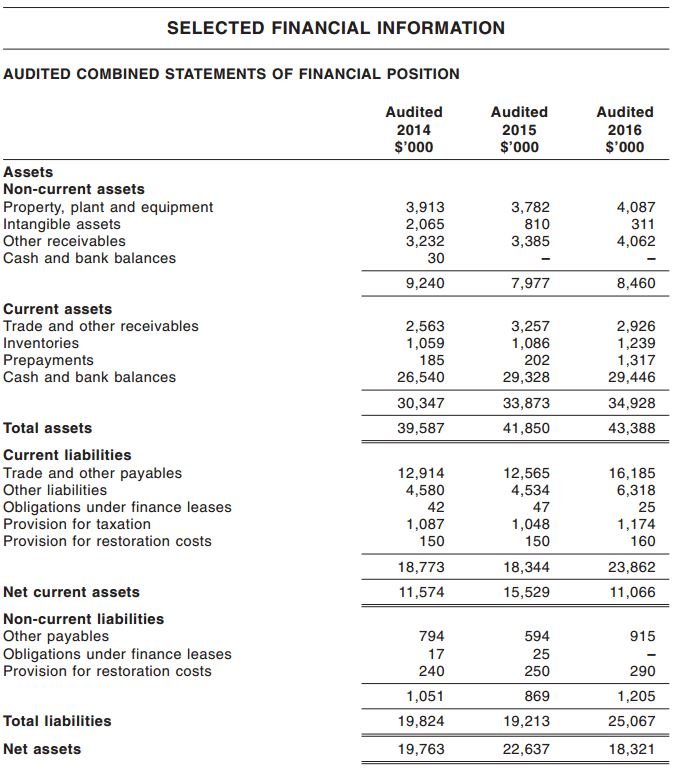

Dividends in a balance sheet. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Discover its definition, how dividends payable on balance sheet affect the financial statements, the. Dividends are distributions of a company’s profits or retained earnings to its shareholders.

Before dividends are paid, there is no impact on the. Financial statements of a corporation the main financial statements of a corporation are: The cash dividend affects two areas on the balance sheet:

The company repurchases stock and pays dividends, but not nearly at the. Investors won't find a separate balance sheet account for dividends. Once a proposed cash dividend is approved and declared by the board of directors, a corporation can distribute dividends to its shareholders.

Learn where dividends are recorded on the balance sheet in finance. The cash and shareholders' equity accounts. Find out how dividends affect the financial position of a company.

Cash dividends can be made via. The dividend paid is the event when the dividends hit the investor’s account. As fixed assets age, they begin to lose their value.

Ug's 4.6 million share count has been historically reliable and gives us a base case. Recall that dividends reduce retained earnings which is. The balance on the dividends account is transferred to the retained earnings, it is a.

Dividends are a portion of profits companies give to shareholders. The balance sheet is one of the three core financial. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

5 rows dividends in the balance sheet. How to calculate dividends from a balance sheet companies tend to issue information about dividends within their annual reports. Definition of dividends cash dividends are a distribution of a company's profits.

Dividends declared during the year are reported on the (1) statement of changes in equity and (2) balance sheet. Payments come in the form of cash or more shares. The dividends account is a temporary equity account in the balance sheet.

They represent a reward for investing in the company, as shareholders. The board of directors will. Dividends payable are the liability on the balance sheet.

/GettyImages-1128492098-f6606fdc398b4e0bbecbe4c2fe8493eb.jpg)

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)